Free Bookkeeping Expense Report

1. Introduction

This Bookkeeping Expense Report provides a comprehensive overview of expenses incurred by [Your Company Name] during the period of January [2050] to March [2050]. The report serves a critical purpose by documenting all financial transactions systematically, which enables effective analysis and management of expenses. Proper tracking of expenses is essential for maintaining budgetary control, ensuring compliance with regulatory requirements, and supporting strategic decision-making.

Accurate and timely expense reporting is vital not only for internal management but also for external stakeholders, including investors, regulators, and partners. It provides transparency about the financial practices of [Your Company Name], fostering trust and credibility in our financial dealings. Moreover, a well-structured expense report allows management to assess performance and make informed decisions that align with the company's goals.

This report will outline the total expenses incurred, categorize these expenses, and provide insights for future financial planning. It aims to equip management with the necessary tools to analyze spending patterns and implement cost-saving strategies while ensuring that funds are allocated effectively to support business objectives.

2. Executive Summary

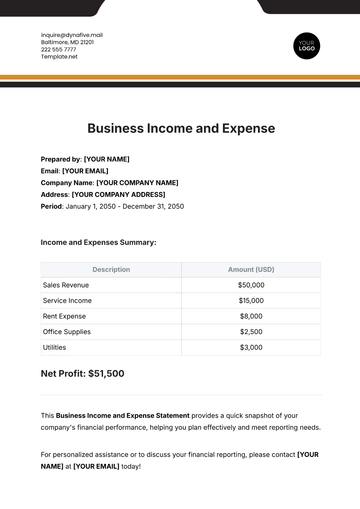

During the period from January [2050] to March [2050], [Your Company Name] incurred total expenses amounting to $[150,000]. This figure represents a detailed summation of various operational costs that contribute to the daily functioning and growth of the company. The report categorizes these expenses into several key areas, allowing management to analyze spending trends, assess adherence to the established budget, and identify areas for potential cost savings.

The primary categories of expenses for this reporting period included:

Office Supplies: $[10,000]

Travel Expenses: $[25,000]

Utilities: $[15,000]

Salaries and Wages: $[80,000]

Marketing Expenses: $[20,000]

The total expenses of $[150,000] represent a [5]% increase compared to the previous quarter, primarily driven by increased travel and marketing expenditures. This increase reflects the company's commitment to expanding its market presence and enhancing employee engagement through professional development opportunities.

3. Detailed Expense Breakdown

This section provides a detailed breakdown of the expenses incurred during the reporting period, categorized for clarity and ease of analysis. Each category is accompanied by a table summarizing individual transactions, enabling a transparent view of expenditures.

3.1 Office Supplies

Office supplies are essential for the daily operations of [Your Company Name], ensuring that employees have the necessary tools to perform their tasks efficiently. Below is the breakdown of office supply expenses:

Date | Description | Amount |

|---|---|---|

January [5, 2050] | Printer Ink | $[500] |

January [15, 2050] | Office Furniture | $[3,000] |

February [2, 2050] | Stationery Supplies | $[1,000] |

March [10, 2050] | Cleaning Supplies | $[500] |

March [20, 2050] | Computer Accessories | $[5,000] |

Total | Office Supplies | $[10,000] |

Commentary: Office supplies expenditures remained consistent with the previous quarter. The notable purchases of office furniture and computer accessories were essential to improve workplace efficiency and support the company's growth initiatives. The investment in ergonomically designed furniture aimed to enhance employee comfort and productivity, reflecting our commitment to fostering a healthy work environment. Regular assessments of office supply needs will continue to ensure that we optimize spending while maintaining quality.

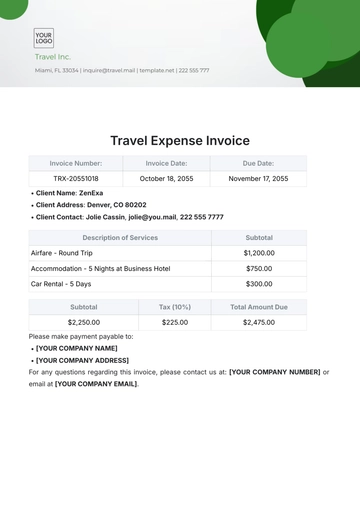

3.2 Travel Expenses

Travel expenses are a vital part of business operations, especially for companies like [Your Company Name] that prioritize client engagement and industry participation. Below is the detailed breakdown of travel expenses incurred during this period:

Date | Description | Amount |

|---|---|---|

January [10, 2050] | Airfare to Conference | $[2,000] |

January [12, 2050] | Hotel Accommodations | $[1,500] |

January [15, 2050] | Meals during Conference | $[500] |

February [5, 2050] | Client Meeting - Airfare | $[1,200] |

February [6, 2050] | Client Meeting - Meals | $[300] |

March [10, 2050] | Trade Show - Airfare | $[3,000] |

March [12, 2050] | Trade Show - Hotel | $[2,000] |

March [15, 2050] | Trade Show - Meals | $[1,500] |

Total | Travel Expenses | $[25,000] |

Commentary: Travel expenses saw a significant increase due to the company's active participation in conferences and trade shows. These events are critical for networking, acquiring new clients, and enhancing industry knowledge. The costs associated with airfare, accommodations, and meals reflect the strategic importance of in-person engagements in building relationships and fostering collaborations.

Management should consider negotiating corporate rates with airlines and hotels to mitigate rising travel costs. Additionally, exploring virtual meeting options may offer alternative solutions for client engagement, potentially reducing travel-related expenses in the future.

3.3 Utilities

Utilities are essential for maintaining the operational capacity of [Your Company Name]. Below is a detailed breakdown of utility expenses incurred during the reporting period:

Month | Description | Amount |

|---|---|---|

January [2050] | Electricity | $[3,000] |

January [2050] | Water | $[1,000] |

February [2050] | Internet | $[500] |

February [2050] | Phone Services | $[500] |

March [2050] | Electricity | $[3,000] |

March [2050] | Water | $[1,000] |

Total | Utilities | $[15,000] |

Commentary: Utility costs remained stable during this reporting period, reflecting consistent usage and effective management of resources. The steady nature of these costs indicates that [Your Company Name] has successfully implemented energy-saving initiatives, which not only help reduce overall utility expenses but also contribute to sustainability efforts. Regular reviews of utility contracts may reveal opportunities for cost savings or service enhancements.

3.4 Salaries and Wages

Salaries and wages are a significant portion of [Your Company Name]'s operating expenses, directly tied to employee productivity and satisfaction. Below is a breakdown of salaries and wages incurred during the reporting period:

Employee | Position | Amount |

|---|---|---|

[Employee A] | Manager | $[20,000] |

[Employee B] | Senior Accountant | $[15,000] |

[Employee C] | Marketing Specialist | $[10,000] |

[Employee D] | Administrative Assistant | $[5,000] |

[Employee E] | Sales Representative | $[10,000] |

[Employee F] | IT Support | $[5,000] |

[Employee G] | Customer Service | $[5,000] |

Total | Salaries and Wages | $[80,000] |

Commentary: Salaries and wages accounted for the majority of total expenses, reflecting the company’s strategy of investing in human capital. Increased staffing levels in response to business growth contributed to this rise in expenses, with a focus on hiring skilled professionals to enhance overall productivity.

Future staffing strategies should continue to align with organizational goals, ensuring that we have the right personnel in place to meet the demands of a competitive marketplace. Regular employee performance reviews can provide insights into staffing needs and help identify potential areas for training and development, which may ultimately reduce turnover costs.

3.5 Marketing Expenses

Marketing expenses play a crucial role in promoting [Your Company Name]'s products and services. Below is the detailed breakdown of marketing expenses incurred during the reporting period:

Date | Description | Amount |

|---|---|---|

January [15, 2050] | Digital Marketing Campaign | $[5,000] |

February [5, 2050] | Print Advertising | $[3,000] |

February [10, 2050] | Website Development | $[7,000] |

March [15, 2050] | Event Sponsorship | $[5,000] |

Total | Marketing Expenses | $[20,000] |

Commentary: Marketing expenses increased significantly due to enhanced digital marketing efforts and a new website launch aimed at improving brand visibility and outreach. These initiatives are designed to attract a broader customer base and establish a stronger online presence in an increasingly digital marketplace.

Going forward, it will be essential to measure the effectiveness of marketing campaigns through key performance indicators (KPIs) to assess their impact on sales and brand awareness. This approach will ensure that marketing budgets are utilized efficiently, and that we are able to pivot strategies based on data-driven insights.

4. Comparative Analysis

This section provides a comparative analysis of the current period's expenses against those of the previous quarter, enabling stakeholders to understand trends and identify any areas of concern.

4.1 Quarter Comparison

The following table presents a comparison of expenses incurred in Q1 2050 versus Q4 2051:

Expense Category | Q4 2050 | Q1 2051 | Difference |

|---|---|---|---|

Office Supplies | $[9,500] | $[10,000] | +$[500] |

Travel Expenses | $[20,000] | $[25,000] | +$[5,000] |

Utilities | $[15,000] | $[15,000] | $[0] |

Salaries and Wages | $[75,000] | $[80,000] | +$[5,000] |

Marketing Expenses | $[15,000] | $[20,000] | +$[5,000] |

Total Expenses | $[134,500] | $[150,000] | +$[15,500] |

Analysis: The total expenses for Q4 2050 increased by [$15,500] compared to Q1 2051. The most significant rises were observed in travel, salaries and wages, and marketing expenses. This upward trend indicates a proactive approach towards expanding the business, investing in human resources, and enhancing brand visibility through marketing efforts.

The increase in travel expenses reflects the company’s strategic focus on building relationships and networking, which are critical for long-term growth. As the company navigates through this period of expansion, careful consideration of expense management practices is vital to ensure that all spending aligns with the overall strategic goals of [Your Company Name].

5. Recommendations

Based on the findings of the Bookkeeping Expense Report, several recommendations are made to enhance the efficiency of expense management and ensure the sustainable financial health of [Your Company Name].

5.1 Expense Tracking Improvements

Implement a Robust Expense Management System:

Invest in a comprehensive software solution that automates expense tracking, integrates with other financial systems, and provides real-time insights into spending patterns. This will facilitate timely reporting and enhance visibility into budget adherence.

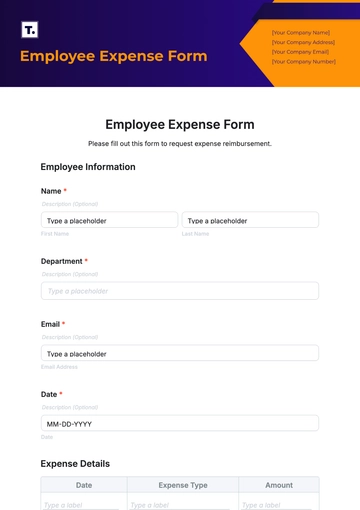

Establish Clear Expense Policies:

Develop and disseminate clear policies regarding allowable expenses, approval processes, and reporting requirements. This will help reduce discrepancies and ensure that all employees understand their responsibilities concerning expense management.

Regular Audits of Expense Reports:

Conduct regular audits of submitted expense reports to ensure compliance with company policies and identify potential areas of misuse or unnecessary expenditures. This proactive approach can help mitigate risks and reinforce accountability among employees.

5.2 Strategic Budgeting

Create Departmental Budgets:

Encourage each department to establish its own budget based on projected needs and past spending patterns. This decentralized approach allows for greater ownership of financial management at the departmental level and ensures that budgets are aligned with strategic objectives.

Monitor Budget Variances:

Implement a system for regularly monitoring budget variances and analyzing the reasons behind any discrepancies. This practice will enable the company to make informed adjustments and respond proactively to changing circumstances.

Incorporate Cost-Benefit Analysis:

For significant expenditures, such as marketing campaigns and capital investments, implement a formal cost-benefit analysis process. This analysis should assess potential returns on investment and help prioritize expenditures that drive growth.

5.3 Employee Training

Training Programs on Expense Management:

Develop training programs for employees that emphasize the importance of expense management and provide guidance on best practices. This will enhance employees’ understanding of their roles in financial stewardship and reinforce a culture of responsible spending.

Incentives for Cost-Saving Initiatives:

Consider implementing an incentive program that rewards employees for identifying cost-saving opportunities and contributing to expense reduction initiatives. This can foster a collaborative effort toward achieving financial efficiency.

6. Future Outlook

Looking ahead, it is imperative for [Your Company Name] to maintain a forward-thinking approach to expense management. The company should continually assess its financial strategies to ensure that they align with both short-term operational needs and long-term growth objectives.

6.1 Focus on Sustainable Practices

As part of its commitment to corporate social responsibility, [Your Company Name] should focus on implementing sustainable practices that reduce costs and environmental impact. For instance, embracing remote work options where feasible can decrease overhead costs related to utilities and office supplies. Additionally, adopting energy-efficient technologies and processes can lead to long-term savings while contributing to a greener environment.

6.2 Adaptability to Market Changes

The business landscape is continually evolving, and [Your Company Name] must remain adaptable to market changes. Regularly reviewing and adjusting expense categories in response to shifts in industry trends, customer preferences, and economic conditions will position the company to thrive. For example, investing in digital marketing channels may yield a higher return on investment compared to traditional advertising methods in a rapidly changing market.

6.3 Emphasis on Data-Driven Decision Making

Finally, a strong emphasis on data-driven decision-making will empower [Your Company Name] to make informed choices regarding expenses. By leveraging data analytics tools, management can identify spending trends, uncover inefficiencies, and optimize resource allocation. This proactive approach ensures that financial resources are allocated effectively to initiatives that contribute to growth.

7. Conclusion

The Bookkeeping Expense Report for the period of January [2050] to March [2050] provides an in-depth analysis of the financial expenditures incurred by [Your Company Name]. Total expenses of $[150,000] reflect both ongoing operational needs and strategic investments aimed at promoting growth and enhancing the company’s market presence.

Through systematic analysis of expenses, the company can enhance its financial health and operational efficiency. As we move forward, it is critical to optimize expense management practices to ensure that financial resources are used efficiently, supporting long-term objectives and driving sustainable growth.

Continuous monitoring, strategic planning, and effective financial stewardship will position [Your Company Name] to navigate the complexities of the business landscape, paving the way for future success and resilience.

Appendices

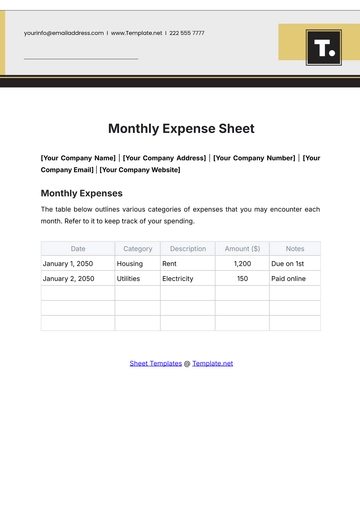

Appendix A: Expense Report Template

To ensure consistency and accuracy in future expense reports, the following template can be utilized:

Date | Category | Description | Amount |

|---|---|---|---|

Appendix B: Historical Expense Data

A summary of historical expense data over the past year is provided below for comparative purposes and trend analysis.

Quarter | Total Expenses |

|---|---|

Q1 2049 | $[120,000] |

Q2 2049 | $[125,000] |

Q3 2049 | $[130,000] |

Q4 2049 | $[134,500] |

Q1 2050 | $[150,000] |

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Keep track of your spending with the Bookkeeping Expense Report Template from Template.net. This editable and customizable template allows you to record and categorize expenses systematically, making reimbursement and budget analysis easier. Personalize it using our Ai Editor Tool to streamline your financial processes.