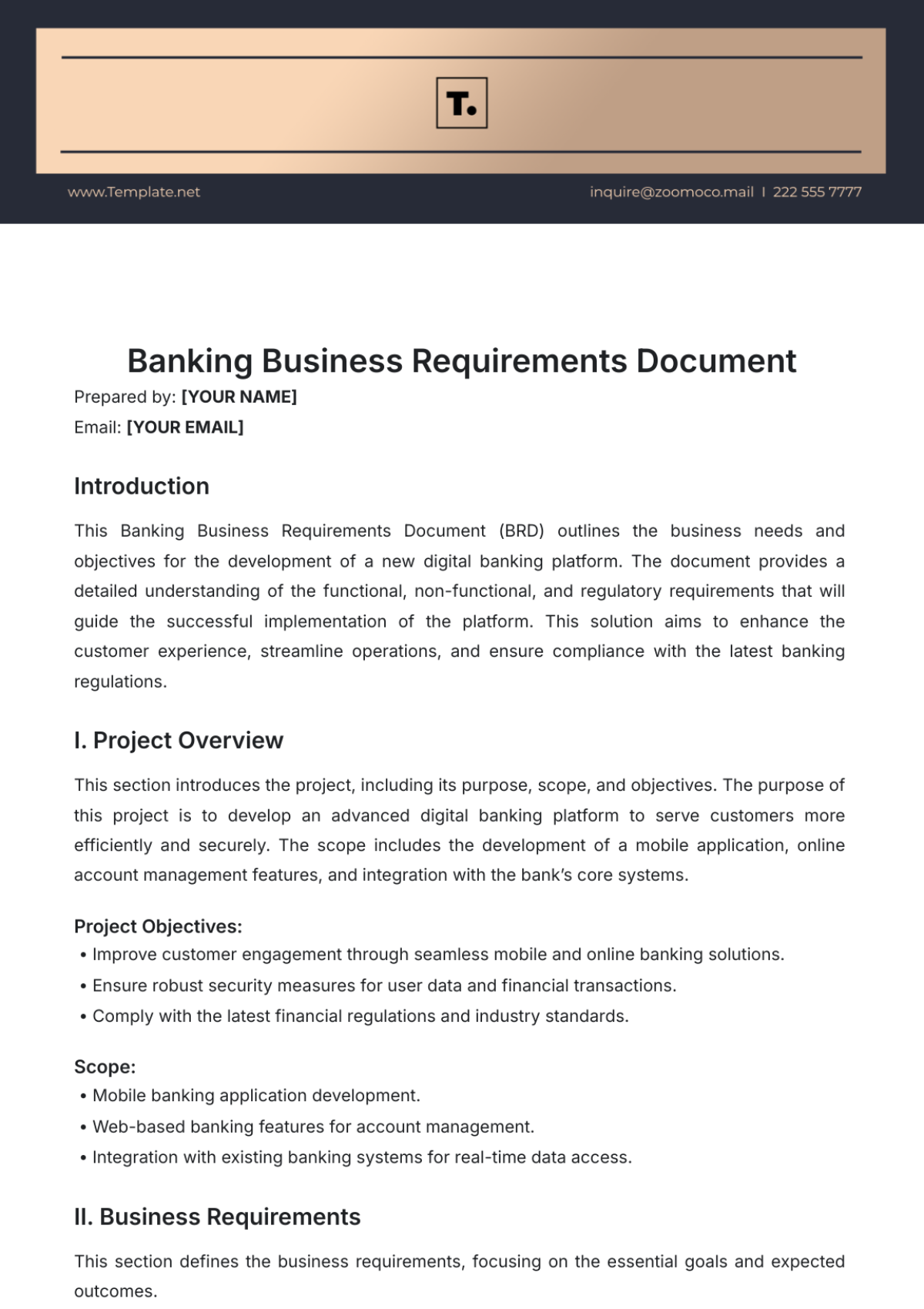

Free Banking Business Requirements Document

Prepared by: [YOUR NAME]

Email: [YOUR EMAIL]

Introduction

This Banking Business Requirements Document (BRD) outlines the business needs and objectives for the development of a new digital banking platform. The document provides a detailed understanding of the functional, non-functional, and regulatory requirements that will guide the successful implementation of the platform. This solution aims to enhance the customer experience, streamline operations, and ensure compliance with the latest banking regulations.

I. Project Overview

This section introduces the project, including its purpose, scope, and objectives. The purpose of this project is to develop an advanced digital banking platform to serve customers more efficiently and securely. The scope includes the development of a mobile application, online account management features, and integration with the bank’s core systems.

Project Objectives:

Improve customer engagement through seamless mobile and online banking solutions.

Ensure robust security measures for user data and financial transactions.

Comply with the latest financial regulations and industry standards.

Scope:

Mobile banking application development.

Web-based banking features for account management.

Integration with existing banking systems for real-time data access.

II. Business Requirements

This section defines the business requirements, focusing on the essential goals and expected outcomes.

Key Business Requirements:

Customer Registration: The platform must allow customers to easily register and verify their identity using multi-factor authentication.

Account Management: Customers should be able to view balances, transfer funds, and apply for services such as loans and credit cards.

Transaction Security: Implement end-to-end encryption and real-time fraud detection to secure user data and financial transactions.

Business Goals:

Improve user experience through intuitive UI/UX design.

Ensure the platform's scalability to handle millions of active users.

III. Functional Requirements

Functional requirements specify the features and capabilities the system must deliver. These should directly support business objectives and enhance operational efficiency.

Functional Features:

Login/Authentication:

Multi-factor authentication (e.g., biometrics and one-time password).

Secure login via mobile devices and web browsers.

Fund Transfers:

Instant domestic and international transfers.

Option to schedule recurring payments.

Customer Support:

Chatbot for 24/7 support.

Option for live customer service via chat or voice call.

User Interface (UI) Requirements:

Mobile App: Must support Android and iOS devices.

Web Platform: Compatible with all major browsers.

IV. Non-Functional Requirements

Non-functional requirements outline the system’s performance characteristics, such as scalability, security, and usability.

Performance Requirements:

Scalability: The platform should handle up to 5 million users concurrently without degradation in performance.

Availability: 99.99% uptime required, with maintenance windows scheduled for weekends.

Security: Data encryption at rest and in transit. Compliance with GDPR and PCI DSS standards.

Usability Requirements:

Easy-to-navigate user interface for both novice and experienced users.

Support for multiple languages and currencies to serve a global customer base.

V. Compliance and Regulatory Requirements

This section focuses on the legal and regulatory requirements that the platform must adhere to. Compliance with relevant financial regulations is critical.

Compliance Requirements:

General Data Protection Regulation (GDPR): Ensure that customer data is stored and processed in accordance with GDPR requirements.

Anti-Money Laundering (AML) Compliance: The platform must have features for transaction monitoring and suspicious activity reporting.

Payment Card Industry Data Security Standard (PCI DSS): Adhere to all PCI DSS security protocols for card payments.

Regulatory Reporting:

Automated reporting tools to track compliance and generate audit trails as per Financial Conduct Authority (FCA) guidelines.

VI. Timeline and Milestones

This section provides a detailed project timeline, including key milestones and delivery dates.

Project Timeline:

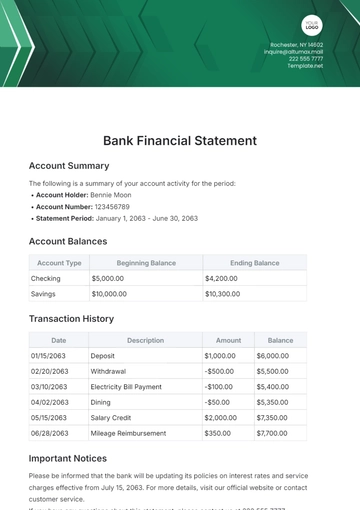

Milestone | Expected Completion Date |

|---|---|

Requirement Gathering Completed | March 15, 2050 |

Design Phase Completed | May 30, 2050 |

Development and Integration | August 20, 2050 |

Testing and Quality Assurance | October 5, 2050 |

Go Live / Launch | December 1, 2050 |

VII. Stakeholders

The following stakeholders are crucial to the success of this project. They will provide necessary inputs and approve deliverables.

Stakeholder | Role | Contact Information |

|---|---|---|

Edgar Spencer | Project Sponsor | edgar@you.mail |

Garfield Williams | Regulatory Compliance | garfield@you.mail |

Jeremy Marvin | Technical Lead | jeremy@you.mail |

Ernesto Murphy | Quality Assurance Manager | ernesto@you.mail |

Ena Cassin | Customer Support Lead | ena@you.mail |

VIII. Conclusion

This Banking Business Requirements Document outlines the necessary steps, specifications, and regulations to build a robust digital banking platform that meets customer needs while ensuring compliance and operational efficiency. By adhering to the guidelines outlined in this document, the project will deliver a secure, scalable, and user-friendly banking solution that will enhance the bank's competitive edge in the digital space.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

The Banking Business Requirements Document Template from Template.net offers a fully customizable and editable solution to help you outline and organize your banking project needs efficiently. With its user-friendly AI Editor Tool, you can quickly adjust the document to match your specific requirements. This template ensures accuracy and professionalism for your banking business documentation.