AI

Marketing

Print

Document

Templates

Business

Categories

Marketing

Document

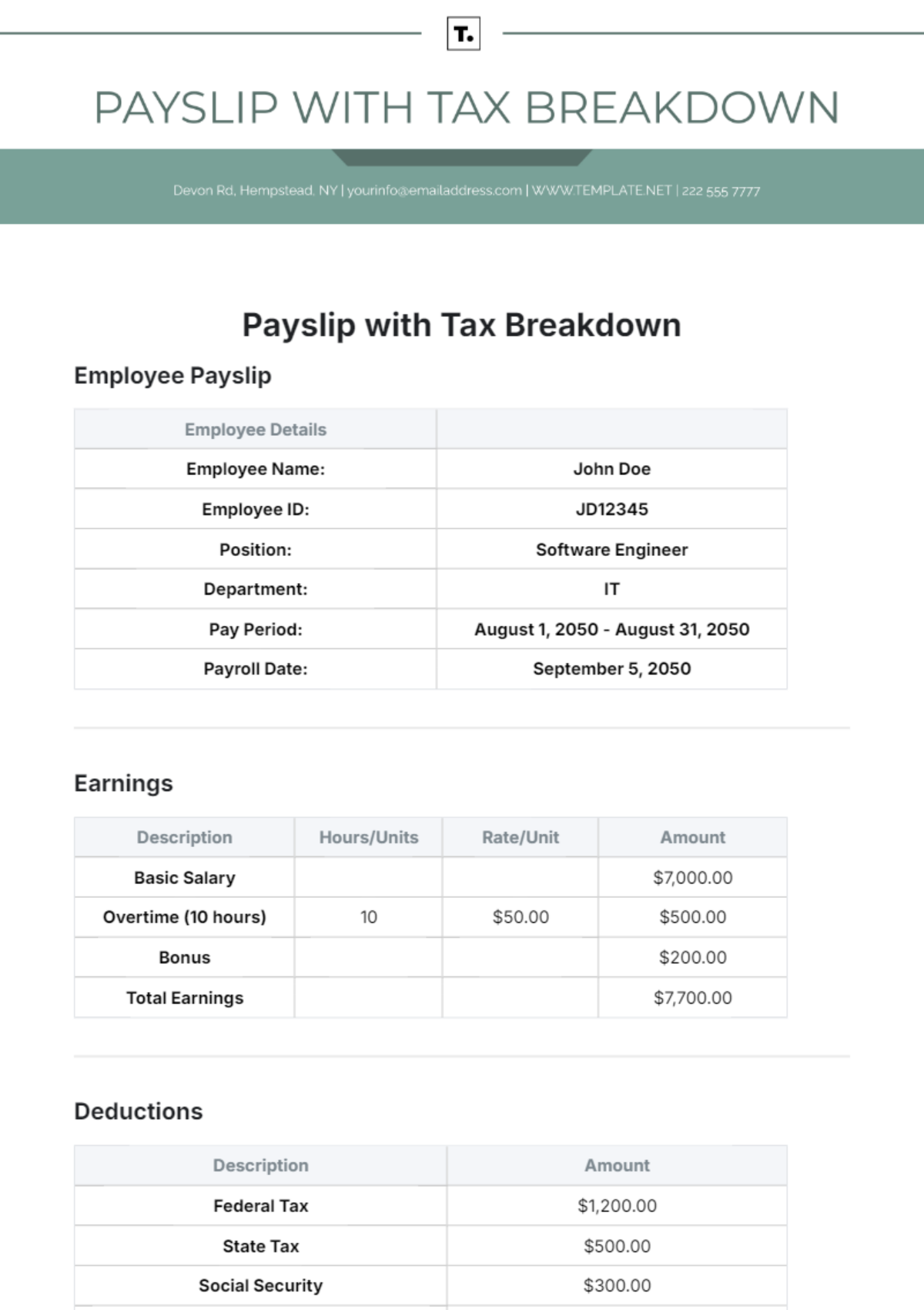

Free Payslip with Tax Breakdown

Payslip with Tax Breakdown

Pay Period: August 1 - 31, 2050 | Payroll Date: September 5, 2050

Employee Name: Carmel Ryan, Software Engineer

Employee SSN: 261-54-2140

Earnings | Amount |

|---|---|

Base Salary | |

Overtime Pay | |

Hourly Rate | |

Gross Salary |

Deductions | Amount |

|---|---|

Federal Tax | |

State Tax | |

Social Security | |

Medicare | |

Health Insurance | |

Total Deductions |

Net Pay |

For inquiries, please feel free to contact [Your Name] at [Your Email].

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Simplify tax management with the Payslip Template with Tax Breakdown, offered by Template.net. This customizable and printable template is easily downloadable and editable in our AI Editor Tool. It provides a clear format for detailing earnings, deductions, taxes, and net pay, ensuring a comprehensive and professional approach to payroll with accurate tax information.