Weekly Inventory Management Report

Company: [Your Company Name]

Prepared by: [Your Name]

Report Period: [Date]

1. Executive Summary

The inventory levels for the week remained stable, with no major disruptions in the supply chain. Stock turnover improved slightly compared to the previous week, mainly due to increased demand for Category A and B items. We have identified a few underperforming SKUs that require immediate attention to prevent overstock situations.

Key highlights for the week:

Overall inventory levels: Stable

Stock turnover: 2.5% increase

Out-of-stock occurrences: 3 instances (down from 5 last week)

Excess inventory: 4 SKUs flagged for action

Total Inventory Value: $2,345,650

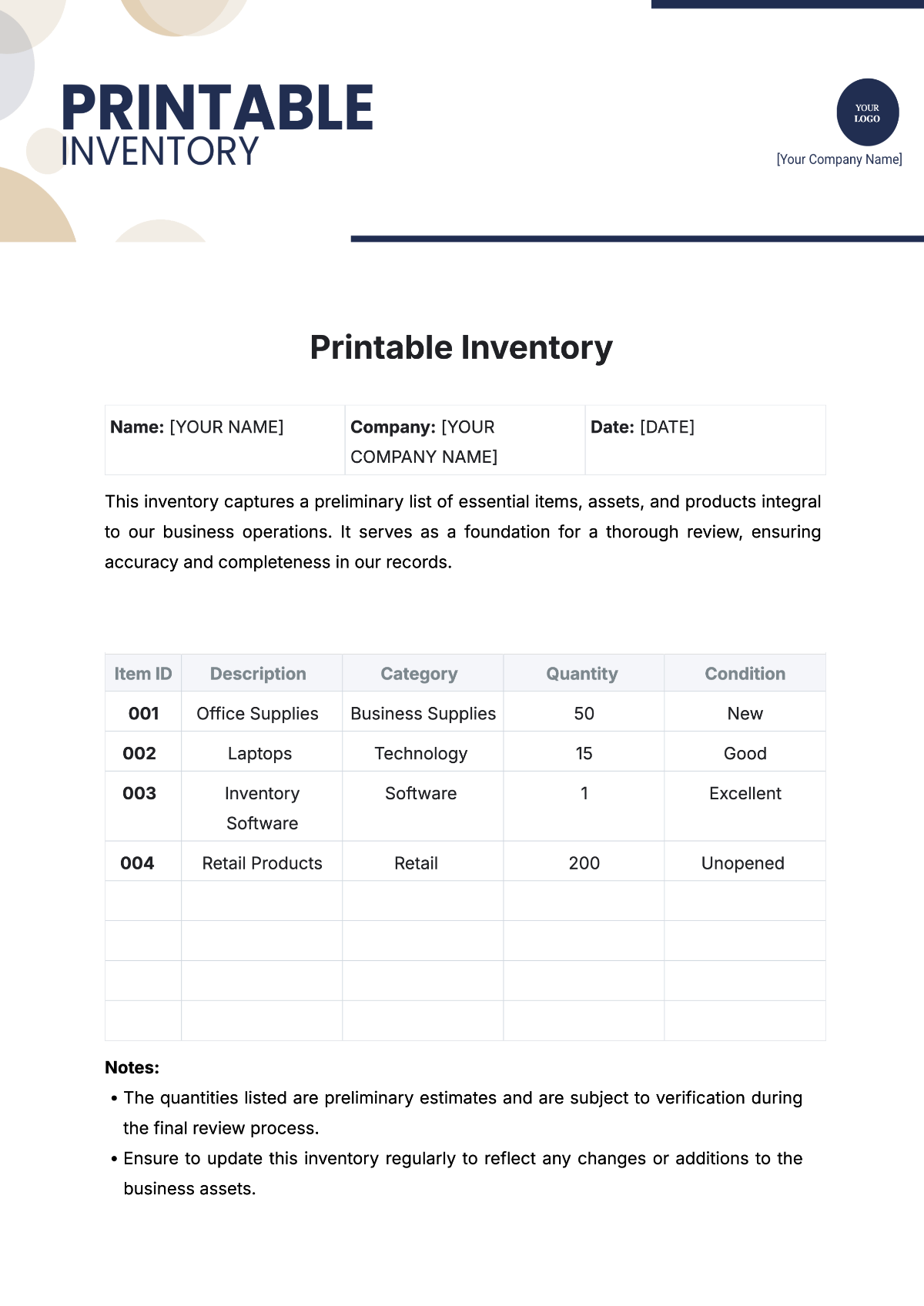

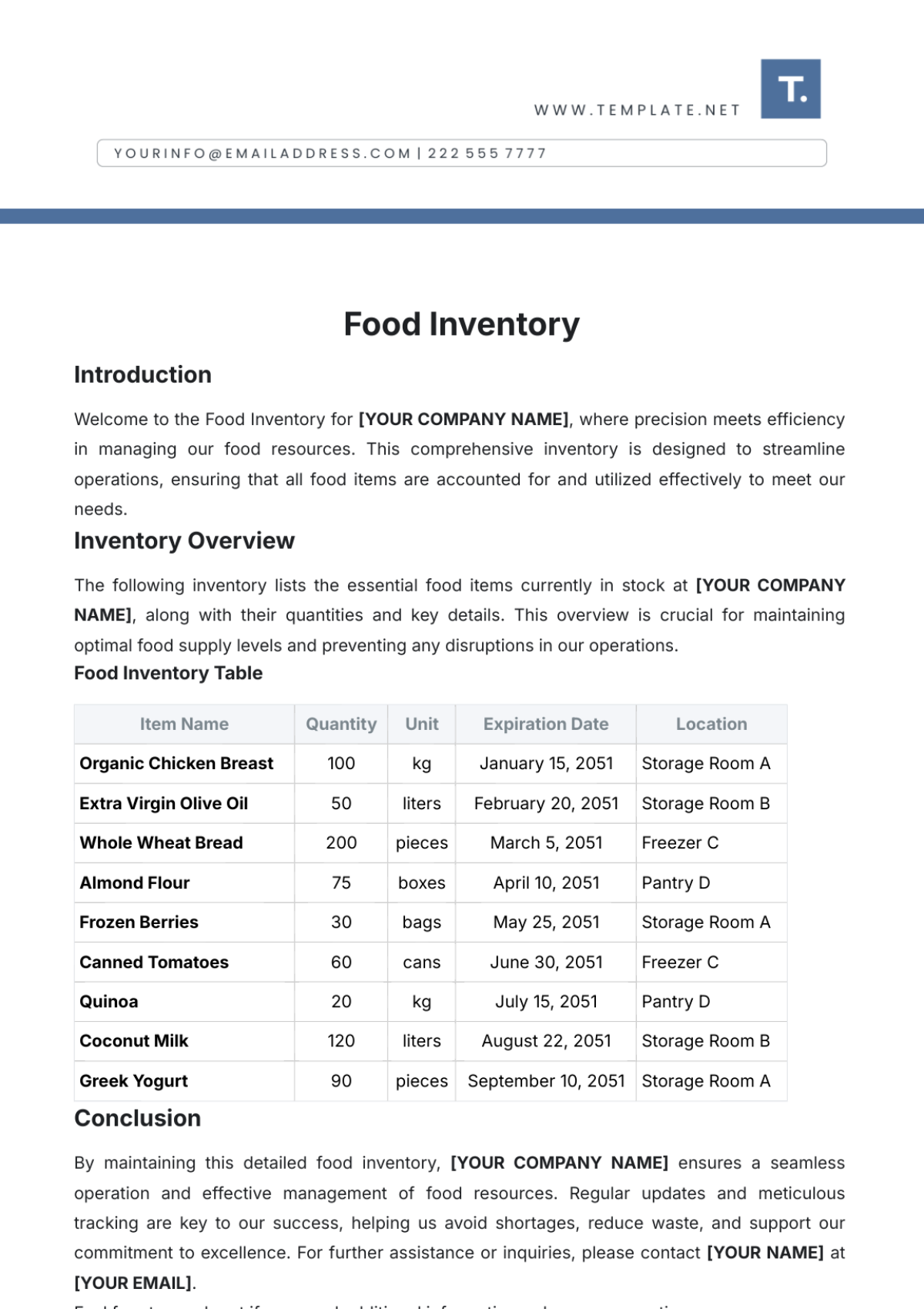

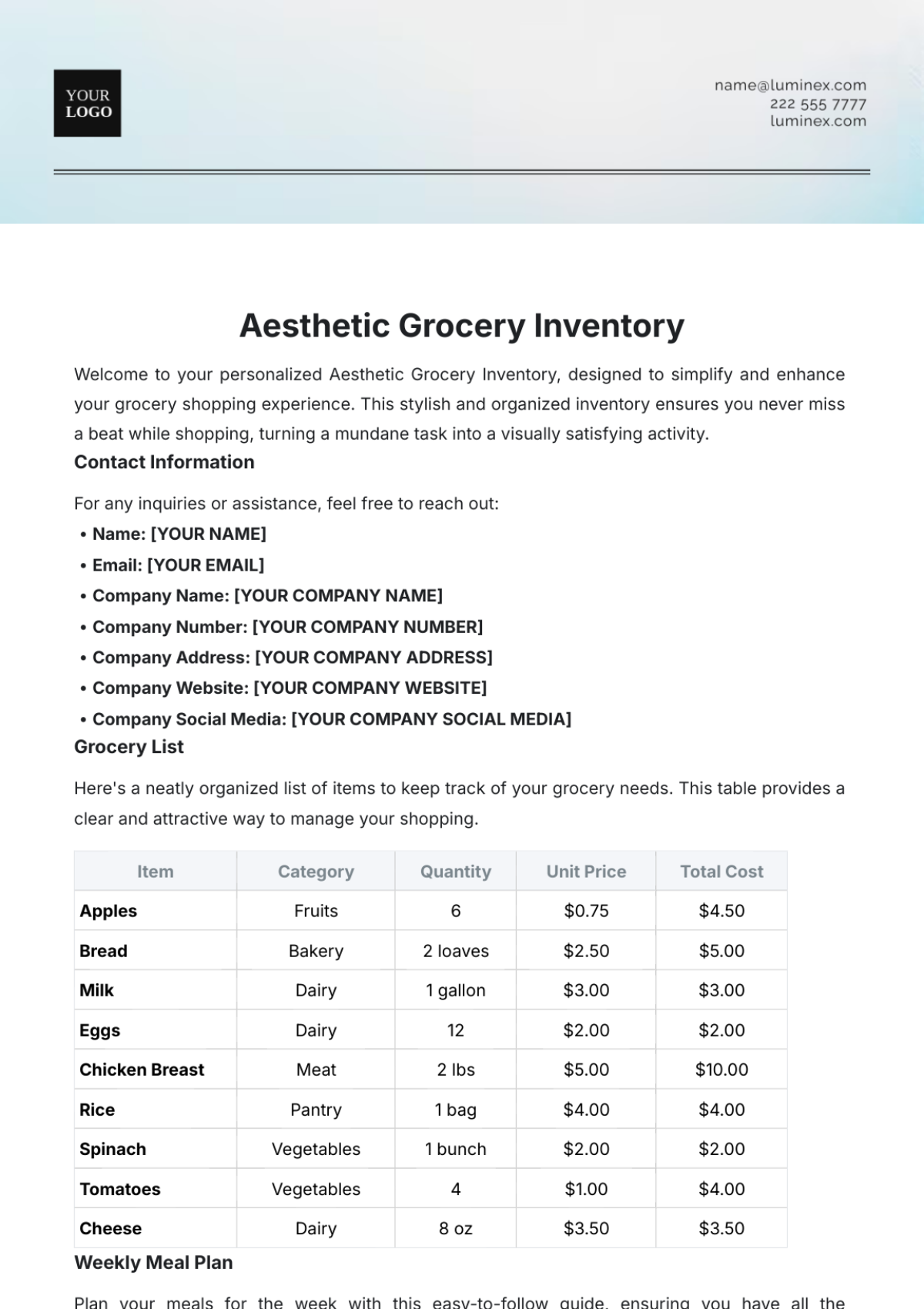

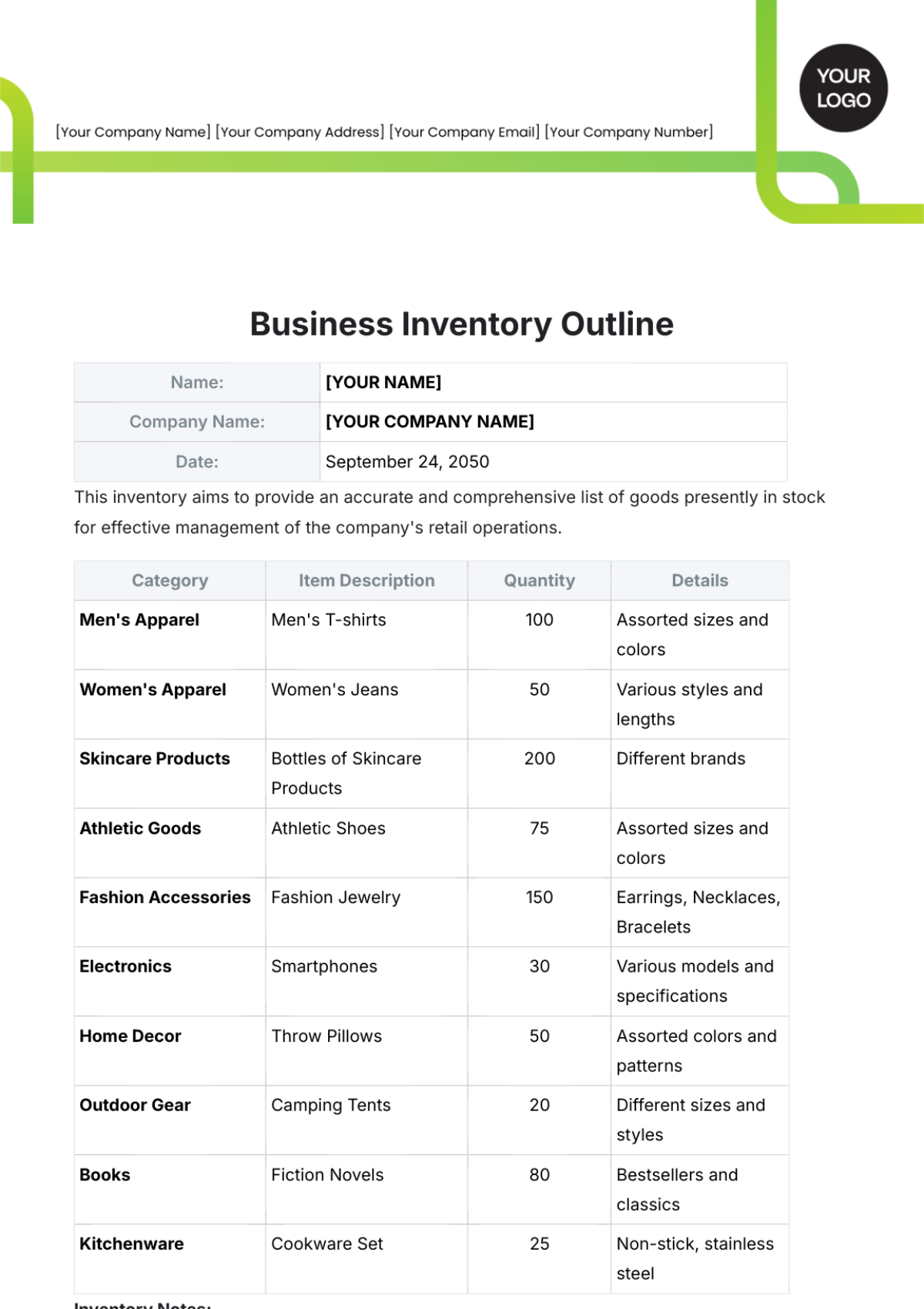

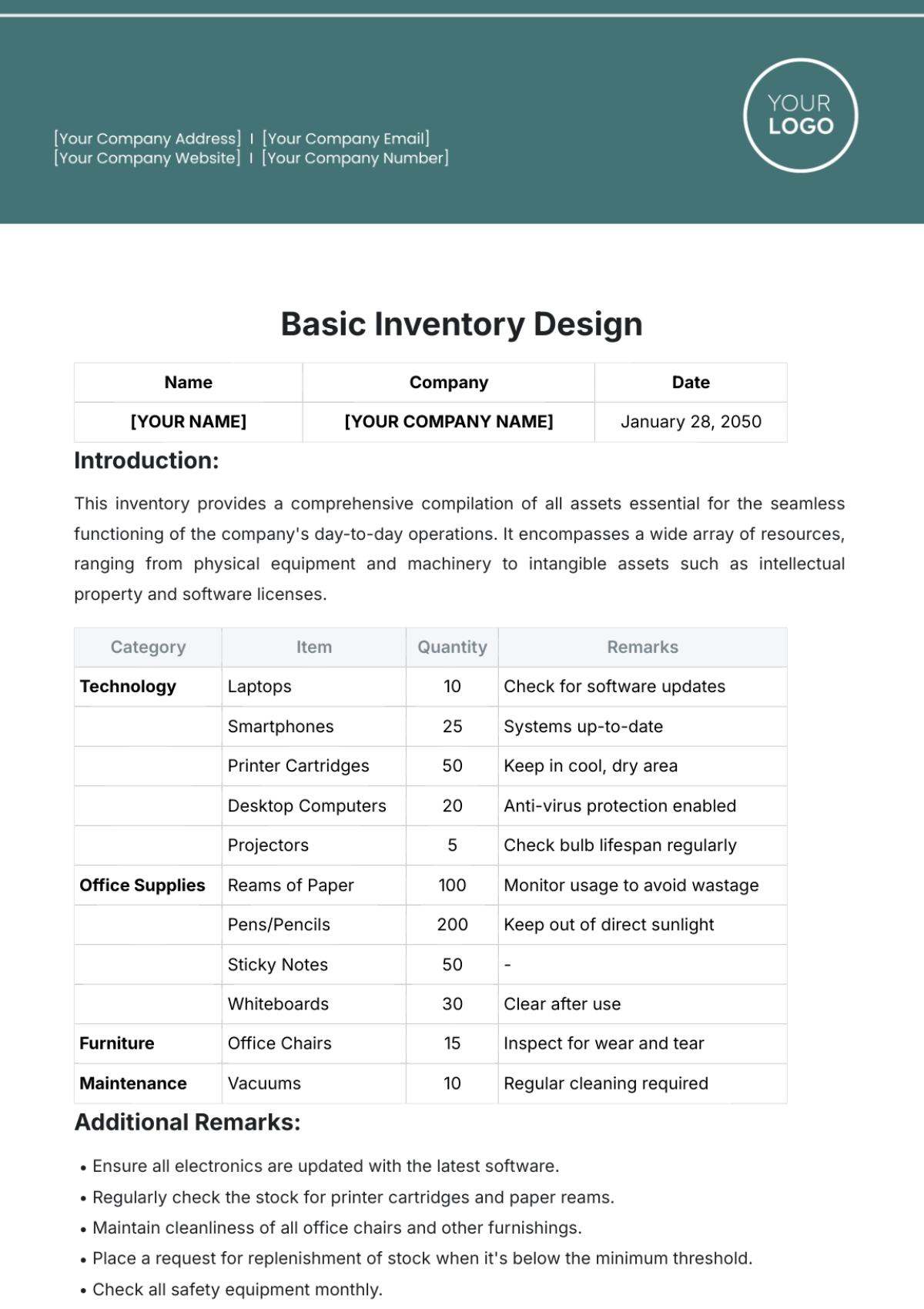

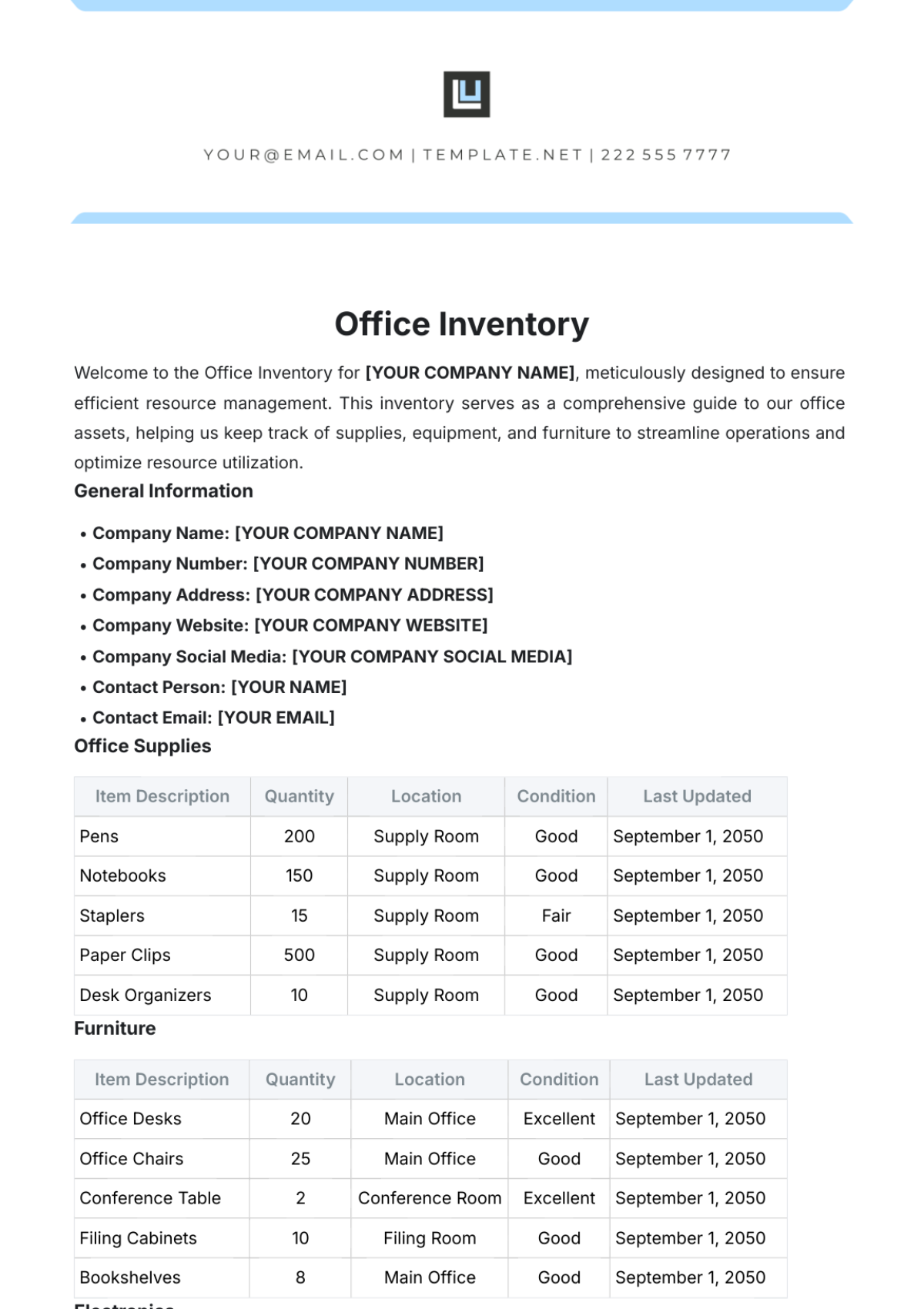

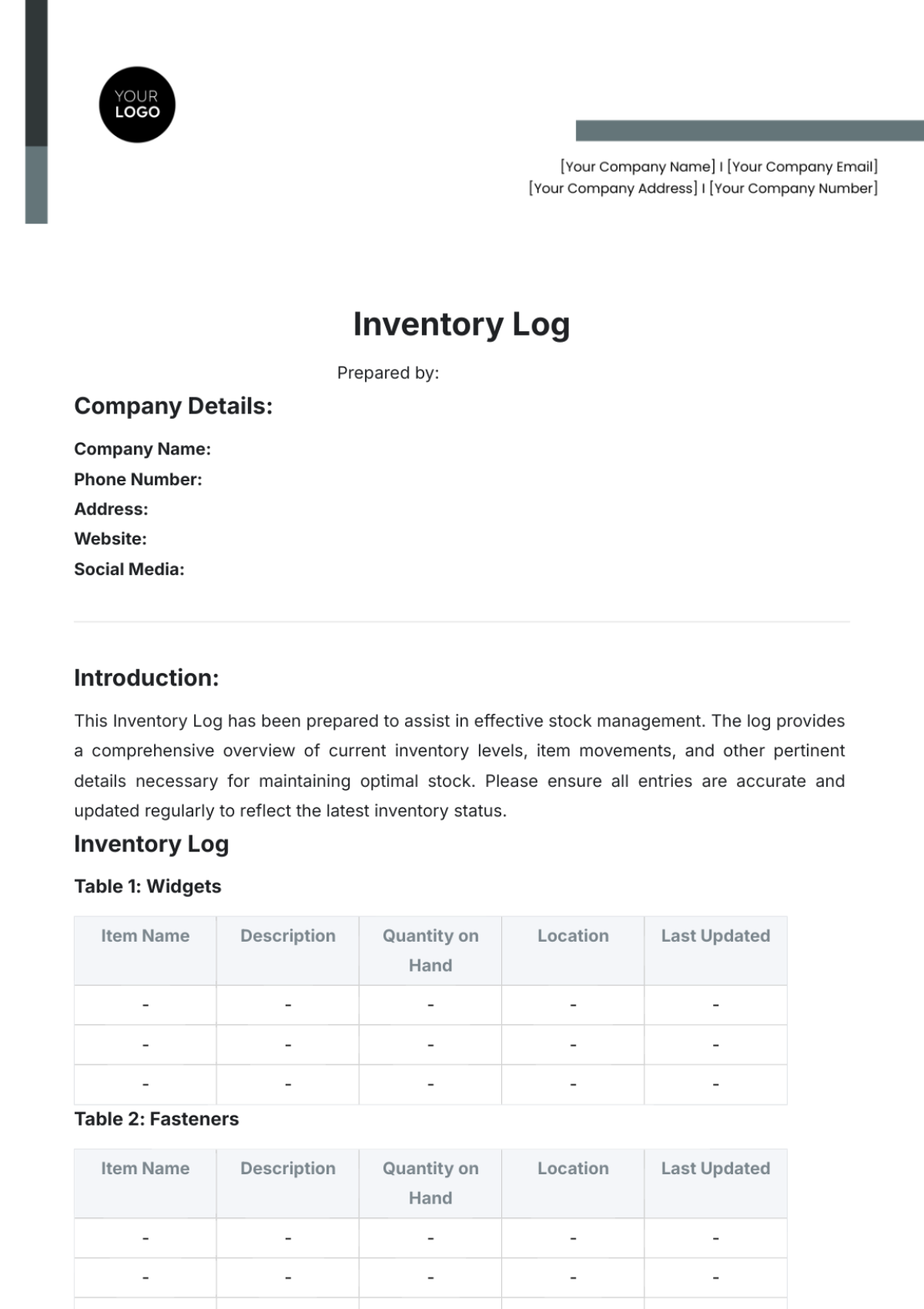

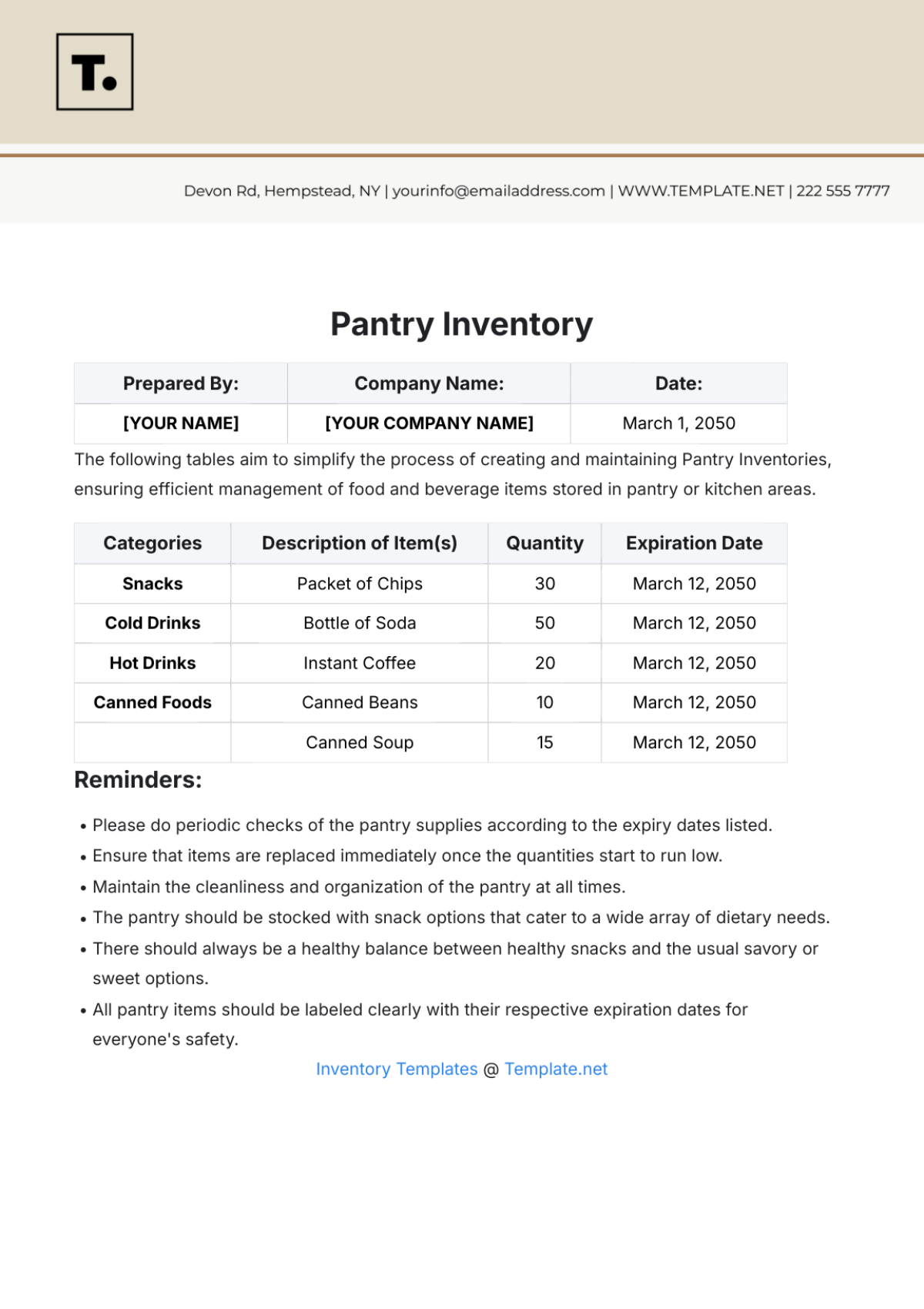

2. Inventory Status Overview

Category | Opening Inventory (Units) | Closing Inventory (Units) | Variance (%) | Average Days in Stock | Status |

|---|---|---|---|---|---|

Category A | 5,000 | 4,800 | -4% | 12 | Stable |

Category B | 3,500 | 3,100 | -11% | 9 | Normal |

Category C | 7,200 | 7,400 | +3% | 35 | Overstock |

Category D | 1,200 | 1,050 | -12.5% | 15 | Low stock |

Total | 16,900 | 16,350 | -3.25% | 17.75 | Stable |

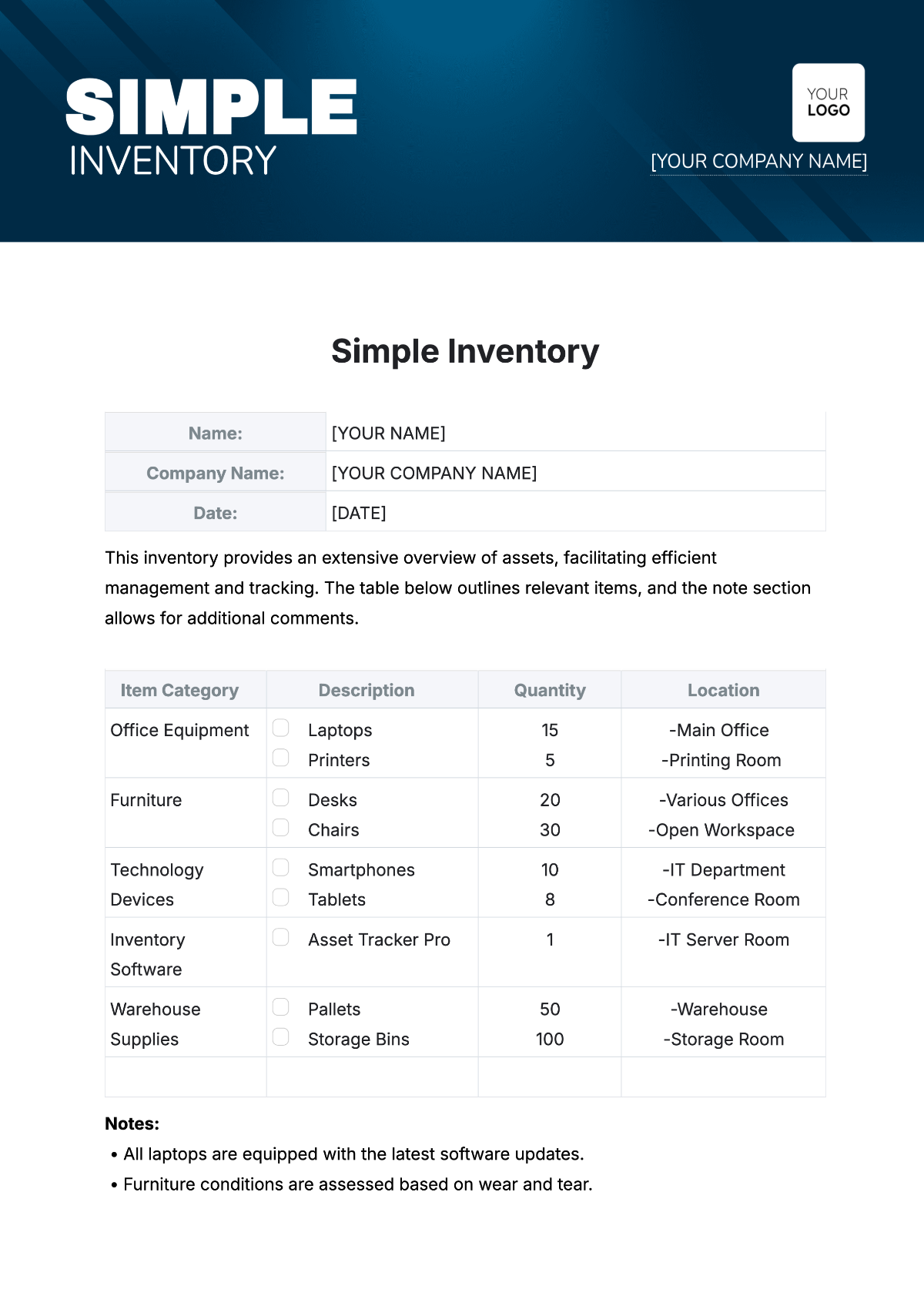

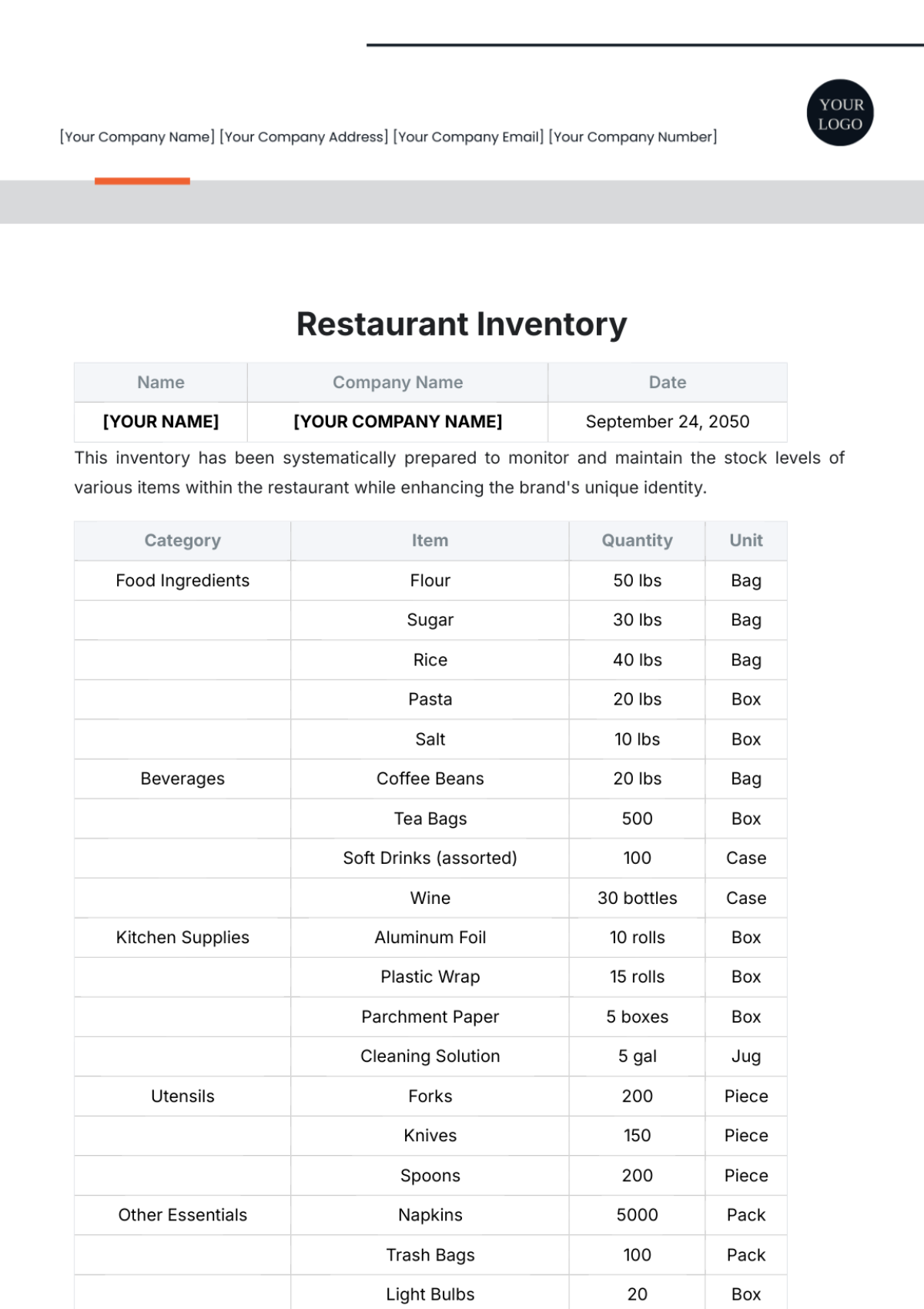

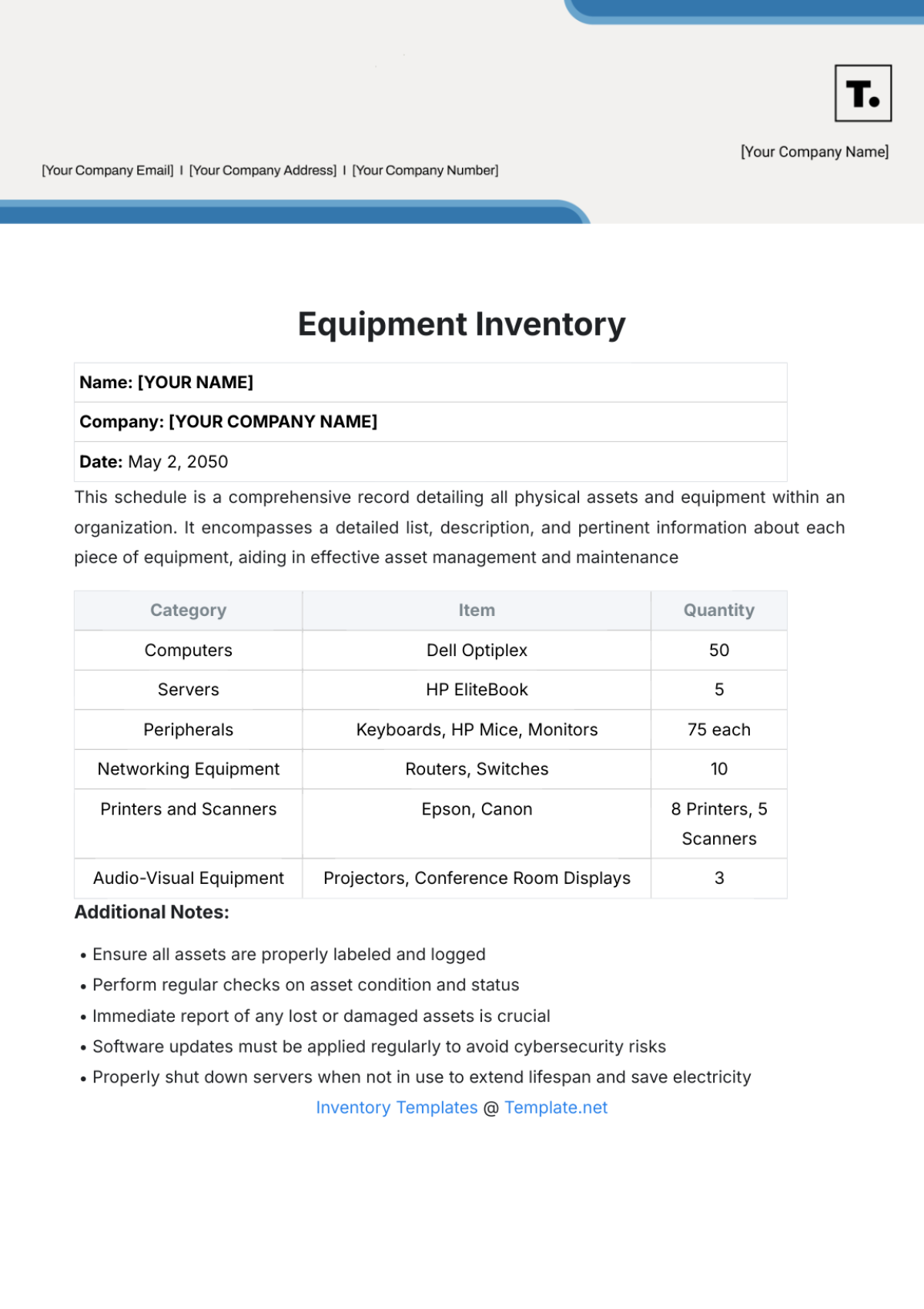

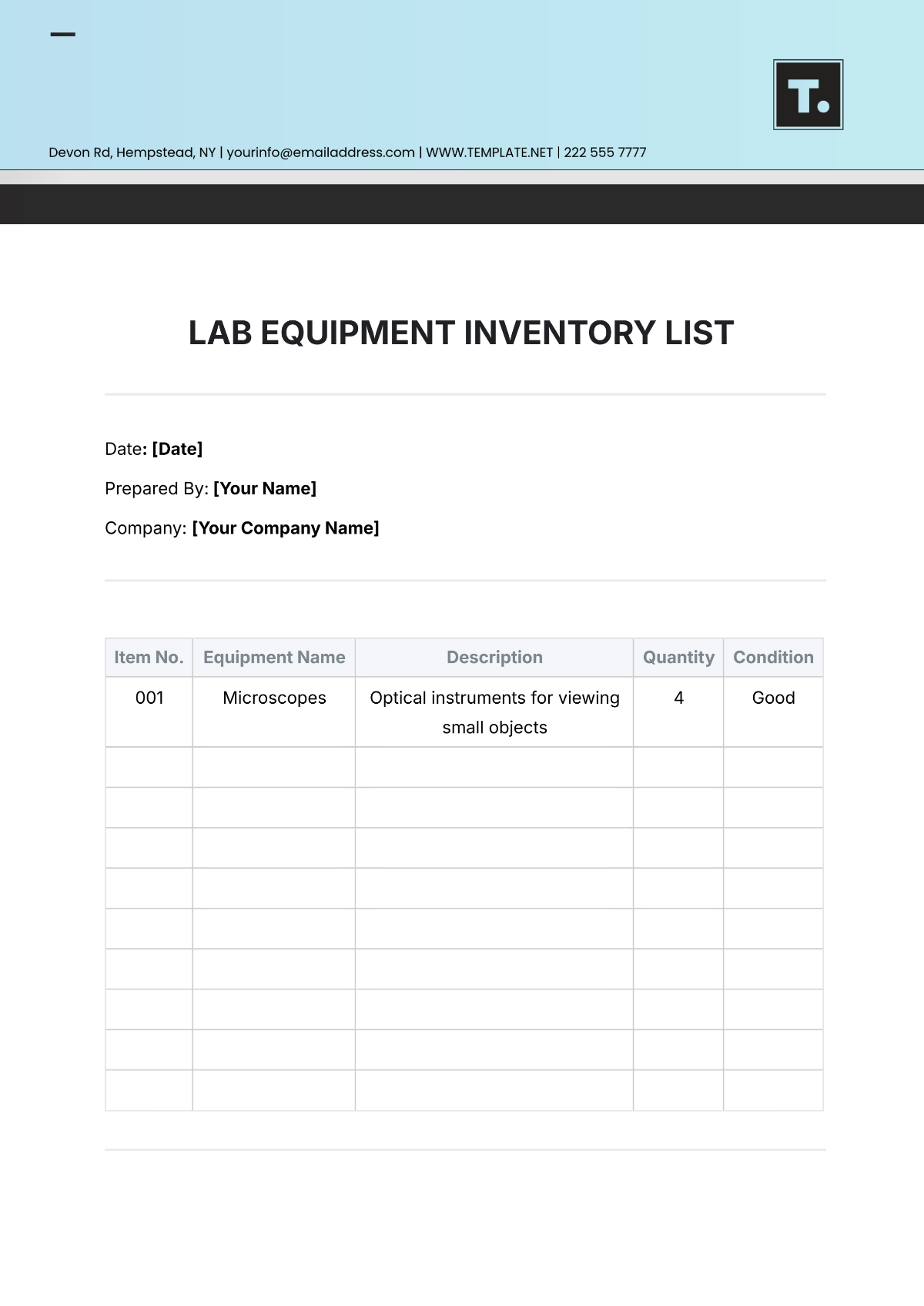

3. Stock Turnover Rate

The stock turnover rate for this week is 1.75 compared to 1.70 the previous week. This marginal increase was driven by the faster movement of Category B items, which saw increased demand due to seasonal factors.

Category | Turnover Rate (This Week) | Turnover Rate (Previous Week) | Change (%) |

|---|---|---|---|

Category A | 1.25 | 1.20 | +4.2% |

Category B | 2.00 | 1.80 | +11.1% |

Category C | 0.75 | 0.80 | -6.25% |

Category D | 0.90 | 0.95 | -5.3% |

Total | 1.75 | 1.70 | +2.9% |

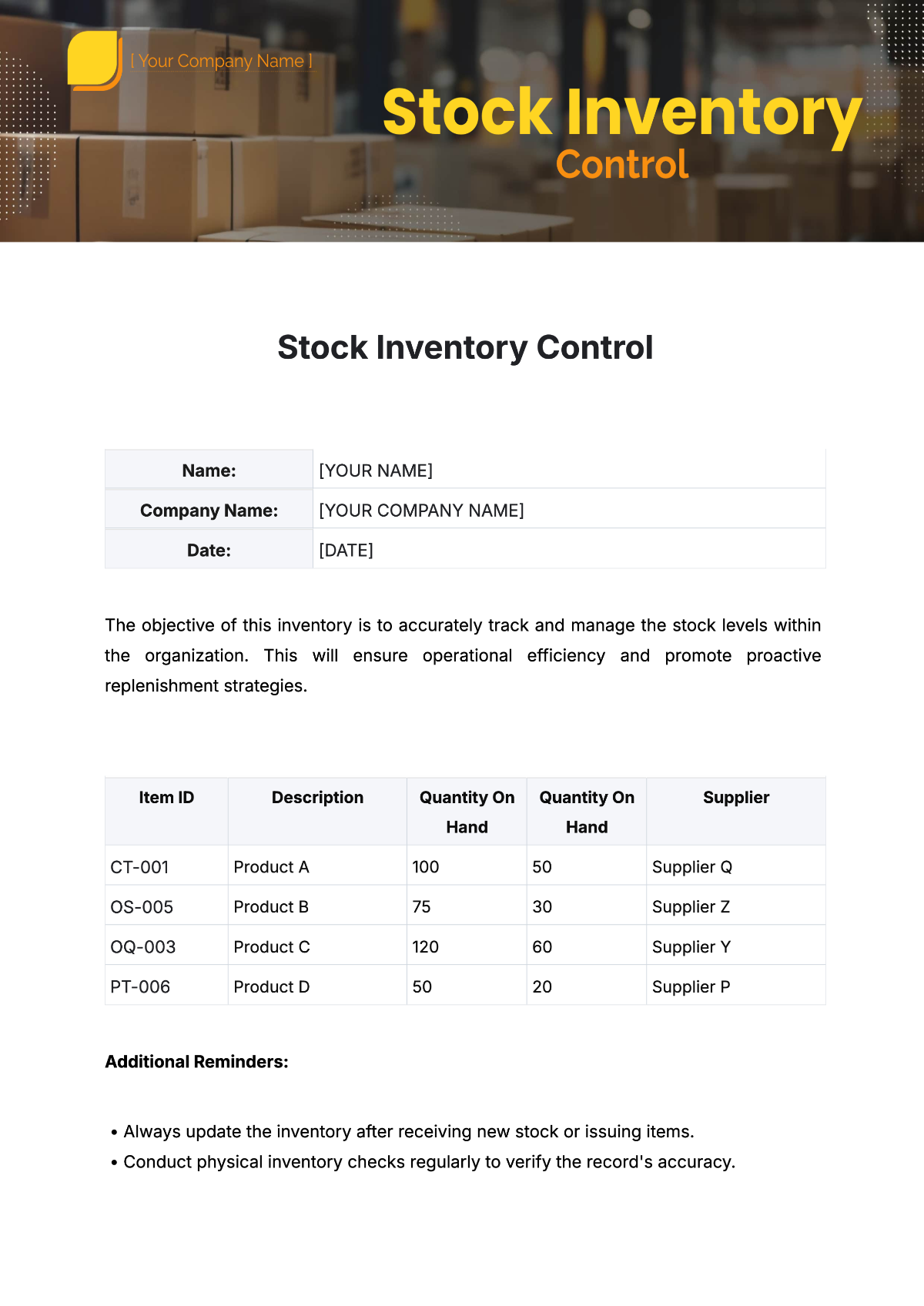

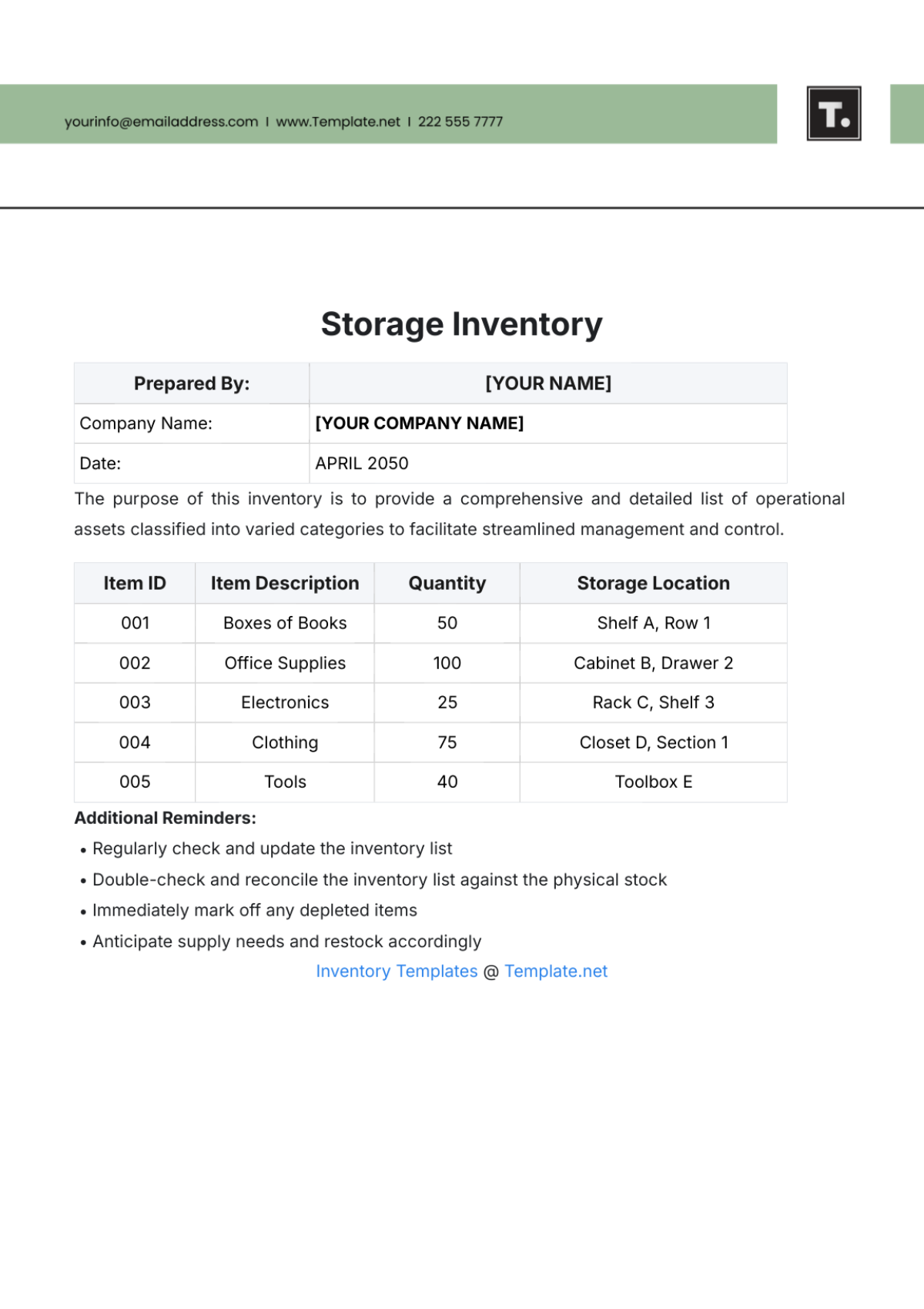

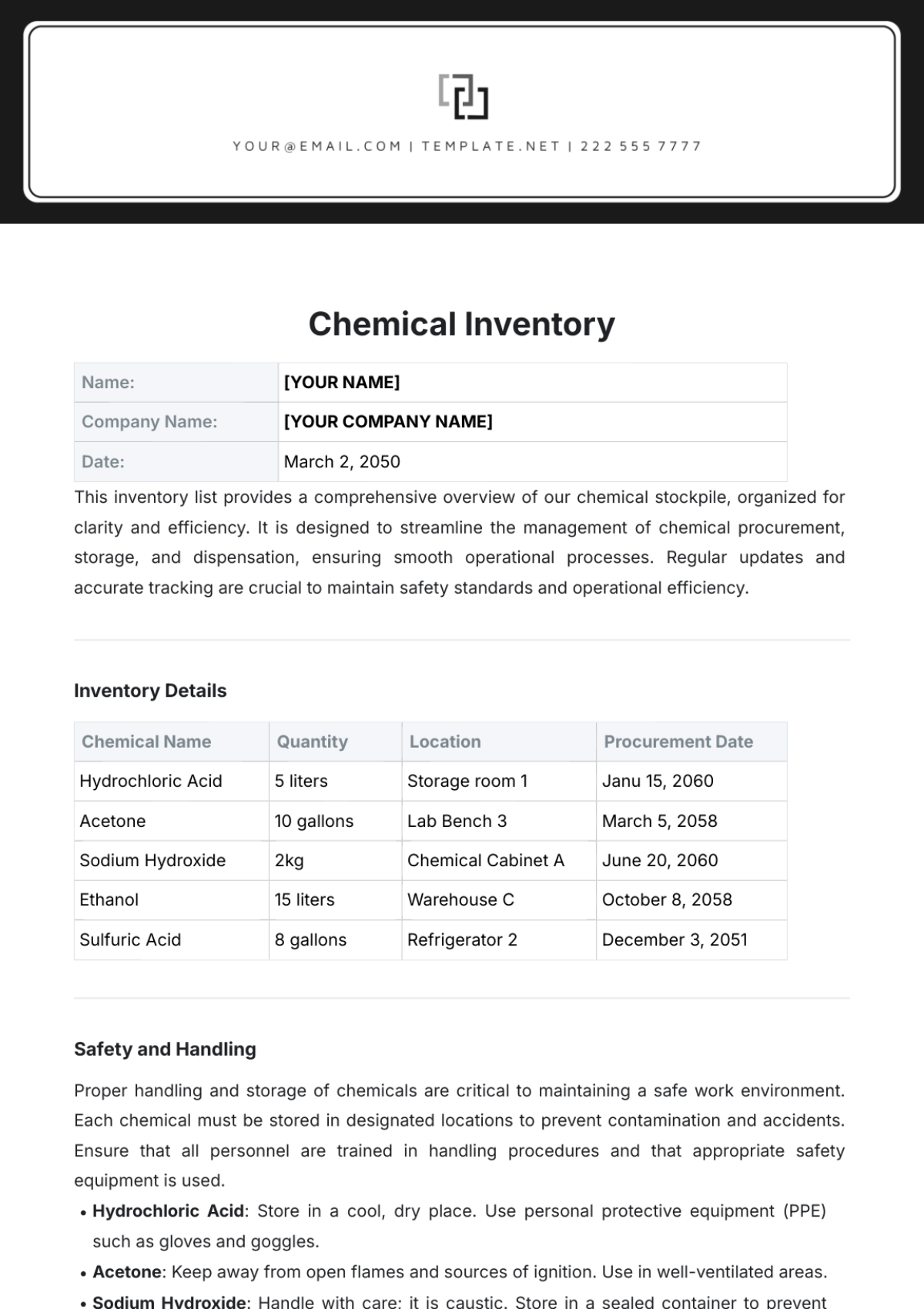

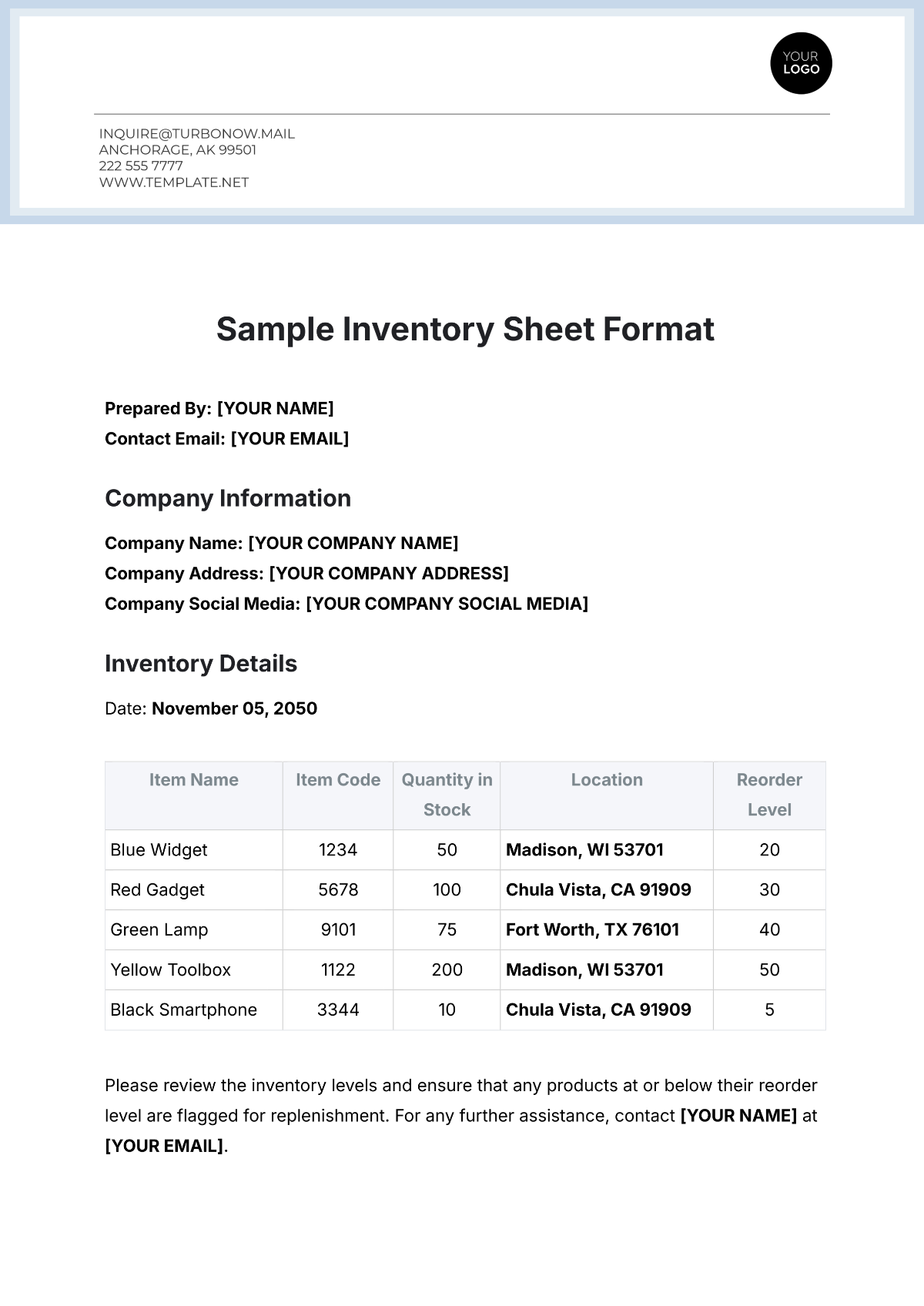

4. Out-of-Stock Analysis

This week saw 3 out-of-stock occurrences, which is an improvement compared to the 5 reported last week. All instances were quickly resolved, and replenishment orders have already been placed.

SKU | Category | Out-of-Stock Date | Restock Date | Comments |

|---|---|---|---|---|

SKU-1024 | Category A | September 16, 2054 | September 18, 2054 | Restocked within 2 days |

SKU-2035 | Category B | September 14, 2054 | September 16, 2054 | Temporary supplier delay |

SKU-4568 | Category D | September 15, 2054 | September 19, 2054 | Vendor shipment delay |

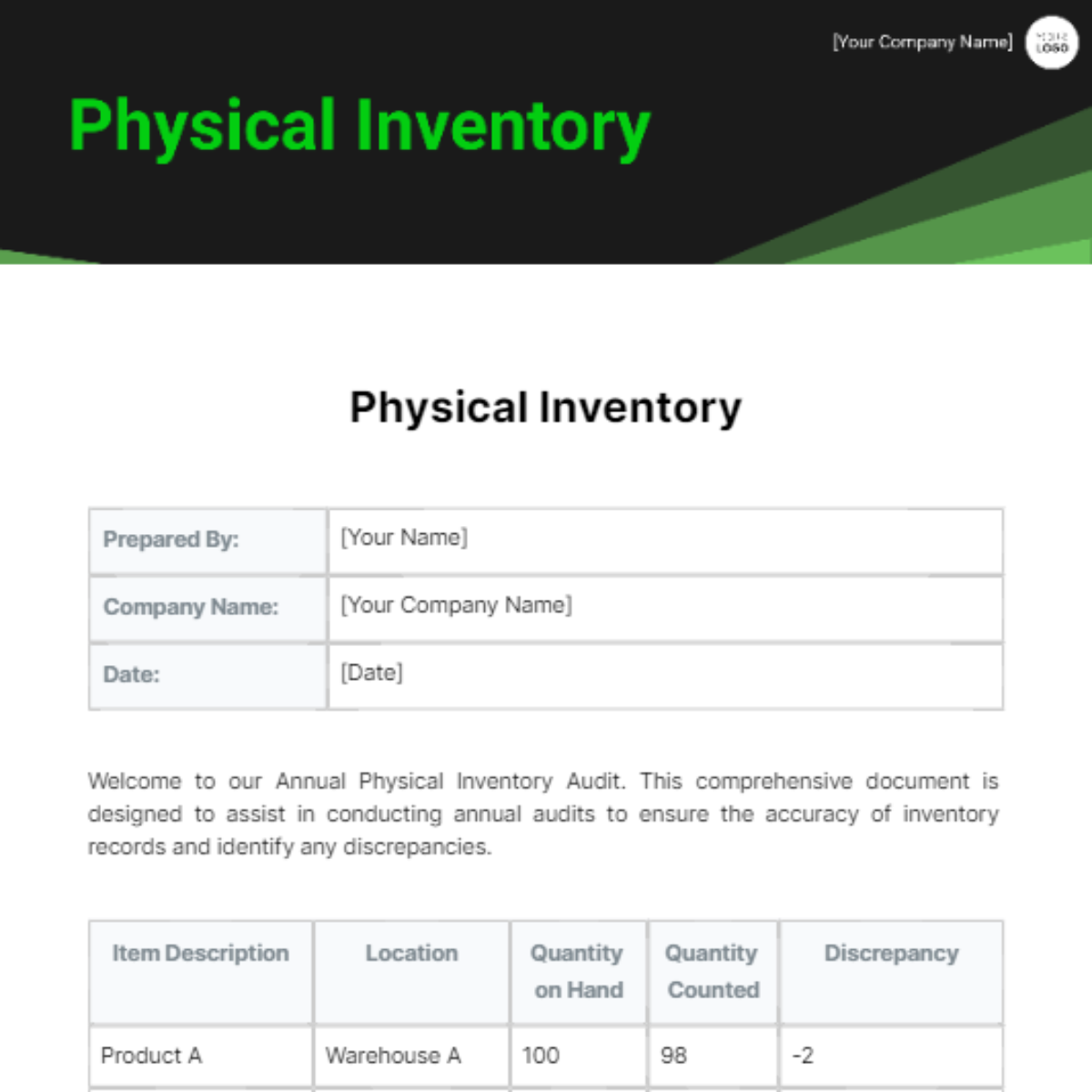

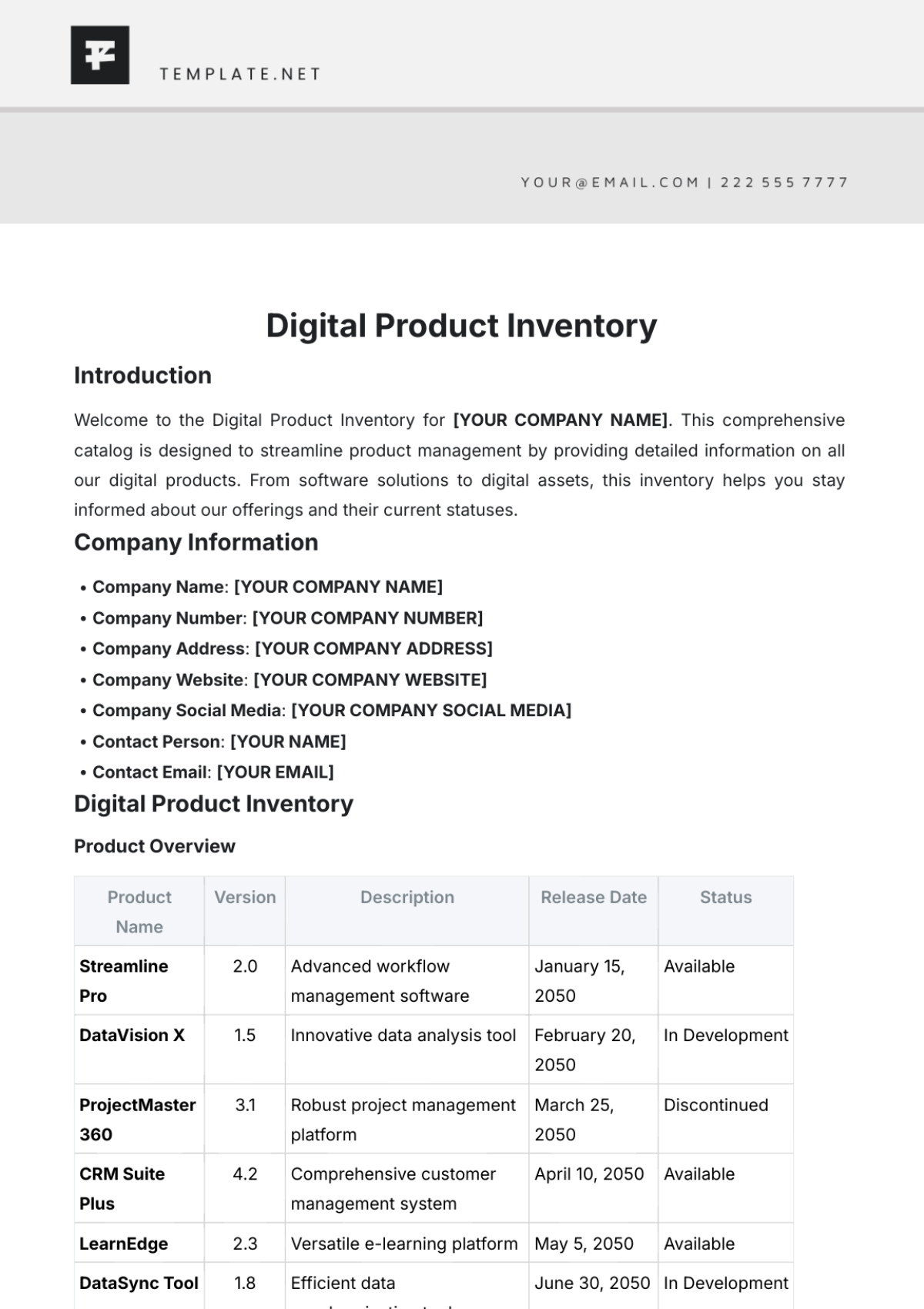

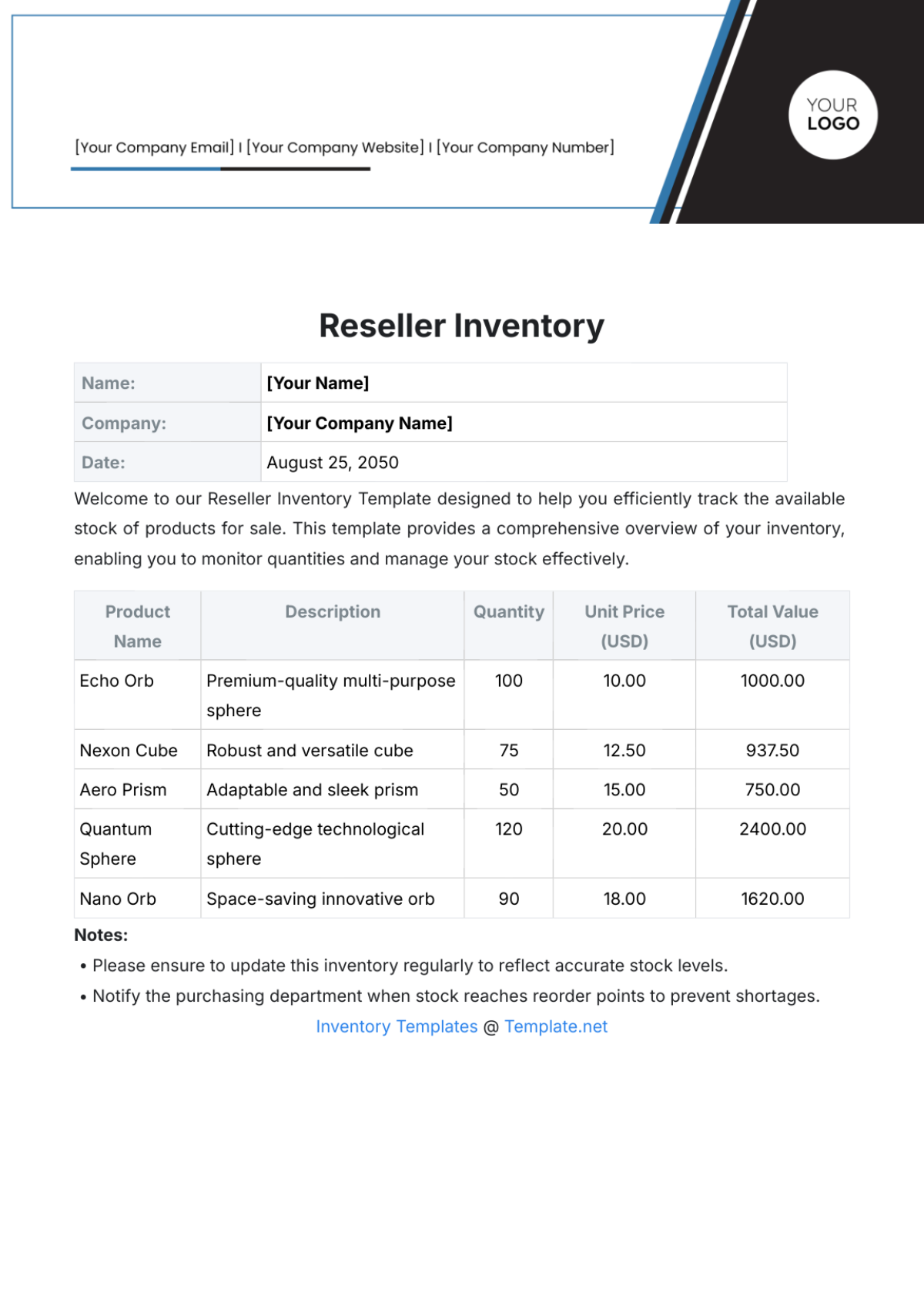

5. Excess Inventory

There were 4 SKUs identified with excess inventory this week. We recommend considering markdowns, promotions, or adjustments in procurement to mitigate overstock risks.

SKU | Category | Closing Inventory (Units) | Recommended Action |

|---|---|---|---|

SKU-3312 | Category C | 2,100 | Promotion |

SKU-4015 | Category C | 1,800 | Hold for next cycle |

SKU-5210 | Category D | 750 | Reduce procurement |

SKU-6457 | Category C | 1,200 | Markdown |

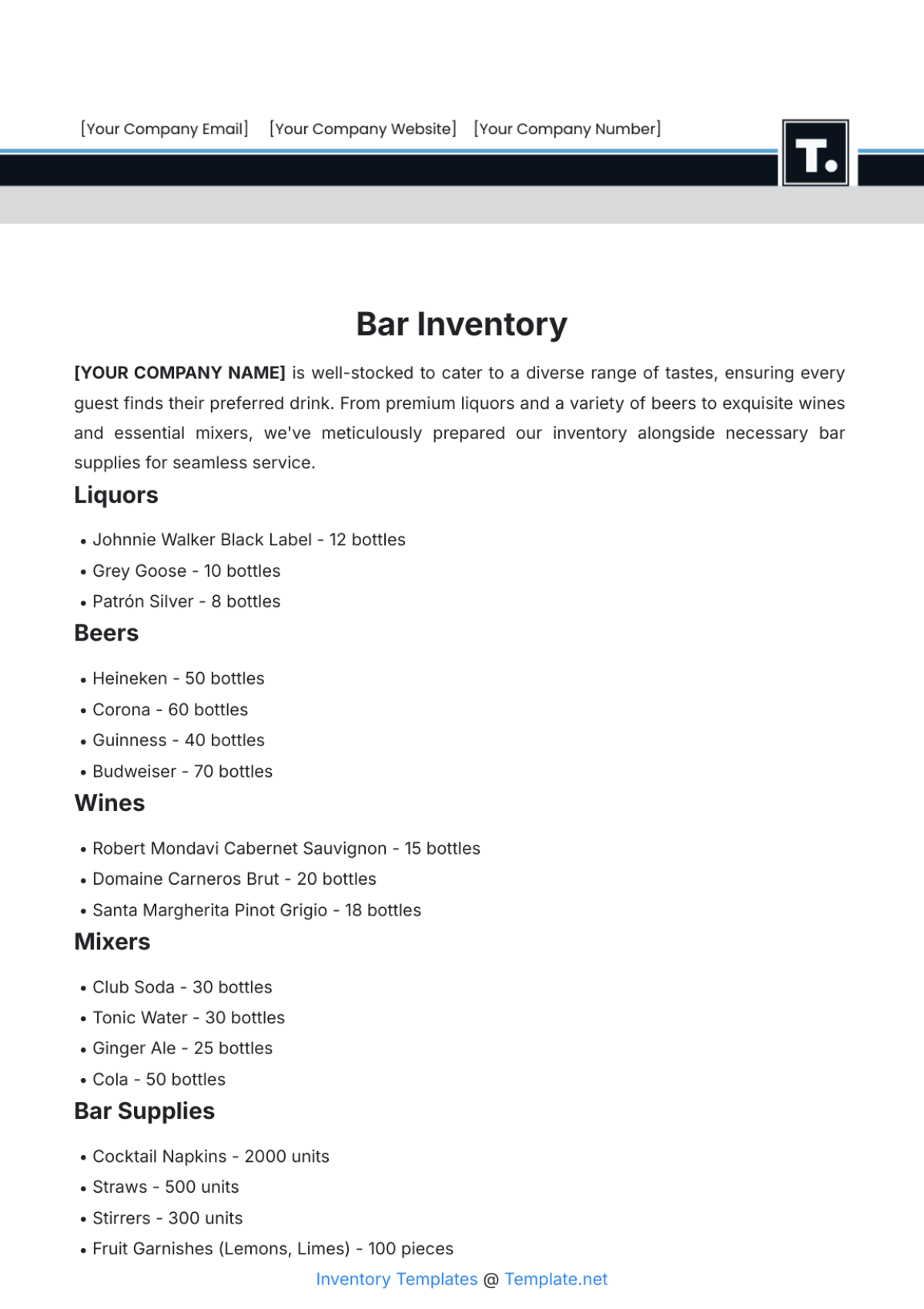

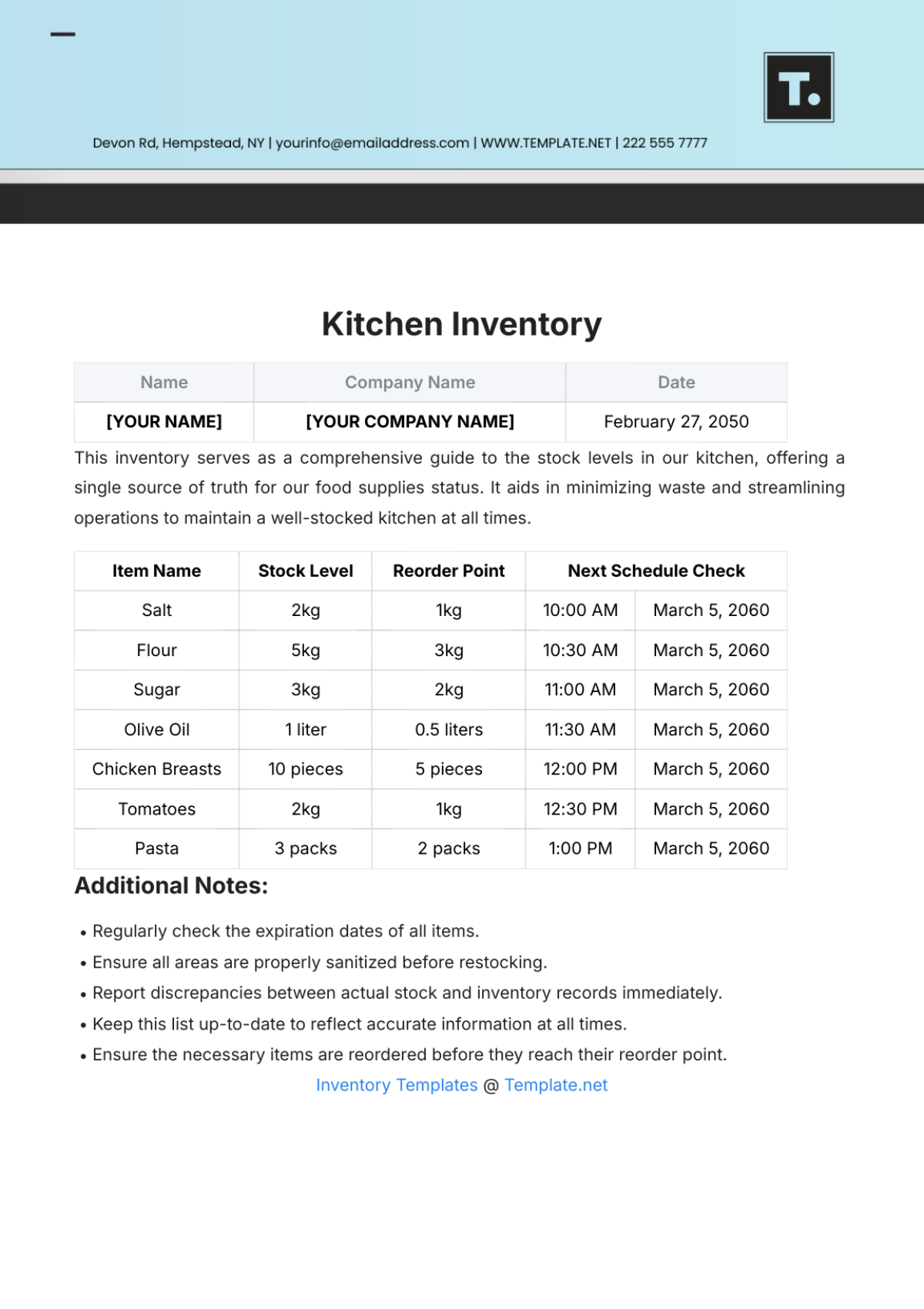

6. Replenishment & Procurement

SKU | Category | Order Quantity | Expected Arrival Date | Comments |

|---|---|---|---|---|

SKU-1024 | Category A | 1,000 | September 23, 2054 | Regular cycle replenishment |

SKU-2035 | Category B | 500 | September 22, 2054 | Seasonal increase |

SKU-4568 | Category D | 150 | September 24, 2054 | Delayed due to vendor issues |

7. Action Items & Recommendations

Monitor SKUs with excess inventory: For Categories C and D, promotions or markdowns should be implemented to prevent long-term overstock.

Improve stock forecasting: Fine-tune procurement for Category B, which is moving quickly, to avoid future stock-outs.

Vendor management: Follow up with suppliers for Category D to address delayed shipments and mitigate future risks.

8. Conclusion

This week showed promising improvements in stock turnover and fewer stock-outs. However, some overstock risks and vendor delays in Category C and D need proactive management. Overall, the inventory system is performing well, with continuous monitoring in place to optimize stock levels and minimize inefficiencies.