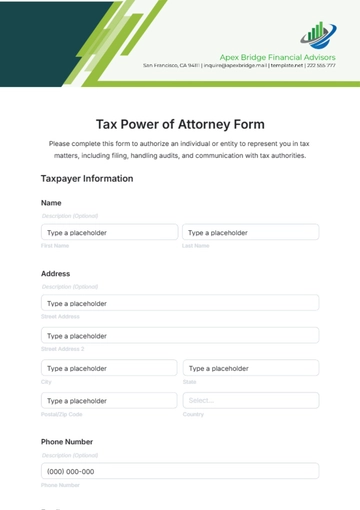

Free Tax Power of Attorney Form

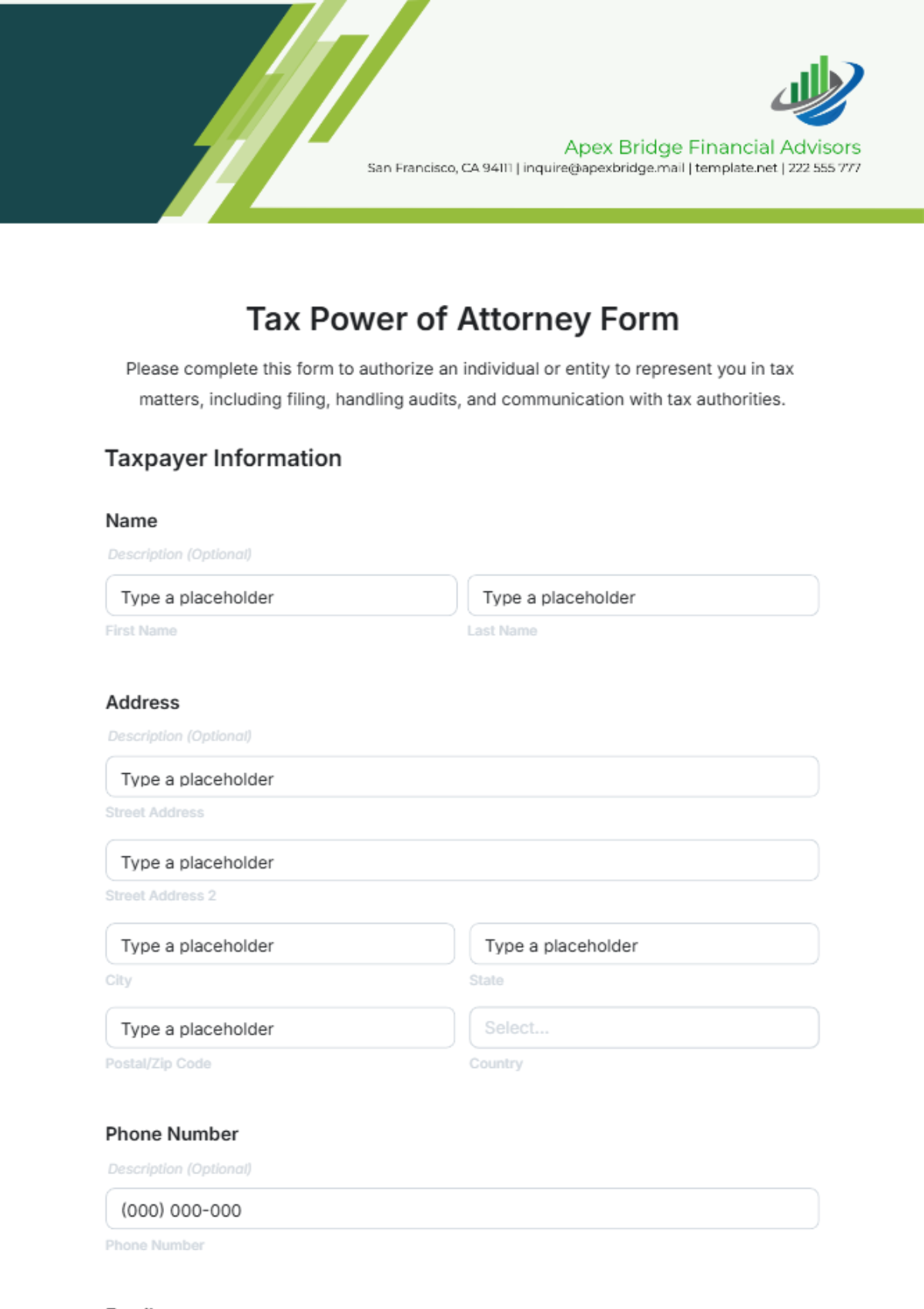

Please complete this form to authorize an individual or entity to represent you in tax matters, including filing, handling audits, and communication with tax authorities.

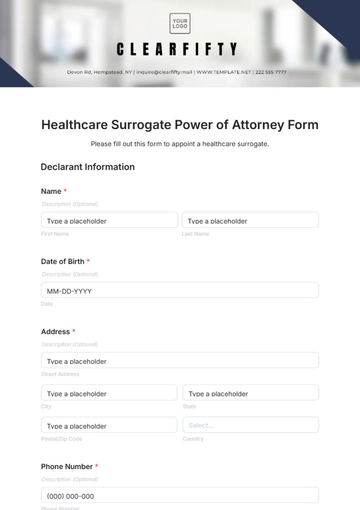

Taxpayer Information

Name

Address

Phone Number

Social Security Number (SSN) / Tax ID

Attorney-in-Fact (Agent) Information

Name

Business Name (if applicable)

Address

Phone Number

Preparer Tax Identification Number (PTIN)

Tax Matters Authorized

The Attorney-in-Fact (Agent) is authorized to act on behalf of the taxpayer in the following tax-related matters:

Filing Tax Returns

Handling Audits and Reviews

Payment Agreements and Settlements

Access to Tax Records and Confidential Information

Representation before Tax Authorities

Type of Tax

Income Tax

Corporate Tax

Property Tax

Sale and Use Tax

Employment Tax

Tax Year(s) or Period(s) Covered

Effective Date

Termination Date

This power of attorney will remain in effect until:

Taxpayer’s Signature

Name:

Date:

Attorney-in-Fact’s (Agent’s) Signature

Name:

Date:

Power of Attorney Form Templates @ Template.net

Thank you for your valuable feedback!

We appreciate you taking the time to submit.

Create free forms at Template.net

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Streamline your tax filing process with Template.net's Tax Power of Attorney Form Template. This customizable and editable template ensures you can quickly designate authority for tax matters. With seamless accessibility, you can personalize your document, editable in our AI Editor Tool, to suit specific needs. Empower your professional tasks today, saving time and ensuring accuracy in crucial financial transactions.