Audit Analysis Report

Executive Summary

The purpose of this audit was to assess the efficiency and effectiveness of financial management processes at [Your Company Name] for the fiscal years 2060 to 2062. The audit scope covered key operational areas, including budget allocation, expense tracking, and financial reporting. Key findings revealed a discrepancy in expense reporting that led to a 15% over-expenditure in the marketing budget, and an inconsistent application of procurement policies that risked compliance issues. Recommendations include implementing a comprehensive training program for the finance team and refining expense approval workflows to mitigate future discrepancies.

Introduction

The audit was conducted on [Your Company Name], a mid-sized technology firm specializing in software solutions, with a focus on enhancing operational efficiency. The audit aimed to ensure adherence to internal policies and regulatory standards while identifying opportunities for process improvements. The rationale behind this audit stemmed from observed variances in financial reporting and a commitment to achieving operational excellence as part of the organization's strategic plan for 2060.

Audit Objectives

The primary objectives of this audit included:

Evaluating the accuracy and completeness of financial records for the years 2060 to 2062.

Assessing compliance with internal financial policies and external regulations.

Identifying areas for operational efficiency improvements in financial management processes.

Audit Scope and Methodology

The audit scope encompassed the following areas:

Financial reporting processes.

Budget management and expense tracking.

Procurement and vendor management.

The methodology employed included:

Sampling Techniques: A random sampling approach was used to select transactions for detailed examination, ensuring a representative overview of financial activities.

Data Collection Methods: Data was gathered through interviews with key personnel, review of financial documents, and analysis of automated financial systems.

Audit Findings

A. Overview

The audit revealed several key insights into [Your Company Name]'s financial management practices. Overall, while many processes function effectively, areas requiring immediate attention were identified, particularly concerning budget adherence and compliance with procurement procedures.

B. Findings

Category 1: Financial Reporting

Observation 1: Inconsistencies were noted in the reporting of quarterly financial statements, with discrepancies averaging 10% against actual figures.

Observation 2: There were delays in closing monthly financial reports, which averaged a five-day lag, impacting timely decision-making.

Category 2: Budget Management

Observation 1: The marketing department exceeded its budget by 15% over the last two fiscal years due to unapproved expenses.

Observation 2: Variances between budgeted and actual expenditures were not effectively monitored, leading to unaddressed overspending.

Data Analysis

Metric | Value | Benchmark | Analysis |

|---|---|---|---|

Expense Reporting Accuracy | 85% | 95% | The analysis indicates a significant gap in accuracy, primarily due to unverified expense claims. |

Budget Adherence Rate | 80% | 90% | The low adherence rate highlights the need for stricter monitoring and approval processes. |

Key Observations

Observation 1: The financial reporting process lacks sufficient checks and balances, leading to discrepancies in reported figures.

Observation 2: The absence of a formal expense approval system has resulted in unauthorized expenditures.

Observation 3: Training deficiencies among financial staff have contributed to errors in budget management.

Recommendations

To address the findings, the following actionable recommendations are proposed:

Implement a Training Program: Develop a comprehensive training program focused on financial reporting and budget management for all relevant personnel.

Enhance Approval Workflows: Establish a formalized expense approval process to prevent unauthorized spending and ensure compliance with budgetary constraints.

Regular Monitoring and Reporting: Introduce monthly reviews of budget adherence and financial reporting accuracy, with senior management oversight.

Conclusion

The audit highlighted critical areas of improvement in [Your Company Name]'s financial management processes. By addressing the identified discrepancies and implementing the recommended changes, the organization can enhance its operational efficiency and ensure compliance with internal and external financial standards.

Appendices

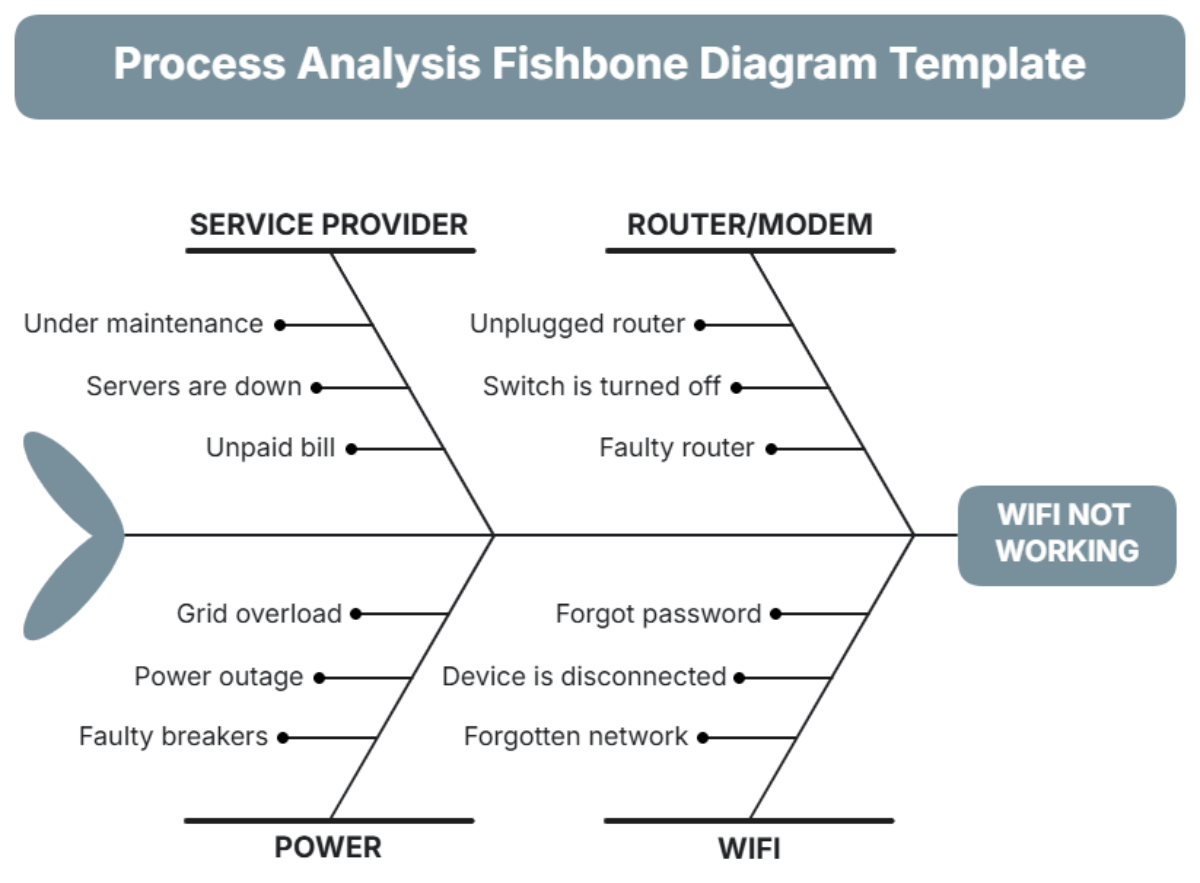

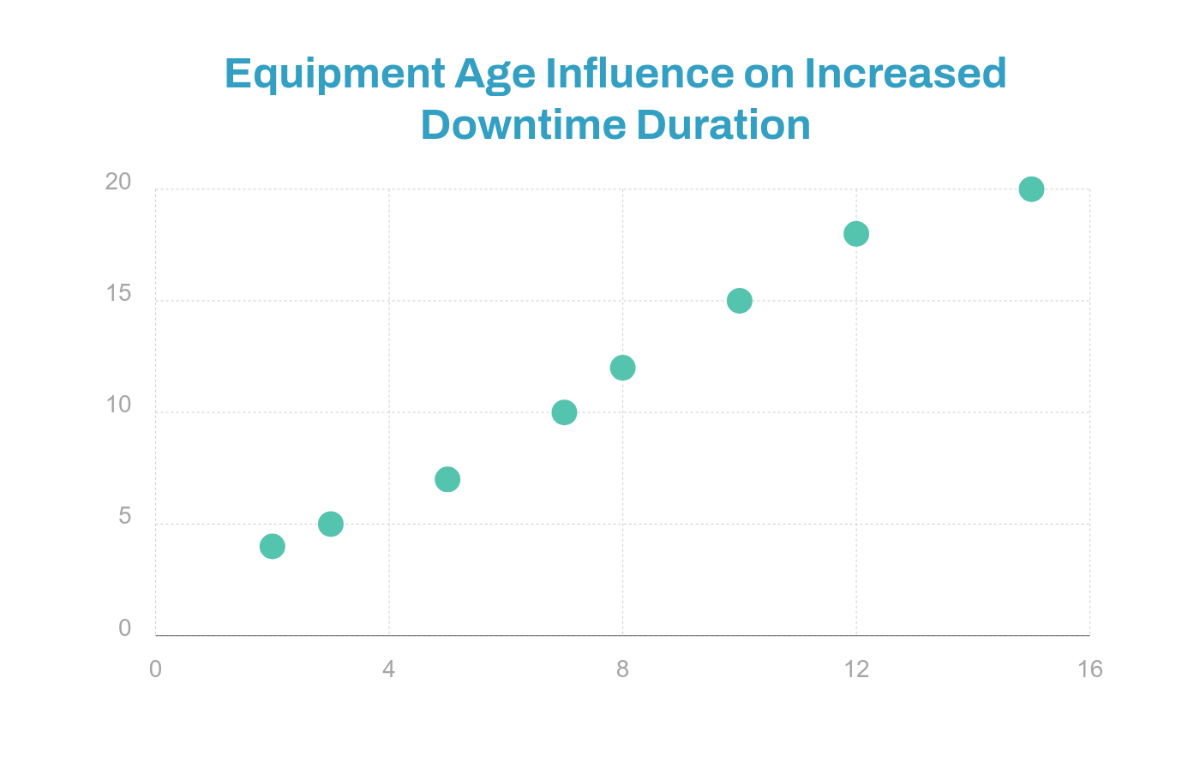

Appendix A: Detailed charts and graphs illustrating budget variances and expense tracking.

Appendix B: Sample financial statements reviewed during the audit.

Appendix C: List of personnel interviewed and their respective roles.