Free Professional Business Budget

Introduction

A well-structured budget is vital for effective cost control and ensuring financial stability. This Professional Business Budget is designed to provide a comprehensive overview of projected expenses and revenues for [YOUR COMPANY NAME]. By adhering to this budget, we aim to identify cost-saving opportunities and maintain financial discipline.

Prepared By

[YOUR NAME]

[YOUR EMAIL]

Company Details

Company Name: [YOUR COMPANY NAME]

Company Number: [YOUR COMPANY NUMBER]

Company Address: [YOUR COMPANY ADDRESS]

Company Website: [YOUR COMPANY WEBSITE]

Company Social Media: [YOUR COMPANY SOCIAL MEDIA]

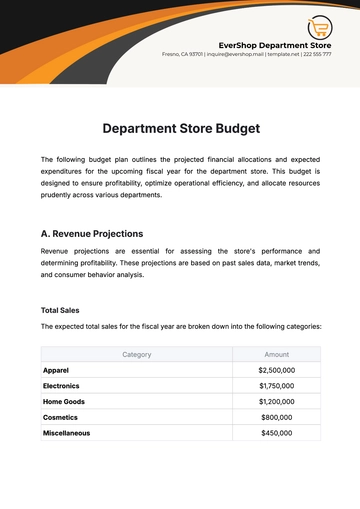

Budget Overview

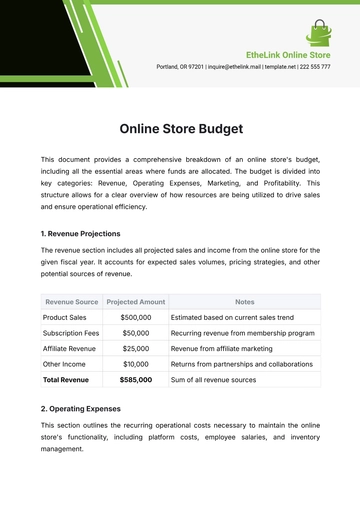

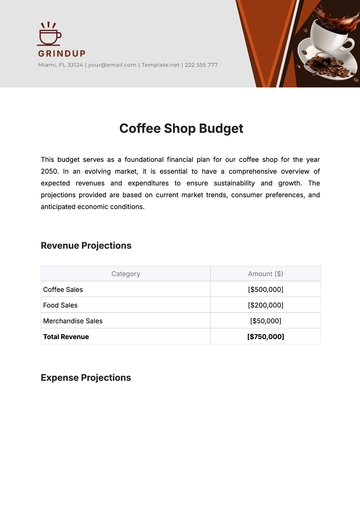

The following table outlines the projected budget for [YOUR COMPANY NAME] for the fiscal year beginning January 1, 2050, and ending December 31, 2050. This budget is aimed at controlling costs effectively across various departments and operational areas.

Category | Q1 Projection (2050) | Q2 Projection (2050) | Q3 Projection (2050) | Q4 Projection (2050) |

|---|---|---|---|---|

Revenue | $1,200,000 | $1,250,000 | $1,300,000 | $1,350,000 |

Operating Costs | $600,000 | $620,000 | $630,000 | $640,000 |

Salaries | $400,000 | $410,000 | $420,000 | $430,000 |

Marketing | $100,000 | $110,000 | $120,000 | $130,000 |

Utilities | $50,000 | $55,000 | $60,000 | $65,000 |

Rent | $90,000 | $90,000 | $90,000 | $90,000 |

Supplies | $30,000 | $35,000 | $40,000 | $45,000 |

Miscellaneous | $20,000 | $25,000 | $30,000 | $35,000 |

Total Expenses | $1,290,000 | $1,345,000 | $1,370,000 | $1,435,000 |

Budget Breakdown

The budget is broken down into key categories to ensure clarity in monitoring and controlling costs. Each category includes projected figures for quarterly assessment, allowing for effective tracking and adjustments as needed.

Conclusion

Maintaining strict adherence to this budget will aid in identifying areas of potential cost savings and ensuring that financial resources are used efficiently. Regular reviews and updates of this budget will be crucial for staying on track with our financial goals.

Reminders

Review budget projections quarterly.

Adjust allocations based on actual performance and emerging needs.

Monitor departmental spending closely.

Conduct regular financial analysis to identify cost-saving opportunities.

Communicate any significant changes or deviations to the management team.

Ensure all departments are adhering to their allocated budgets.

Evaluate and reforecast the budget if there are major changes in revenue or expenses.

Document all budgetary adjustments and their justifications

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Maximize your financial planning with the Professional Business Budget Template from Template.net. This fully customizable and editable tool simplifies budgeting with its intuitive layout. Utilize the AI Editor Tool to tailor each section to your specific needs, ensuring accurate and efficient financial management. Ideal for professionals seeking precision and flexibility in their budgeting strategy.

You may also like

- Budget Sheet

- Personal Budget

- Non Profit Budget

- Monthly Budget

- Project Budget

- HR Budget

- Company Budget

- Home Budget

- Weekly Budget

- College Budget

- Business Budget

- Construction Budget

- Small Business Budget

- Hotel Budget

- Annual Budget

- Home Renovation Budget

- Household Budget

- Student Budget

- Grocery Budget

- Marketing Budget

- Corporate Budget

- Startup Budget

- Manufacturing Budget

- Church Budget

- University Budget

- Annual Budget Plan

- Event Budget

- Operating Budget

- Travel Budget

- Food Budget

- IT and Software Budget

- School Budget

- Real Estate Budget

- Sales Budget

- Conference Budget

- Budget Finance

- Freelancer Budget

- Budget Advertising