Free Financial Statement Report

I. Introduction

1. Overview

The Financial Statement Report serves as a critical document that offers a comprehensive analysis of the company's financial health and performance. It is designed to inform a range of stakeholders, including shareholders, investors, creditors, and regulatory bodies, about the company’s financial standing. By detailing key financial metrics and providing a transparent view of the company’s operations, this report enables stakeholders to make informed decisions.

2. Purpose

The primary aim of this report is to deliver an in-depth analysis of financial data, emphasizing critical metrics and trends that affect the company’s operations. This analysis aids stakeholders in evaluating the company's financial stability, profitability, and potential for growth. Additionally, the report strives to ensure transparency and adherence to established financial reporting standards, thus fostering trust among stakeholders.

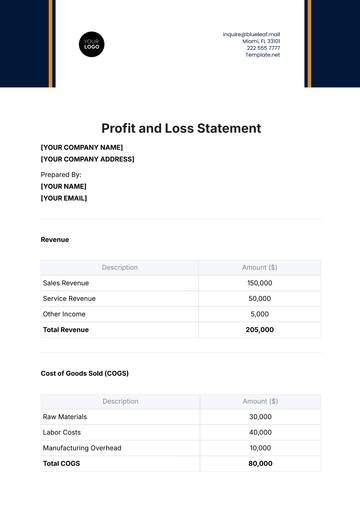

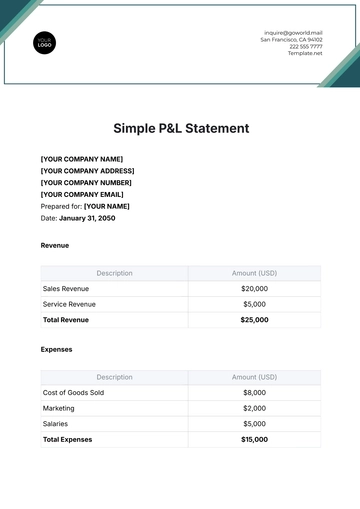

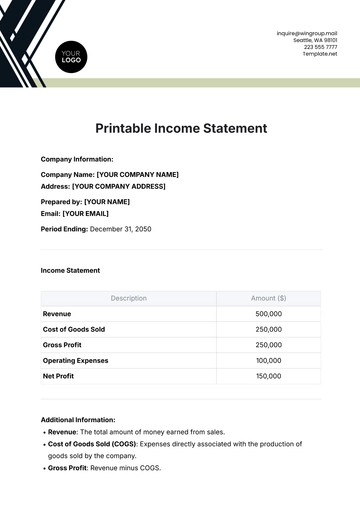

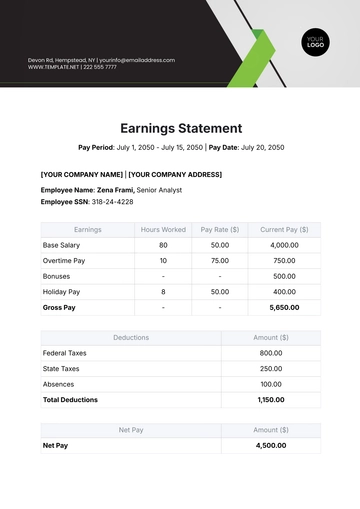

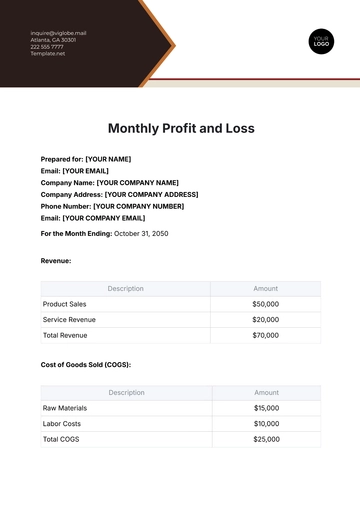

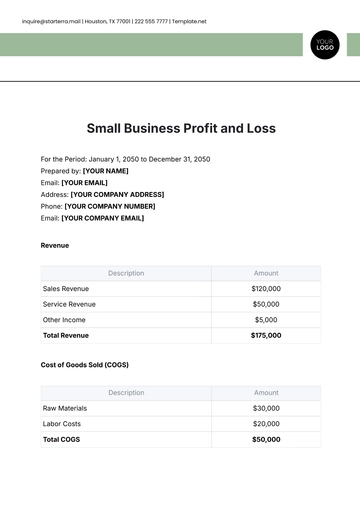

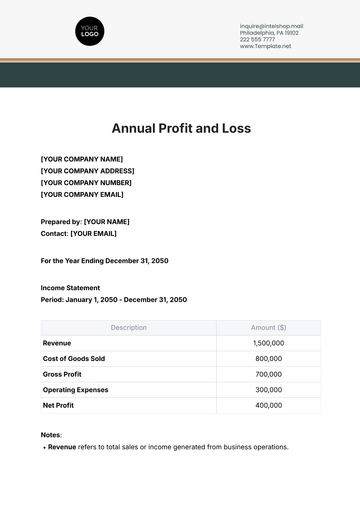

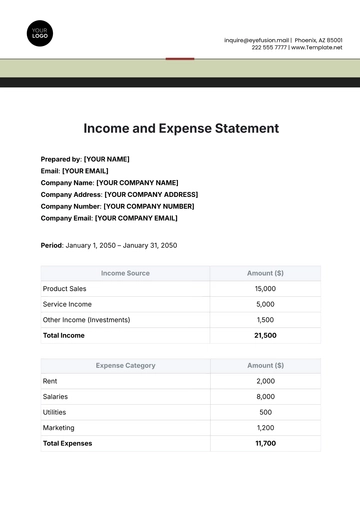

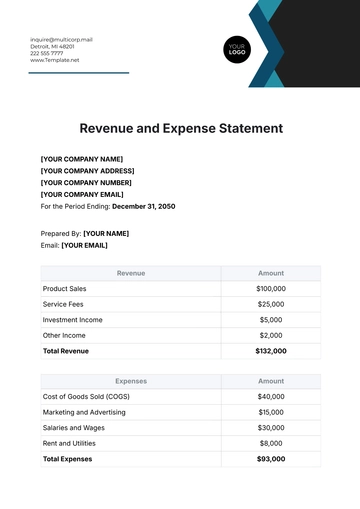

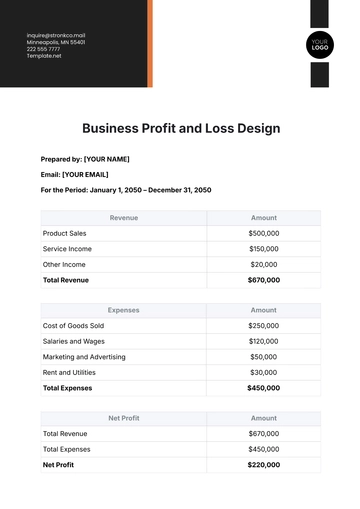

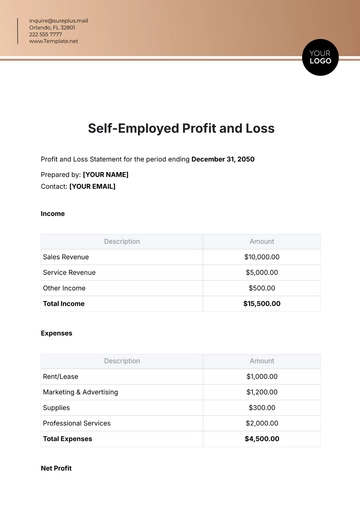

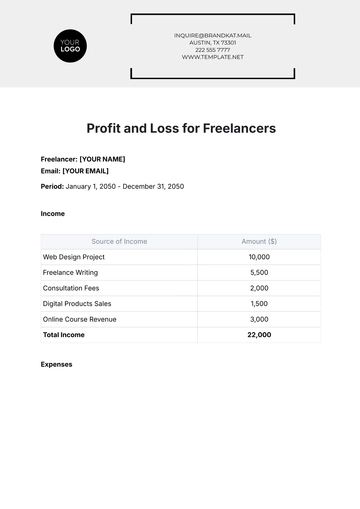

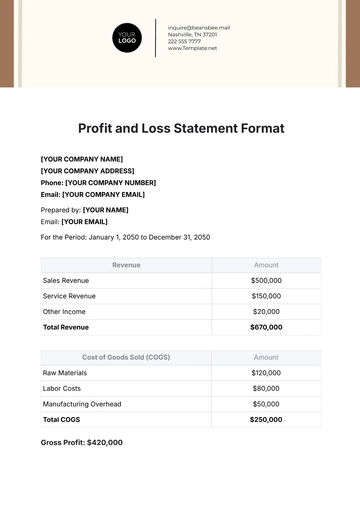

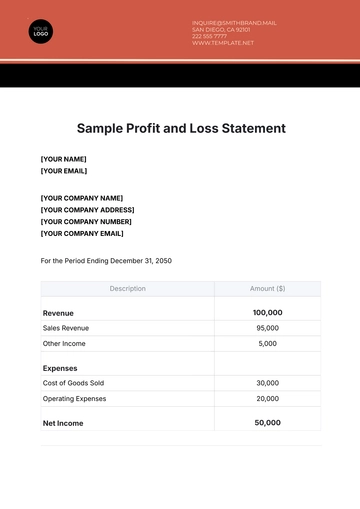

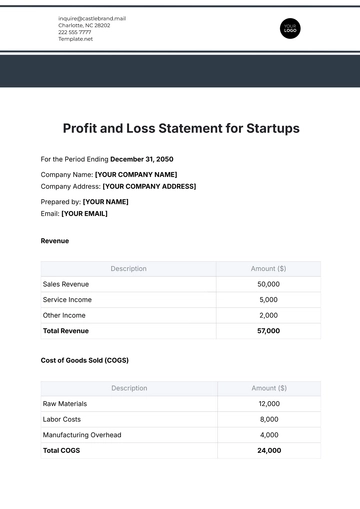

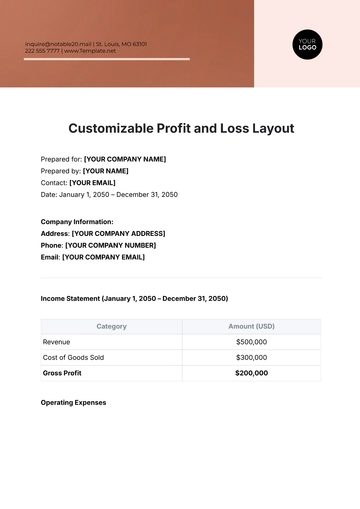

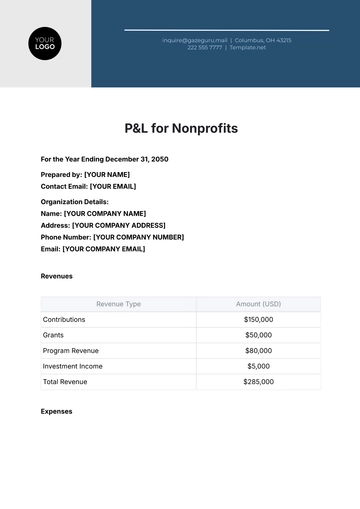

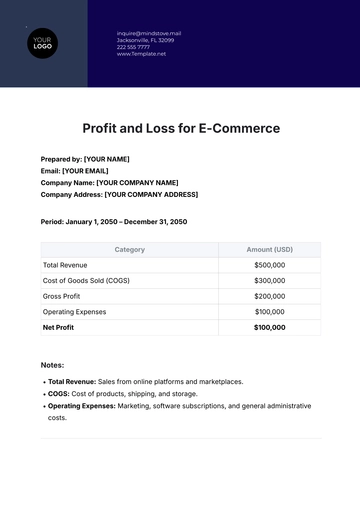

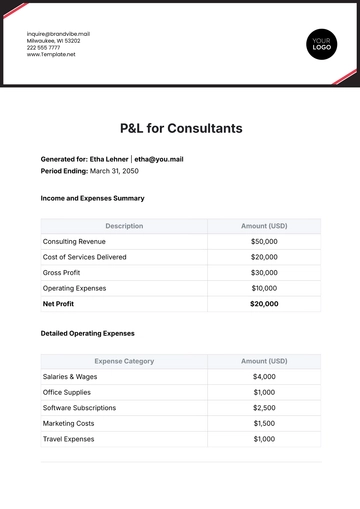

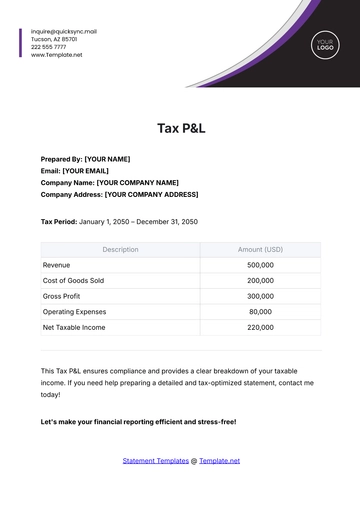

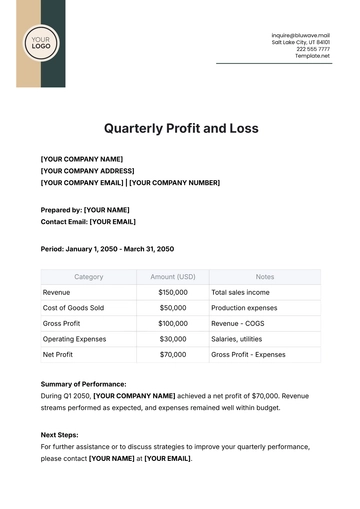

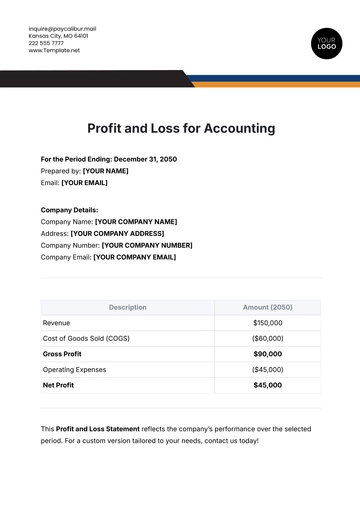

II. Income Statement

1. Revenue

The income statement reflects the company’s revenue generated over specific periods, providing insight into financial performance. Below is a breakdown of revenue streams for each quarter, highlighting key contributors and trends in revenue generation:

Quarter | Revenue (in USD) |

|---|---|

Q1 | 10,000,000 |

Q2 | 12,000,000 |

Q3 | 15,000,000 |

Q4 | 18,000,000 |

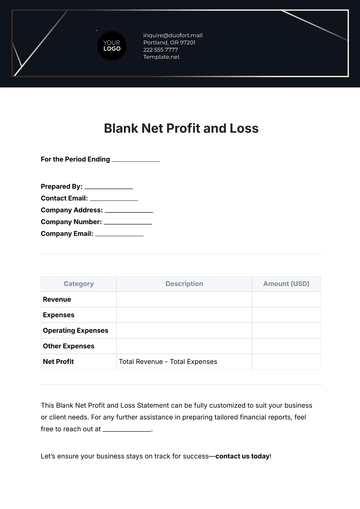

2. Expenses

This section outlines the various costs incurred by the company to generate revenue. A detailed breakdown of expenses includes operating expenses, cost of goods sold, and administrative costs. Understanding this breakdown is vital for identifying opportunities for cost reduction and efficiency improvements.

Operating Expenses: $5,000,000

Cost of Goods Sold: $8,000,000

Administrative Expenses: $2,000,000

Other Expenses: $1,000,000

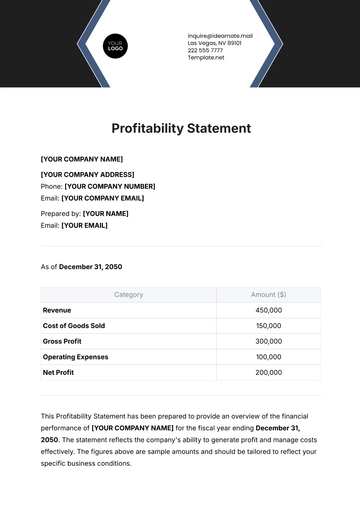

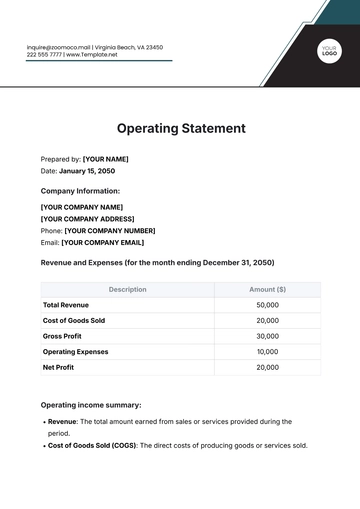

3. Net Income

Net income signifies the company’s profitability after all expenses have been deducted from total revenue. A higher net income indicates superior financial performance and effective management of costs. The net income for each quarter is summarized below:

Quarter | Net Income (in USD) |

|---|---|

Q1 | 1,000,000 |

Q2 | 1,500,000 |

Q3 | 2,000,000 |

Q4 | 2,500,000 |

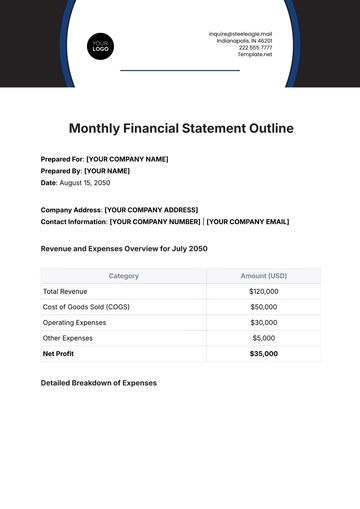

III. Balance Sheet

1. Assets

The balance sheet provides a snapshot of the company’s financial position at a specific point in time. This section details the assets owned by the company, categorized into current assets, fixed assets, and intangible assets:

Current Assets: $20,000,000

Fixed Assets: $30,000,000

Intangible Assets: $5,000,000

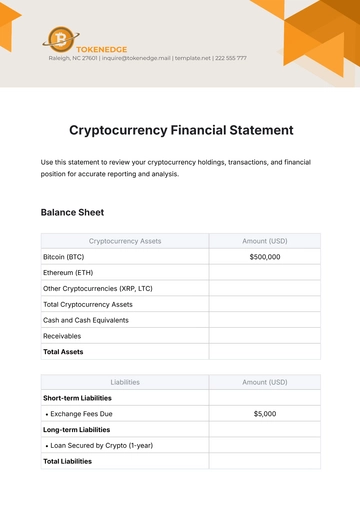

2. Liabilities

Liabilities represent the company’s obligations to creditors and other stakeholders. This section includes both current and long-term liabilities, offering a clear view of the company’s debt and financial responsibilities:

Current Liabilities: $10,000,000

Long-term Liabilities: $15,000,000

3. Equity

Equity reflects the residual interest in the company's assets after deducting liabilities. It encompasses common stock, retained earnings, and other equity reserves. The equity summary is as follows:

Common Stock: $10,000,000

Retained Earnings: $20,000,000

Other Equity Reserves: $2,000,000

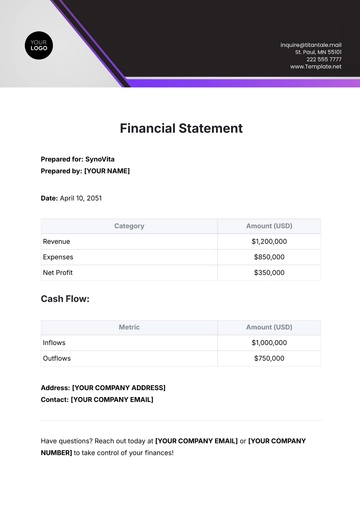

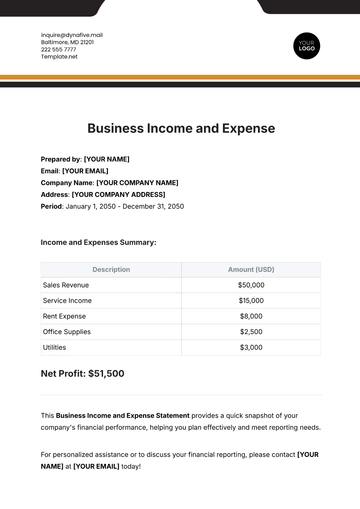

IV. Cash Flow Statement

1. Operating Activities

This section details the cash generated from or utilized in the company's core business operations, capturing the essential cash receipts from sales and payments to suppliers:

Cash Receipts from Sales: $40,000,000

Cash Payments to Suppliers: $25,000,000

Other Operational Cash Receipts: $2,000,000

2. Investing Activities

Investing activities outline the cash flows associated with investments in long-term assets. This includes the purchase and sale of fixed assets, as well as investments in securities.

Purchase of Fixed Assets: $5,000,000

Sale of Fixed Assets: $1,500,000

Investments in Securities: $2,000,000

3. Financing Activities

Finance activities provide insights into cash flows resulting from the company’s financing decisions, such as borrowing, debt repayment, issuing equity, and dividend distributions.

Proceeds from Issuing Equity: $10,000,000

Repayment of Debt: $4,000,000

Dividends Paid: $1,000,000

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Streamline your financial reporting process with the Financial Statement Report Template offered by Template.net. This customizable and printable template is designed to meet your specific needs, whether for personal or business purposes. It’s easily downloadable and editable in our AI Editor Tool, allowing you to tailor it to your requirements in minutes. Achieve accuracy and professionalism in your financial reports today!