Free Food Costing

Prepared by: [YOUR NAME]

Email: [YOUR EMAIL]

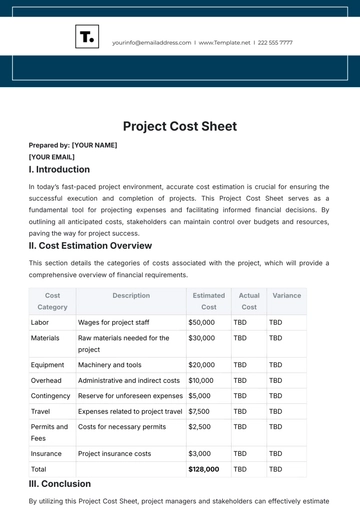

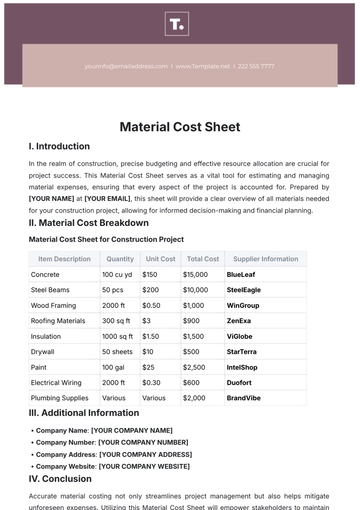

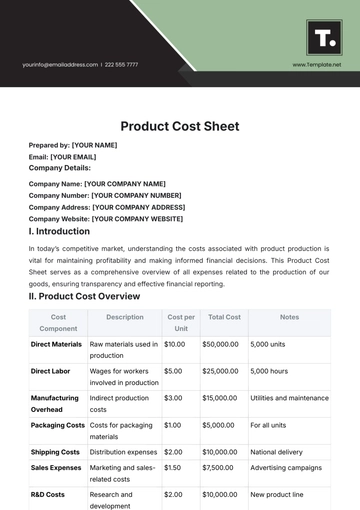

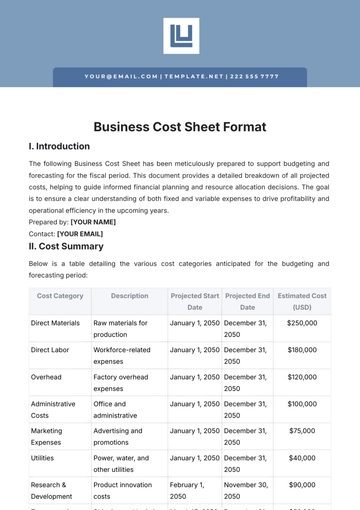

In the ever-evolving landscape of the food service industry, effective budgeting and financial planning are crucial for sustained success. This food costing document serves as a comprehensive guide to analyzing and managing food expenses, ultimately helping your business thrive in a competitive market.

I. Overview of Food Costing

Food costing involves calculating the total expenses associated with ingredients and overhead to inform pricing strategies and financial decisions. A meticulous approach to food costing enables businesses to optimize their menu offerings while maximizing profitability.

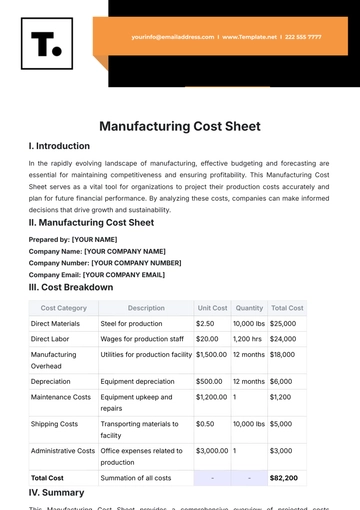

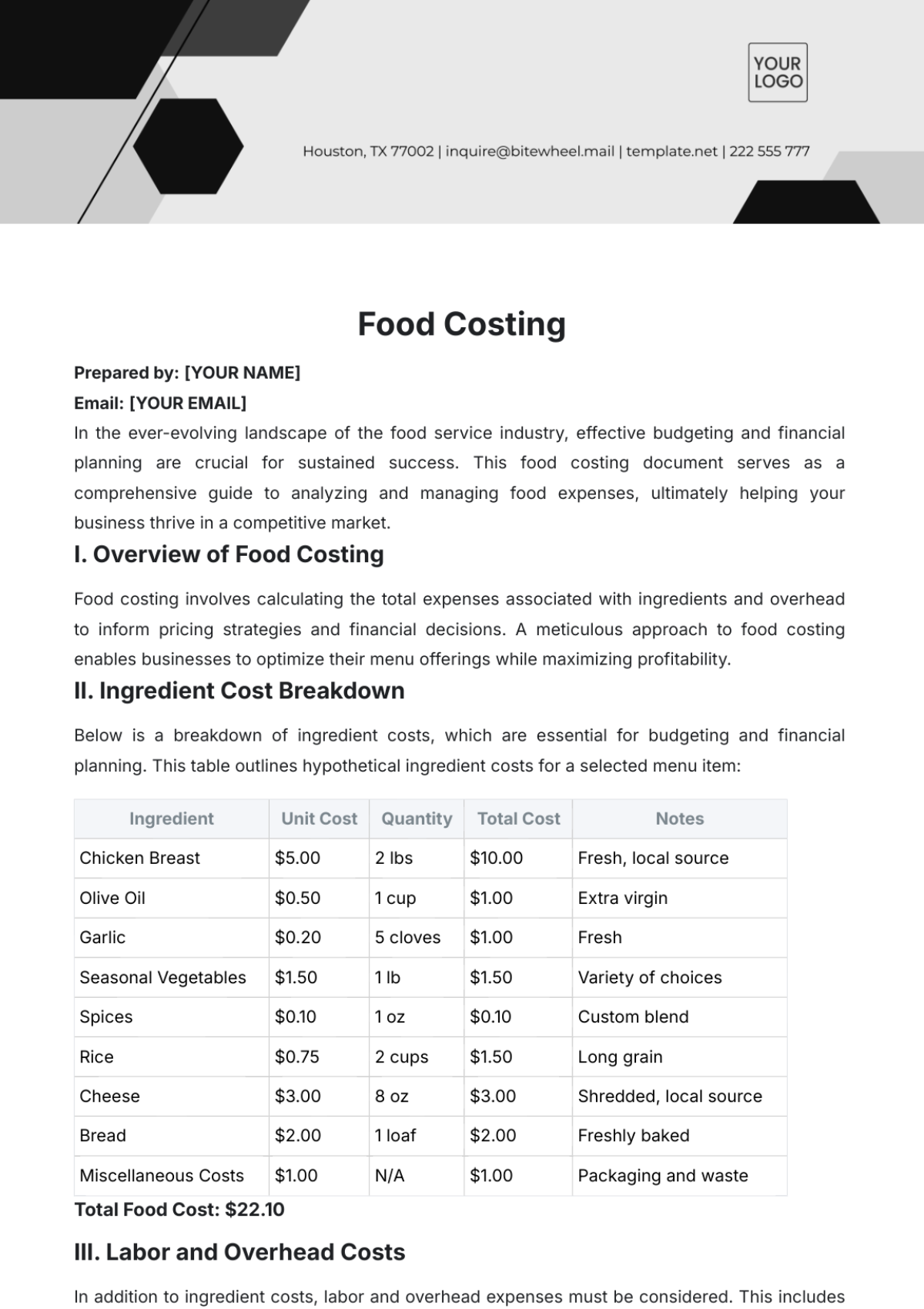

II. Ingredient Cost Breakdown

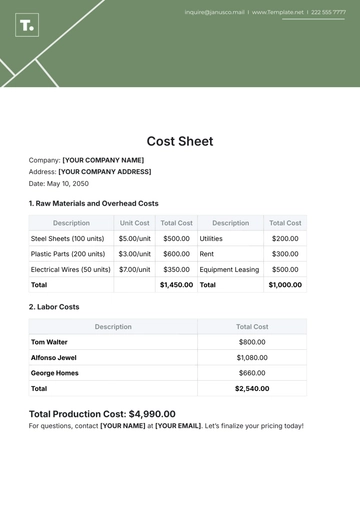

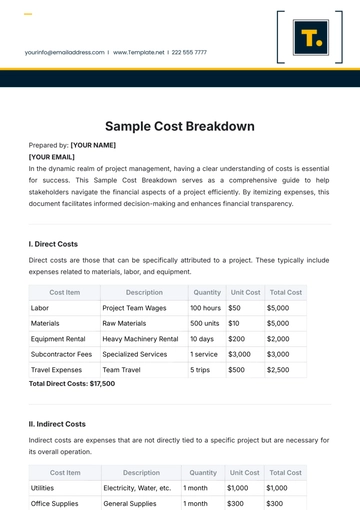

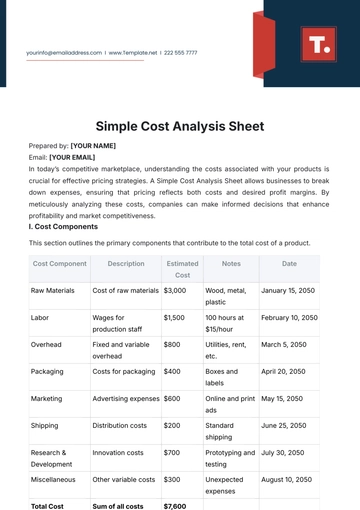

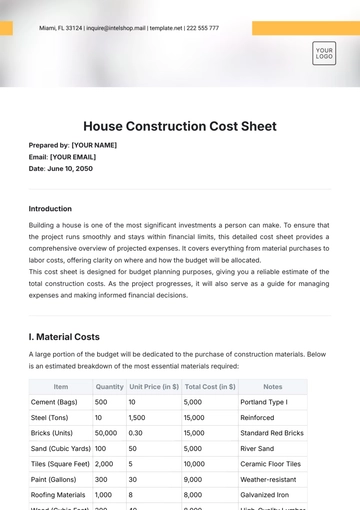

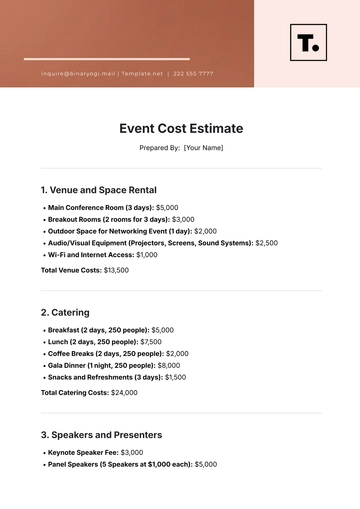

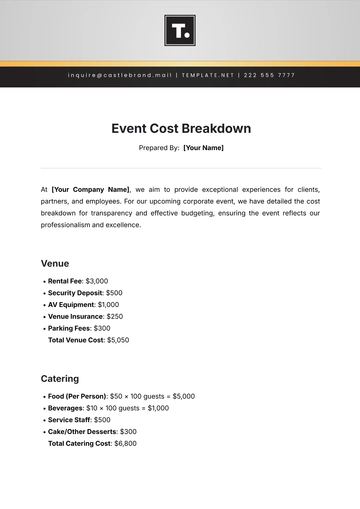

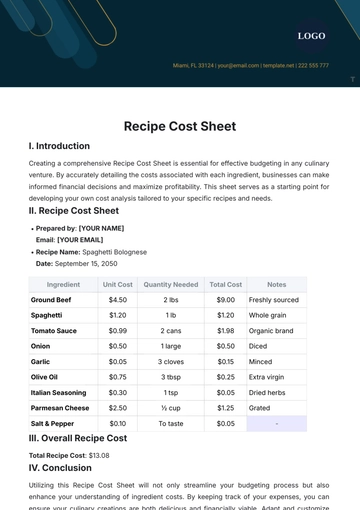

Below is a breakdown of ingredient costs, which are essential for budgeting and financial planning. This table outlines hypothetical ingredient costs for a selected menu item:

Ingredient | Unit Cost | Quantity | Total Cost | Notes |

|---|---|---|---|---|

Chicken Breast | $5.00 | 2 lbs | $10.00 | Fresh, local source |

Olive Oil | $0.50 | 1 cup | $1.00 | Extra virgin |

Garlic | $0.20 | 5 cloves | $1.00 | Fresh |

Seasonal Vegetables | $1.50 | 1 lb | $1.50 | Variety of choices |

Spices | $0.10 | 1 oz | $0.10 | Custom blend |

Rice | $0.75 | 2 cups | $1.50 | Long grain |

Cheese | $3.00 | 8 oz | $3.00 | Shredded, local source |

Bread | $2.00 | 1 loaf | $2.00 | Freshly baked |

Miscellaneous Costs | $1.00 | N/A | $1.00 | Packaging and waste |

Total Food Cost: $22.10

III. Labor and Overhead Costs

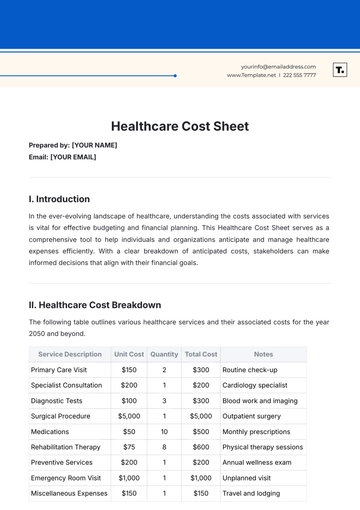

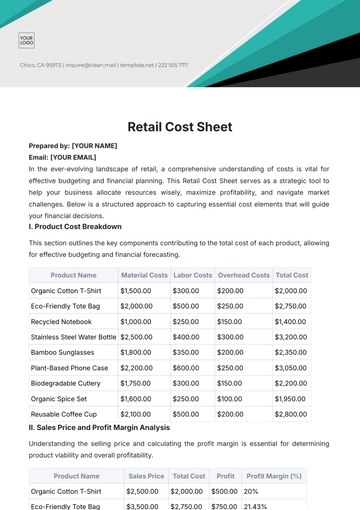

In addition to ingredient costs, labor and overhead expenses must be considered. This includes wages for kitchen staff, utilities, and rent. The following table illustrates a basic estimate of these costs for effective budgeting:

Cost Type | Monthly Cost | Annual Cost | Notes | Allocation |

|---|---|---|---|---|

Kitchen Staff | $5,000 | $60,000 | 2 full-time cooks | 30% of total cost |

Utilities | $1,000 | $12,000 | Electricity and water | 10% of total cost |

Rent | $3,000 | $36,000 | Monthly lease | 25% of total cost |

Equipment Depreciation | $500 | $6,000 | Annual depreciation costs | 5% of total cost |

Miscellaneous Costs | $500 | $6,000 | Unexpected expenses | 5% of total cost |

Total Labor and Overhead Costs: $84,000 annually

IV. Summary of Costs

The total food costing, including ingredients, labor, and overhead, provides a comprehensive overview essential for effective financial planning. As outlined in the tables above, understanding both direct and indirect costs allows for strategic decision-making regarding pricing and menu development.

Conclusion

In conclusion, accurate food costing is an indispensable tool for effective budgeting and financial planning in the food service industry. By maintaining a detailed understanding of ingredient, labor, and overhead costs, businesses can better navigate financial challenges and capitalize on growth opportunities.

For further inquiries or assistance, please feel free to reach out to us.

[YOUR COMPANY NAME]

Phone: [YOUR COMPANY NUMBER]

Address: [YOUR COMPANY ADDRESS]

Website: [YOUR COMPANY WEBSITE]

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Maximize your food business's profitability with our Food Costing Template from Template.net. This customizable and editable tool allows you to easily track and analyze your ingredient costs. Use our AI Editor Tool to modify the template to fit your specific needs, ensuring accurate budgeting and efficient management. Optimize your food costs today.