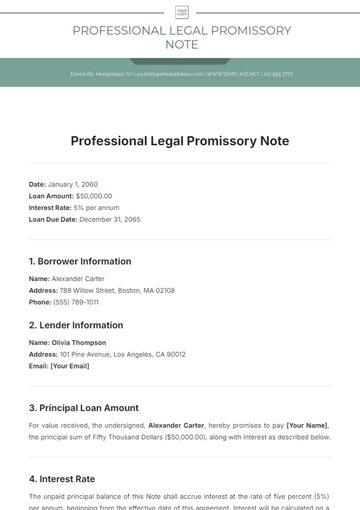

Free Promissory Note for Debt Repayment

Effective Date: July 1, 2060

Principal Amount: Fifty Thousand Dollars ($50,000)

Location of Execution: 123 Financial Avenue, Suite 200, Pleasantville, CA 90210

Borrower:

Name: John Alexander

Address: 456 Main Street, Apartment 9B, Pleasantville, CA 90210

Contact Number: (555) 123-4567

Lender:

Name: [Your Name]

Address: 789 Corporate Lane, Suite 400, Metropolis, CA 90211

Email: [Your Email]

1. Principal and Interest

1.1 Principal Amount: The principal balance of Fifty Thousand Dollars ($50,000) shall accrue interest at the fixed annual rate of 5.00%, starting on July 1, 2060 (the "Effective Date"). Interest shall accrue and be calculated based on a 365-day year and be payable along with each installment payment.

1.2 Interest Accrual: Interest shall continue to accrue until the full repayment of the principal amount. In case of any delay or default in payment, interest will continue to accrue on the outstanding principal at the same rate.

2. Repayment Terms

2.1 Installment Payments: The Borrower shall repay the total principal sum and interest through monthly installments of One Thousand Dollars ($1,000), commencing on August 1, 2060, and continuing on the first day of each subsequent month. Each payment will be applied first toward any accrued interest, with the remaining balance applied toward the principal.

2.2 Final Payment: The outstanding balance, including any accrued interest, shall be due and payable in full no later than July 1, 2070 (the "Maturity Date"). The Borrower agrees that any remaining unpaid balance on the Maturity Date shall be payable in full, along with all outstanding interest.

2.3 Method of Payment: All payments shall be made via direct bank transfer to an account designated by the Lender, or through an alternate method as agreed upon in writing by both parties. Payments must be received no later than 5:00 PM (PST) on the due date.

3. Prepayment

3.1 Right to Prepay: The Borrower may prepay the principal amount of this Note, in whole or in part, at any time without incurring any prepayment penalties. Any such prepayments shall first be applied toward accrued interest, with the remainder applied to the outstanding principal balance.

3.2 Notice of Prepayment: The Borrower must provide 15 days written notice before making any lump-sum prepayment exceeding 10% of the outstanding principal balance.

4. Late Payments and Penalties

4.1 Grace Period: The Borrower shall be granted a grace period of 15 calendar days after the due date for each installment payment.

4.2 Late Payment Penalty: If any payment is not made within the grace period, the Borrower agrees to pay a late fee of 5% of the overdue installment amount. This late fee shall be added to the outstanding balance.

4.3 Additional Default Interest: In the event of default, the Borrower shall incur interest on the overdue amount at the rate of 8.00% per annum from the date of default until full payment is made.

5. Events of Default

The occurrence of any of the following shall constitute a default under this Note:

5.1 Non-Payment: Failure to make any scheduled payment when due, following the expiration of the grace period.

5.2 Bankruptcy or Insolvency: The Borrower becomes insolvent or files for bankruptcy, or any other proceedings are initiated under any insolvency or bankruptcy laws.

5.3 Breach of Terms: Any breach or failure to comply with the terms and conditions of this Note.

Upon default, the Lender shall have the right to declare the entire unpaid balance of principal and all accrued interest immediately due and payable, without notice or demand.

6. Waivers

6.1 Waiver of Rights: The Borrower waives presentment for payment, demand, protest, notice of protest, and notice of dishonor, and further waives any defenses arising from an extension of time or modification of terms.

6.2 Lender's Rights: No failure or delay on the part of the Lender in exercising any right or remedy shall operate as a waiver thereof.

7. Amendments

This Note may only be amended, modified, or supplemented by a written agreement signed by both the Borrower and the Lender.

8. Severability

If any provision of this Note is found to be invalid or unenforceable by a court of competent jurisdiction, the remaining provisions shall continue in full force and effect and shall be interpreted to best accomplish the original intent of the parties.

9. Governing Law

This Promissory Note and the rights and obligations of the parties hereunder shall be governed by and construed following the laws of the State of California, without regard to its conflict of law provisions.

10. Dispute Resolution

In the event of any dispute arising out of or related to this Note, the parties agree to submit the matter to binding arbitration following the rules of the American Arbitration Association. The arbitration shall take place in Pleasantville, California, and the award rendered by the arbitrator(s) may be entered in any court of competent jurisdiction.

IN WITNESS WHEREOF, the undersigned Borrower has executed this Promissory Note as of the 1st day of July 2060.

Borrower:

Name: John Alexander

Name: John Alexander

Date: July 1, 2060

Lender:

Name: [Your Name]

Name: [Your Name]

Date: July 1, 2060

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Manage debt repayment effortlessly with the Promissory Note for Debt Repayment Template from Template.net. This editable and customizable document provides a clear structure for repayment terms. Modify it to fit your situation using our Ai Editor Tool, ensuring transparency and mutual understanding.