Financial Outline Feasibility Study

Prepared by: [Your Name]

Date: December 24, 2050

Executive Summary

Urban Brew Coffee Shop is a proposed cafe to be located in the downtown area, targeting young professionals, students, and residents. This feasibility study evaluates the project’s financial viability, including projected startup costs, potential revenue, and operating expenses. With an expected annual revenue of $260,400 and an annual profit of $140,800, the project appears financially feasible.

1. Project Overview

Business Name: Urban Brew Coffee Shop

Location: Downtown area near public transport

Business Model: A trendy coffee shop offering specialty coffee, artisan teas, and light food items such as pastries, sandwiches, and salads. The shop will focus on quality service, a comfortable environment for work and socializing, and a community vibe.

Target Market: Young professionals (ages 25-40), students from nearby universities, and local residents in the area.

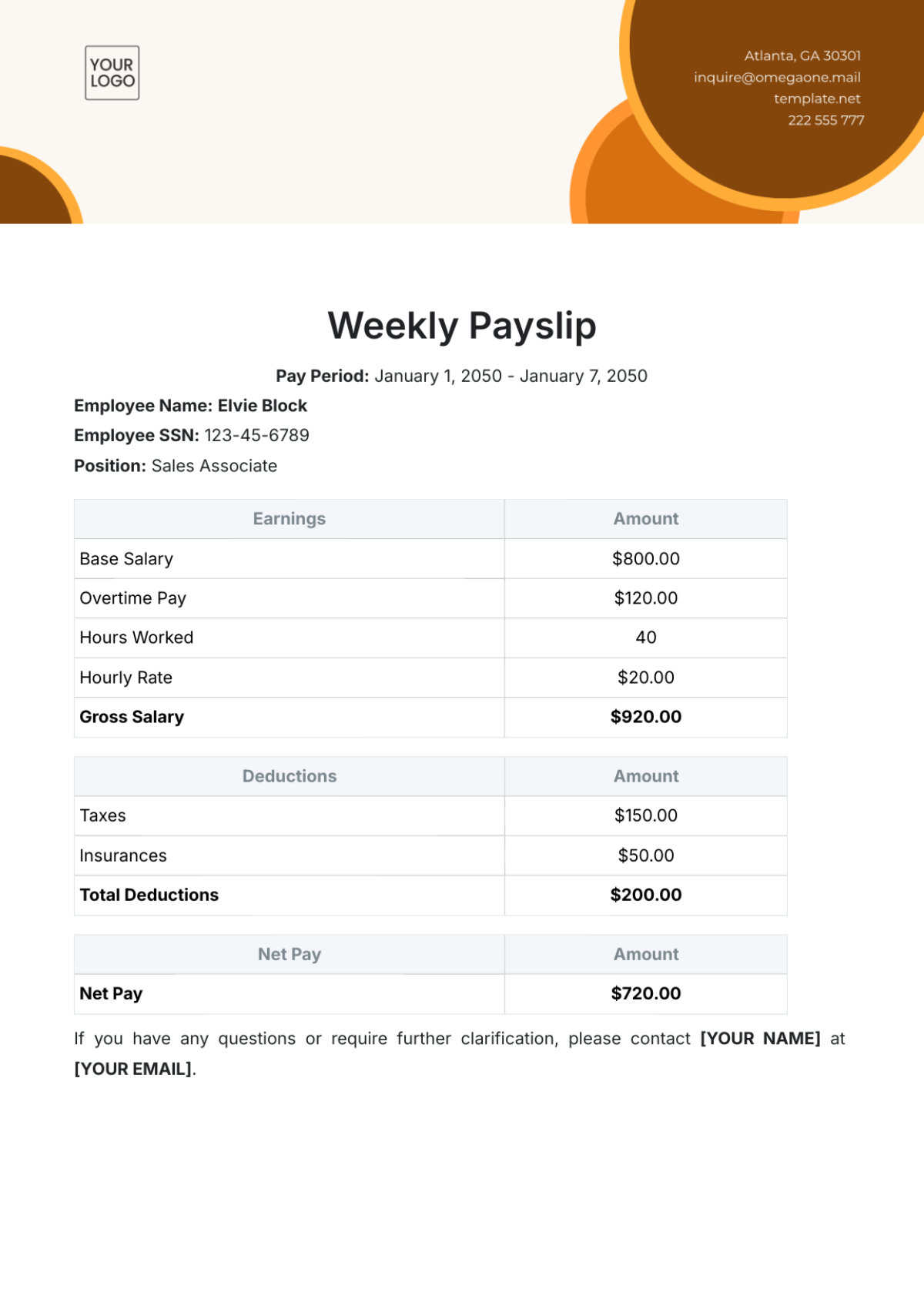

2. Startup Costs

Item | Estimated Cost |

|---|---|

Leasehold Improvements | $40,000 |

Equipment (espresso machines, grinders, furniture) | $28,000 |

Initial Inventory (coffee, food supplies) | $12,000 |

Licenses and Permits | $3,000 |

Marketing & Promotion (initial launch campaign) | $6,000 |

Branding & Signage | $2,500 |

Working Capital (first 3 months) | $20,000 |

Total Startup Costs | $111,500 |

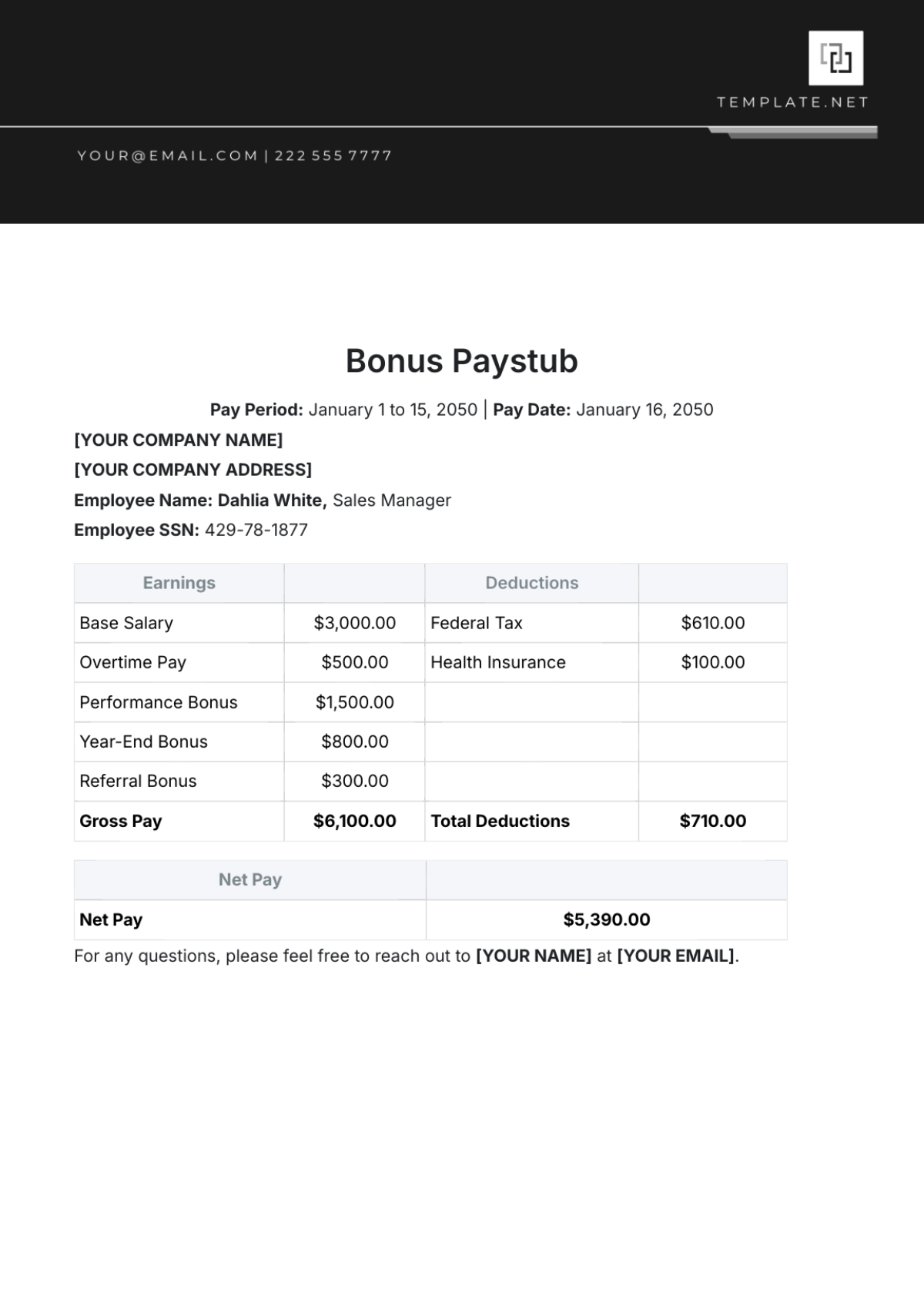

3. Revenue Projections

Metric | Estimate |

|---|---|

Average Sale per Customer | $8 |

Estimated Daily Customers | 110 customers |

Daily Revenue | 110 customers × $8 = $880 |

Monthly Revenue | $880 × 30 days = $26,400 |

Annual Revenue | $26,400 × 12 months = $316,800 |

This projection is based on sales of coffee, snacks, and lunch items, as well as projected customer volume during peak hours (morning and lunch rush) and throughout the day.

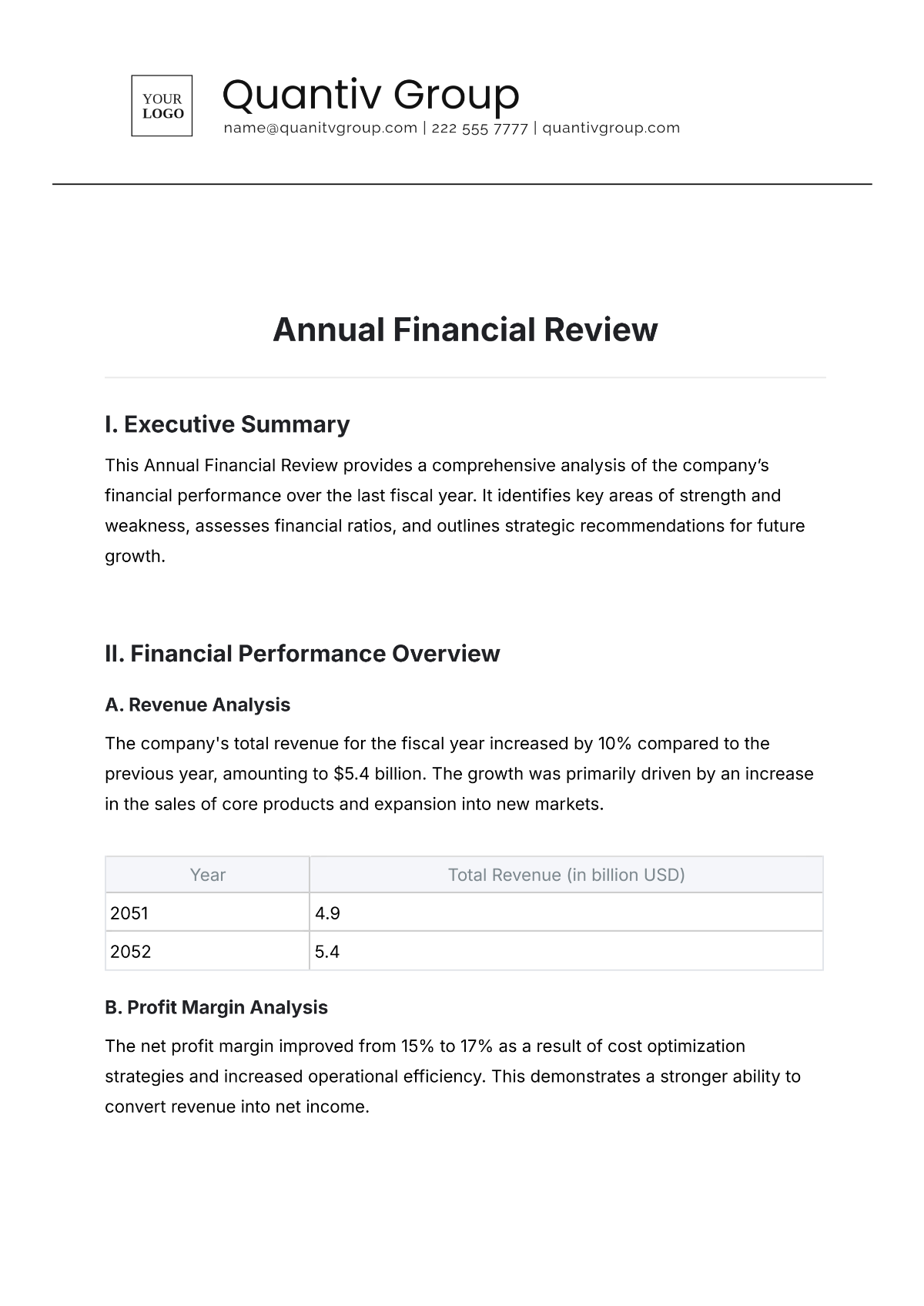

4. Operating Expenses

Item | Monthly Expense | Annual Expense |

|---|---|---|

Rent | $3,200 | $38,400 |

Utilities (electricity, water, internet) | $400 | $4,800 |

Salaries (2 baristas, 1 manager) | $7,000 | $84,000 |

Supplies & Inventory (coffee beans, food, etc.) | $1,800 | $21,600 |

Marketing (ongoing digital/social media ads) | $500 | $6,000 |

Miscellaneous (repairs, maintenance, etc.) | $300 | $3,600 |

Insurance | $200 | $2,400 |

Total Annual Operating Expenses | $160,800 |

5. Profit Analysis

Annual Revenue: $316,800

Total Annual Operating Expenses: $160,800

Annual Profit (Before Tax): $316,800 - $160,800 = $156,000

After deducting operating expenses, Urban Brew is projected to generate an annual profit of approximately $156,000 before taxes.

6. Break-Even Analysis

Break-Even Point: Total Startup Costs / (Average Sale Price - Variable Cost per Sale)

Assuming the variable costs (ingredients, packaging) are 30% of sales:

Variable Cost per Sale: $8 × 30% = $2.40

Contribution Margin per Sale: $8 - $2.40 = $5.60

Break-Even Point (in Sales): $111,500 / $5.60 ≈ 19,911 Sales

Break-Even Point (in Time): 19,911 sales / (110 customers per day) ≈ 181 days

Conclusion: Urban Brew would reach its break-even point in about 6 months of operation, assuming projected customer traffic and sales figures.

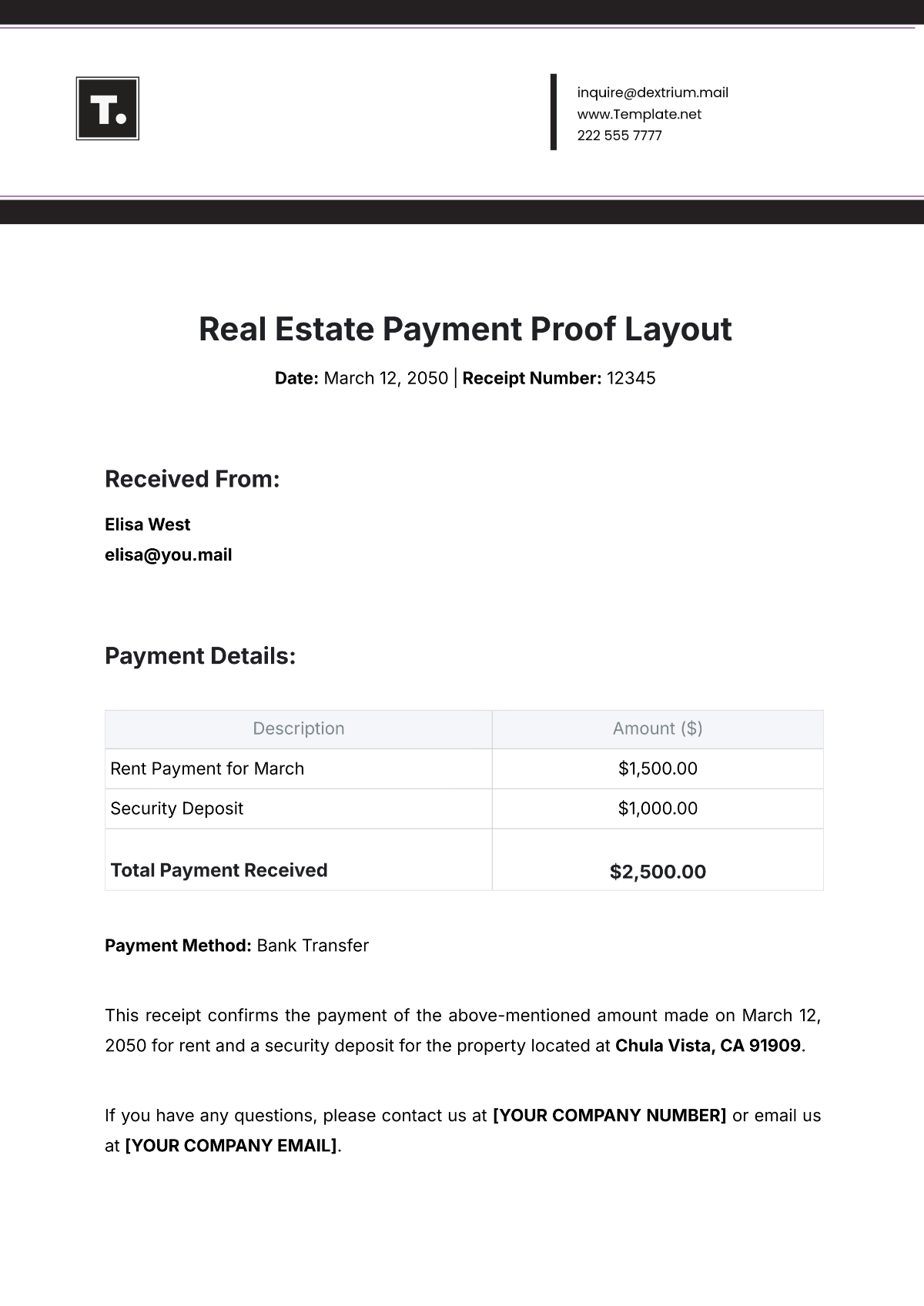

7. Funding Sources

Source | Amount |

|---|---|

Personal Savings | $30,000 |

Small Business Loan (local bank) | $70,000 |

Crowdfunding (platform-based funding) | $11,500 |

Total Funds Available | $111,500 |

Urban Brew’s startup costs will be financed through a combination of personal savings, a bank loan, and crowdfunding.

8. Conclusion

This financial feasibility study shows that Urban Brew Coffee Shop is a financially viable project. With a total startup cost of $111,500 and a projected annual profit of $156,000, the business is expected to be profitable within its first year of operations. The break-even point will occur within 6 months, and the location, combined with the target demographic, supports a strong potential for success.