Free Estate Planning

I. Introduction

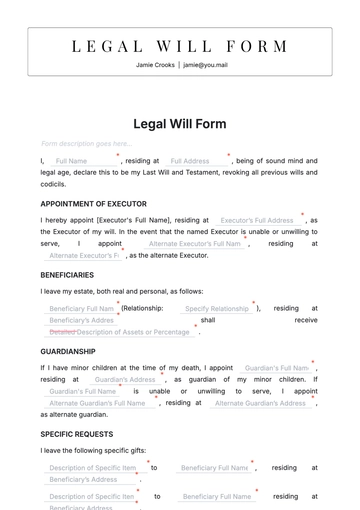

Creating a comprehensive estate plan is essential for ensuring your assets are distributed according to your wishes after your passing. This document serves as a roadmap for your loved ones, guiding them in the distribution of your estate while minimizing potential conflicts. By outlining your intentions clearly, you can provide peace of mind to both yourself and your beneficiaries.

II. Asset Distribution Plan

A. Distribution of Personal Assets

Family Home

Beneficiary Name: Johann Harvey

Percentage Share: 50%

Special Instructions: To remain in the family for at least 5 years.

Vacation Property

Beneficiary Name: Lyda Fadel

Percentage Share: 30%

Special Instructions: To be shared with family for vacations.

Investment Account

Beneficiary Name: Sigmund Corwin

Percentage Share: 20%

Special Instructions: Manage according to financial advisor's guidance.

Jewelry Collection

Beneficiary Name: Jolie Cassin

Percentage Share: 100%

Special Instructions: To be divided equally among daughters.

Art Collection

Beneficiary Name: Rocky Orn

Percentage Share: 50%

Special Instructions: Keep in the family.

Car

Beneficiary Name: Maria Turner

Percentage Share: 100%

Special Instructions: May sell after my passing.

Savings Account

Beneficiary Name: Lawrence Orn

Percentage Share: 100%

Special Instructions: For education expenses only.

Business Shares

Beneficiary Name: Clint Renner

Percentage Share: 100%

Special Instructions: To manage with the current business partners.

Other Assets

Beneficiary Name: Jean Harris

Percentage Share: 10% of estate value

Special Instructions: For education and community projects.

B. Additional Considerations

When planning for asset distribution, consider any specific instructions or conditions you want to include, such as setting up trusts for minors or specifying how debts should be settled.

III. Conclusion

A well-crafted asset distribution plan not only fulfills your wishes but also eases the burden on your loved ones during a difficult time. By taking the time to create this plan, you ensure that your legacy is preserved and that your assets are managed and distributed as you intended. For further assistance in finalizing your estate plan, please feel free to contact [YOUR NAME] at [YOUR EMAIL].

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Create a secure future with our Estate Planning Template available on Template.net. This customizable and editable solution ensures your assets are protected and wishes are clearly outlined. Utilize our AI Editor Tool to easily personalize each section, making the process straightforward and efficient. Perfect for anyone looking to simplify their estate planning needs.