Free Finance KRA

Prepared by: [YOUR NAME]

Email: [YOUR EMAIL]

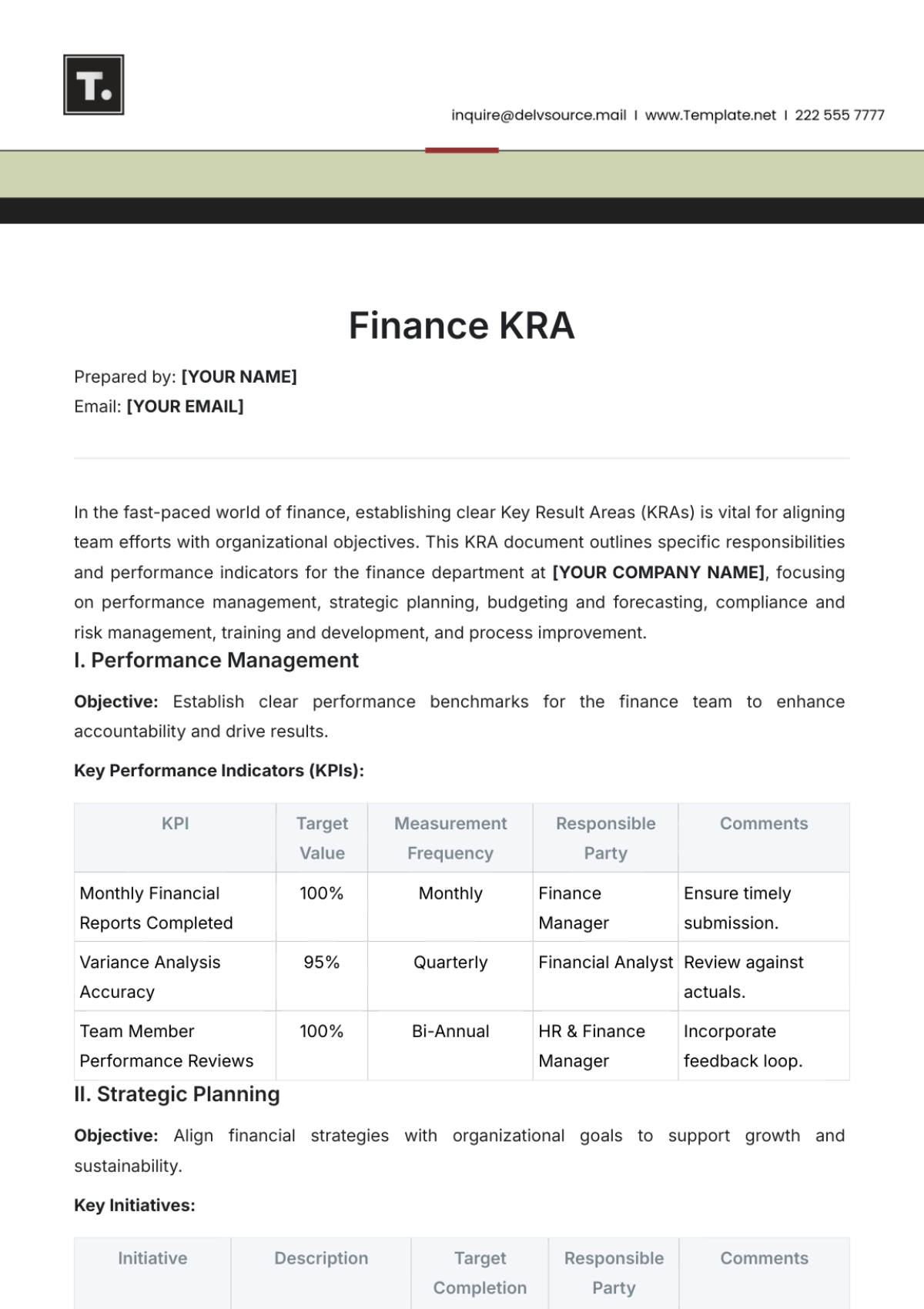

In the fast-paced world of finance, establishing clear Key Result Areas (KRAs) is vital for aligning team efforts with organizational objectives. This KRA document outlines specific responsibilities and performance indicators for the finance department at [YOUR COMPANY NAME], focusing on performance management, strategic planning, budgeting and forecasting, compliance and risk management, training and development, and process improvement.

I. Performance Management

Objective: Establish clear performance benchmarks for the finance team to enhance accountability and drive results.

Key Performance Indicators (KPIs):

KPI | Target Value | Measurement Frequency | Responsible Party | Comments |

|---|---|---|---|---|

Monthly Financial Reports Completed | 100% | Monthly | Finance Manager | Ensure timely submission. |

Variance Analysis Accuracy | 95% | Quarterly | Financial Analyst | Review against actuals. |

Team Member Performance Reviews | 100% | Bi-Annual | HR & Finance Manager | Incorporate feedback loop. |

II. Strategic Planning

Objective: Align financial strategies with organizational goals to support growth and sustainability.

Key Initiatives:

Initiative | Description | Target Completion Date | Responsible Party | Comments |

|---|---|---|---|---|

Annual Strategic Review Meeting | Evaluate financial strategies and align with business goals | March 15, 2050 | CFO | Engage all department heads. |

Long-term Financial Forecasting | Develop 5-year financial projections to support strategic initiatives | April 30, 2050 | Finance Team | Focus on market trends. |

III. Budgeting and Forecasting

Objective: Implement accurate budgeting processes to ensure effective resource allocation.

Budgeting Cycle:

Activity | Responsible Party | Start Date | End Date | Comments |

|---|---|---|---|---|

Budget Preparation | Finance Manager | January 5, 2050 | January 20, 2050 | Gather departmental inputs. |

Budget Review Meetings | CFO & Department Heads | January 21, 2050 | January 30, 2050 | Finalize adjustments. |

IV. Compliance and Risk Management

Objective: Ensure adherence to financial regulations and mitigate risks effectively.

Compliance Checklist:

Compliance Area | Responsible Party | Review Frequency | Comments | Next Review Date |

|---|---|---|---|---|

Financial Reporting Standards | Compliance Officer | Annually | Ensure alignment with GAAP/IFRS | December 1, 2050 |

Internal Controls Assessment | Internal Auditor | Semi-Annually | Test effectiveness of controls | June 15, 2050 |

V. Training and Development

Objective: Enhance the skills and knowledge of the finance team to improve performance.

Training Program:

Training Topic | Training Provider | Duration | Target Participants | Next Session Date |

|---|---|---|---|---|

Advanced Financial Analysis | External Consultant | 3 Days | Finance Analysts | February 10, 2050 |

Regulatory Compliance Update | In-House | 1 Day | All Finance Staff | May 25, 2050 |

VI. Process Improvement

Objective: Identify and implement enhancements to financial processes for greater efficiency.

Improvement Initiatives:

Initiative | Description | Target Completion Date | Responsible Party | Comments |

|---|---|---|---|---|

Automation of Reporting | Implement tools for automated reporting | June 30, 2050 | IT & Finance Team | Reduce manual entry errors. |

Expense Management System Upgrade | Revise expense management processes | September 15, 2050 | Finance Manager | Streamline approval process. |

This Finance KRA document serves as a roadmap for the finance department at [YOUR COMPANY NAME] to achieve operational excellence and strategic alignment. By focusing on these key areas, the organization will not only meet regulatory requirements but also position itself for sustainable growth and profitability in the future.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Maximize efficiency with the Finance KRA Template from Template.net. This customizable and editable solution simplifies tracking key performance indicators for finance teams. Designed for versatility, it integrates seamlessly with various workflows. Utilize the built-in AI Editor Tool for quick adjustments, ensuring your team meets financial goals with precision. Transform your finance management today.