Free Grocery Store Budget Plan

I. Introduction

Proper budgeting for grocery expenses is essential to maintain financial stability and ensure that essential needs are met without overspending. A well-structured grocery budget allows families and individuals to plan meals effectively, minimize food waste, and prioritize healthier food choices. By assessing income and expenses, [Your Company Name] can help customers create a realistic grocery budget that reflects their lifestyle and dietary preferences. This approach empowers shoppers to make informed decisions, ultimately leading to a more sustainable and enjoyable grocery shopping experience.

This plan outlines a step-by-step approach to creating and sticking to a grocery budget. It emphasizes the importance of tracking expenses, setting clear financial goals, and regularly reviewing budgetary allocations. By using tools such as shopping lists, digital budgeting apps, and store flyers, consumers can strategize their purchases, take advantage of discounts, and avoid impulse buys. Additionally, this grocery budget plan considers factors such as seasonal sales, bulk buying options, and alternative grocery sources, allowing shoppers to maximize their budgets. With the guidance of [Your Company Name], customers can navigate their grocery shopping with confidence, ensuring their financial well-being while enjoying quality food options.

II. Assessing Your Monthly Income and Expenses

Understanding your financial situation is crucial for effective grocery budgeting. This section outlines the steps to calculate both your monthly income and expenses, providing a clear picture of your financial landscape. By categorizing your earnings and regular outgoings, you can identify how much discretionary income is available for grocery spending. This foundational assessment will empower you to set realistic budget goals, ensuring that you allocate funds appropriately and maintain financial stability.

A. Calculate Monthly Income

List all sources of income to get an accurate picture of your total monthly earnings.

Primary job salary

Secondary job income

Side hustle or freelance work

Other income sources

B. Calculate Monthly Fixed Expenses

Include all regular, recurring expenses.

Rent/Mortgage

Utilities (electricity, water, gas, internet)

Transportation (car payment, public transport)

Loan payments

C. Calculate Monthly Variable Expenses

Identify costs that may fluctuate month-to-month.

Entertainment

Dining Out

Clothing

Miscellaneous

III. Setting a Grocery Budget

Establishing a grocery budget is a crucial step toward financial discipline and effective meal planning. This section provides guidance on determining how much of your monthly income should be allocated to grocery expenses, ensuring that your spending aligns with your overall financial goals. By following a percentage-based approach, you can create a realistic grocery budget that accommodates your lifestyle. Additionally, tracking your grocery spending is essential for staying within your budget, helping you make informed decisions about your food purchases and avoid unnecessary overspending.

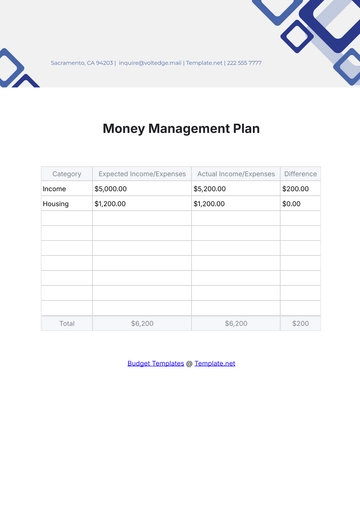

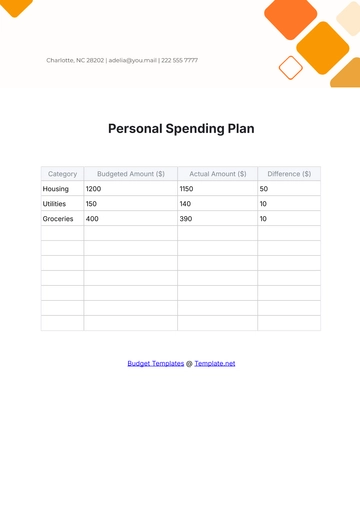

A. Determine Percentage of Income

Allocate a percentage of your monthly income specifically for groceries. A general guideline is to spend around 10-15% of your income on groceries.

Monthly Income ($ | Percentage | Grocery Budget ($ |

|---|---|---|

3000 | 10% | 300 |

4000 | 12% | 480 |

5000 | 15% | 750 |

B. Track Grocery Spending

Keep a detailed record of all grocery purchases to ensure you stay within your budget. Use tools like spreadsheets or budgeting apps to monitor expenses.

Example:

Week 1 | $100 |

Week 2 | $85 |

Week 3 | $90 |

Week 4 | $95 |

IV. Smart Shopping Strategies

Implementing smart shopping strategies can significantly enhance your grocery budgeting efforts. By planning ahead and making informed decisions during your shopping trips, you can reduce expenses and make the most of your budget. This section outlines effective tactics that can help you save money, minimize waste, and prioritize healthier food choices. From creating a detailed shopping list to taking advantage of seasonal produce, these strategies empower you to make smarter purchasing decisions while still enjoying quality food options that fit your lifestyle and financial goals.

A. Create a Shopping List

Planning your meals ahead of time is a key component of effective grocery shopping. Before heading to the store, take some time to outline your meals for the week and list all the ingredients you'll need. This not only helps ensure you have everything necessary for your meals but also minimizes the likelihood of impulse purchases. Stick to your list while shopping to avoid buying items that aren’t part of your meal plan, which can lead to overspending. Additionally, organizing your list by store layout can make your shopping experience more efficient and enjoyable.

B. Use Coupons and Discounts

Looking for coupons and discounts can lead to significant savings at your favorite grocery stores. Many retailers offer weekly ads, and digital coupons are often available through their websites or mobile apps. Consider joining loyalty programs, which can provide additional savings and exclusive offers. It’s also beneficial to combine store promotions with manufacturer coupons for even greater discounts. Remember to check expiration dates and keep your coupons organized, so you can easily access them during your shopping trips. By being proactive about finding deals, you can stretch your grocery budget further.

C. Buy in Bulk

Purchasing non-perishable items in bulk can lead to substantial long-term savings. Items such as grains, canned goods, and personal care products often come at a lower per-unit price when bought in larger quantities. Before buying in bulk, assess your storage space and ensure that you will consume the items before they expire. Additionally, consider joining warehouse clubs or bulk-buying cooperatives, which often offer membership discounts on a variety of products. This strategy not only helps you save money but also reduces the frequency of shopping trips, allowing for better time management.

D. Shop Seasonal Produce

Choosing seasonal produce is an excellent way to enjoy fresh fruits and vegetables while staying within your budget. Seasonal items are typically less expensive due to higher availability and often taste better as they are harvested at their peak. Planning meals around what’s in season can lead to a more varied and nutritious diet. To find out what’s currently in season, consult local farmers’ markets or check seasonal produce guides online. Incorporating seasonal fruits and vegetables into your meals not only saves money but also supports local agriculture and sustainability.

V. Conclusion

Establishing a well-planned grocery budget is essential for maintaining both financial health and a balanced diet. By assessing your income and expenses, determining a specific percentage for grocery spending, and employing smart shopping strategies, you can effectively control your food costs while still enjoying nutritious meals. This proactive approach helps to minimize waste, encourages healthier eating habits, and allows you to make informed decisions about your purchases.

It’s important to recognize that budgeting is not a one-time task but an ongoing process. Regularly reviewing and adjusting your grocery budget ensures that it remains aligned with your financial goals and changing circumstances. Life events such as a job change, relocation, or changes in family size can impact your income and spending habits. By staying adaptable and open to adjustments, you can continue to prioritize your grocery needs without compromising your financial stability.

Moreover, leveraging tools like budgeting apps, spreadsheets, and meal planning can streamline the budgeting process, making it easier to track your spending and identify areas for improvement. With dedication and a clear plan, you can enjoy a fulfilling shopping experience while staying within your means, ultimately leading to a healthier lifestyle and greater financial peace of mind. Embrace this journey toward better budgeting with [Your Company Name] as your trusted resource.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Create a detailed financial strategy with the Grocery Store Budget Plan Template, an editable and customizable tool for managing store expenses and revenue. This template is available at Template.net and provides a professional and structured format to help you track and allocate resources effectively. Fully editable in our Ai Editor Tool, it ensures accurate financial planning for your grocery store.

You may also like

- Finance Plan

- Construction Plan

- Sales Plan

- Development Plan

- Career Plan

- Budget Plan

- HR Plan

- Education Plan

- Transition Plan

- Work Plan

- Training Plan

- Communication Plan

- Operation Plan

- Health And Safety Plan

- Strategy Plan

- Professional Development Plan

- Advertising Plan

- Risk Management Plan

- Restaurant Plan

- School Plan

- Nursing Home Patient Care Plan

- Nursing Care Plan

- Plan Event

- Startup Plan

- Social Media Plan

- Staffing Plan

- Annual Plan

- Content Plan

- Payment Plan

- Implementation Plan

- Hotel Plan

- Workout Plan

- Accounting Plan

- Campaign Plan

- Essay Plan

- 30 60 90 Day Plan

- Research Plan

- Recruitment Plan

- 90 Day Plan

- Quarterly Plan

- Emergency Plan

- 5 Year Plan

- Gym Plan

- Personal Plan

- IT and Software Plan

- Treatment Plan

- Real Estate Plan

- Law Firm Plan

- Healthcare Plan

- Improvement Plan

- Media Plan

- 5 Year Business Plan

- Learning Plan

- Marketing Campaign Plan

- Travel Agency Plan

- Cleaning Services Plan

- Interior Design Plan

- Performance Plan

- PR Plan

- Birth Plan

- Life Plan

- SEO Plan

- Disaster Recovery Plan

- Continuity Plan

- Launch Plan

- Legal Plan

- Behavior Plan

- Performance Improvement Plan

- Salon Plan

- Security Plan

- Security Management Plan

- Employee Development Plan

- Quality Plan

- Service Improvement Plan

- Growth Plan

- Incident Response Plan

- Basketball Plan

- Emergency Action Plan

- Product Launch Plan

- Spa Plan

- Employee Training Plan

- Data Analysis Plan

- Employee Action Plan

- Territory Plan

- Audit Plan

- Classroom Plan

- Activity Plan

- Parenting Plan

- Care Plan

- Project Execution Plan

- Exercise Plan

- Internship Plan

- Software Development Plan

- Continuous Improvement Plan

- Leave Plan

- 90 Day Sales Plan

- Advertising Agency Plan

- Employee Transition Plan

- Smart Action Plan

- Workplace Safety Plan

- Behavior Change Plan

- Contingency Plan

- Continuity of Operations Plan

- Health Plan

- Quality Control Plan

- Self Plan

- Sports Development Plan

- Change Management Plan

- Ecommerce Plan

- Personal Financial Plan

- Process Improvement Plan

- 30-60-90 Day Sales Plan

- Crisis Management Plan

- Engagement Plan

- Execution Plan

- Pandemic Plan

- Quality Assurance Plan

- Service Continuity Plan

- Agile Project Plan

- Fundraising Plan

- Job Transition Plan

- Asset Maintenance Plan

- Maintenance Plan

- Software Test Plan

- Staff Training and Development Plan

- 3 Year Plan

- Brand Activation Plan

- Release Plan

- Resource Plan

- Risk Mitigation Plan

- Teacher Plan

- 30 60 90 Day Plan for New Manager

- Food Safety Plan

- Food Truck Plan

- Hiring Plan

- Quality Management Plan

- Wellness Plan

- Behavior Intervention Plan

- Bonus Plan

- Investment Plan

- Maternity Leave Plan

- Pandemic Response Plan

- Succession Planning

- Coaching Plan

- Configuration Management Plan

- Remote Work Plan

- Self Care Plan

- Teaching Plan

- 100-Day Plan

- HACCP Plan

- Student Plan

- Sustainability Plan

- 30 60 90 Day Plan for Interview

- Access Plan

- Site Specific Safety Plan