Free Professional Finance Tracker

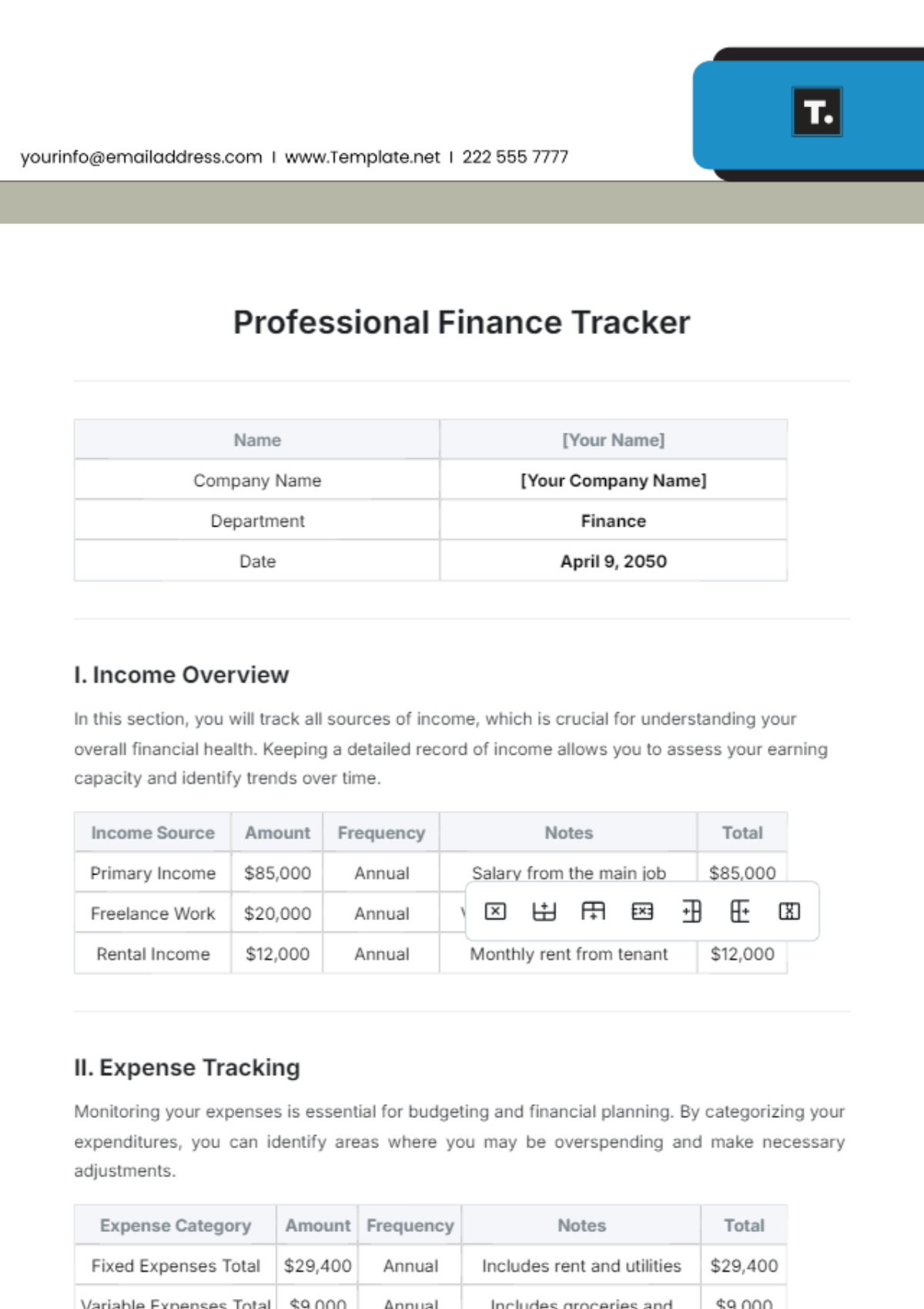

Name | [Your Name] |

|---|---|

Company Name | [Your Company Name] |

Department | Finance |

Date | April 9, 2050 |

I. Income Overview

Income Source | Amount | Frequency | Notes | Total |

|---|---|---|---|---|

Primary Income | $85,000 | Annual | Salary from the main job | $85,000 |

Freelance Work | $20,000 | Annual | Various consulting projects | $20,000 |

Rental Income | $12,000 | Annual | Monthly rent from the tenant | $12,000 |

II. Expense Tracking

Expense Category | Amount | Frequency | Notes | Total |

|---|---|---|---|---|

Fixed Expenses Total | $29,400 | Annual | Includes rent and utilities | $29,400 |

Variable Expenses Total | $9,000 | Annual | Includes groceries and entertainment | $9,000 |

Total Expenses | $38,400 | Annual | Overall yearly spending | $38,400 |

III. Savings Goals

Savings Goal | Target Amount | Current Amount | Due Date | Notes |

|---|---|---|---|---|

Emergency Fund | $11,400 | $6,000 | June 15, 2051 | 3 months of expenses |

Retirement Fund | $127,500 | $75,000 | December 31, 2050 | Long-term goal |

Vacation Fund | $5,000 | $2,500 | March 1, 2052 | A planned trip to Europe |

IV. Investment Portfolio

Investment Type | Amount Invested | Current Value | Growth/Loss | Notes |

|---|---|---|---|---|

Stocks | $40,000 | $50,000 | $10,000 (25% gain) | Tech sector investments |

Bonds | $30,000 | $32,000 | $2,000 (6.67% gain) | Government bonds |

Mutual Funds | $20,000 | $22,000 | $2,000 (10% gain) | Diverse portfolio |

V. Cash Flow Analysis

Period | Total Inflows | Total Outflows | Net Cash Flow | Notes |

|---|---|---|---|---|

Year 2050 | $117,000 | $38,400 | $78,600 | Positive cash flow |

Year 2051 | $120,000 | $40,000 | $80,000 | Projecting growth |

Year 2052 | $125,000 | $42,000 | $83,000 | Increasing savings |

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Take charge of your finances with our Professional Finance Tracker Template from Template.net. This editable and customizable template allows you to manage income, expenses, and budgets seamlessly. Gain insights into your financial health and make informed decisions. It’s editable in our Ai Editor Tool, enabling personalized adjustments to suit your financial goals.