Free Annual Credit Report

I. Introduction

The annual credit report from [Your Company Name] offers a detailed overview of an individual's credit history. It serves as an essential tool for evaluating financial health and understanding the factors that influence credit scores. This report will explore the various components of a credit report, the importance of monitoring credit information, and how it affects financial opportunities.

II. Components of a Credit Report

A. Personal Information

This section contains personal identification details that help verify the individual's identity. It is crucial to ensure that the information here is accurate to prevent identity theft or fraud.

Name

Date of Birth

Social Security Number

Addresses

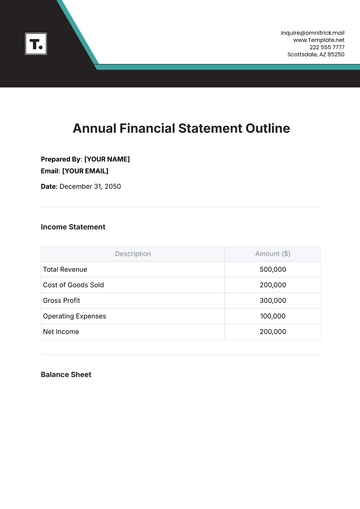

B. Credit Accounts

A detailed list of credit accounts provides insight into the individual's borrowing and repayment behavior. This section includes information about all open and closed accounts.

Account Type | Credit Limit | Balance | Status |

|---|---|---|---|

Credit Card | $5,000 | $1,200 | Open |

Auto Loan | $15,000 | $8,000 | Open |

Mortgage | $200,000 | $180,000 | Open |

C. Credit Inquiries

This part records the number of inquiries made by lenders reviewing the credit report while considering credit applications. Too many inquiries can negatively impact the credit score.

Hard Inquiries

Soft Inquiries

D. Public Records

This includes financial issues from legal proceedings, such as bankruptcies, tax liens, or civil judgments. These records significantly impact a credit score and report.

III. Importance of Monitoring Credit Report

A. Detecting Fraud

Regular monitoring of credit reports enables individuals to detect unauthorized activities and protect against identity theft.

B. Improving Credit Score

Insight into negative factors affecting the credit score can help individuals develop strategies for improvement.

Factor | Impact on Score |

|---|---|

Payment History | High |

Credit Utilization | Moderate |

Length of Credit History | Low |

IV. Conclusion

Annual credit reports from [Your Company Name] are essential for maintaining financial well-being. By understanding and regularly reviewing credit report components, individuals can protect their financial future and optimize their credit scores to access better financial opportunities.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

You may also like

- Sales Report

- Daily Report

- Project Report

- Business Report

- Weekly Report

- Incident Report

- Annual Report

- Report Layout

- Report Design

- Progress Report

- Marketing Report

- Company Report

- Monthly Report

- Audit Report

- Status Report

- School Report

- Reports Hr

- Management Report

- Project Status Report

- Handover Report

- Health And Safety Report

- Restaurant Report

- Construction Report

- Research Report

- Evaluation Report

- Investigation Report

- Employee Report

- Advertising Report

- Weekly Status Report

- Project Management Report

- Finance Report

- Service Report

- Technical Report

- Meeting Report

- Quarterly Report

- Inspection Report

- Medical Report

- Test Report

- Summary Report

- Inventory Report

- Valuation Report

- Operations Report

- Payroll Report

- Training Report

- Job Report

- Case Report

- Performance Report

- Board Report

- Internal Audit Report

- Student Report

- Monthly Management Report

- Small Business Report

- Accident Report

- Call Center Report

- Activity Report

- IT and Software Report

- Internship Report

- Visit Report

- Product Report

- Book Report

- Property Report

- Recruitment Report

- University Report

- Event Report

- SEO Report

- Conference Report

- Narrative Report

- Nursing Home Report

- Preschool Report

- Call Report

- Customer Report

- Employee Incident Report

- Accomplishment Report

- Social Media Report

- Work From Home Report

- Security Report

- Damage Report

- Quality Report

- Internal Report

- Nurse Report

- Real Estate Report

- Hotel Report

- Equipment Report

- Credit Report

- Field Report

- Non Profit Report

- Maintenance Report

- News Report

- Survey Report

- Executive Report

- Law Firm Report

- Advertising Agency Report

- Interior Design Report

- Travel Agency Report

- Stock Report

- Salon Report

- Bug Report

- Workplace Report

- Action Report

- Investor Report

- Cleaning Services Report

- Consulting Report

- Freelancer Report

- Site Visit Report

- Trip Report

- Classroom Observation Report

- Vehicle Report

- Final Report

- Software Report