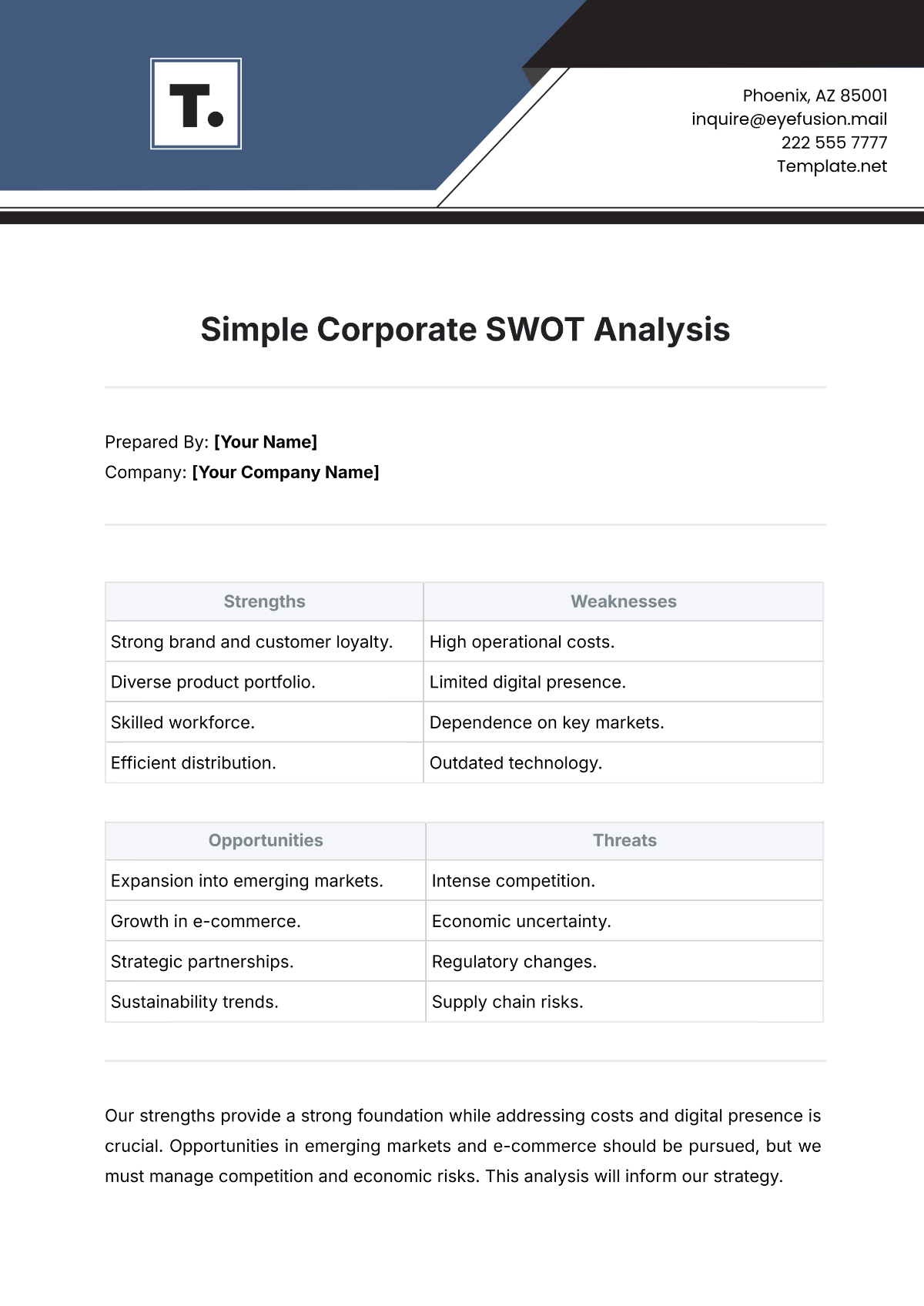

Simple Financial Business Analysis

Introduction

This financial business analysis aims to provide a straightforward overview of a company's financial health and performance. Key metrics such as revenue, expenses, profit margins, and cash flow will be analyzed to gain insights into the company's operations and strategic positioning.

Financial Overview

Revenue Analysis

Year | Total Revenue ($) |

|---|---|

2050 | 1,000,000 |

2051 | 1,200,000 |

2052 | 1,500,000 |

The company has consistently increased revenue over the past three years, indicating a positive growth trend.

Expense Analysis

Year | Total Expenses ($) |

|---|---|

2050 | 600,000 |

2051 | 700,000 |

2052 | 800,000 |

Expenses have also been rising, but remain proportionate to the revenue increase, allowing the company to maintain healthy profit margins.

Profit Margin Analysis

Year | Profit Margin (%) |

|---|---|

2050 | 40% |

2051 | 41.7% |

2052 | 46.7% |

The growth in profit margin reflects the company's effective cost management and increasing revenue. This has improved shareholder value and investor confidence.

Cash Flow Analysis

Cash flow is a critical measure of financial health as it indicates the company's ability to generate cash to fund operations and growth. The following list highlights the company's cash flow focus areas:

Operating Cash Flow

Investing Cash Flow

Financing Cash Flow

Conclusion

The company is in a strong financial position, increasing revenue, controlling expenses, and improving profit margins. Continued focus on cash flow management will be crucial for sustaining growth and competitive advantage.