Free Bookkeeping Budget Report

I. Executive Summary

A. Introduction

The primary objective of this Bookkeeping Budget Report is to provide a comprehensive overview of the financial status and budget performance of [Your Company Name] for the fiscal year ending December 2050. This report consolidates revenue, expenditure, and key financial data to assess the company’s current financial health and to identify future financial strategies. The detailed budget analysis aims to support informed decision-making and long-term planning for the company’s operations.

As of December 2050, [Your Company Name] experienced a stable year-over-year growth in revenue and a controlled increase in expenses. Key areas of focus include operational expenses, administrative costs, personnel salaries, and capital expenditures. This report highlights budget variances, provides insight into cash flow, and includes suggestions for optimizing future spending. It is essential for the company to continuously monitor and adjust its budget in response to changing market conditions and operational requirements to maintain financial health and growth trajectory.

B. Report Objectives

The objectives of this report are as follows:

To summarize [Your Company Name]'s revenue and expenses for the fiscal year 2050 in detail.

To analyze actual performance against the budget to identify variances and their implications.

To provide actionable insights and recommendations to enhance financial efficiency and performance.

To project budget requirements for the fiscal year 2051 based on historical data, trends, and anticipated changes in market conditions.

II. Revenue Analysis

A. Total Revenue for 2050

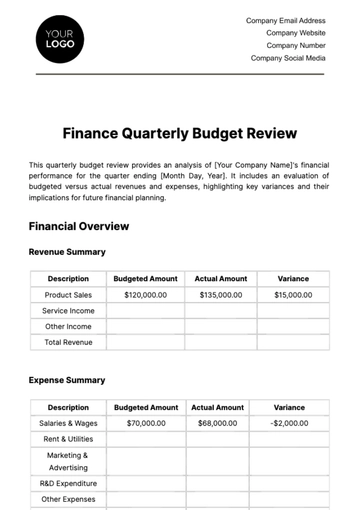

The total revenue generated by [Your Company Name] for the fiscal year 2050 amounted to [$5,500,000]. This figure represents an increase of [7%] from the previous year, when revenue was [$5,140,000]. The revenue is categorized into two major streams:

Product Sales: The largest source of income, accounting for [$4,200,000] or [76.36%] of the total revenue. This segment experienced significant growth due to increased demand and strategic marketing efforts.

Service Revenue: Generated [$1,300,000] from service contracts, contributing to [23.64%] of the total revenue. This revenue stream benefitted from the introduction of new service packages and enhanced customer support.

Revenue Source | Amount ($) | Percentage (%) |

|---|---|---|

Product Sales | [$4,200,000] | [76.36%] |

Service Revenue | [$1,300,000] | [23.64%] |

Total Revenue | [$5,500,000] | 100% |

Key Factors Influencing Revenue Growth

Several factors contributed to the revenue growth experienced in 2050:

Market Expansion: The company expanded into new geographic regions, including [Region A] and [Region B], in early 2050, which significantly increased sales opportunities and market presence. This geographical expansion resulted in a [$1,000,000] increase in product sales.

New Product Launches: Successful introduction of [Product X] and [Product Y] in Q2 2050, which together contributed an additional [$800,000] in revenue, reflecting strong market demand and positive customer feedback.

Service Diversification: [Your Company Name] diversified its service portfolio by introducing new maintenance and support packages, which led to a [$300,000] increase in recurring service revenue, indicating a growing base of loyal customers.

B. Revenue Growth Projection for 2051

Based on current performance trends, the projected revenue for the fiscal year 2051 is expected to grow by [6%], reaching an estimated [$5,830,000]. This projection is grounded in historical data, anticipated market trends, and planned marketing initiatives aimed at further penetrating existing markets and entering new ones. Continued product innovation and enhanced customer engagement strategies are expected to drive this growth.

III. Expenditure Analysis

A. Total Expenses for 2050

The total expenditures for 2050 amounted to [$4,000,000], which is [5%] over the budgeted amount of [$3,800,000]. This increase is primarily due to higher operational costs and unexpected capital expenditures. The key expenditure categories include operational costs, employee compensation, and capital investments.

Expenditure Category | Budgeted ($) | Actual ($) | Variance ($) | Variance (%) |

|---|---|---|---|---|

Operational Costs | [$2,000,000] | [$2,100,000] | [$100,000] | [5%] |

Employee Salaries | [$1,200,000] | [$1,250,000] | [$50,000] | [4.2%] |

Capital Expenditure | [$400,000] | [$450,000] | [$50,000] | [12.5%] |

Administrative Costs | [$200,000] | [$200,000] | [$0] | [0%] |

Total Expenses | [$3,800,000] | [$4,000,000] | [$200,000] | [5%] |

B. Breakdown of Major Expense Categories

1. Operational Costs

Operational costs were the largest expenditure for [Your Company Name], amounting to [$2,100,000], which was [5%] higher than the allocated budget. This category includes expenses related to raw materials, manufacturing, and utilities. The increase was primarily attributed to:

Inflation: Higher prices of raw materials due to market inflationary pressures, which increased costs by approximately [$70,000].

Energy Costs: A rise in utility expenses caused by increased energy consumption in production facilities, adding about [$30,000] to the operational cost.

2. Employee Salaries

Total personnel costs, including wages and benefits, amounted to [$1,250,000]. The [4.2%] increase over the budgeted amount was due to merit-based salary adjustments, which accounted for [$40,000] of the increase, and higher health insurance premiums that added an additional [$10,000]. The company anticipates that salary-related expenses will stabilize as the workforce grows at a consistent rate. In 2050, the company added [5] new employees to support growth, contributing to the increase in salary expenses.

3. Capital Expenditure

Capital expenditures totaled [$450,000], exceeding the planned budget by [$50,000] or [12.5%]. The primary reason for the excess was the purchase of new equipment to improve production efficiency, which accounted for [$30,000] of the overspend. Additionally, unexpected repairs and upgrades to existing machinery led to an additional [$20,000] expense. Although this overspend has impacted short-term cash flow, it is expected to yield long-term savings through increased productivity and reduced maintenance costs.

4. Administrative Costs

Administrative expenses were kept within the budget at [$200,000]. These include office supplies, legal fees, insurance, and other overhead costs. The company maintained strict cost control measures, ensuring that no variances occurred in this category. The administrative budget included a [$10,000] allocation for software upgrades that ultimately came in under budget.

IV. Variance Analysis

A. Budget vs. Actual Variance Overview

The overall budget variance for the fiscal year 2050 was a negative [$200,000], reflecting a [5.26%] overspend. The largest variances occurred in the areas of operational costs and capital expenditure, as detailed in Section III.

Category | Budgeted ($) | Actual ($) | Variance ($) | Variance (%) |

|---|---|---|---|---|

Revenue | [$5,200,000] | [$5,500,000] | [$300,000] | [5.77%] |

Expenses | [$3,800,000] | [$4,000,000] | [$200,000] | [5.26%] |

Net Income | [$1,400,000] | [$1,500,000] | [$100,000] | [7.14%] |

B. Explanation of Variances

Revenue Variance:

The revenue exceeded the budget by [$300,000], mainly due to better-than-expected sales performance from new product launches and market expansions. While the original revenue target was ambitious, strong marketing efforts and customer acquisition strategies paid off. The company engaged in targeted advertising campaigns and promotional offers that resulted in a [15%] increase in customer inquiries.Expense Variance:

The negative variance of [$200,000] in expenses is attributed to the rise in operational costs and unplanned capital expenditures. However, these overages were partly mitigated by careful management of administrative costs and a delay in certain planned investments. For instance, the company postponed certain office renovations that were initially planned for Q4 2050, saving an estimated [$25,000].Net Income Variance:

Despite the increased expenses, the net income for the year exceeded expectations by [$100,000]. This was primarily driven by the higher revenue and a continued focus on cost-saving initiatives in non-operational areas, such as reducing travel expenses by [$15,000] through the adoption of virtual meetings.

V. Cash Flow Analysis

A. Cash Flow Statement Overview

The cash flow statement for [Your Company Name] for the fiscal year 2050 shows a net cash inflow of [$800,000]. The cash flow activities are categorized into operating, investing, and financing activities.

Cash Flow Category | Amount ($) |

|---|---|

Operating Activities | [$1,200,000] |

Investing Activities | [-$450,000] |

Financing Activities | [$50,000] |

Net Cash Flow | [$800,000] |

B. Detailed Cash Flow Activities

Operating Activities:

The cash inflow from operating activities totaled [$1,200,000]. This inflow primarily stems from revenue collections, with strong customer payments contributing significantly to this total. Collection efforts improved during 2050, resulting in a decrease in accounts receivable aging by [10%], thereby enhancing cash availability.Investing Activities:

Cash outflows for investing activities amounted to [$450,000]. This was mainly due to capital expenditures discussed in Section III, including the purchase of new equipment and upgrades to existing facilities. These investments are essential for future growth and operational efficiency.Financing Activities:

Cash inflow from financing activities totaled [$50,000], primarily from a small business loan that was secured to assist with working capital needs. The loan will be repaid over the next [5] years, adding an additional liability on the balance sheet but ensuring the company has sufficient liquidity for operational needs.

C. Cash Flow Projections for 2051

For the upcoming fiscal year 2051, the cash flow is projected to be strong, with an estimated net cash inflow of [$1,100,000]. This projection is based on anticipated revenue growth and a continuation of effective collection strategies. The company plans to keep capital expenditures in check to enhance cash retention, limiting major investments to essential upgrades and maintenance.

VI. Key Performance Indicators (KPIs)

A. Overview of KPIs

In assessing the financial performance of [Your Company Name], several key performance indicators (KPIs) were analyzed. These metrics provide insight into the company’s operational efficiency, profitability, and financial stability. The following table summarizes the key performance indicators for the year ended 2050:

KPI | 2050 | 2049 | Trend |

|---|---|---|---|

Current Ratio | [2.5] | [2.3] | Improving |

Quick Ratio | [1.8] | [1.6] | Improving |

Debt-to-Equity Ratio | [0.2] | [0.3] | Improving |

Gross Profit Margin | [50%] | [48%] | Improving |

Net Profit Margin | [27.3%] | [26.9%] | Improving |

Return on Assets (ROA) | [15%] | [14.5%] | Improving |

Return on Equity (ROE) | [20%] | [19%] | Improving |

B. Liquidity Ratios

The Current Ratio of [2.5] indicates that [Your Company Name] has sufficient current assets to cover its current liabilities, which is a sign of robust liquidity management. This is crucial for ensuring that the company can meet its short-term obligations without financial strain. A ratio above [1.5] is considered healthy in the industry.

The Quick Ratio of [1.8] also reflects strong liquidity, as it excludes inventory from current assets. This suggests that the company can still cover its immediate liabilities even if inventory levels are not readily converted to cash. Both ratios have shown improvement from the previous year, indicating that the company is effectively managing its working capital.

C. Profitability Ratios

[Your Company Name] reported a Gross Profit Margin of [50%], which is above the industry average of [47%]. This margin demonstrates effective cost control in production and highlights the company's ability to maintain a competitive pricing strategy while managing production costs effectively.

The Net Profit Margin of [27.3%] shows that the company retains a significant portion of revenue as profit after all expenses. This high net profit margin is a testament to the company's operational efficiency and sound financial management.

D. Return Ratios

Return on Assets (ROA): The ROA of [15%] indicates that the company effectively utilizes its assets to generate profits. This metric is vital for understanding how efficiently the company is managing its assets to produce income.

Return on Equity (ROE): With an ROE of [20%], [Your Company Name] demonstrates a strong ability to generate returns for its shareholders. This metric is crucial for attracting new investments and maintaining shareholder confidence.

VII. Recommendations

A. Cost Optimization

Operational Efficiency: To further improve operational efficiency, it is recommended that [Your Company Name] explore additional cost-saving measures. This may involve analyzing supply chain operations for potential reductions in material costs. By renegotiating contracts with suppliers and seeking bulk purchasing options, the company could reduce operational costs by an estimated [$200,000] annually. Additionally, implementing energy-efficient practices could yield savings of [$50,000] per year.

Technology Investment: Investment in automation tools and advanced software could reduce manual labor costs and enhance productivity. A budget of [$100,000] for such technology could result in long-term savings through improved process efficiencies, reducing errors, and allowing staff to focus on higher-value activities.

B. Revenue Growth Strategies

Market Penetration: There is an opportunity for [Your Company Name] to increase its market share in underdeveloped regions. By boosting marketing efforts and sales promotions in these areas, the company could potentially increase revenues by [$300,000] annually. This would involve allocating additional funds towards localized marketing strategies tailored to regional preferences and behaviors.

New Product Development: The company should invest in research and development to create innovative products that meet current market demands. Allocating [$150,000] for new product development could yield significant returns, especially if the products align with emerging trends and consumer preferences. A successful product launch could contribute an estimated [$500,000] to annual revenue.

C. Financial Planning for 2051

Given the analysis presented in this report, it is recommended that [Your Company Name] conservatively increase the overall budget by [5%] for 2051. This increase reflects anticipated revenue growth and necessary investments in operational improvements. Key focus areas should include maintaining a balance between revenue growth and cost control to ensure sustained profitability.

The strategic financial planning should also account for potential market fluctuations, allowing for adjustments to be made throughout the fiscal year. Implementing a quarterly review process will help the company stay aligned with its financial goals and respond promptly to changing market conditions.

VIII. Conclusion

In summary, [Your Company Name] had a successful fiscal year 2050, achieving a total revenue of [$5,500,000] and a net income of [$1,500,000]. Despite some overspends in operational and capital expenditures, these investments were necessary for long-term growth and efficiency. The company’s financial health remains robust, supported by strong liquidity ratios, effective cost management, and profitable operations.

To continue on this positive trajectory, it is crucial for [Your Company Name] to focus on optimizing costs, enhancing revenue streams, and planning strategically for future growth. By adhering to the recommendations outlined in this report, the company is well-positioned to achieve its financial objectives in 2051 and beyond, ensuring sustained profitability and shareholder value.

This comprehensive report serves as a foundational tool for stakeholders to understand the financial positioning of [Your Company Name] and to make informed decisions moving forward.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Manage your finances effectively with the Bookkeeping Budget Report Template from Template.net. This editable and customizable template allows you to track income, expenses, and variances against your budget. Personalize it using our Ai Editor Tool to create a clear overview of your financial health and support strategic decision-making.

You may also like

- Budget Sheet

- Personal Budget

- Non Profit Budget

- Monthly Budget

- Project Budget

- HR Budget

- Company Budget

- Home Budget

- Weekly Budget

- College Budget

- Business Budget

- Construction Budget

- Small Business Budget

- Hotel Budget

- Annual Budget

- Home Renovation Budget

- Household Budget

- Student Budget

- Grocery Budget

- Marketing Budget

- Corporate Budget

- Startup Budget

- Manufacturing Budget

- Church Budget

- University Budget

- Annual Budget Plan

- Event Budget

- Operating Budget

- Travel Budget

- Food Budget

- IT and Software Budget

- School Budget

- Real Estate Budget

- Sales Budget

- Conference Budget

- Budget Finance

- Freelancer Budget

- Budget Advertising