Free Budget Planning

Prepared by: [YOUR NAME]

Email: [YOUR EMAIL]

Company: [YOUR COMPANY NAME]

Company Number: [YOUR COMPANY NUMBER]

Address: [YOUR COMPANY ADDRESS]

Website: [YOUR COMPANY WEBSITE]

Social Media: [YOUR COMPANY SOCIAL MEDIA]

Date: January 1, 2050

Introduction

The following business operations budget plan outlines the projected income and expenses for [YOUR COMPANY NAME] for the fiscal year starting January 1, 2050. This plan is designed to provide a comprehensive overview of expected financial activity, ensuring that resources are allocated effectively to support the company’s growth and strategic objectives. By adhering to this budget, [YOUR COMPANY NAME] can maintain financial stability and optimize operational efficiency throughout the year.

Income Projections

The income projections for 2050 include revenue from product sales, service offerings, and subscription fees. These figures reflect an optimistic but achievable forecast based on market trends and company performance in previous years.

Income Source | Q1 (Jan-Mar) | Q2 (Apr-Jun) | Q3 (Jul-Sep) | Q4 (Oct-Dec) | Total 2050 |

|---|---|---|---|---|---|

Product Sales | $250,000 | $275,000 | $300,000 | $325,000 | $1,150,000 |

Service Revenue | $180,000 | $200,000 | $210,000 | $220,000 | $810,000 |

Subscription Fees | $120,000 | $130,000 | $140,000 | $150,000 | $540,000 |

Investment Income | $50,000 | $55,000 | $60,000 | $65,000 | $230,000 |

Other Income | $10,000 | $12,000 | $15,000 | $18,000 | $55,000 |

Total Income | $610,000 | $672,000 | $725,000 | $778,000 | $2,785,000 |

Operational Expenses

Projected operational expenses for 2050 cover essential areas such as salaries, rent, marketing, and office supplies. By keeping these costs within planned limits, [YOUR COMPANY NAME] aims to optimize its spending for maximum return.

Expense Category | Q1 (Jan-Mar) | Q2 (Apr-Jun) | Q3 (Jul-Sep) | Q4 (Oct-Dec) | Total 2050 |

|---|---|---|---|---|---|

Salaries and Wages | $150,000 | $155,000 | $160,000 | $165,000 | $630,000 |

Rent and Utilities | $25,000 | $25,000 | $25,000 | $25,000 | $100,000 |

Marketing and Advertising | $40,000 | $45,000 | $50,000 | $55,000 | $190,000 |

Office Supplies | $5,000 | $5,500 | $6,000 | $6,500 | $23,000 |

Equipment Maintenance | $10,000 | $10,500 | $11,000 | $11,500 | $43,000 |

Total Expenses | $230,000 | $241,000 | $252,000 | $263,000 | $986,000 |

Cash Flow Management

Proper cash flow management ensures that [YOUR COMPANY NAME] maintains liquidity to meet its short-term obligations and invest in future opportunities. By monitoring cash flow monthly, the company can quickly address any discrepancies between expected and actual performance.

Month | Projected Income | Projected Expenses | Net Cash Flow | Cumulative Cash Flow |

|---|---|---|---|---|

January 2050 | $200,000 | $75,000 | $125,000 | $125,000 |

February 2050 | $210,000 | $80,000 | $130,000 | $255,000 |

March 2050 | $200,000 | $75,000 | $125,000 | $380,000 |

April 2050 | $220,000 | $85,000 | $135,000 | $515,000 |

May 2050 | $225,000 | $90,000 | $135,000 | $650,000 |

June 2050 | $227,000 | $85,000 | $142,000 | $792,000 |

Total 2050 | $1,282,000 | $490,000 | $792,000 | $792,000 |

Budget Allocation for Key Departments

Allocating budgets to key departments ensures that each area has the resources necessary to support [YOUR COMPANY NAME]'s operational and strategic initiatives. This allocation reflects the company's commitment to growth, customer satisfaction, and technological advancement.

Department | Q1 Budget | Q2 Budget | Q3 Budget | Q4 Budget | Total 2050 Budget |

|---|---|---|---|---|---|

Sales and Marketing | $70,000 | $75,000 | $80,000 | $85,000 | $310,000 |

Research and Development | $50,000 | $55,000 | $60,000 | $65,000 | $230,000 |

Customer Support | $30,000 | $32,000 | $35,000 | $37,000 | $134,000 |

IT and Infrastructure | $40,000 | $42,000 | $45,000 | $47,000 | $174,000 |

Human Resources | $25,000 | $27,000 | $28,000 | $30,000 | $110,000 |

Conclusion

By adhering to this budget plan, [YOUR COMPANY NAME] is well-positioned to achieve its financial goals for 2050. Continuous monitoring and quarterly reviews will ensure that the company adapts to changing market conditions while maintaining financial discipline.

Reminders

Quarterly Review: Review budget allocations and cash flow statements every quarter to ensure the company remains on track.

Contingency Planning: Maintain a reserve fund for unexpected costs or market fluctuations.

Communication: Ensure all departments are informed of their budget constraints and targets to promote alignment.

Adjustments: Be prepared to make strategic adjustments to the budget as necessary to respond to market changes or new opportunities.

Goal Setting: Set monthly and quarterly financial goals to guide performance evaluation and decision-making.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Achieve financial clarity with the Budget Planning Template from Template.net. This customizable and editable tool is designed to simplify budgeting with its user-friendly interface. Utilize the AI Editor Tool to adjust categories and track expenses effortlessly. Perfect for personal and professional use, this template ensures effective financial management while adapting to your needs.

You may also like

- Budget Sheet

- Personal Budget

- Non Profit Budget

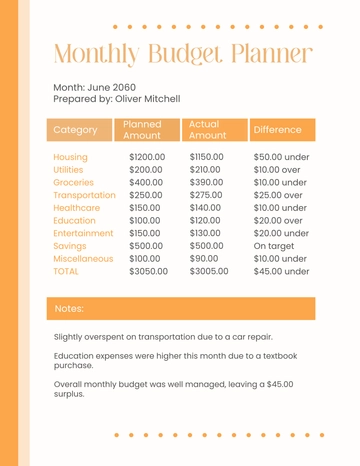

- Monthly Budget

- Project Budget

- HR Budget

- Company Budget

- Home Budget

- Weekly Budget

- College Budget

- Business Budget

- Construction Budget

- Small Business Budget

- Hotel Budget

- Annual Budget

- Home Renovation Budget

- Household Budget

- Student Budget

- Grocery Budget

- Marketing Budget

- Corporate Budget

- Startup Budget

- Manufacturing Budget

- Church Budget

- University Budget

- Annual Budget Plan

- Event Budget

- Operating Budget

- Travel Budget

- Food Budget

- IT and Software Budget

- School Budget

- Real Estate Budget

- Sales Budget

- Conference Budget

- Budget Finance

- Freelancer Budget

- Budget Advertising