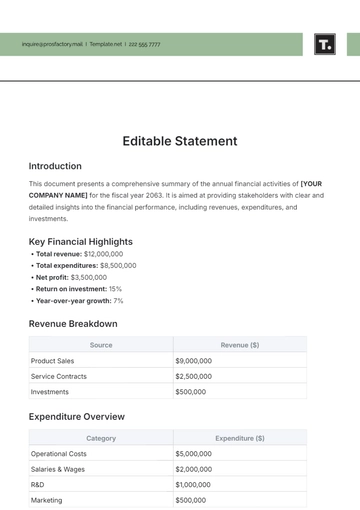

Free Annual Financial Statement Outline

Prepared By: [YOUR NAME]

Email: [YOUR EMAIL]

Date: December 31, 2050

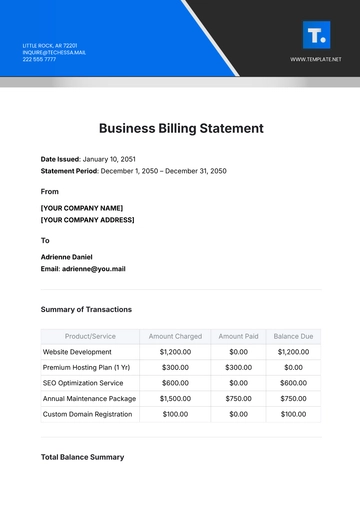

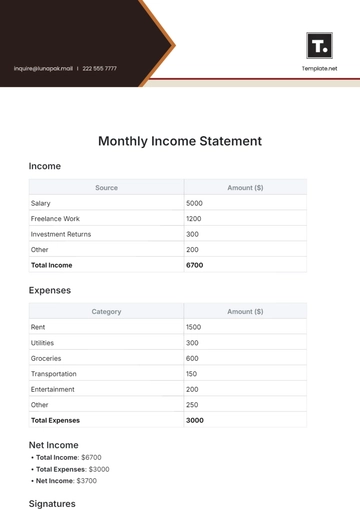

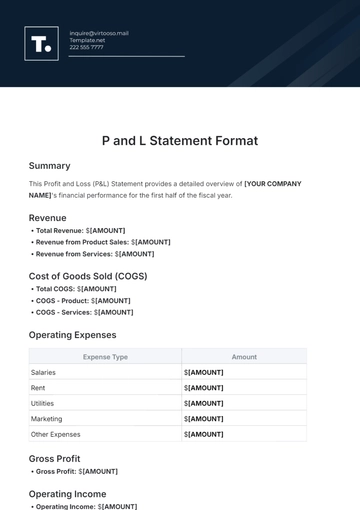

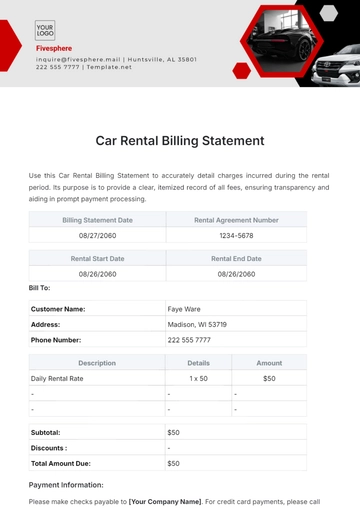

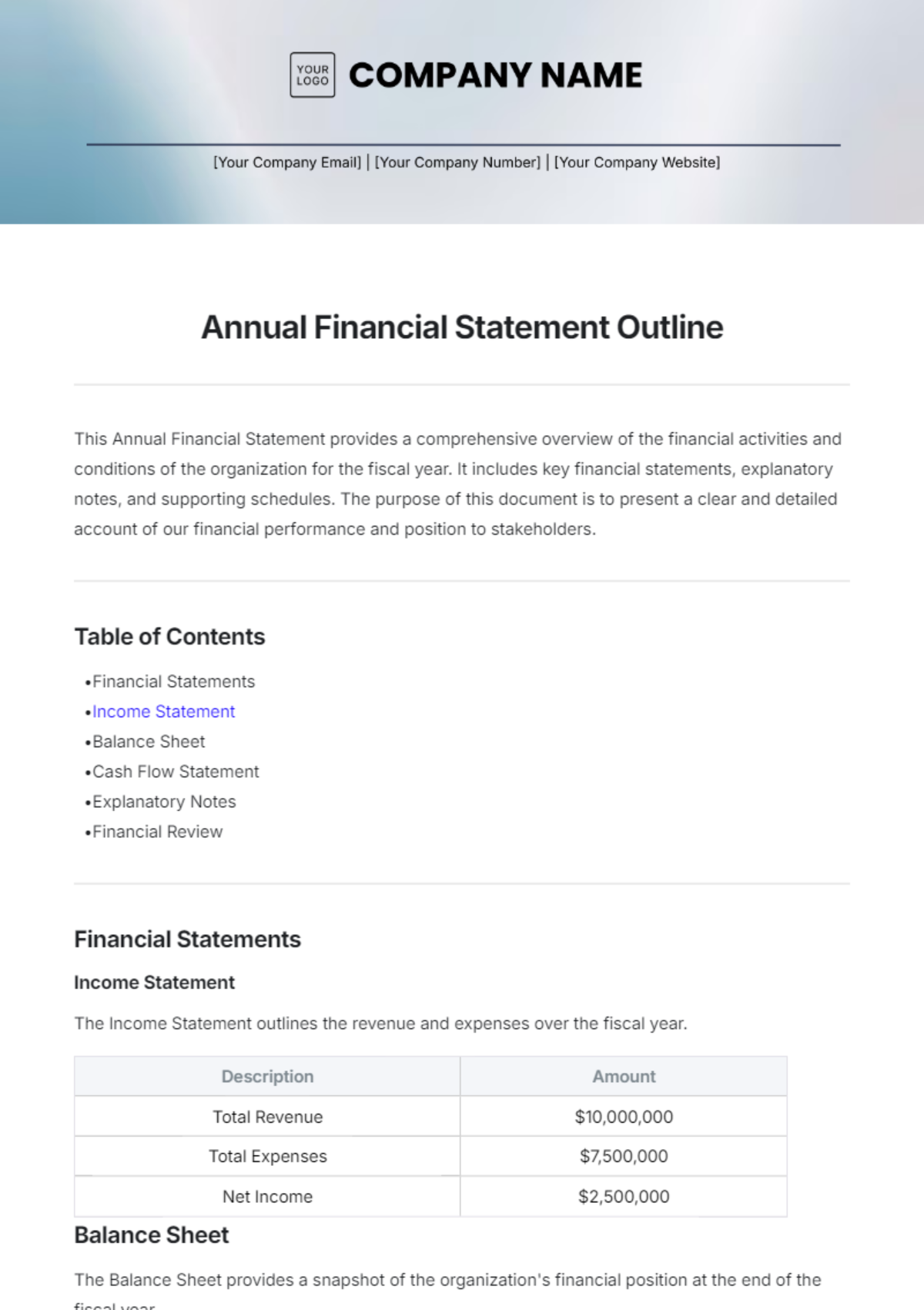

Income Statement

Description | Amount ($) |

|---|---|

Total Revenue | 500,000 |

Cost of Goods Sold | 200,000 |

Gross Profit | 300,000 |

Operating Expenses | 100,000 |

Net Income | 200,000 |

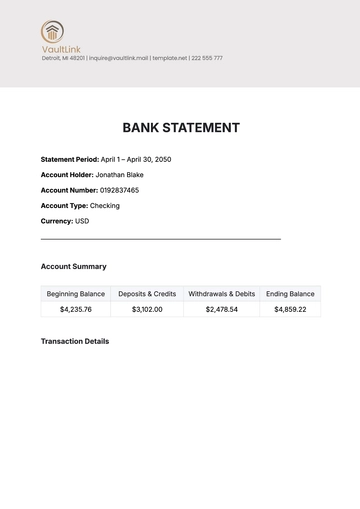

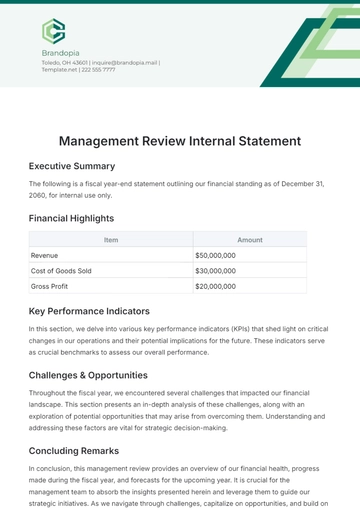

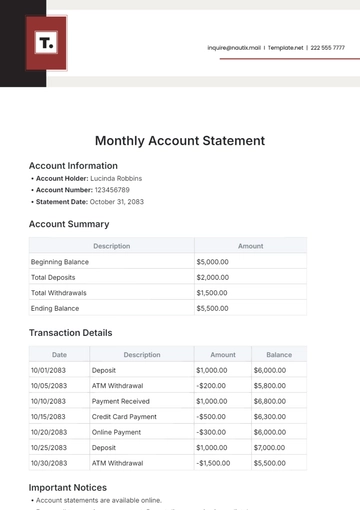

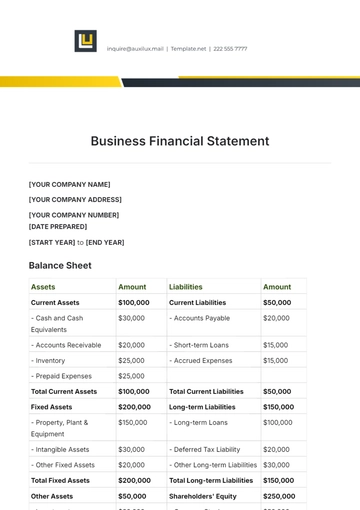

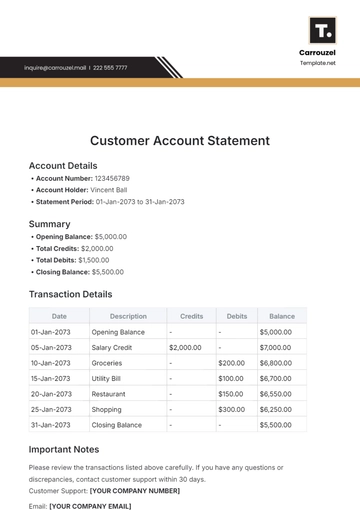

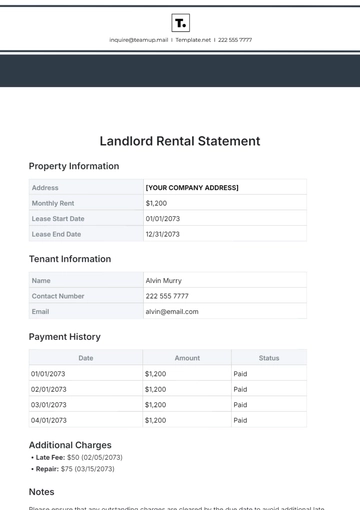

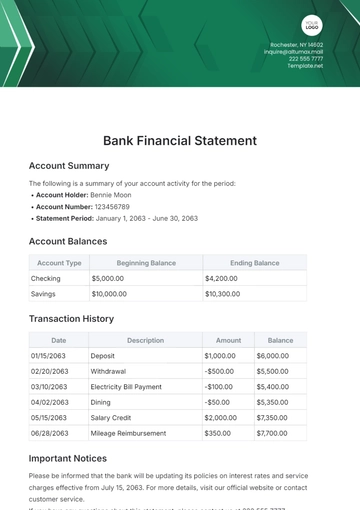

Balance Sheet

Assets | Amount ($) | Liabilities | Amount ($) |

|---|---|---|---|

Cash and Cash Equivalents | 100,000 | Accounts Payable | 50,000 |

Accounts Receivable | 150,000 | Long-term Debt | 100,000 |

Property, Plant & Equipment | 400,000 | Total Liabilities | 150,000 |

Equity | 500,000 | ||

Total Assets | 650,000 | Total Liabilities & Equity | 650,000 |

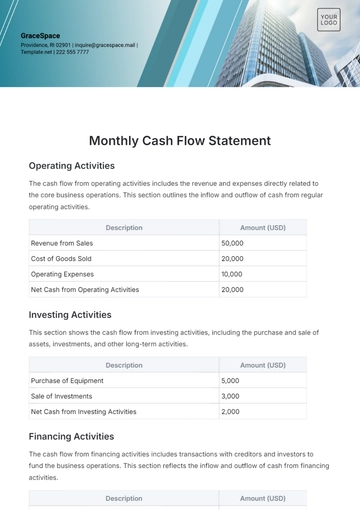

Statement of Cash Flows

Description | Amount ($) |

|---|---|

Operating Activities | 150,000 |

Investing Activities | -50,000 |

Financing Activities | 30,000 |

Net Increase in Cash | 130,000 |

Cash at End of Year | 100,000 |

Key Financial Ratios

Ratio | Value |

|---|---|

Return on Investment (ROI) | 20% |

Debt-to-Equity Ratio | 0.3 |

Current Ratio | 2.0 |

Quick Ratio | 1.5 |

Gross Margin | 60% |

Notes & Observations

Revenue Growth: The company has experienced steady revenue growth of 10% compared to the previous year.

Expenses: Operating expenses increased due to investment in new technology.

Future Projections: Expecting a 15% increase in revenue for 2051.

For more information or to discuss these financials in detail, feel free to reach out at [YOUR EMAIL].

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Streamline your financial reporting with the Annual Financial Statement Outline Template from Template.net. This fully editable and customizable resource ensures professional, accurate documents in minutes. Designed for ease, it integrates seamlessly with an AI Editable Tool, enabling effortless customization to meet your unique needs. Simplify your workflow and impress stakeholders with this reliable solution!