Free Food Truck Expense Report

I. Introduction

Managing a food truck business, while potentially highly profitable, requires a keen eye for tracking expenses. A comprehensive approach to financial oversight ensures that the business remains sustainable in the long term by allowing owners to gauge profitability, identify opportunities for cost reduction, and effectively plan for expansion. This Food Truck Expense Report aims to provide an in-depth analysis of costs incurred by [Your Company Name] for the year 2050. It will categorize expenses into operational costs, administrative costs, marketing expenses, and other essential categories. Each section will also highlight trends, areas for improvement, and potential financial strategies. Ultimately, a detailed breakdown will facilitate a deeper understanding of where resources are allocated, and how [Your Company Name] can further optimize its operations.

II. Summary of Key Expenses

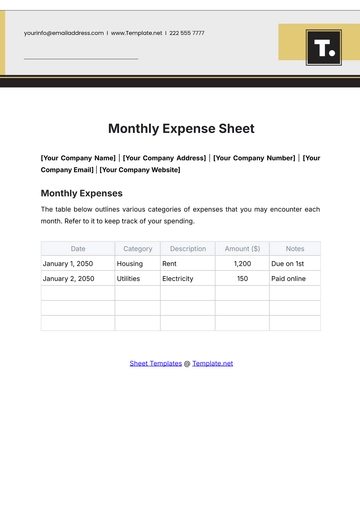

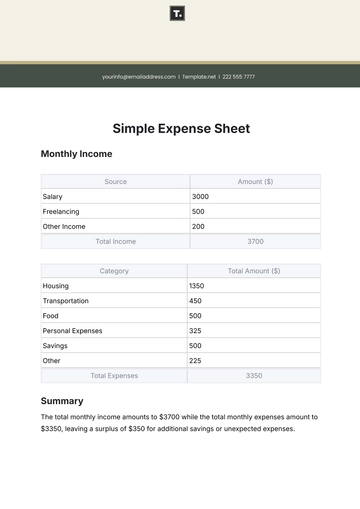

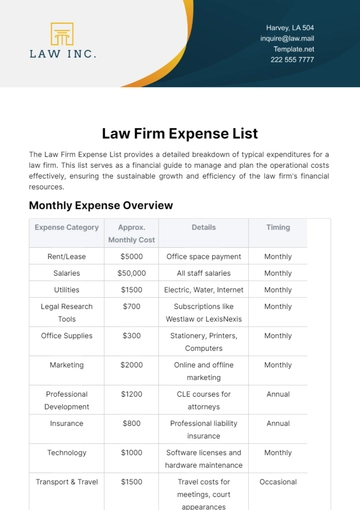

This section offers an overview of major expenses for [Your Company Name]'s food truck operations during the fiscal year of 2050. All values are represented in dollars ($), and costs are segmented into specific categories for clarity. The following table outlines the various categories of expenses, their total amounts, and the percentage they contribute to overall costs.

Expense Category | Total Amount ($) | Percentage of Total |

|---|---|---|

Fuel | [10,500] | [7.5%] |

Labor Costs | [40,000] | [28.5%] |

Food & Beverage Inventory | [35,000] | [25%] |

Truck Maintenance | [7,000] | [5%] |

Permits and Licenses | [3,500] | [2.5%] |

Marketing & Advertising | [5,000] | [3.5%] |

Insurance | [4,000] | [3%] |

Utilities (Gas, Electricity, etc.) | [8,000] | [6%] |

Miscellaneous | [3,000] | [2%] |

Depreciation | [6,000] | [4%] |

Total Operating Expenses | [122,000] | [87%] |

Net Profit | [18,000] | [13%] |

As indicated in the table, the total operating expenses for [Your Company Name] amount to $[122,000], with a net profit of $[18,000], reflecting a [13%] profit margin. These figures underscore the necessity of continuous monitoring and strategic adjustments to maintain and potentially increase profitability in the ever-competitive food truck industry.

III. Breakdown of Key Expense Categories

A. Operational Costs

Operational costs are the day-to-day expenses essential for the functioning of the food truck. These expenses are broken down further into subcategories to provide a clearer picture of where resources are being utilized.

1. Fuel

The food truck’s fuel consumption represents a significant portion of operational expenses. In the year 2050, [Your Company Name] spent approximately $[10,500] on fuel. Fuel prices have seen moderate fluctuations due to global market conditions and local supply chain factors, affecting the overall operational budget. Consistent travel to multiple locations across the city contributes to the fuel expenditure, emphasizing the need for efficient route planning to minimize unnecessary costs. Strategies to mitigate this expense include optimizing routes, utilizing technology for navigation, and exploring alternative fuel options. Leveraging renewable energy solutions, such as electric or hybrid engines, is becoming increasingly accessible and offers a promising avenue for reducing fuel costs while appealing to environmentally-conscious consumers.

2. Labor Costs

Labor costs encompass wages, salaries, and benefits for employees. In 2050, labor costs for [Your Company Name] reached $[40,000], accounting for [28.5%] of total expenses. This substantial figure includes not only the hourly wages for chefs, cashiers, and helpers but also bonuses and overtime pay, reflecting the commitment to fair compensation for dedicated staff. As the food truck industry continues to evolve, rising labor costs are a common trend, making it crucial to ensure that the workforce is optimally utilized. Strategies such as cross-training staff to handle multiple roles can improve efficiency and minimize downtime during off-peak hours. Additionally, implementing a performance-based incentive program can motivate employees to enhance productivity, ultimately leading to better service and customer satisfaction.

3. Food & Beverage Inventory

Food and beverage inventory is one of the highest expenses, totaling $[35,000] for the year. This figure represents the procurement of raw ingredients, beverages, and packaging materials required for daily operations. The cost of ingredients fluctuates based on seasonality, market trends, and supply chain disruptions, impacting the overall profitability of the food truck. For instance, shortages in organic produce during the summer months led to a temporary spike in costs, highlighting the importance of inventory management. Close inventory management practices, including tracking stock levels and expiration dates, can help reduce waste and ensure freshness. Forming partnerships with local suppliers not only strengthens community ties but can also lead to cost savings and more reliable sourcing of quality ingredients.

4. Truck Maintenance

Maintaining the food truck is essential to keep operations running smoothly and avoid costly downtime. In 2050, [Your Company Name] spent $[7,000] on maintenance, which includes tire replacements, engine tune-ups, and regular servicing. The importance of preventive maintenance programs cannot be overstated, as they help extend the truck’s lifespan and reduce unexpected breakdowns that can lead to business interruptions. Regular inspections and maintenance schedules should be established to ensure that the vehicle operates at peak efficiency. Additionally, investing in quality parts and timely repairs can prevent more significant issues down the line, ultimately saving money and enhancing operational reliability.

5. Permits and Licenses

Food trucks operate under a variety of regulations that differ by state or municipality, and compliance is paramount for legal operation. [Your Company Name] spent $[3,500] on renewing permits and licenses required to operate legally in various regions. These expenses also cover parking permits, health inspections, and local food safety certifications, which are critical for maintaining the trust of customers and authorities alike. It’s vital to stay abreast of regulatory changes to ensure compliance, and consider integrating a calendar system to track renewal dates. Failure to renew permits on time can lead to fines or interruptions in business, emphasizing the need for proactive management in this area.

B. Administrative Costs

Administrative costs encompass expenses related to the overall management of the food truck business. These costs are essential for operational continuity and compliance with regulatory standards.

1. Insurance

Insurance protects the business from unforeseen risks, such as accidents, food poisoning claims, or damage to the truck. In 2050, the total cost for insurance was $[4,000]. As the food truck industry grows, so does the demand for more comprehensive coverage, making insurance a critical part of administrative expenses. It is essential to regularly review insurance policies to ensure they provide adequate coverage while seeking competitive rates. Consulting with an insurance broker who specializes in the food truck industry can yield potential savings and tailored coverage options that align with the unique risks faced by mobile food vendors.

2. Utilities

The cost of utilities, which includes electricity for lighting, gas for cooking, and water for cleaning, amounted to $[8,000] for the year. Utility expenses can fluctuate based on operational demands, such as peak service hours during busy events. Efficient energy usage is essential to reduce these expenses, particularly as the food truck industry moves toward eco-friendly practices. Implementing energy-saving appliances, LED lighting, and water-efficient fixtures can significantly lower utility bills. Additionally, considering renewable energy sources, like solar panels, could further reduce dependence on conventional utilities and enhance the truck's sustainability profile.

3. Depreciation

Depreciation refers to the gradual loss in value of the truck and equipment over time due to wear and tear. For the year 2050, depreciation expenses amounted to $[6,000]. Depreciation is accounted for as an operational cost but does not represent a cash outflow. This value is essential for financial accounting and tax purposes, affecting net profit calculations and investment decisions. Properly accounting for depreciation can also aid in understanding the need for future capital expenditures, ensuring that [Your Company Name] is prepared for necessary upgrades or replacements as the truck ages.

C. Marketing and Advertising

Marketing and advertising expenses are crucial for attracting customers and building brand awareness in a competitive food truck landscape. This section outlines how funds are allocated towards these efforts and their impact on overall business performance.

1. Social Media and Digital Marketing

In an increasingly digital world, social media marketing plays a vital role in reaching customers and creating brand loyalty. For [Your Company Name], approximately $[3,000] was spent on promoting the food truck through platforms like Instagram, Facebook, and TikTok. These platforms are critical for attracting younger demographics and maintaining a loyal customer base, as they allow for interactive engagement. Investments in social media advertising allow for targeted campaigns that reach local food enthusiasts, increasing foot traffic and overall sales. Developing high-quality content, including mouth-watering photos of menu items, behind-the-scenes videos, and customer testimonials, can further enhance engagement and drive sales. Regular interaction with followers, responding to comments, and running contests can also foster a community around the brand.

2. Traditional Advertising

Despite the dominance of digital marketing, traditional advertising still plays an essential role in reaching a broader audience. Traditional advertising, including flyers, banners, and local radio ads, accounted for $[2,000] of the marketing budget. While less effective than digital marketing in some respects, traditional advertising can effectively reach an older audience or those less active on digital platforms. Additionally, participating in local events or sponsoring community activities can provide valuable exposure and reinforce brand presence in the local market. Creating visually appealing banners and engaging flyers can capture the attention of passersby, converting foot traffic into sales.

IV. Miscellaneous and Other Expenses

A. Unexpected Expenses

Despite careful planning, unexpected costs may arise, and in 2050, [Your Company Name] faced $[3,000] in unanticipated expenses. These included emergency repairs, additional permit fees for special events, and one-off fines from minor regulatory issues. Such costs highlight the importance of maintaining a flexible budget that can absorb unexpected financial shocks. Building a contingency fund to account for these surprises is advisable for better financial planning. This fund could be allocated a percentage of monthly profits to ensure that capital is available when unplanned expenditures occur, minimizing disruptions to operations.

B. Expansion-Related Expenses

In 2050, [Your Company Name] explored potential growth by investigating a second food truck or a brick-and-mortar location. This resulted in research and feasibility studies amounting to $[2,500]. While this is classified as an expansion-related cost rather than a regular operational expense, it’s crucial for strategic business growth. Understanding market demand and conducting competitor analysis can inform the decision-making process, allowing [Your Company Name] to make informed choices about future investments. Additionally, exploring funding options, such as small business loans or investor partnerships, can provide the necessary capital for expansion.

V. Profitability and Financial Analysis

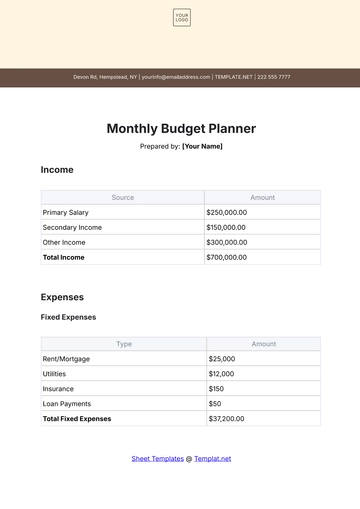

Despite a total operating expense of $[122,000], [Your Company Name] successfully achieved a net profit of $[18,000]. This represents a [13%] profit margin, which is a healthy indicator of financial performance in the highly competitive food truck industry. This section will delve deeper into the financial metrics that underpin the business's success.

A. Profit Margin Analysis

The [13%] profit margin reflects effective cost management and a strong pricing strategy that aligns with customer expectations. By maintaining high standards in food quality while managing costs such as labor and inventory, [Your Company Name] has demonstrated an ability to convert revenue into profit efficiently. Monitoring this metric regularly can help identify trends and adjust strategies to maintain or improve profitability over time. The management team should set specific profit margin targets and analyze monthly performance to ensure these goals are being met.

B. Break-Even Point

The break-even analysis indicates that the food truck needs to generate approximately $[10,167] per month to cover all operating costs. With an average monthly revenue of $[11,666], the business consistently surpasses this threshold, ensuring long-term viability. Regularly revisiting the break-even analysis can provide insights into sales trends and seasonal fluctuations, enabling proactive adjustments to the business model or pricing strategy. Understanding the break-even point is essential for future planning, especially when considering expansion or launching new menu items.

C. Cost-Cutting Opportunities

While overall expenses are well-managed, there are areas for potential cost reduction that can further enhance profitability. For example, reducing fuel consumption through optimized route planning or switching to electric-powered vehicles could significantly lower transportation costs and align with sustainability goals. Similarly, renegotiating supply contracts with local vendors might reduce food inventory expenses, allowing for better margins on popular menu items. Regularly conducting a thorough review of all expenses and actively seeking areas for efficiency improvements can lead to substantial savings over time.

VI. Recommendations and Future Outlook

Looking ahead to the next fiscal year and beyond, [Your Company Name] should consider several strategies to enhance profitability and streamline operations. These recommendations are based on thorough analysis and industry best practices.

A. Investment in Sustainable Technology

Adopting electric or hybrid food trucks could significantly reduce fuel costs and align with growing consumer demand for eco-friendly businesses. The initial investment in such technology may seem substantial; however, it can yield considerable savings on fuel and maintenance in the long run. Additionally, promoting the environmental benefits of using sustainable technology can attract a conscientious customer base, enhancing brand loyalty and community support. Exploring government grants or subsidies for green energy initiatives can also ease the financial burden associated with this transition.

B. Expanding Digital Marketing Efforts

In an era where digital presence drives customer engagement, further investments in social media, influencer partnerships, and search engine optimization (SEO) will enhance visibility and attract more customers. Implementing an email marketing strategy to keep customers informed of promotions, menu changes, and upcoming events can cultivate a loyal following. Integrating online pre-orders or mobile app services could streamline operations and drive higher sales during peak hours, providing customers with the convenience they increasingly demand. Tracking and analyzing digital marketing metrics will help determine which strategies yield the best return on investment.

C. Strengthening Supplier Relationships

Building strong partnerships with suppliers will ensure better pricing and consistent supply, reducing fluctuations in food and beverage costs. Long-term contracts with local farmers or vendors might also create a unique selling proposition, emphasizing farm-to-table freshness for customers. Regular communication with suppliers can foster a collaborative relationship that benefits both parties, allowing for negotiations on pricing and exploring bulk purchasing options that lead to significant savings. Networking within the industry may also uncover new suppliers who can offer competitive pricing and quality ingredients.

D. Additional Revenue Streams

Consider expanding the business model to include catering for events, partnerships with local breweries, or pop-up events at festivals. These additional revenue streams would not only increase sales but also build brand recognition in new markets. Establishing a presence at local events, fairs, and farmers' markets can attract new customers and create a buzz around the food truck. Offering exclusive menu items for these events can also entice regular customers to try new offerings, fostering a culture of excitement and anticipation.

VII. Conclusion

The Food Truck Expense Report for 2050 reveals that [Your Company Name] has successfully managed a complex array of expenses while maintaining profitability in a competitive environment. With careful cost management and strategic investments in technology, marketing, and sustainability, the business is well-positioned for continued growth and success. By implementing cost-saving measures, enhancing operational efficiency, and exploring new revenue opportunities, [Your Company Name] can capitalize on emerging trends and ensure long-term success in the food truck industry. Continuous monitoring of financial metrics, alongside proactive adaptation to market changes, will be essential for navigating the challenges and opportunities that lie ahead. Ultimately, the insights gained from this report will serve as a valuable foundation for informed decision-making, allowing [Your Company Name] to thrive in the dynamic food service landscape of 2050 and beyond.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Monitor your costs effectively with the Food Truck Expense Report Template from Template.net. This editable and customizable template helps you track expenses, categorize costs, and manage your budget efficiently. Customize it using our Ai Editor Tool to ensure accurate financial reporting for your food truck.