Free Bookstore Financial Projection

I. Introduction

This document provides a comprehensive financial projection for [Your Company Name] over the next fiscal year. In the dynamic and competitive landscape of the retail book industry, a well-defined financial strategy is essential for success. Our projections are built on thorough market analysis, historical data, and anticipated trends, which collectively inform our expectations for revenue and expenses. This financial roadmap will serve as a vital tool for monitoring our performance and making informed decisions.

Our aim is to outline expected revenue, expenses, net profit, and other key financial metrics that are crucial for guiding business decisions and securing stakeholder confidence. By examining various revenue streams, such as book sales, events, and merchandise, we will identify opportunities for growth and areas that may require adjustments. Additionally, the projection will address potential risks and contingencies, enabling us to navigate uncertainties effectively. Through this comprehensive approach, we seek to establish a sustainable financial foundation that supports our mission and enhances the overall customer experience at [Your Company Name].

II. Revenue Projection

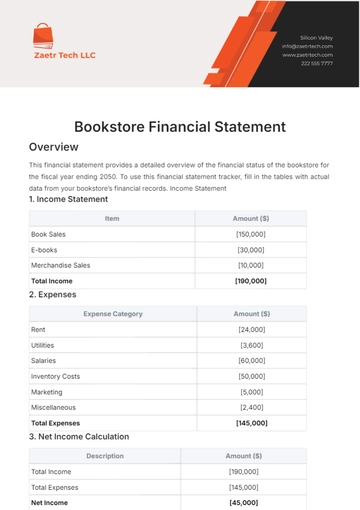

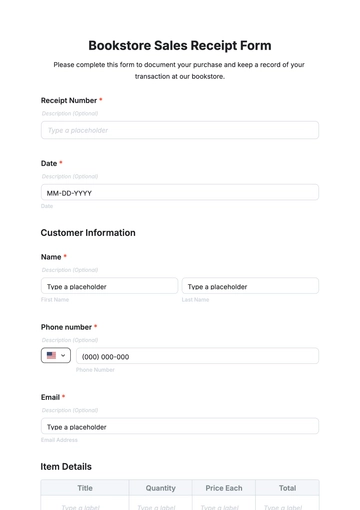

Understanding our revenue potential is crucial for the financial health of [Your Company Name]. By analyzing historical data and current market trends, we have developed projections for each quarter. The table below outlines the anticipated revenue, highlighting our growth expectations and providing a clear roadmap for financial planning.

Quarter | Projected Revenue |

|---|---|

Q1 | $150,000 |

Q2 | $170,000 |

Q3 | $180,000 |

Q4 | $200,000 |

III. Expense Projection

Accurately forecasting expenses is essential for the financial stability of [Your Company Name]. The table below details our projected expenses across key categories for the upcoming fiscal year. Each category reflects a crucial aspect of our operational costs, providing insight into how we allocate resources to support our business objectives.

Category | Projected Expenses |

|---|---|

Staff Salaries | $90,000 |

Rent and Utilities | $45,000 |

Marketing | $30,000 |

Inventory | $80,000 |

This expense projection will enable us to manage cash flow effectively, optimize spending, and ensure we invest wisely in areas that drive growth and enhance the customer experience at [Your Company Name].

IV. Net Profit Projection

Projecting net profit is crucial for assessing the financial viability of [Your Company Name] and for strategic planning. By evaluating the difference between our projected revenues and expenses, we can gain insight into our profitability and overall business health. The following table summarizes our anticipated net profit for each quarter of the upcoming fiscal year, reflecting our growth and operational efficiency.

Quarter | Projected Net Profit |

|---|---|

Q1 | $10,000 |

Q2 | $15,000 |

Q3 | $10,000 |

Q4 | $25,000 |

These projections highlight the expected fluctuations in net profit throughout the year, driven by seasonal sales trends and our strategic initiatives. Monitoring these figures will allow us to make informed decisions to enhance profitability and ensure the long-term success of [Your Company Name].

V. Cash Flow Analysis

Maintaining a positive cash flow is vital for the ongoing operations of [Your Company Name]. The projected cash flow will be monitored closely to ensure liquidity and operational efficiency. Effective cash flow management allows us to meet our financial obligations while supporting growth initiatives.

Our analysis will focus on the following key components:

Operating Cash Flow: This includes cash generated from core business operations, derived from sales revenue minus operational expenses. Understanding this flow helps us assess the health of our primary business activities.

Investing Cash Flow: This section accounts for cash spent on capital expenditures, such as investments in inventory, technology, and improvements to the bookstore environment. Careful planning of these expenditures is essential to balance growth with liquidity.

Financing Cash Flow: This includes cash transactions related to loans, equity financing, and dividends. Monitoring these flows ensures that we are maintaining a healthy capital structure.

Strategically managing working capital is crucial for sustaining operations, meeting unexpected expenses, and ensuring [Your Company Name] is well-positioned for future opportunities. By closely tracking our cash flow projections, we can make informed decisions that support our financial health and operational goals.

VI. Break-Even Analysis

The break-even analysis is a crucial financial tool that helps [Your Company Name] determine the point at which total revenues equal total expenses, indicating a state of financial equilibrium. Understanding this point is vital for strategic planning, allowing us to set realistic sales targets and assess operational efficiency.

For the upcoming fiscal year, our target is to cover all operating costs by the end of Q2. This analysis is calculated using the following components:

Fixed Costs: These are costs that remain constant regardless of sales volume, such as rent, salaries, and utilities. For our bookstore, the total fixed costs are projected to be approximately $135,000.

Variable Costs: These costs fluctuate with sales levels and include inventory purchases, marketing expenses, and other operational costs. Based on projections, variable costs are estimated to be around $80,000.

Selling Price per Unit: By determining the average selling price of our books and merchandise, we can assess how many units need to be sold to cover costs.

VII. Conclusion

This financial projection serves as a roadmap for [Your Company Name] for the upcoming fiscal year. By outlining expected revenue, expenses, net profit, and cash flow, we are equipped with a comprehensive understanding of our financial landscape. With strategic planning and agile management, the bookstore aims to achieve the outlined financial goals, ensuring that we not only meet our immediate targets but also build a solid foundation for future expansion.

The insights gained from this projection will guide our decision-making processes, helping us to navigate challenges and seize opportunities in a competitive market. By focusing on maintaining liquidity, optimizing operational efficiency, and monitoring our progress towards the break-even point, we can enhance our profitability and drive sustainable growth. Ultimately, our commitment to providing exceptional customer experiences will remain at the core of our efforts, positioning [Your Company Name] for long-term success.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Forecast your bookstore’s financial future with this Bookstore Financial Projection Template from Template.net. This customizable and editable template provides a clear framework for projecting revenues, expenses, and profits. Fully editable in our Ai Editor Tool, you can adjust each section to meet your specific financial goals, ensuring accurate and insightful financial planning.