Free 3-Year Financial Plan

I. Introduction

A well-structured 3-year financial plan is critical for building financial resilience, achieving growth, and securing your future. This plan provides a clear framework for setting actionable goals, managing income and expenses, making strategic investments, and mitigating risks. Regular reviews and adjustments will ensure the plan stays relevant and aligned with both personal and business financial objectives.

II. Objective Setting

A. Personal Finance Goals

Setting clear personal finance goals is the foundation of your financial plan. These goals should be specific, measurable, attainable, realistic, and time-bound (SMART).

Short-term goals (0-1 year):

Build an emergency fund that covers 3-6 months of essential living expenses.

Reduce or eliminate high-interest debt (e.g., credit card debt, payday loans).

Start tracking expenses and optimize spending habits.

Medium-term goals (1-3 years):

Save for a significant purchase (e.g., home down payment, car, or travel).

Pursue personal or professional development through education or certifications.

Set aside savings for family milestones (e.g., weddings, education for children).

Long-term goals (3+ years):

Plan for retirement by maximizing contributions to retirement accounts (401(k), IRA).

Invest in real estate or other income-generating assets.

Consider building a passive income stream (e.g., rental properties, stock dividends).

B. Business Finance Goals

For entrepreneurs or business owners, clear financial targets are essential for growth and sustainability.

Revenue Growth:

Increase revenue by 20% annually through new customer acquisition, product diversification, or market expansion.

Develop strategies to improve customer retention and repeat sales.

Profitability:

Improve profit margins by reducing operational costs by 10-15% through process optimization, automation, or strategic outsourcing.

Implement cost control measures without sacrificing quality or customer satisfaction.

Capital Investment:

Allocate funds toward business expansion, technology upgrades, or R&D to stay competitive and foster innovation.

III. Budget Development

A. Income Analysis

A detailed analysis of all income streams is essential to creating an accurate budget.

Primary Income:

This includes your main salary or revenue from your business or job. Make sure you account for any seasonal fluctuations.

Secondary Income:

Include earnings from side businesses, freelance work, or investments such as dividends or rental income.

Potential Passive Income:

Consider developing new passive income streams through stocks, real estate, or royalties.

B. Expense Management

Tracking and categorizing expenses is key to understanding where your money goes and finding areas to cut back or optimize.

Fixed Costs:

These are recurring costs such as rent, mortgage payments, utilities, insurance, and loans.

Variable Costs:

These expenses fluctuate and include groceries, entertainment, travel, and other discretionary spending.

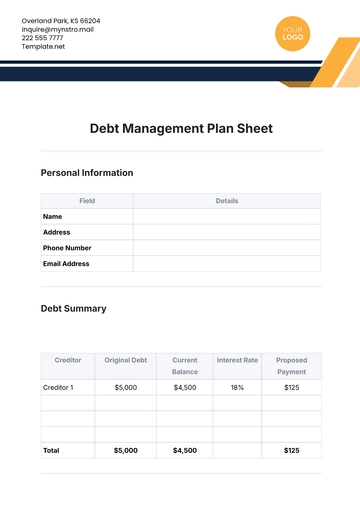

C. Budget Allocation

Allocating your income strategically helps to ensure that you meet both short-term needs and long-term goals.

Category | Percentage Allocation |

|---|---|

Living Expenses | 50% |

Savings and Investments | 20% |

Debt Repayment | 20% |

Discretionary Spending | 10% |

Living Expenses (50%):

Cover essential needs such as housing, food, transportation, and utilities.

Savings and Investments (20%):

Allocate towards building an emergency fund, contributing to retirement accounts, or investing in stocks, bonds, or real estate.

Debt Repayment (20%):

Focus on paying off high-interest debt first, such as credit cards, followed by lower-interest loans.

Discretionary Spending (10%):

Set aside funds for non-essential spending such as dining out, hobbies, entertainment, and travel.

IV. Investment Strategy

A. Risk Assessment

Your investment strategy should be aligned with your risk tolerance and financial goals. Assess how much risk you're comfortable taking based on your age, income stability, and financial objectives.

Conservative Approach:

Focus on low-risk investments such as bonds, high-yield savings accounts, or dividend-paying stocks for steady returns.

Moderate Approach:

A balanced portfolio with a mix of stocks and bonds can offer growth potential while managing risk.

Aggressive Approach:

Prioritize growth through higher-risk investments like equities, real estate, or start-ups.

B. Portfolio Diversification

Diversification is key to managing risk while aiming for consistent returns.

Stocks:

Invest in a mix of large-cap, mid-cap, and small-cap stocks across various industries.

Bonds:

Incorporate government, municipal, or corporate bonds for stability.

Real Estate and Alternative Assets:

Consider investing in real estate, commodities, or venture capital for higher returns and portfolio diversity.

C. Monitoring and Evaluation

Regularly review your portfolio to ensure it remains aligned with your goals and market conditions.

Annual Portfolio Reviews:

Adjust asset allocation based on market trends, performance, and evolving financial objectives.

Rebalancing:

Periodically rebalance your portfolio to maintain your desired risk exposure.

V. Risk Management

A. Emergency Fund

Maintaining a robust emergency fund is crucial for handling unforeseen expenses or life changes.

Target:

Aim for 3-6 months of essential living expenses in liquid savings.

Utilization:

Use the emergency fund only for critical needs such as job loss, medical emergencies, or major home repairs.

B. Insurance Coverage

Protecting yourself and your assets through appropriate insurance policies mitigates financial risks.

Health Insurance:

Ensure comprehensive health coverage to avoid large medical bills that could derail your financial plan.

Life Insurance:

Consider term life insurance for income replacement and to protect dependents.

Property and Casualty Insurance:

Protect your home, car, and other assets from damage, theft, or liability claims.

VI. Conclusion

A comprehensive 3-year financial plan integrates clear personal and business objectives, effective budgeting, strategic investment, and risk management. By regularly reviewing and adjusting the plan based on your changing circumstances, you will stay on track to achieve financial stability and growth. This roadmap will help ensure your long-term financial security while allowing for flexibility to adapt to unexpected challenges and opportunities.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Plan your financial future with ease using the 3-Year Financial Plan Template from Template.net. This fully customizable and editable template is designed to suit your business needs. Effortlessly make changes, as it’s editable in our AI Editor Tool, ensuring your plan is tailored and accurate for long-term success.

You may also like

- Finance Plan

- Construction Plan

- Sales Plan

- Development Plan

- Career Plan

- Budget Plan

- HR Plan

- Education Plan

- Transition Plan

- Work Plan

- Training Plan

- Communication Plan

- Operation Plan

- Health And Safety Plan

- Strategy Plan

- Professional Development Plan

- Advertising Plan

- Risk Management Plan

- Restaurant Plan

- School Plan

- Nursing Home Patient Care Plan

- Nursing Care Plan

- Plan Event

- Startup Plan

- Social Media Plan

- Staffing Plan

- Annual Plan

- Content Plan

- Payment Plan

- Implementation Plan

- Hotel Plan

- Workout Plan

- Accounting Plan

- Campaign Plan

- Essay Plan

- 30 60 90 Day Plan

- Research Plan

- Recruitment Plan

- 90 Day Plan

- Quarterly Plan

- Emergency Plan

- 5 Year Plan

- Gym Plan

- Personal Plan

- IT and Software Plan

- Treatment Plan

- Real Estate Plan

- Law Firm Plan

- Healthcare Plan

- Improvement Plan

- Media Plan

- 5 Year Business Plan

- Learning Plan

- Marketing Campaign Plan

- Travel Agency Plan

- Cleaning Services Plan

- Interior Design Plan

- Performance Plan

- PR Plan

- Birth Plan

- Life Plan

- SEO Plan

- Disaster Recovery Plan

- Continuity Plan

- Launch Plan

- Legal Plan

- Behavior Plan

- Performance Improvement Plan

- Salon Plan

- Security Plan

- Security Management Plan

- Employee Development Plan

- Quality Plan

- Service Improvement Plan

- Growth Plan

- Incident Response Plan

- Basketball Plan

- Emergency Action Plan

- Product Launch Plan

- Spa Plan

- Employee Training Plan

- Data Analysis Plan

- Employee Action Plan

- Territory Plan

- Audit Plan

- Classroom Plan

- Activity Plan

- Parenting Plan

- Care Plan

- Project Execution Plan

- Exercise Plan

- Internship Plan

- Software Development Plan

- Continuous Improvement Plan

- Leave Plan

- 90 Day Sales Plan

- Advertising Agency Plan

- Employee Transition Plan

- Smart Action Plan

- Workplace Safety Plan

- Behavior Change Plan

- Contingency Plan

- Continuity of Operations Plan

- Health Plan

- Quality Control Plan

- Self Plan

- Sports Development Plan

- Change Management Plan

- Ecommerce Plan

- Personal Financial Plan

- Process Improvement Plan

- 30-60-90 Day Sales Plan

- Crisis Management Plan

- Engagement Plan

- Execution Plan

- Pandemic Plan

- Quality Assurance Plan

- Service Continuity Plan

- Agile Project Plan

- Fundraising Plan

- Job Transition Plan

- Asset Maintenance Plan

- Maintenance Plan

- Software Test Plan

- Staff Training and Development Plan

- 3 Year Plan

- Brand Activation Plan

- Release Plan

- Resource Plan

- Risk Mitigation Plan

- Teacher Plan

- 30 60 90 Day Plan for New Manager

- Food Safety Plan

- Food Truck Plan

- Hiring Plan

- Quality Management Plan

- Wellness Plan

- Behavior Intervention Plan

- Bonus Plan

- Investment Plan

- Maternity Leave Plan

- Pandemic Response Plan

- Succession Planning

- Coaching Plan

- Configuration Management Plan

- Remote Work Plan

- Self Care Plan

- Teaching Plan

- 100-Day Plan

- HACCP Plan

- Student Plan

- Sustainability Plan

- 30 60 90 Day Plan for Interview

- Access Plan

- Site Specific Safety Plan