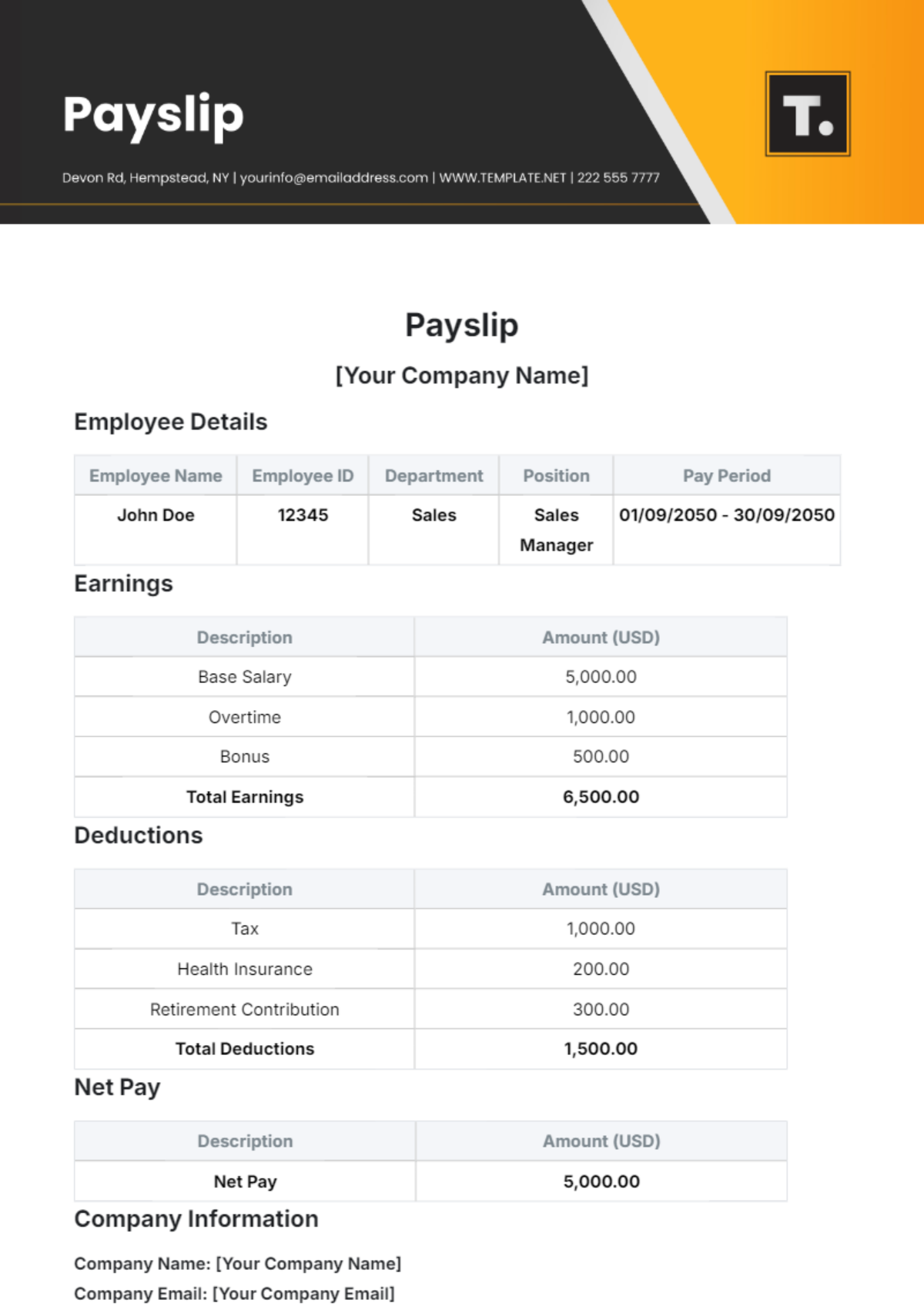

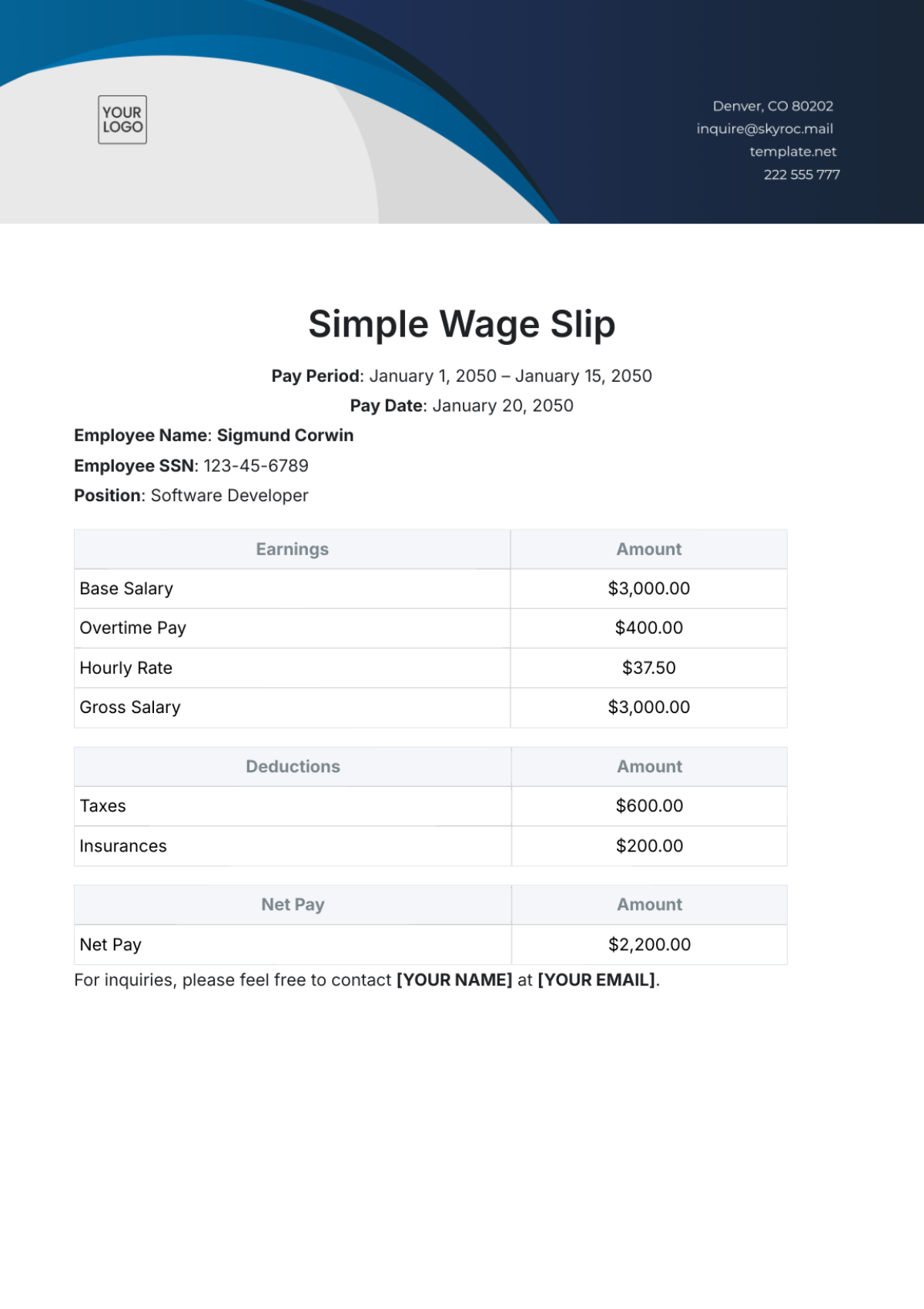

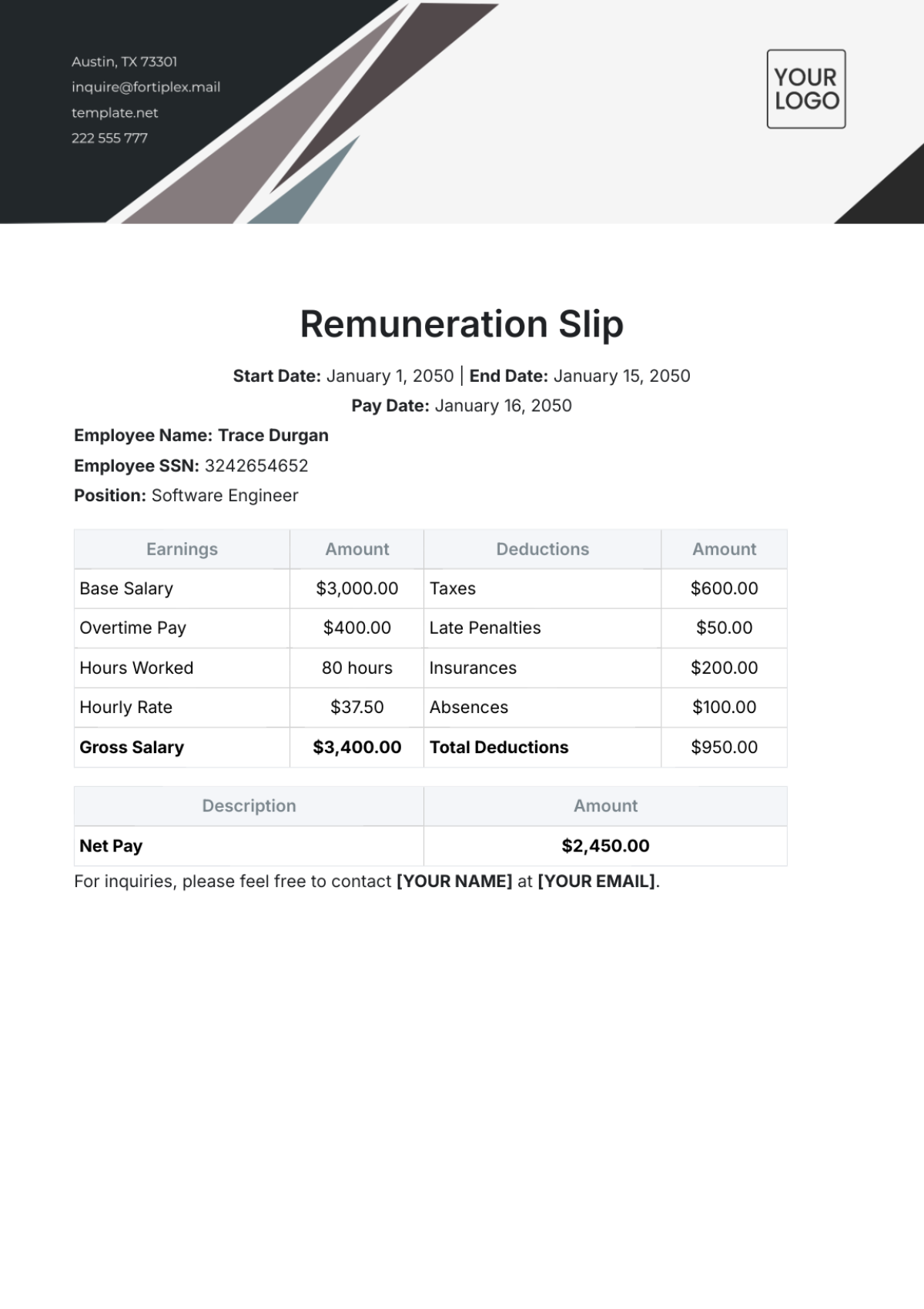

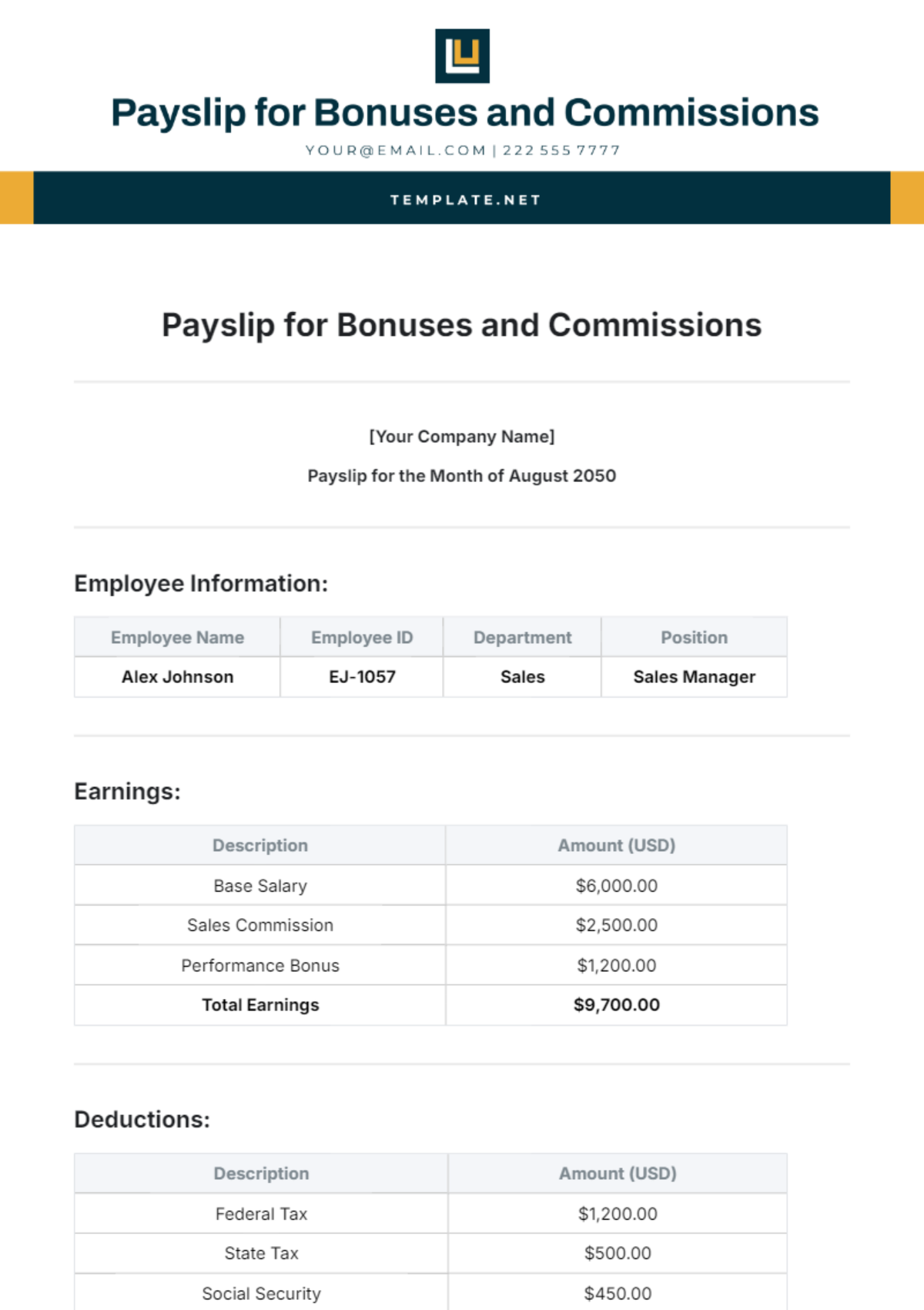

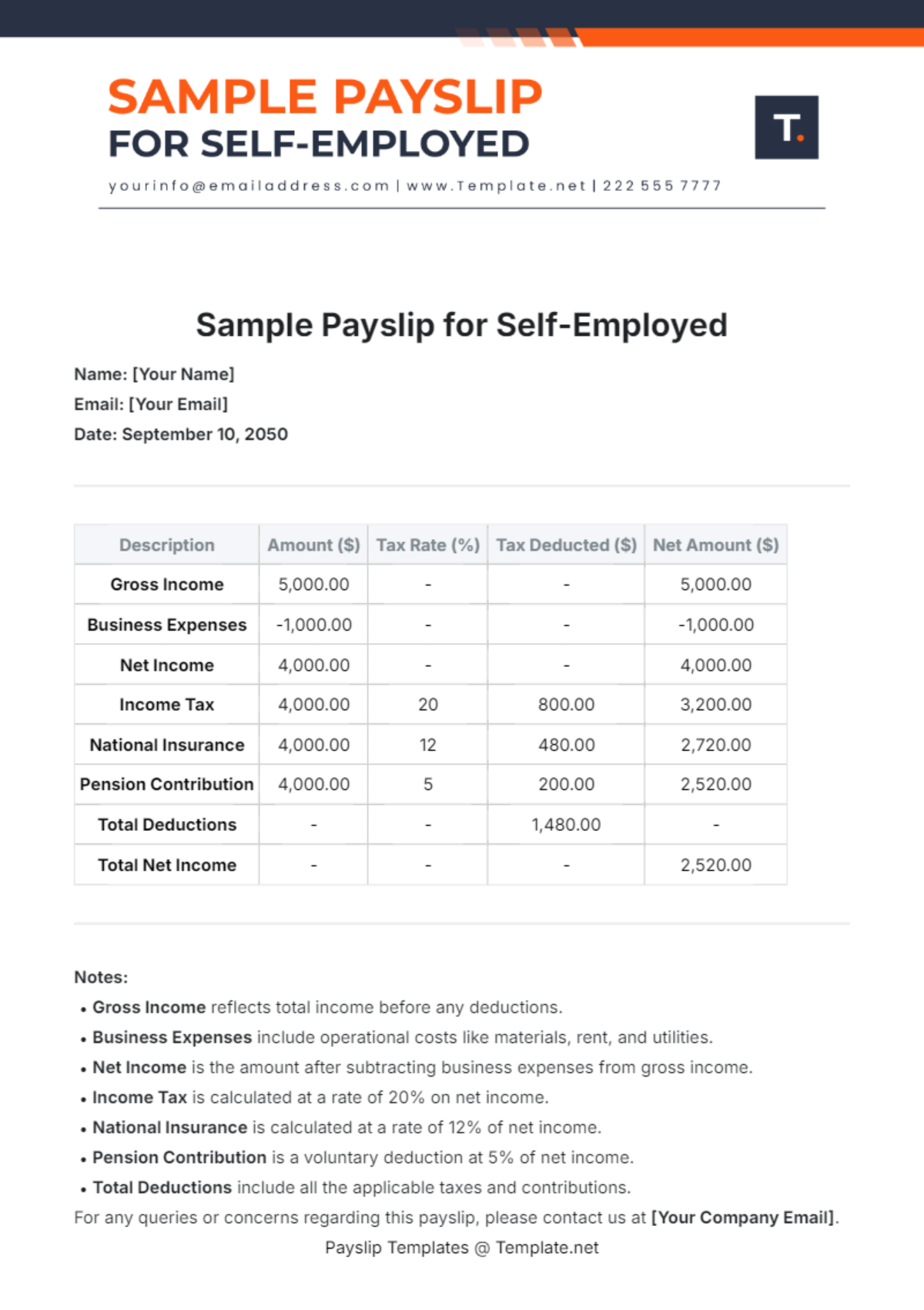

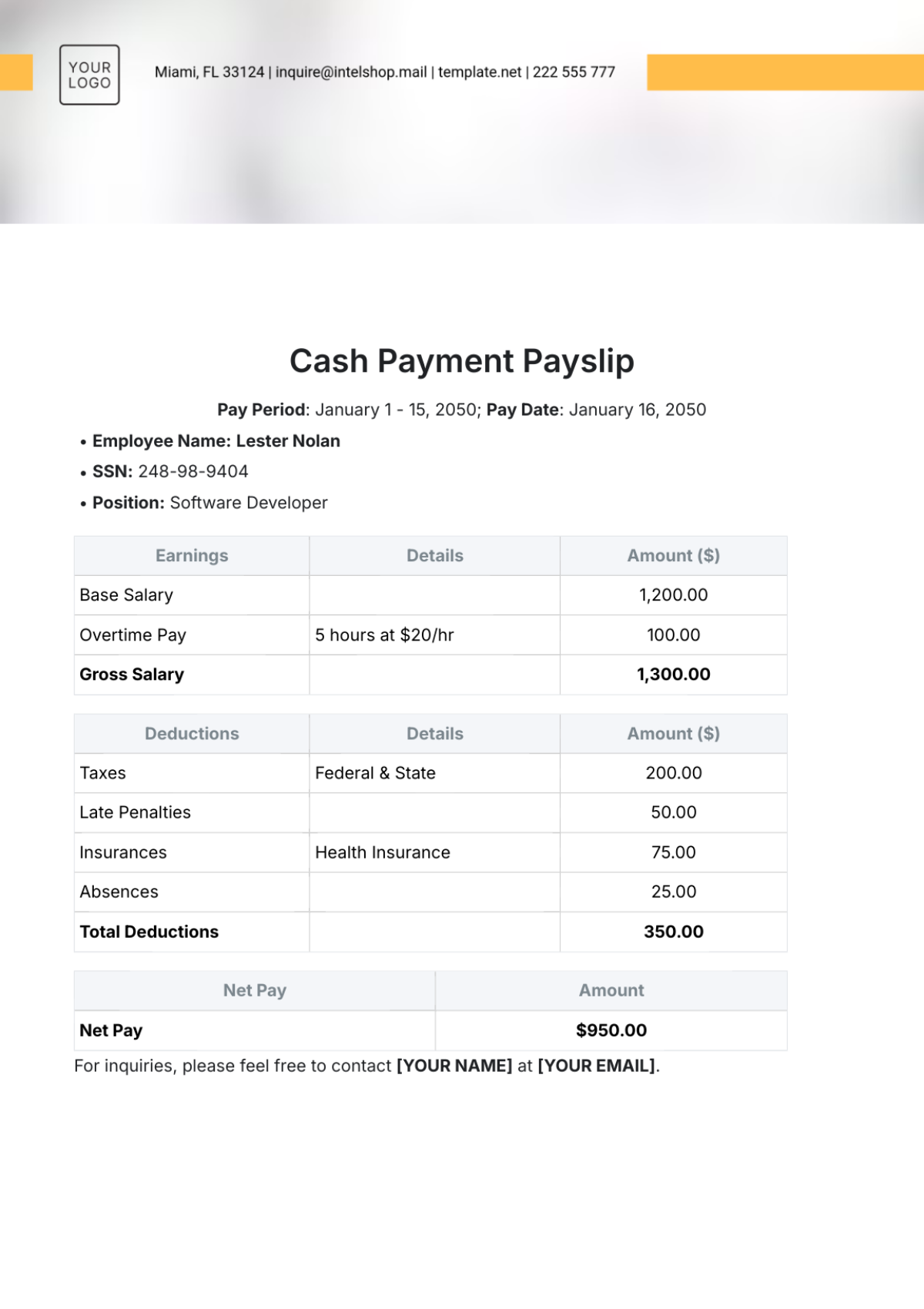

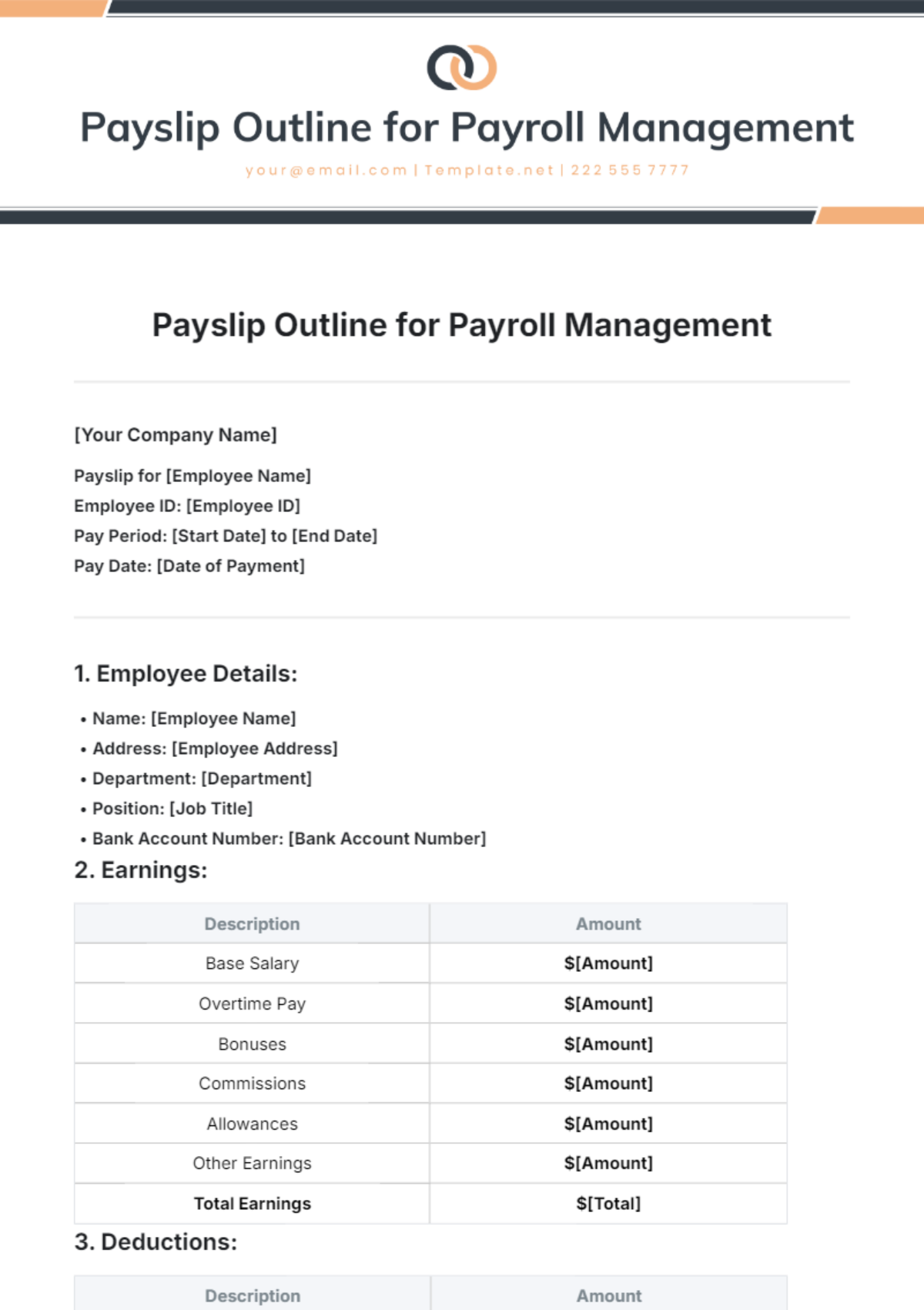

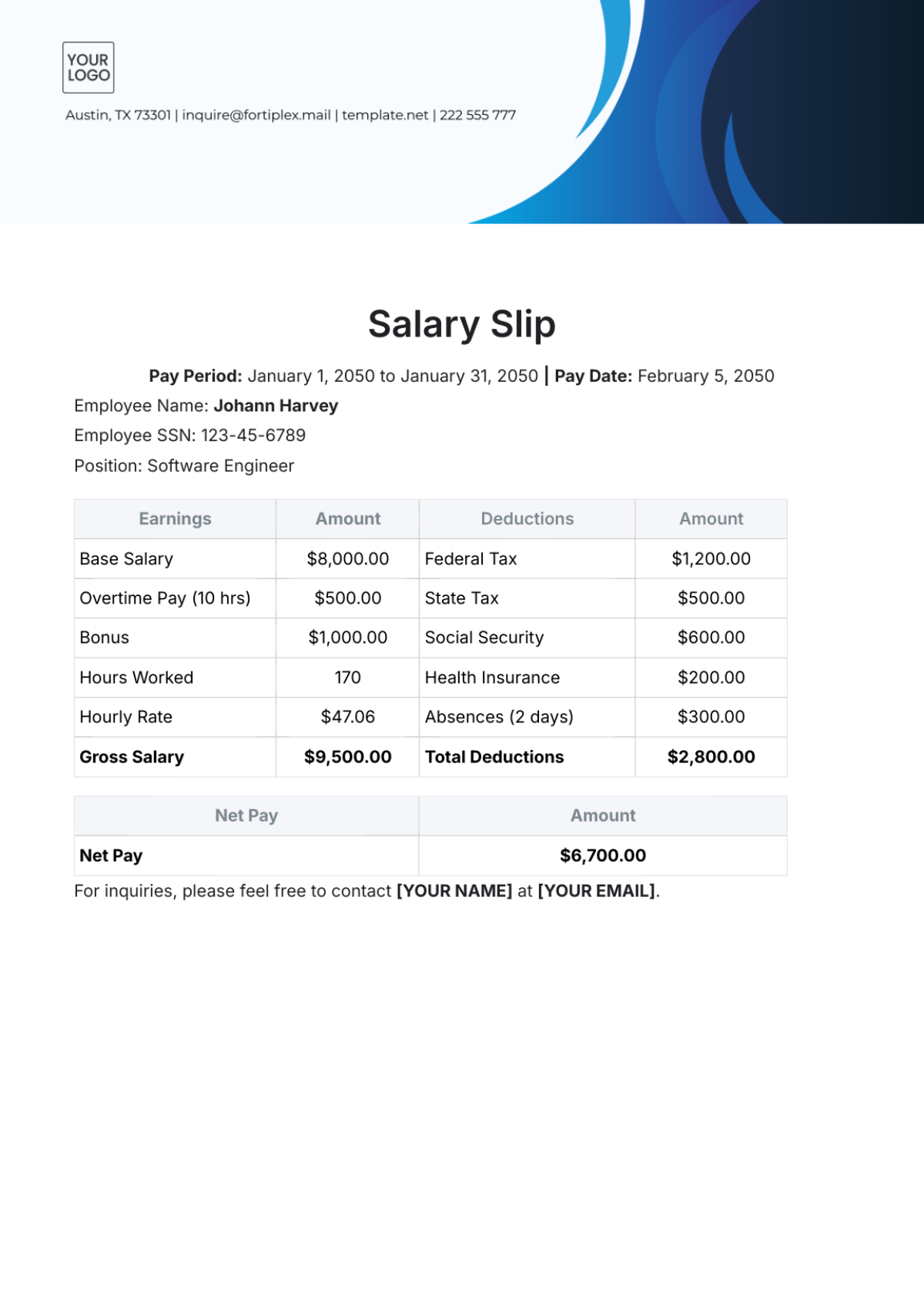

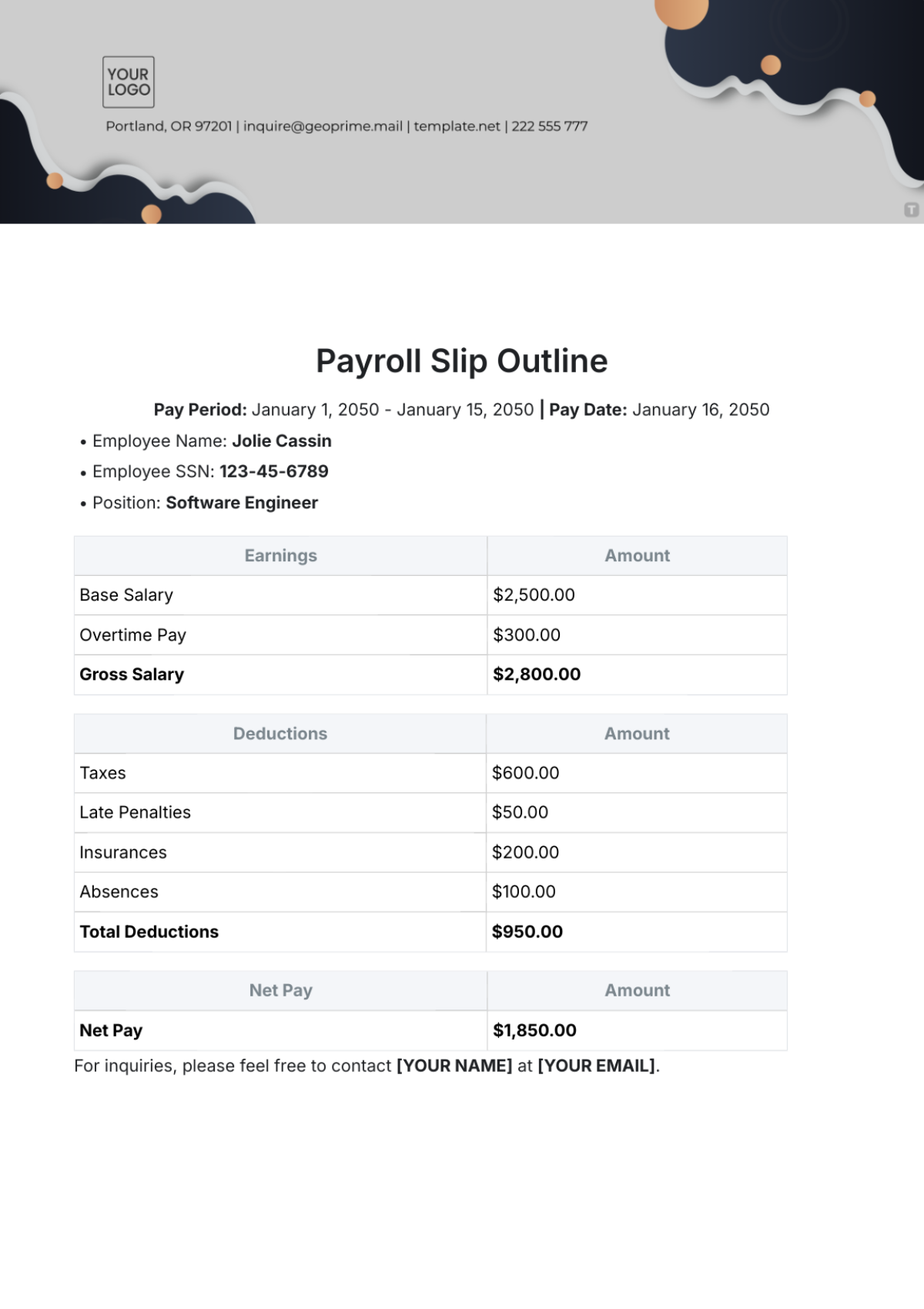

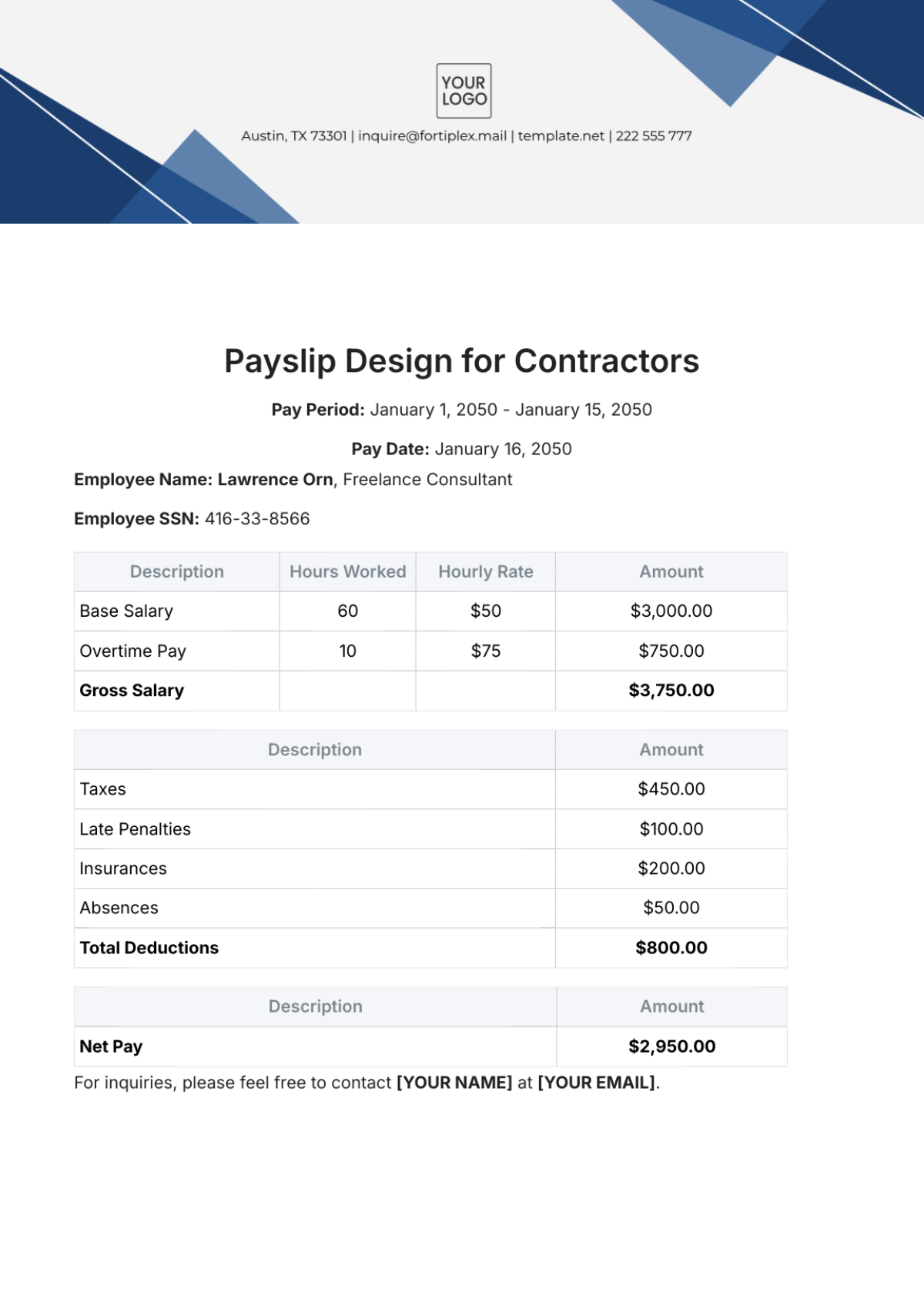

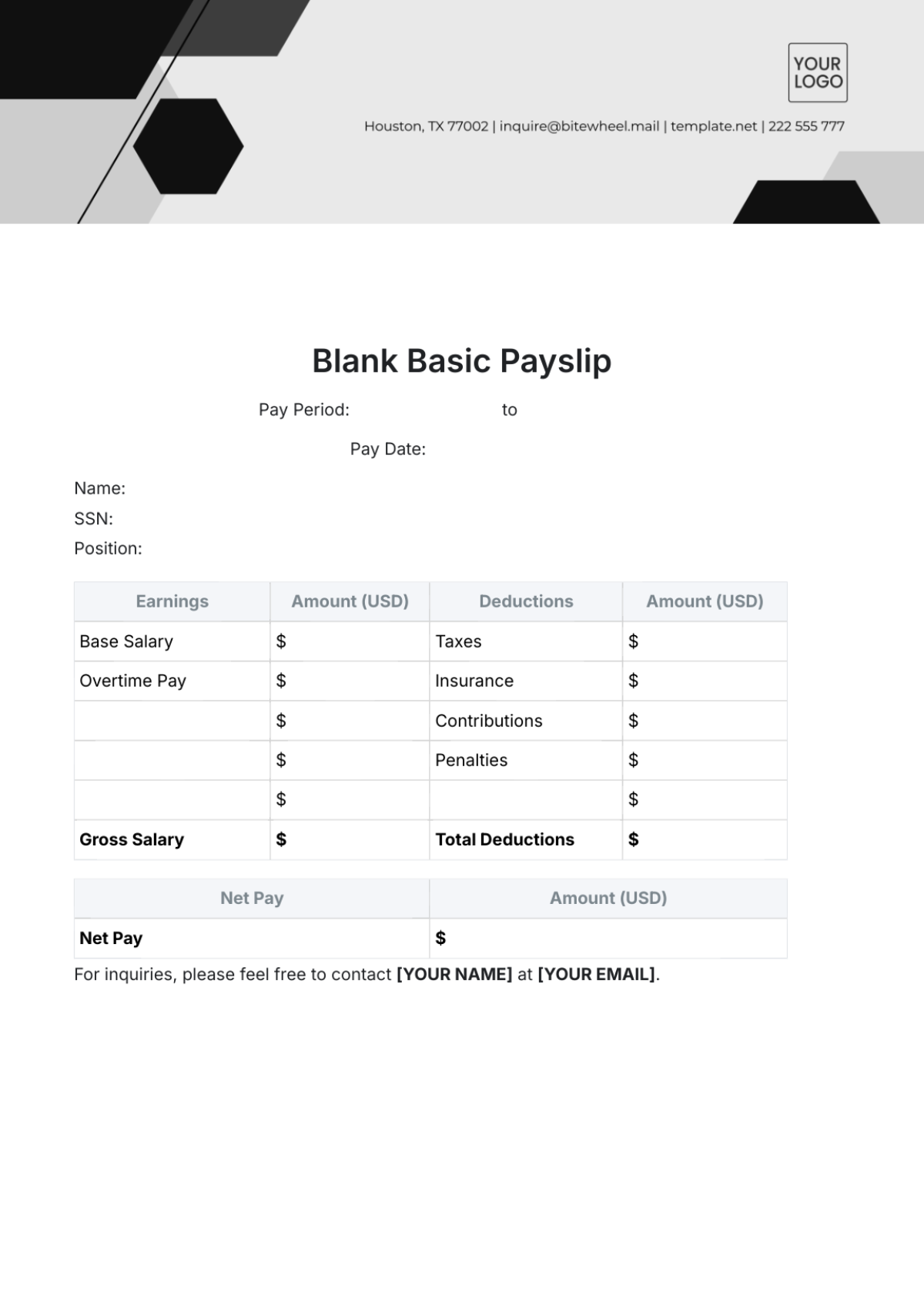

Sample Payslip for Self-Employed

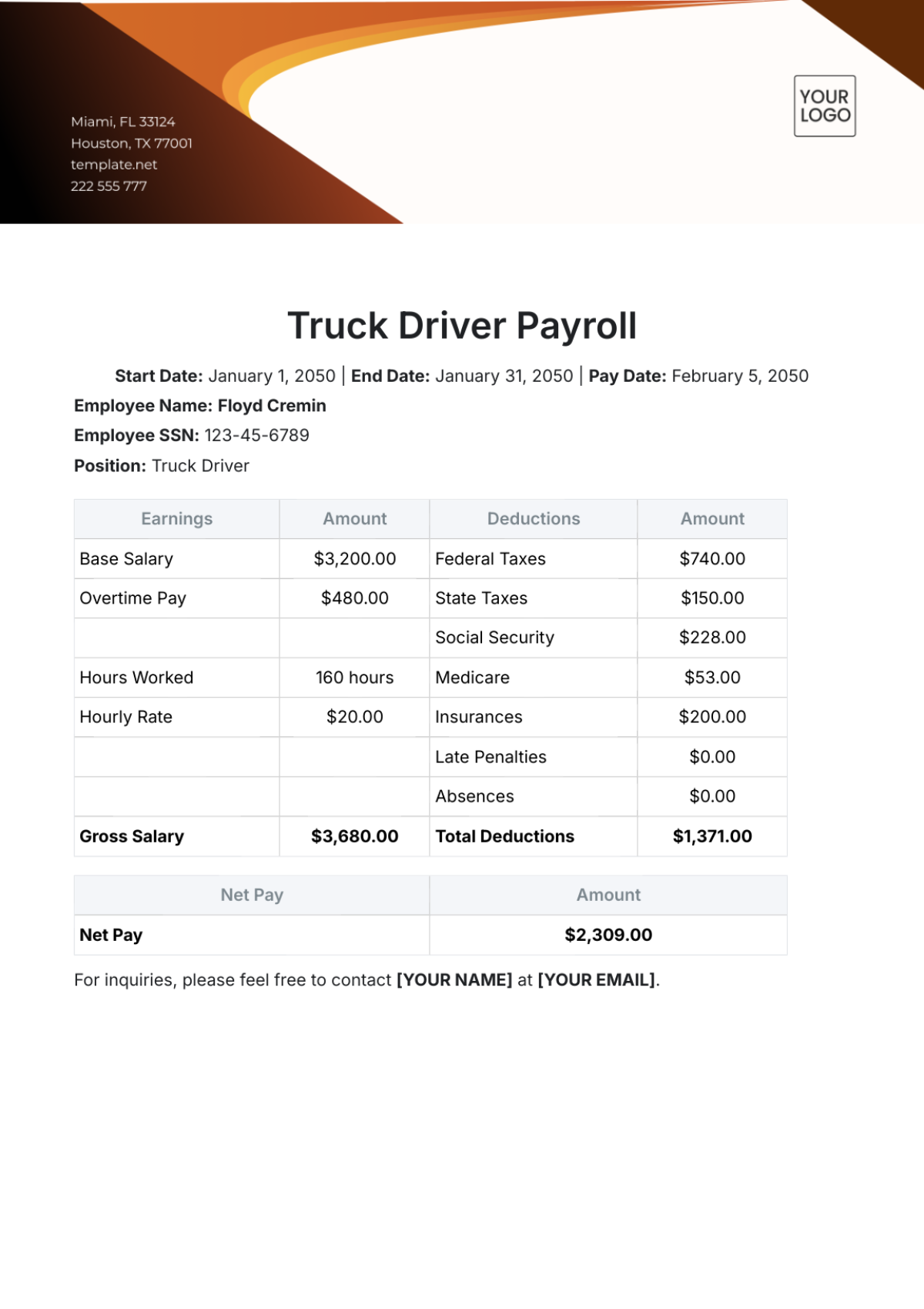

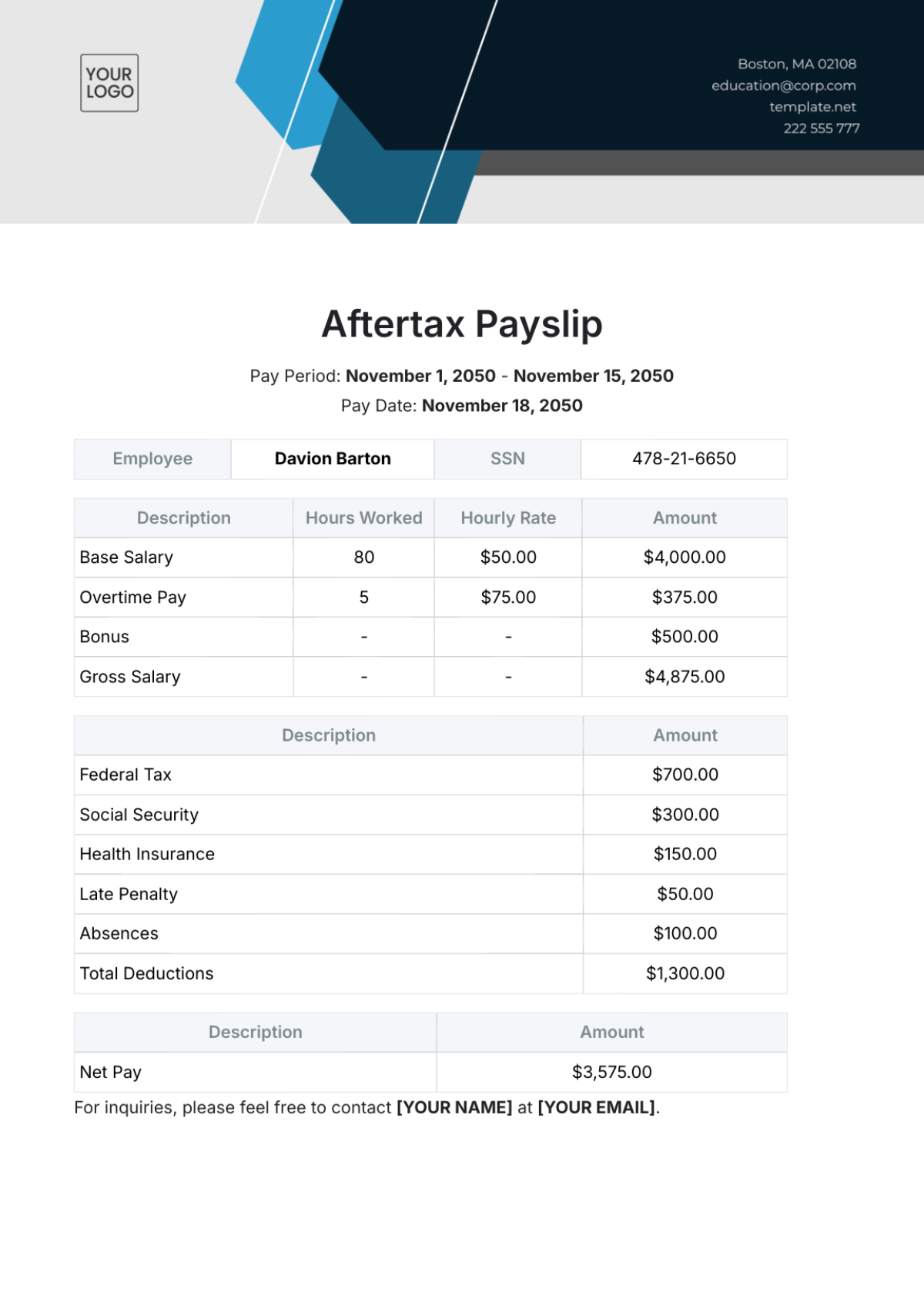

Start Date: [Month Day, Year] | End Date: [Month Day, Year]

Pay Date: [Month Day, Year]

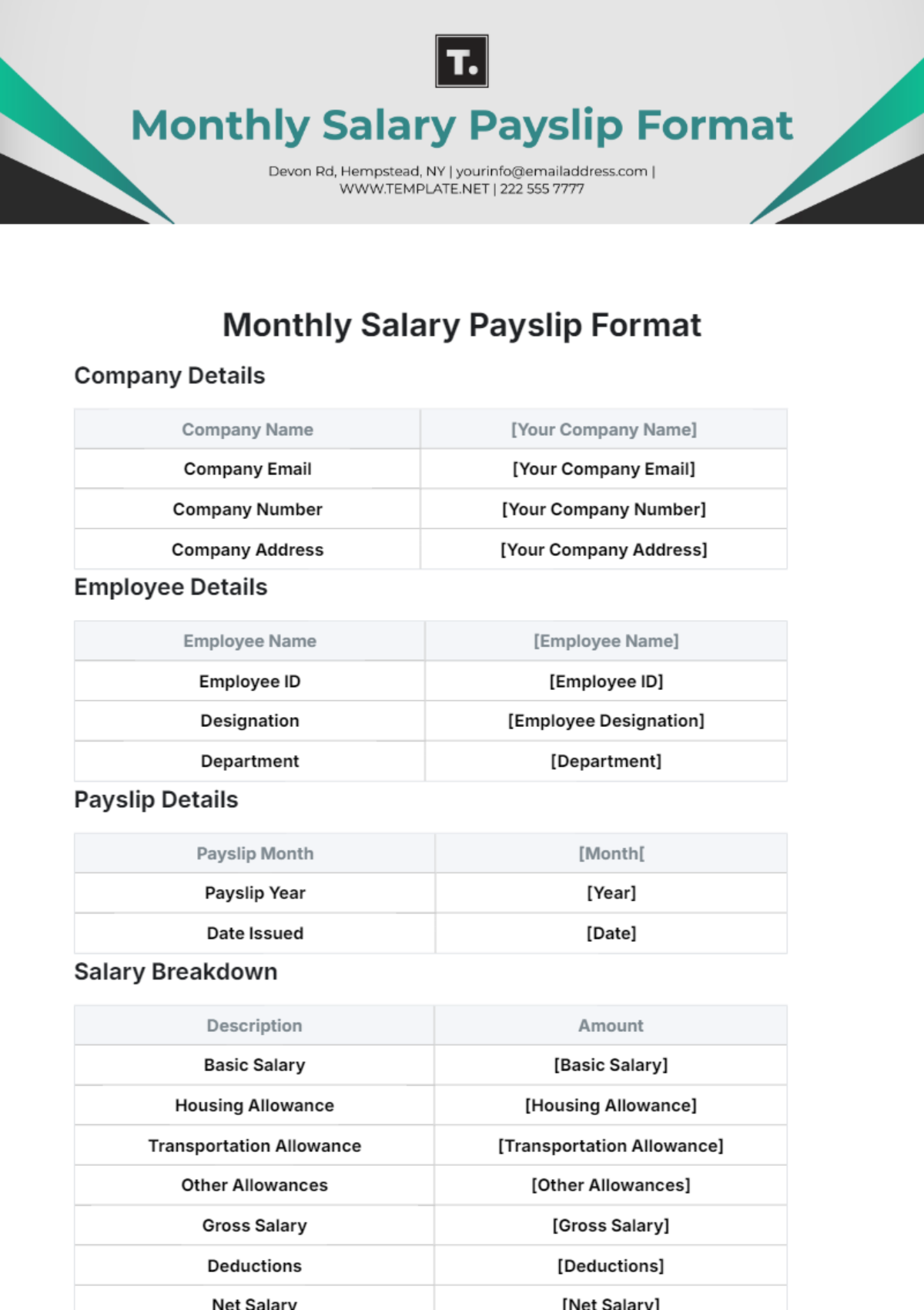

Employee Name: [Employee Name]

Employee SSN: [Employee SSN]

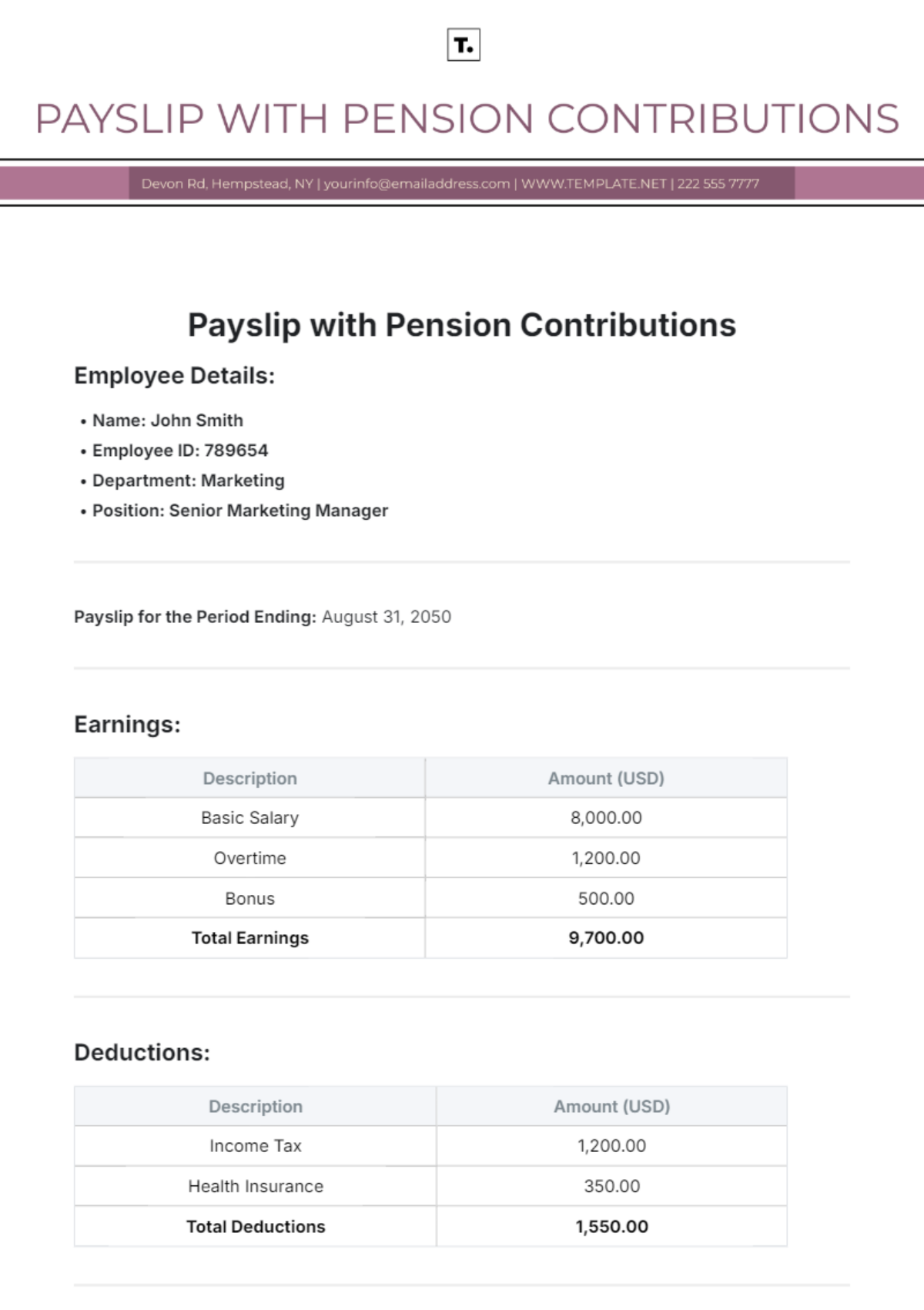

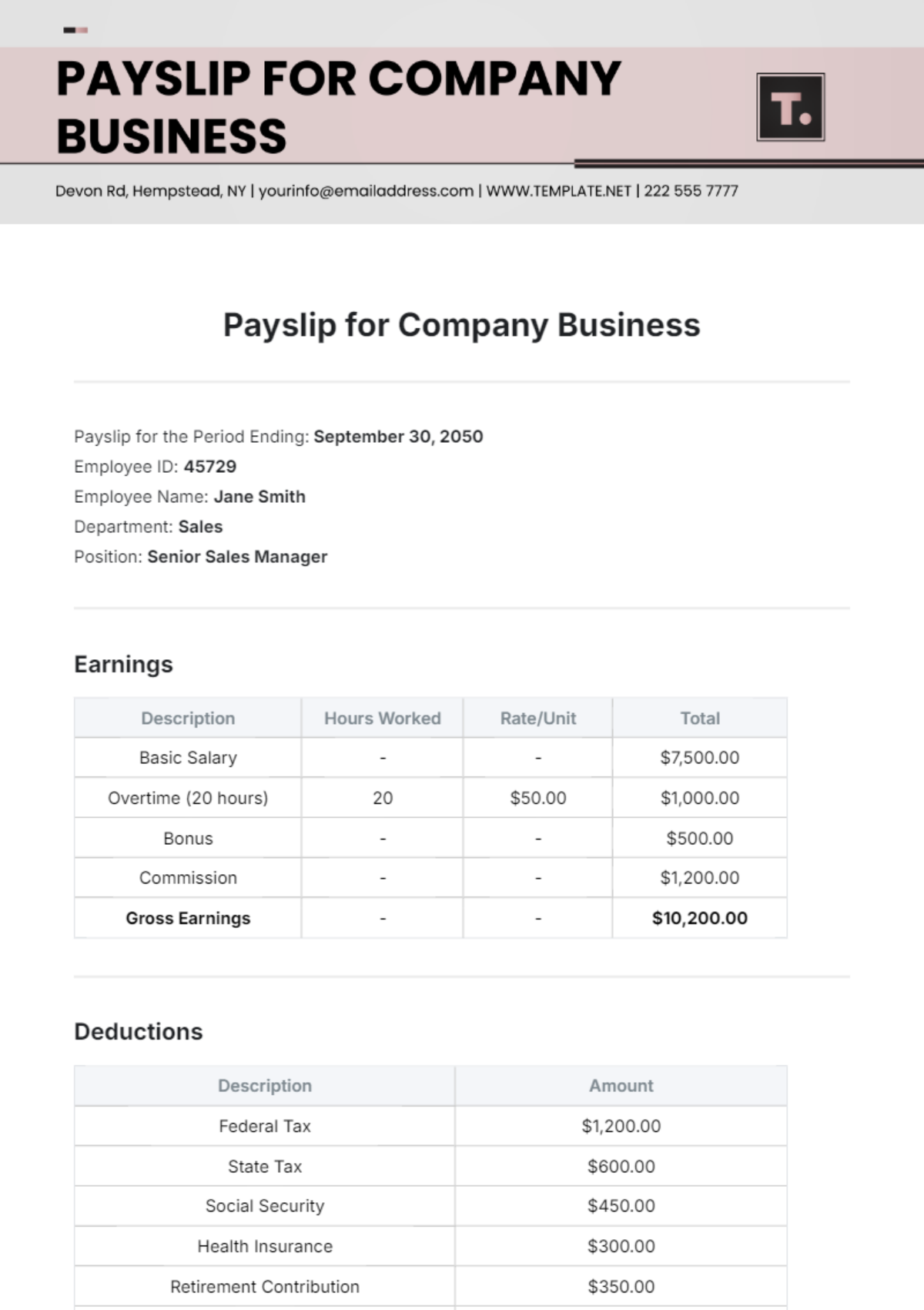

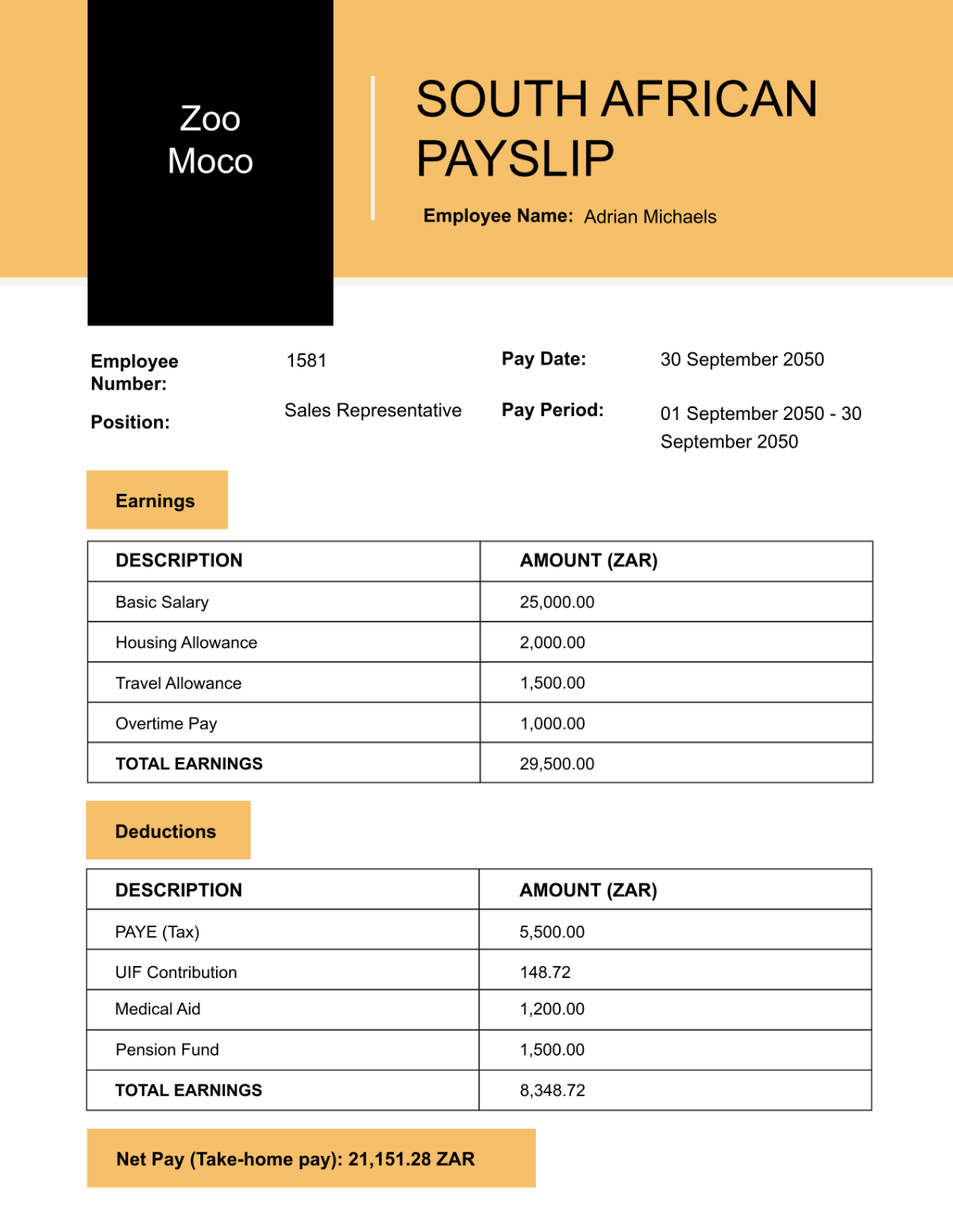

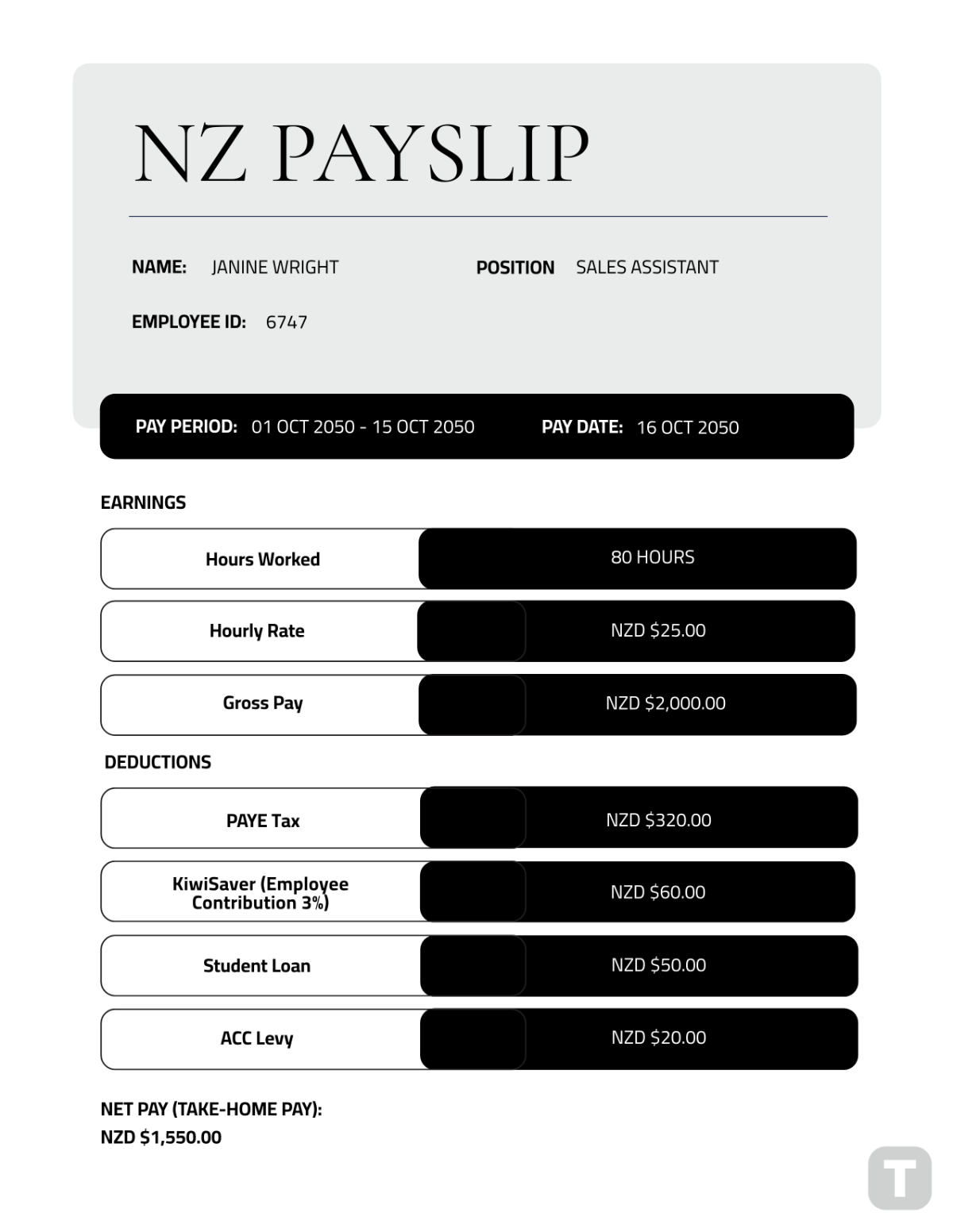

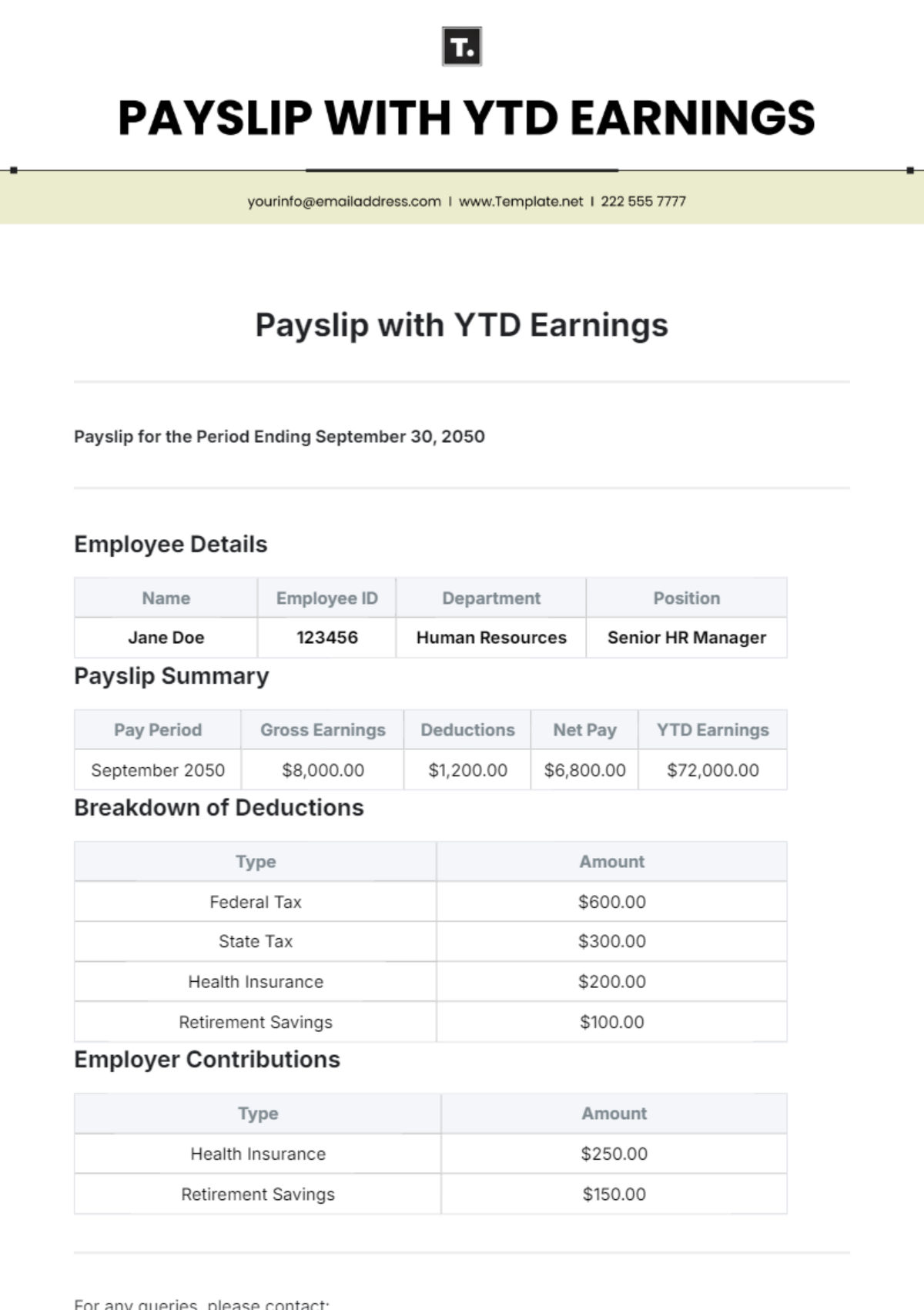

Earnings | Amount |

|---|---|

Base Salary | |

Overtime Pay | |

Hours Worked | |

Hourly Rate | |

Gross Salary |

Deductions | Amount |

|---|---|

Taxes | |

Late Penalties | |

Insurances | |

Absences | |

Total Deductions |

Net Pay |