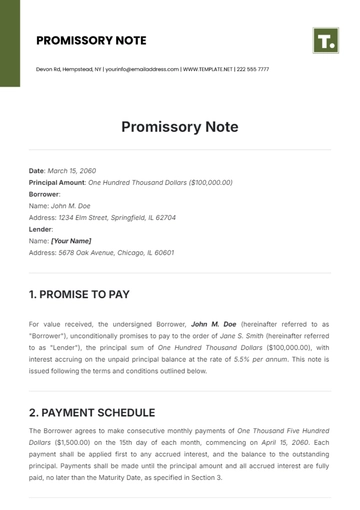

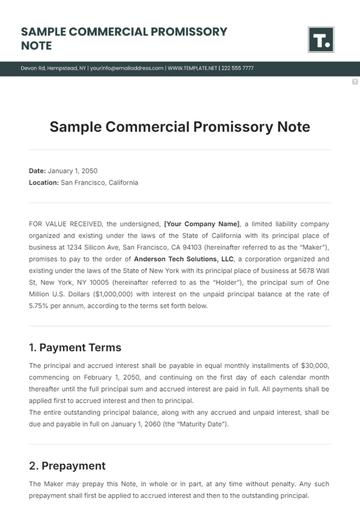

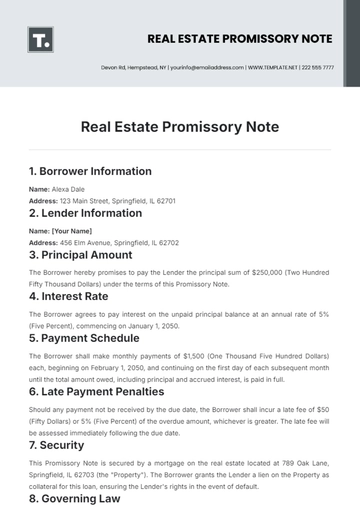

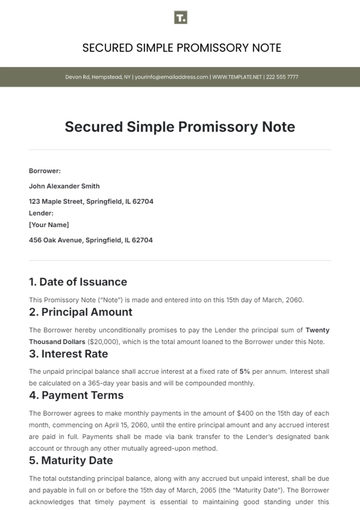

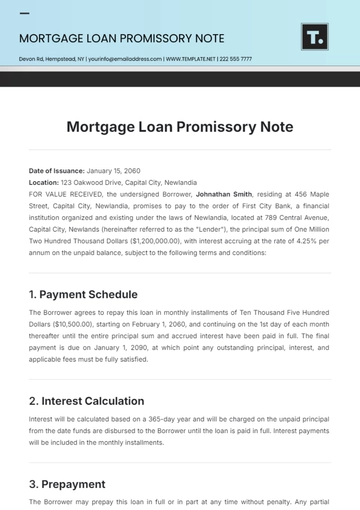

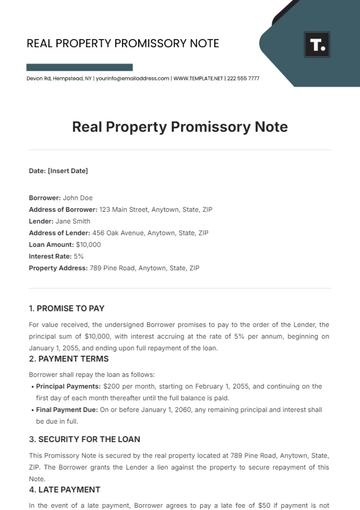

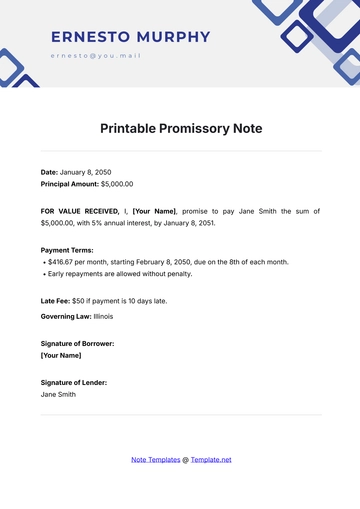

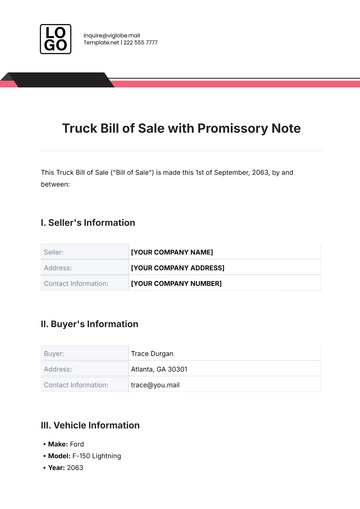

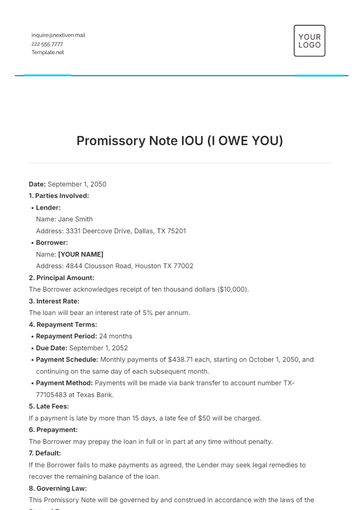

Free Mortgage Loan Promissory Note

Date of Issuance: January 15, 2060

Location: 123 Oakwood Drive, Capital City, Newlandia

FOR VALUE RECEIVED, the undersigned Borrower, Johnathan Smith, residing at 456 Maple Street, Capital City, Newlandia, promises to pay to the order of First City Bank, a financial institution organized and existing under the laws of Newlandia, located at 789 Central Avenue, Capital City, Newlands (hereinafter referred to as the "Lender"), the principal sum of One Million Two Hundred Thousand Dollars ($1,200,000.00), with interest accruing at the rate of 4.25% per annum on the unpaid balance, subject to the following terms and conditions:

1. Payment Schedule

The Borrower agrees to repay this loan in monthly installments of Ten Thousand Five Hundred Dollars ($10,500.00), starting on February 1, 2060, and continuing on the 1st day of each month thereafter until the entire principal sum and accrued interest have been paid in full. The final payment is due on January 1, 2090, at which point any outstanding principal, interest, and applicable fees must be fully satisfied.

2. Interest Calculation

Interest will be calculated based on a 365-day year and will be charged on the unpaid principal from the date funds are disbursed to the Borrower until the loan is paid in full. Interest payments will be included in the monthly installments.

3. Prepayment

The Borrower may prepay this loan in full or in part at any time without penalty. Any partial prepayments will be applied to the outstanding principal, thereby reducing the amount of interest due on subsequent payments.

4. Late Payment Penalty

If any monthly payment is not received by the Lender within ten (10) days of the due date, the Borrower will incur a late fee of $250.00. Late payments will first be applied to accrued interest, fees, and then to the outstanding principal.

5. Security for Loan

This Promissory Note is secured by a mortgage on the property located at 123 Oakwood Drive, Capital City, Newlandia, which serves as collateral for the loan. The Borrower agrees that if any default occurs, the Lender may enforce its rights under the mortgage agreement, including but not limited to foreclosure proceedings.

6. Default and Acceleration

If the Borrower defaults on any payment or violates any covenant contained within this Promissory Note or the associated mortgage agreement, the entire unpaid principal and accrued interest shall become immediately due and payable at the Lender’s option. Events of default include but are not limited to, failure to make a payment on time, bankruptcy, or the sale of the secured property without the Lender’s written consent.

7. Governing Law

This Promissory Note shall be governed by and construed following the laws of the State of Newlandia. Any legal proceedings arising from this Promissory Note shall be filed in the appropriate court within Capital City, Newlandia.

8. Severability

If any provision of this Promissory Note is found to be unenforceable or invalid, the remaining provisions will continue in full force and effect.

9. Notices

Any notices required under this Promissory Note shall be sent via certified mail to the respective parties at the following addresses:

Borrower:

Johnathan Smith

Johnathan Smith

456 Maple Street

Capital City, Newlandia

Lender:

[Your Company Name]

[Your Company Name]

[Your Company Address]

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Simplify mortgage transactions with the Mortgage Loan Promissory Note Template from Template.net. This editable and customizable template provides a solid framework for your loan agreement. Tailor it to your specifications easily, and make it uniquely yours with our Ai Editor Tool.