Bookkeeping Checklist Form

Stay on top of your finances with this comprehensive checklist, covering daily, weekly, monthly, quarterly, and annual bookkeeping tasks.

Name

Phone number

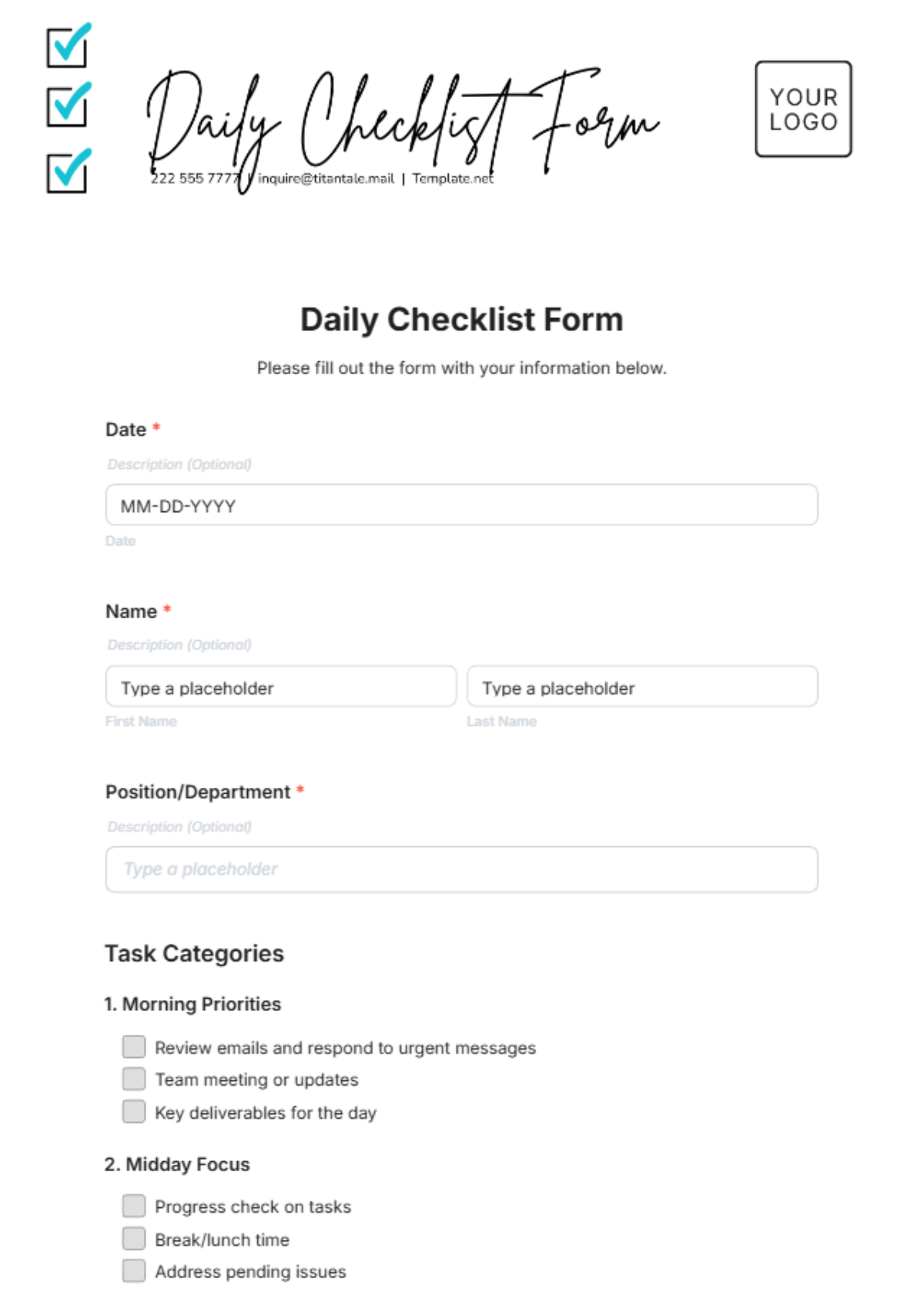

Daily Tasks

Record all income from sales, services, or other sources.

Log every business expense and attach relevant receipts.

Update accounts receivable to track outstanding customer payments.

Record payments made to vendors and suppliers.

Monitor cash flow and ensure it balances with bank transactions.

Check for any errors or discrepancies in the day’s entries.

Weekly Tasks

Review and categorize all expenses by category (e.g., utilities, supplies, payroll).

Follow up on unpaid invoices and communicate with clients.

Prepare a weekly cash flow report for review.

Review payroll records to ensure employee payments are accurate.

Check inventory levels and update financial records accordingly.

Verify that all bank transactions have been logged and categorized correctly.

Monthly Tasks

Reconcile bank statements to ensure all transactions match.

Review and update financial reports, including balance sheets and profit & loss statements.

Update fixed asset records for depreciation and additions.

Review and process employee reimbursements or advances.

Check tax obligations and ensure all necessary payments are made (e.g., sales tax, payroll tax).

Ensure all bills and invoices for the month have been paid and recorded.

Quarterly Tasks

Prepare and file quarterly tax estimates for income and payroll taxes.

Review all financial statements to ensure accuracy before preparing for tax filings.

Reassess your budget and adjust financial goals as needed.

Analyze cash flow and make adjustments to reduce unnecessary expenses.

Review your financial reports with an accountant to ensure compliance and identify areas of improvement.

Ensure all payroll taxes have been filed correctly and on time.

Annual Tasks

Organize and prepare all documents for year-end tax filing.

Conduct a thorough year-end reconciliation of all accounts.

Review your annual financial performance and prepare a summary report.

Close out the fiscal year in your accounting software, ensuring all data is accurate.

Meet with your accountant to assess tax liability, deductions, and possible savings.

Set new financial goals and budgets for the upcoming year.

Thank you for your submission!

We appreciate you taking the time to submit.

Create free forms at Template.net