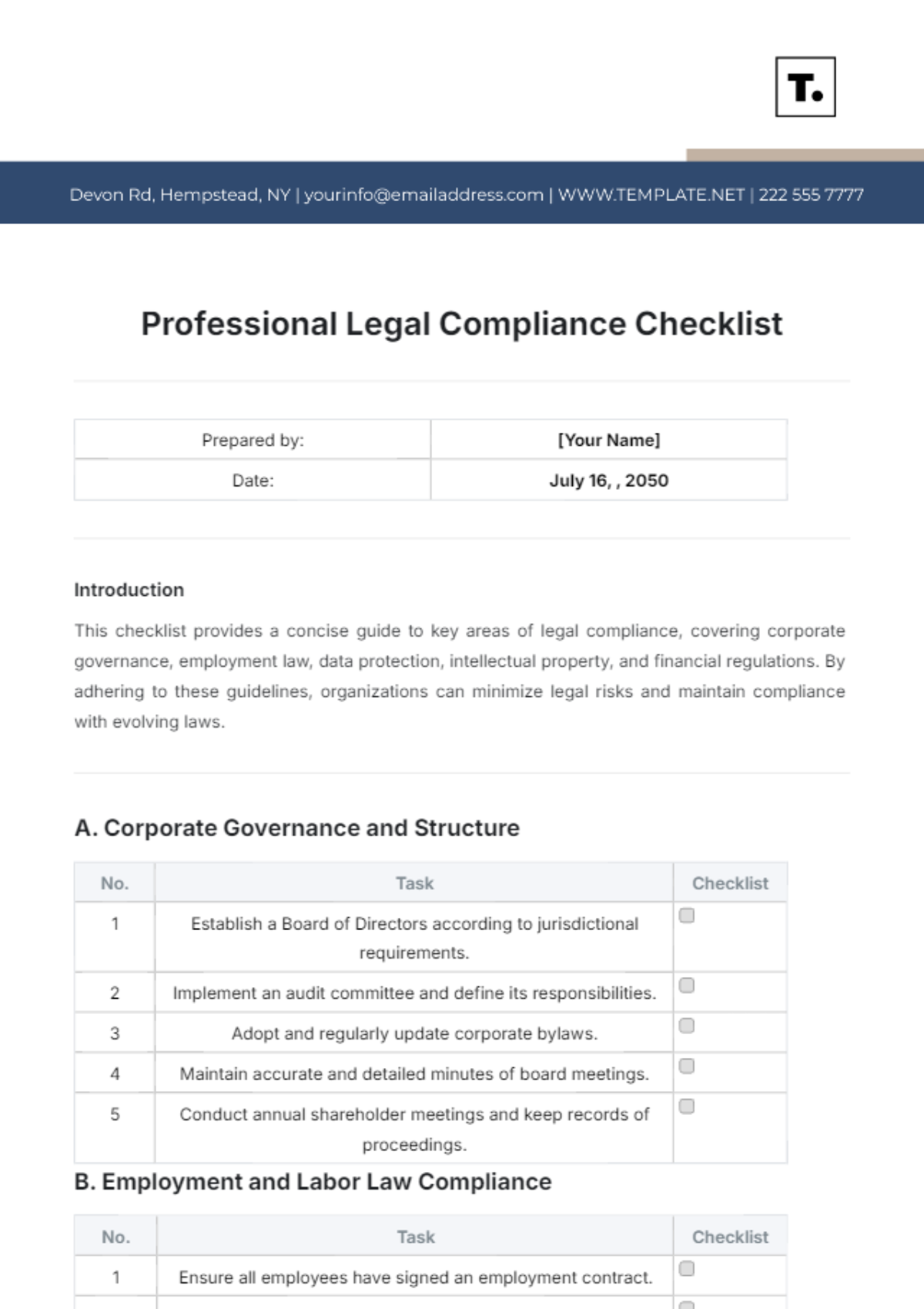

Free Professional Legal Compliance Checklist

Prepared by: | [Your Name] |

Date: | July 16, , 2050 |

Introduction

This checklist provides a concise guide to key areas of legal compliance, covering corporate governance, employment law, data protection, intellectual property, and financial regulations. By adhering to these guidelines, organizations can minimize legal risks and maintain compliance with evolving laws.

A. Corporate Governance and Structure

No. | Task | Checklist |

|---|---|---|

1 | Establish a Board of Directors according to jurisdictional requirements. | |

2 | Implement an audit committee and define its responsibilities. | |

3 | Adopt and regularly update corporate bylaws. | |

4 | Maintain accurate and detailed minutes of board meetings. | |

5 | Conduct annual shareholder meetings and keep records of proceedings. |

B. Employment and Labor Law Compliance

No. | Task | Checklist |

|---|---|---|

1 | Ensure all employees have signed an employment contract. | |

2 | Review and comply with minimum wage laws and overtime regulations. | |

3 | Implement and enforce anti-discrimination and harassment policies. | |

4 | Comply with health and safety regulations specific to your industry. | |

5 | Maintain an updated employee handbook with current policies and procedures. |

C. Data Protection and Privacy

No. | Task | Checklist |

|---|---|---|

1 | Implement a data protection policy compliant with GDPR, CCPA, or other relevant laws. | |

2 | Conduct regular data protection impact assessments (DPIAs). | |

3 | Ensure secure storage and handling of personal and sensitive data. | |

4 | Provide regular training on data protection for employees. | |

5 | Establish a clear process for data breach notifications and response. |

D. Intellectual Property Management

No. | Task | Checklist |

|---|---|---|

1 | Register trademarks, patents, and copyrights as needed. | |

2 | Monitor and enforce intellectual property rights against infringement. | |

3 | Review and update IP licenses and agreements regularly. | |

4 | Ensure proper use of third-party intellectual property within your organization. | |

5 | Educate employees on the importance of protecting intellectual property. |

E. Financial and Tax Compliance

No. | Task | Checklist |

|---|---|---|

1 | Maintain accurate financial records and statements by GAAP or IFRS. | |

2 | Ensure timely filing of all corporate tax returns and payments. | |

3 | Conduct regular audits to ensure financial compliance and transparency. | |

4 | Implement proper internal controls to prevent and detect financial misconduct. | |

5 | Comply with all payroll tax requirements and provide employees with necessary forms. |

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Stay on top of legal requirements with the Professional Legal Compliance Checklist Template from Template.net. This editable and customizable template ensures that you maintain regulatory compliance with ease. Designed for legal professionals, it is editable in our Ai Editor Tool, enabling you to adapt the checklist to specific cases or legal frameworks. Manage deadlines, filings, and key obligations with confidence

You may also like

- Cleaning Checklist

- Daily Checklist

- Travel Checklist

- Self Care Checklist

- Risk Assessment Checklist

- Onboarding Checklist

- Quality Checklist

- Compliance Checklist

- Audit Checklist

- Registry Checklist

- HR Checklist

- Restaurant Checklist

- Checklist Layout

- Creative Checklist

- Sales Checklist

- Construction Checklist

- Task Checklist

- Professional Checklist

- Hotel Checklist

- Employee Checklist

- Moving Checklist

- Marketing Checklist

- Accounting Checklist

- Camping Checklist

- Packing Checklist

- Real Estate Checklist

- Cleaning Checklist Service

- New Employee Checklist

- Food Checklist

- Home Inspection Checklist

- Advertising Checklist

- Event Checklist

- SEO Checklist

- Assessment Checklist

- Inspection Checklist

- Baby Registry Checklist

- Induction Checklist

- Employee Training Checklist

- Medical Checklist

- Safety Checklist

- Site Checklist

- Job Checklist

- Service Checklist

- Nanny Checklist

- Building Checklist

- Work Checklist

- Office Checklist

- Training Checklist

- Website Checklist

- IT and Software Checklist

- Performance Checklist

- Project Checklist

- Startup Checklist

- Education Checklist

- Home Checklist

- School Checklist

- Maintenance Checklist

- Planning Checklist

- Manager Checklist

- Wedding Checklist

- Vehicle Checklist

- Travel Agency Checklist

- Vehicle Inspection Checklist

- Interior Design Checklist

- Backpacking Checklist

- Business Checklist

- Legal Checklist

- Nursing Home Checklist

- Weekly Checklist

- Recruitment Checklist

- Salon Checklist

- Baby Checklist

- Equipment Checklist

- Trade Show Checklist

- Party Checklist

- Hospital Bag Checklist

- Evaluation Checklist

- Agency Checklist

- First Apartment Checklist

- Hiring Checklist

- Opening Checklist

- Small Business Checklist

- Rental Checklist

- College Dorm Checklist

- New Puppy Checklist

- University Checklist

- Building Maintenance Checklist

- Work From Home Checklist

- Student Checklist

- Application Checklist