Investment Memo

I. Executive Summary

Date: October 1, 2051

Prepared by: [Your Name]

Department: Corporate Development

Company Name: [Your Company Name]

Investment Opportunity:

Company/Project Name: GreenTech Solutions

Industry/Market: Renewable Energy

Investment Type: Equity

Investment Amount: $5,000,000

Transaction Date: December 15, 2051

II. Investment Rationale

Market Opportunity

Growing demand in the solar energy sector is driven by increasing consumer and corporate interest in sustainable energy solutions.

Favorable industry trends include government incentives for renewable energy projects and a global shift towards sustainability.

Competitive Advantage

Unique value proposition includes proprietary solar panel technology that increases energy efficiency by 15% compared to industry standards.

Strong brand recognition in North America and Europe.

Barriers to entry include high R&D costs and regulatory requirements that favor established players.

Financial Performance

Revenue Growth: 25% CAGR over the last 3 years.

Profit Margins: 18%

Cash Flow: Positive cash flow of $1,200,000 last fiscal year.

III. Key Investment Terms

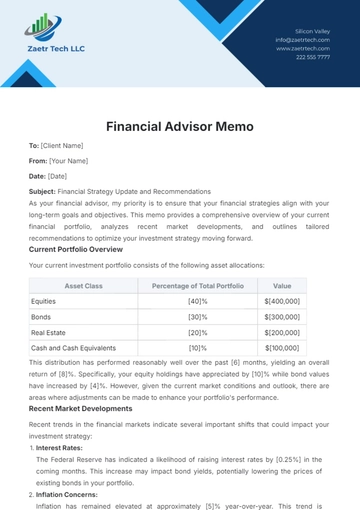

Category | Details |

|---|

Investment Type | Equity |

Amount | $5,000,000 |

Valuation | $20,000,000 (Pre-money Valuation) |

Equity Ownership | 25% Ownership Expected |

Investment Horizon | 5 Years |

Return on Investment | Expected ROI: 30% |

Exit Strategy | Acquisition by a larger energy firm |

IV. Risk Factors

Market Risks:

Operational Risks:

Financial Risks:

V. Recommendation

Based on the analysis provided, [Your Name] from Corporate Development recommends:

Proceed with investment of $5,000,000 in GreenTech Solutions.

Conditionally approve based on the following milestones: successful completion of current projects and achieving projected revenue growth for the next fiscal year.

Decline the investment if any significant operational risks are realized prior to closing.

VI. Appendices

Financial Statements:

Market Analysis:

Legal/Regulatory Documents:

Approved by:

[Your Name]

Director of Corporate Development

[Your Company Name]

Date: October 1, 2051

Memo Templates @ Template.net