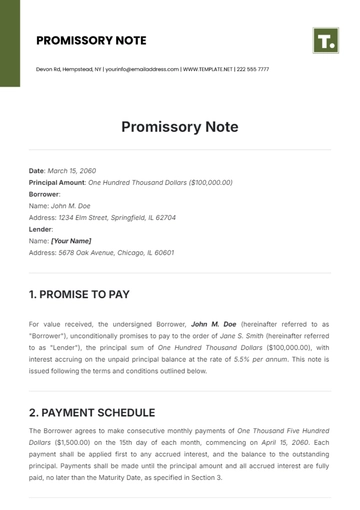

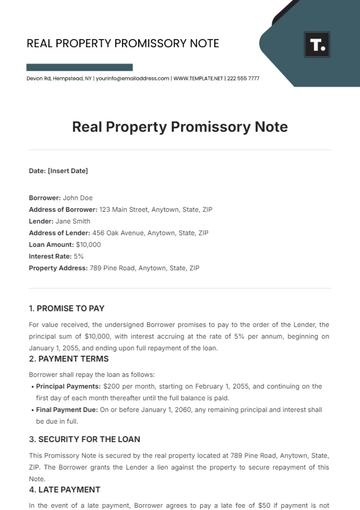

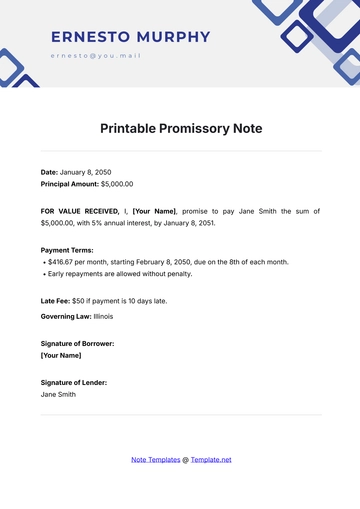

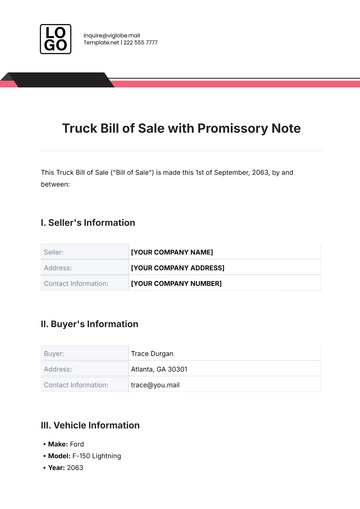

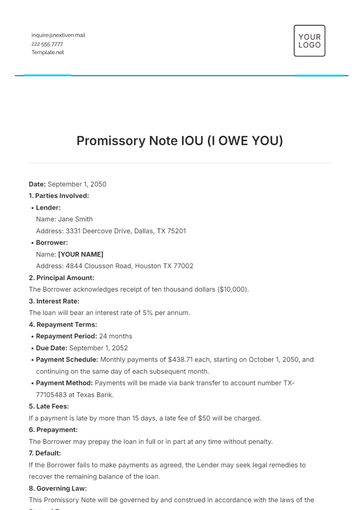

Promissory Note

Date: March 15, 2060

Principal Amount: One Hundred Thousand Dollars ($100,000.00)

Borrower:

Name: John M. Doe

Address: 1234 Elm Street, Springfield, IL 62704

Lender:

Name: [Your Name]

Address: 5678 Oak Avenue, Chicago, IL 60601

1. PROMISE TO PAY

For value received, the undersigned Borrower, John M. Doe (hereinafter referred to as "Borrower"), unconditionally promises to pay to the order of Jane S. Smith (hereinafter referred to as "Lender"), the principal sum of One Hundred Thousand Dollars ($100,000.00), with interest accruing on the unpaid principal balance at the rate of 5.5% per annum. This note is issued following the terms and conditions outlined below.

2. PAYMENT SCHEDULE

The Borrower agrees to make consecutive monthly payments of One Thousand Five Hundred Dollars ($1,500.00) on the 15th day of each month, commencing on April 15, 2060. Each payment shall be applied first to any accrued interest, and the balance to the outstanding principal. Payments shall be made until the principal amount and all accrued interest are fully paid, no later than the Maturity Date, as specified in Section 3.

3. MATURITY DATE

The entire unpaid principal balance, together with any accrued interest, shall be due and payable in full on March 15, 2065 (the "Maturity Date"), unless earlier repayment is made following the prepayment provisions outlined below.

4. INTEREST CALCULATION

Interest shall accrue on the outstanding principal from the date of this Note at an annual rate of 5.5%. Interest shall be calculated on a simple interest basis, based on a 365-day year, and will be applied monthly, on the 15th day of each month.

5. LATE PAYMENT AND PENALTIES

Should any payment due under this Note remain unpaid for more than ten (10) days past its due date, the Borrower agrees to pay a late fee of $50.00 per missed payment. Failure to make payments when due, or within the grace period, may result in the Lender declaring the entire unpaid principal and accrued interest immediately due and payable.

6. PREPAYMENT OPTION

The Borrower may, at any time and without penalty, prepay this Note in whole or in part. Any prepayment shall first be applied to any outstanding interest, and the remainder shall reduce the principal balance. Prepayment does not exempt the Borrower from future scheduled payments unless the full balance has been paid.

7. EVENTS OF DEFAULT

The occurrence of any of the following events shall constitute an "Event of Default" under this Note:

Failure to make any payment when due or within the grace period.

The Borrower’s bankruptcy or insolvency.

Any breach of the terms of this Note or any accompanying agreement.

In the event of a default, the Lender reserves the right to declare the entire principal and any accrued interest immediately due and payable. Additionally, the Borrower shall be responsible for all reasonable costs and expenses, including attorney’s fees, incurred by the Lender in the collection of this Note.

8. SECURITY INTEREST

This Promissory Note is unsecured (or "secured by [specific collateral]", if applicable). The Borrower grants no security interest in any real or personal property unless specifically outlined in a separate agreement.

9. GOVERNING LAW AND JURISDICTION

This Promissory Note shall be governed by, and construed under, the laws of the State of Illinois, without regard to conflict of law principles. The Borrower and Lender agree that any disputes arising out of or in connection with this Note shall be subject to the exclusive jurisdiction of the state and federal courts located in Illinois.

10. SEVERABILITY CLAUSE

If any provision of this Note is found to be invalid or unenforceable by any court of competent jurisdiction, such invalidity or unenforceability shall not affect the remaining provisions, which shall remain in full force and effect.

11. ENTIRE AGREEMENT

This Promissory Note represents the complete and final agreement between the Borrower and Lender concerning the terms outlined herein. Any modifications or amendments to this Note must be made in writing and signed by both the Borrower and Lender.

12. WAIVER OF PRESENTMENT

The Borrower waives the right to require the Lender to demand payment on the due date or to notify the Borrower of non-payment. The Lender is not required to exercise any rights or take any action against the Borrower before taking steps to enforce the terms of this Note.

IN WITNESS WHEREOF, the undersigned Borrower has duly executed this Promissory Note as of the date first written above.

BORROWER:

John M. Doe

John M. Doe

Date: March 15, 2060

LENDER:

[Your Name]

[Your Name]

Date: March 15, 2060

Note Templates @ Template.Net

John M. Doe

John M. Doe