Free Investment Committee Memo

[Your Company Name]

Date: September 30, 2050

To: Investment Committee Members

From: [Your Name], Director of Investments

Subject: Investment Proposal for Green Energy Solar Project

1. Executive Summary

This memo presents a proposal for an investment in the Green Energy Solar Project, a 100 MW solar farm located in Texas. The project seeks a total investment of $25 million and is expected to yield an internal rate of return (IRR) of 12% over 10 years. This investment aligns with [Your Company Name]’s long-term strategy to expand its renewable energy portfolio, enhance sustainability efforts, and capitalize on the growing demand for green energy.

2. Investment Overview

Investment Type: Equity investment in renewable energy infrastructure

Investment Amount: $25 million

Duration: 10 years

Projected Return: IRR of 12%, with an estimated annual cash flow of $3 million starting in year 2

Exit Strategy: Sale to institutional investors or strategic acquirers in year 10

3. Market Analysis

Market Size: The U.S. renewable energy market is projected to grow at a compound annual growth rate (CAGR) of 9.8% from 2050 to 2056, driven by government incentives and global commitments to reduce carbon emissions.

Competitive Landscape: Key competitors in the Texas region include companies like NextEra Energy, Duke Energy Renewables, and Southern Power. However, the Green Energy Solar Project has secured favorable land acquisition terms and long-term power purchase agreements (PPAs), providing a competitive edge.

Trends: Increasing corporate demand for renewable energy, along with federal tax credits under the Inflation Reduction Act (IRA), will continue to drive solar adoption in the U.S. market.

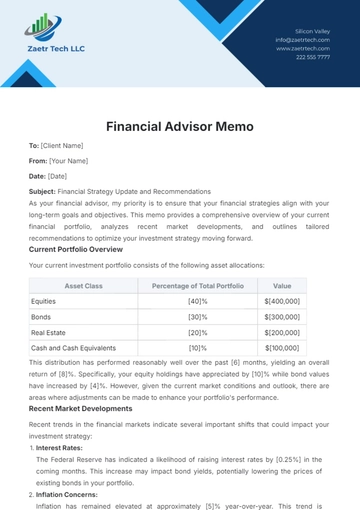

Financial Projections

Revenue Projections:

Year 1: $0.5 million (ramp-up period)

Year 2-5: $3 million annually

Year 6-10: $4 million annually, with an expected sale in year 10 for $40 million

Cost Structure: The primary costs include initial capital expenditure of $15 million for solar panel installation and $5 million for land acquisition. Operational costs are projected to be minimal after year 1, around $500,000 per year.

Break-even Analysis: The project is expected to break even by the end-of-year 5, with positive cash flow generated from year 2 onward.

Risk Factors:

Regulatory Risk: Changes in state or federal energy policies could impact the economic viability.

Technology Risk: Advancements in solar technology could render the project less competitive.

Mitigation: The project has secured 20-year PPAs with local utility companies, ensuring stable demand and predictable cash flow.

Strategic Fit

Alignment with Objectives: [Your Company Name] is committed to expanding its presence in the renewable energy sector as part of its sustainability and ESG (Environmental, social, and governance) goals. This investment supports our corporate objectives of achieving 50% renewable energy usage in our operations by 2056.

Value Creation: The Green Energy Solar Project will not only generate strong financial returns but also enhance [Your Company Name]’s brand image as a leader in sustainability, attracting socially responsible investors and partners.

Recommendation

After careful review and analysis, I recommend that the Investment Committee approve the $25 million investment in the Green Energy Solar Project. This project offers an interesting mix of strong financial returns, minimal operational risk, and strategic alignment with [Your Company Name]’s renewable energy goals. The long-term power purchase agreements also mitigate market risk, ensuring steady cash flows.

Next Steps

If approved, the following steps will be taken:

Due Diligence: Finalize legal and environmental assessments by October 15, 2050.

Financing: Confirm financing structure and finalize investor agreements by November 1, 2050.

Project Launch: Begin construction by December 2050, with a projected operational date in Q3 2051.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Stay organized and make informed decisions with Template.net's Investment Committee Memo Template. This fully customizable and editable template helps streamline your investment process. Easily modify it using our AI Editor Tool for seamless editing. Ideal for investment professionals, this template ensures clarity and precision in documenting committee discussions and decisions. Save time and stay efficient!