Free Paycheck Budget

Introduction

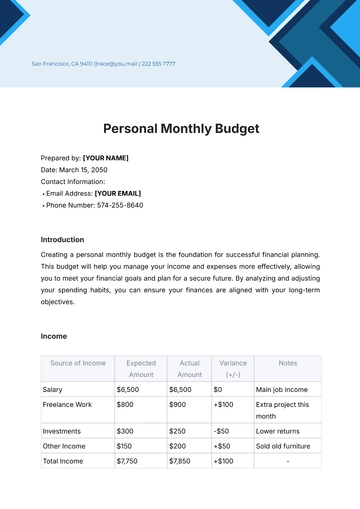

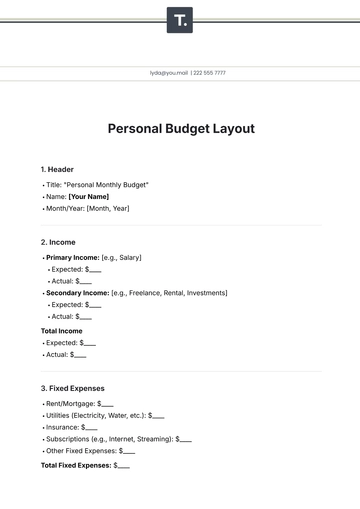

Creating a Paycheck Budget with a focus on Savings Goals is essential for financial stability and growth. By following this structured plan, you can ensure that you’re consistently saving towards your future aspirations. This example will guide you through the process of allocating your income effectively.

Paycheck Budget for Savings Goals

Prepared by: [YOUR NAME]

[YOUR EMAIL]

Details

Source | Amount | Frequency | Total Per Paycheck |

|---|---|---|---|

Salary | $3,500.00 | Bi-Weekly | $3,500.00 |

Other Income | $200.00 | Monthly | $100.00 |

Total Income | $3,600.00 | - | $3,600.00 |

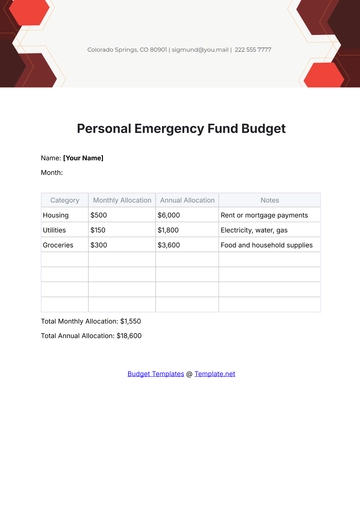

Savings Allocation

Savings Goal | Amount per Paycheck | Target Amount | Amount Saved | Remaining Amount |

|---|---|---|---|---|

Emergency Fund | $300.00 | $5,000.00 | $1,200.00 | $3,800.00 |

Retirement Fund | $400.00 | $50,000.00 | $6,000.00 | $44,000.00 |

Vacation Fund | $150.00 | $2,000.00 | $300.00 | $1,700.00 |

Education Fund | $100.00 | $10,000.00 | $1,000.00 | $9,000.00 |

Total Savings | $950.00 | $67,000.00 | $8,500.00 | $58,500.00 |

Budget Summary

Category | Amount |

|---|---|

Total Income | $3,600.00 |

Total Savings | $950.00 |

Remaining Balance | $2,650.00 |

Reminders

Review Your Budget Monthly: Adjust allocations as needed to stay on track with your savings goals.

Set Up Automatic Transfers: Automate savings to ensure consistency and avoid temptation.

Track Your Progress: Regularly check how your savings are growing and adjust targets if necessary.

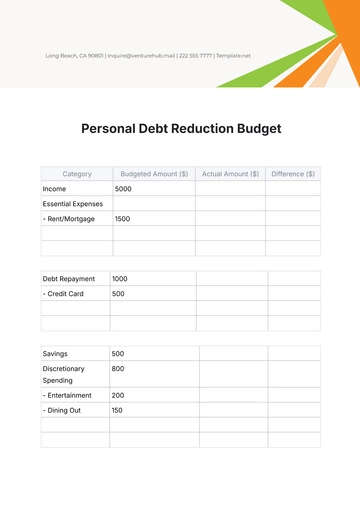

Prioritize Savings Goals: Focus on high-priority goals first, such as emergency funds or debt repayment.

Adjust for Changes: Update your budget if your income or expenses change to reflect your current financial situation.

Consult a Financial Advisor: For personalized advice and adjustments, consider seeking professional guidance.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

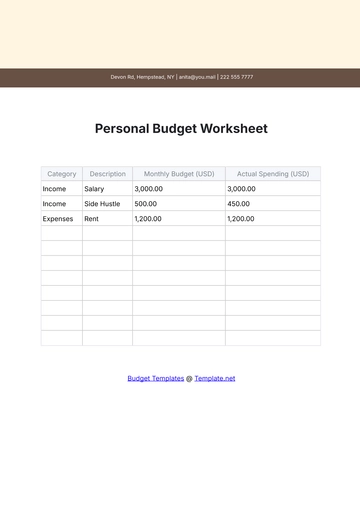

Manage your finances effortlessly with Template.net's Paycheck Budget Template. This fully customizable and editable template makes budgeting simple and efficient. Use the AI Editor Tool to tailor it to your specific needs, ensuring every paycheck is optimized. Stay on top of your expenses and savings with this easy-to-use budgeting solution designed for financial clarity.

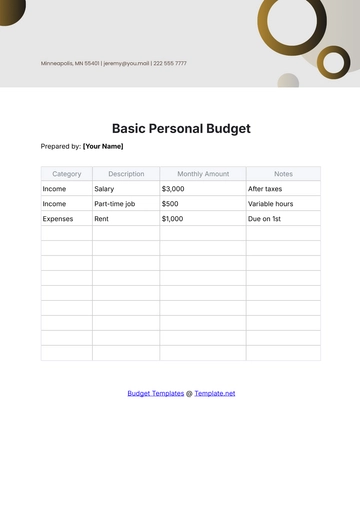

You may also like

- Budget Sheet

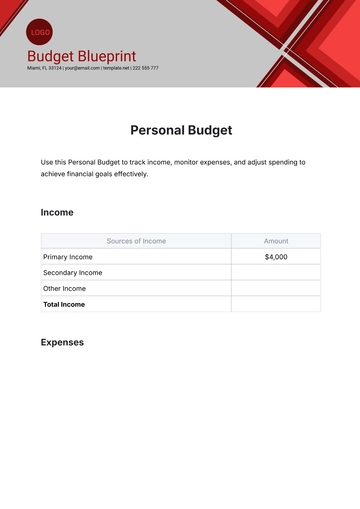

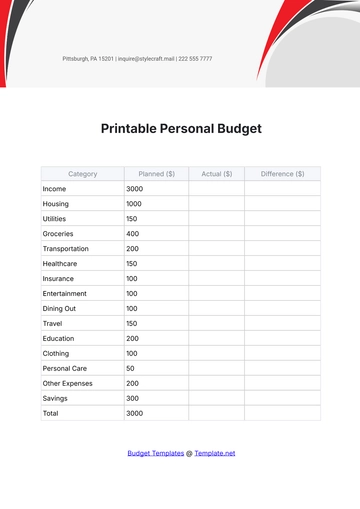

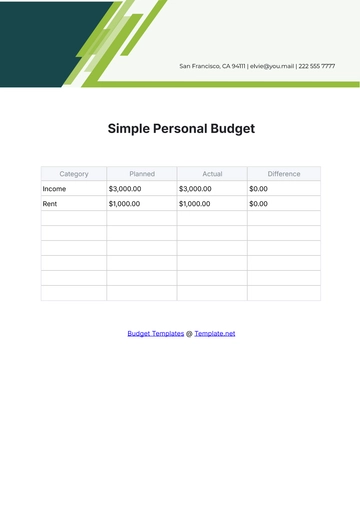

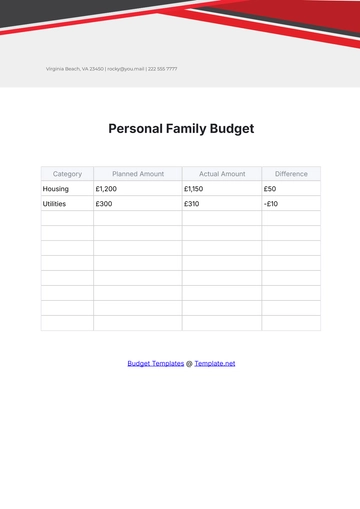

- Personal Budget

- Non Profit Budget

- Monthly Budget

- Project Budget

- HR Budget

- Company Budget

- Home Budget

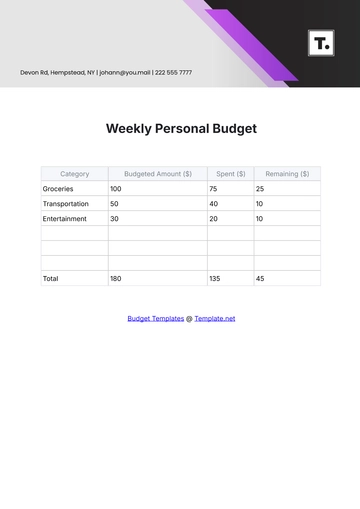

- Weekly Budget

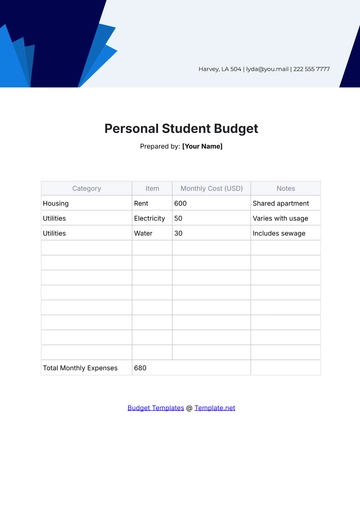

- College Budget

- Business Budget

- Construction Budget

- Small Business Budget

- Hotel Budget

- Annual Budget

- Home Renovation Budget

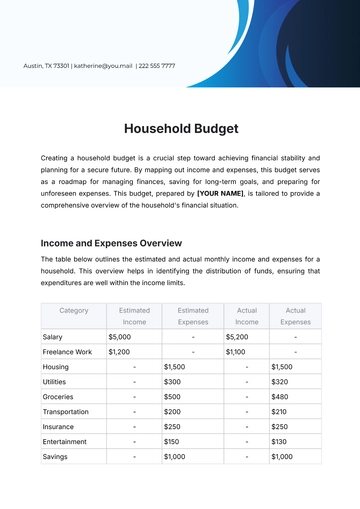

- Household Budget

- Student Budget

- Grocery Budget

- Marketing Budget

- Corporate Budget

- Startup Budget

- Manufacturing Budget

- Church Budget

- University Budget

- Annual Budget Plan

- Event Budget

- Operating Budget

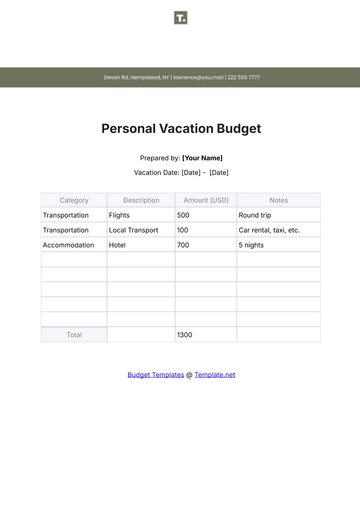

- Travel Budget

- Food Budget

- IT and Software Budget

- School Budget

- Real Estate Budget

- Sales Budget

- Conference Budget

- Budget Finance

- Freelancer Budget

- Budget Advertising