Community Center Expense Report

I. Executive Summary

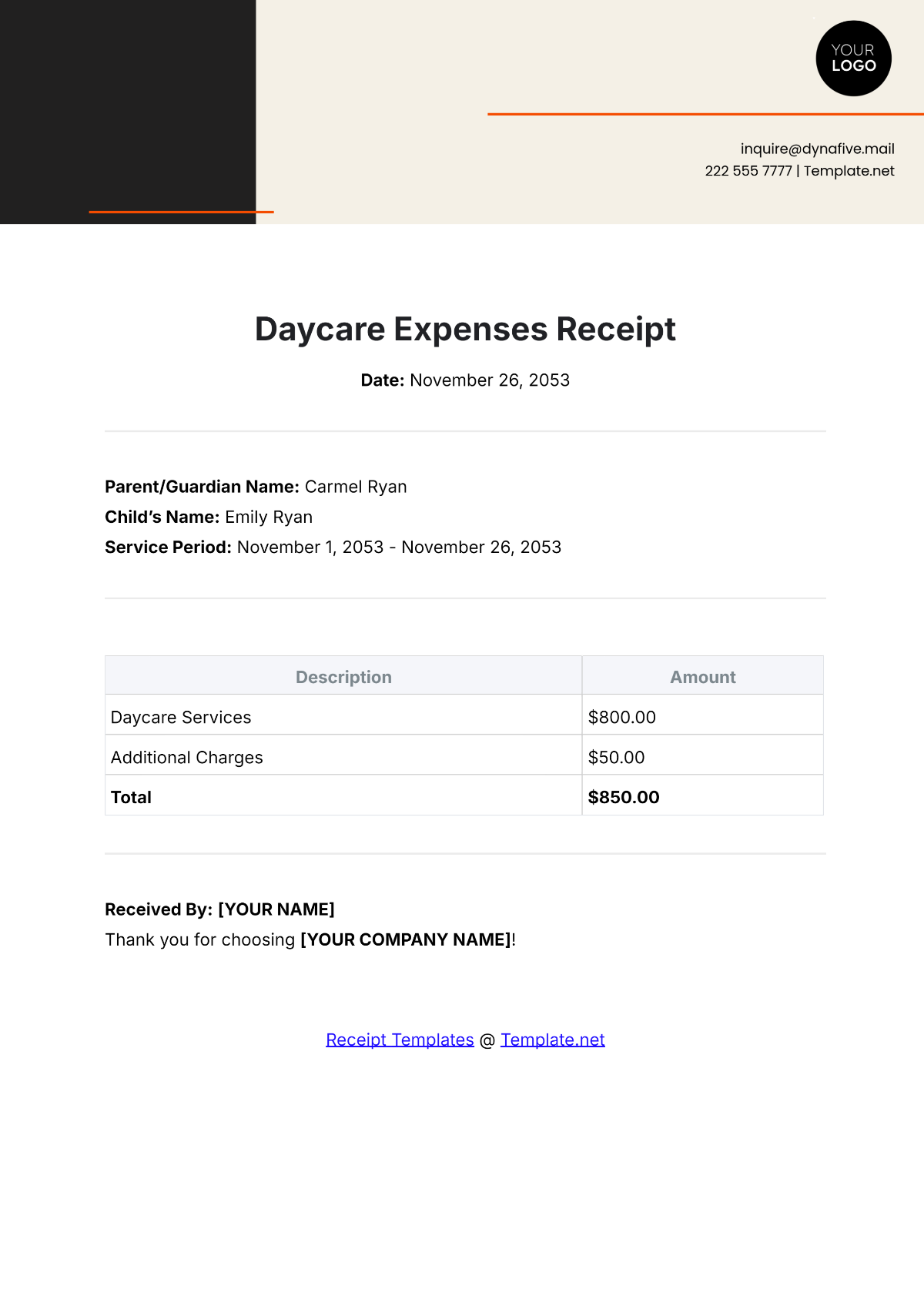

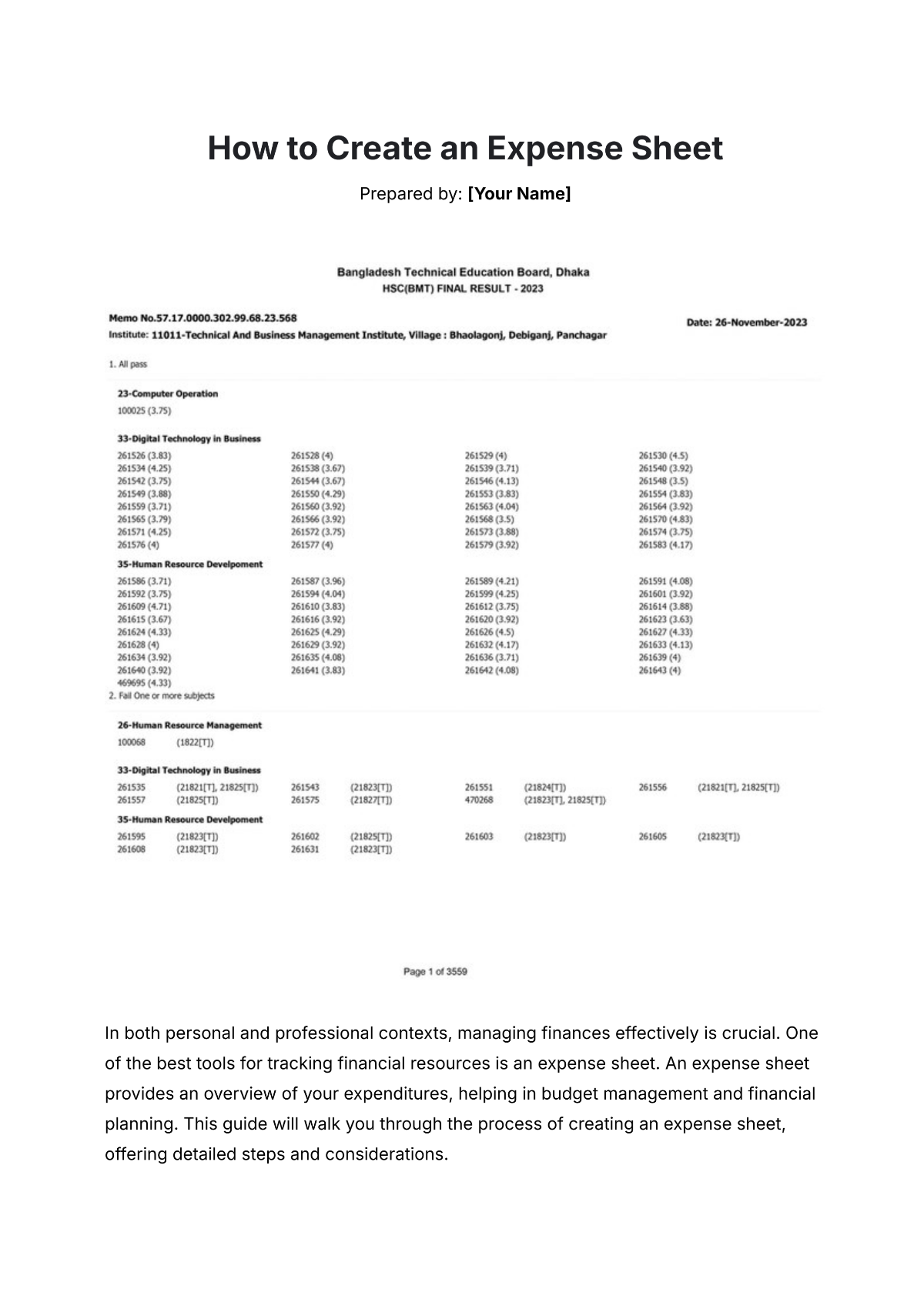

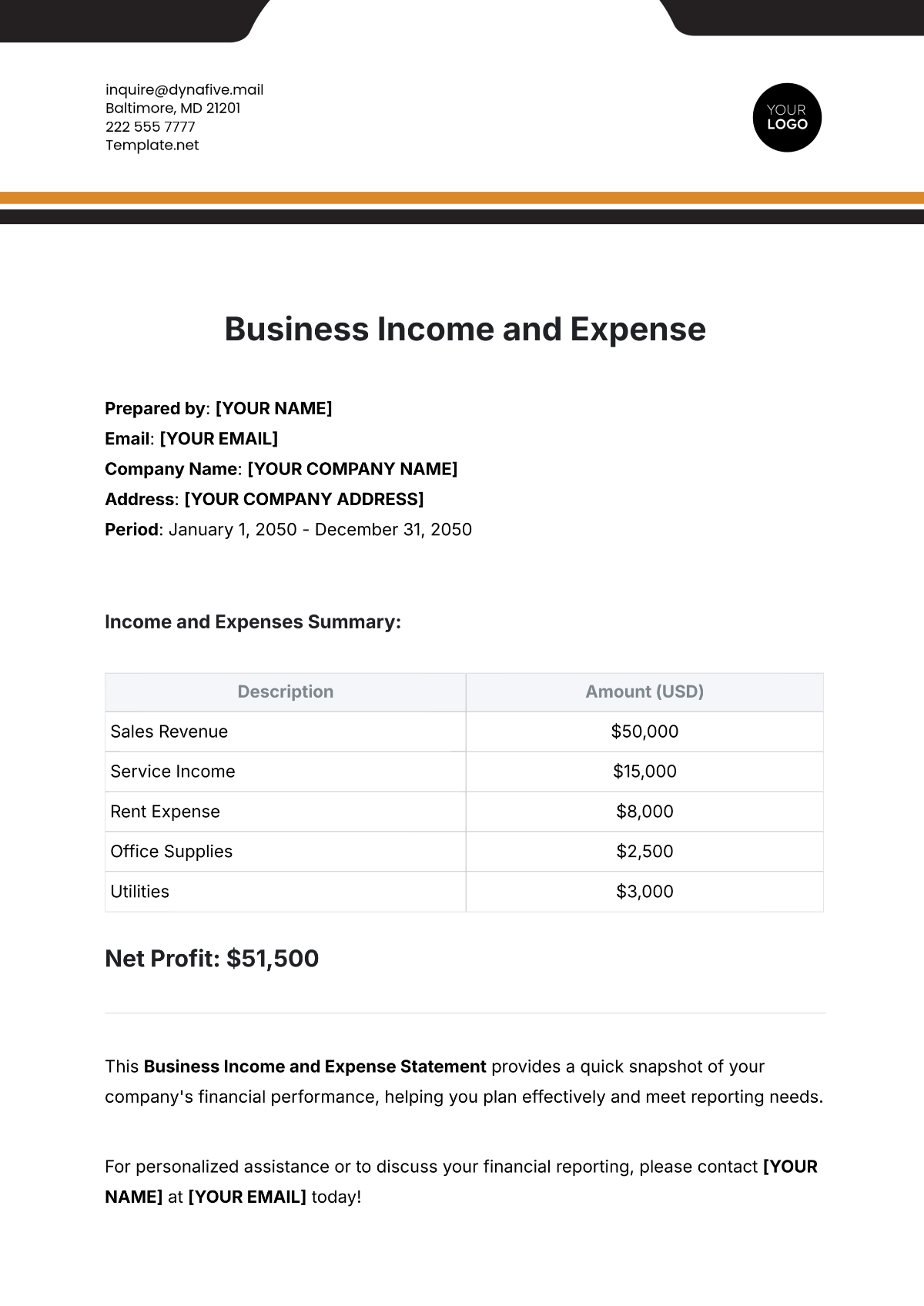

A. Overview of Expenses for the Reporting Period

This expense report highlights the Community Center's financial activities for Q1 of 2024. During this period, the center focused on maintaining its programs while addressing unexpected facility maintenance issues. Overall, expenses have been closely aligned with operational needs, but certain categories have slightly exceeded the planned budget.

B. Total Expenses Incurred

The total expenses for the quarter amounted to $[00]. This figure includes regular operational costs, program-related expenses, and capital investments for necessary improvements. Despite the rise in maintenance and unexpected program costs, the community center’s spending was manageable within the overall budget framework.

C. Variance from Budget

There was a [00]% overage in total expenses compared to the budgeted amounts. The main drivers of this overage were higher-than-anticipated program supply costs and urgent facility repairs. These areas need to be more closely monitored in future quarters to ensure better alignment with the set budget.

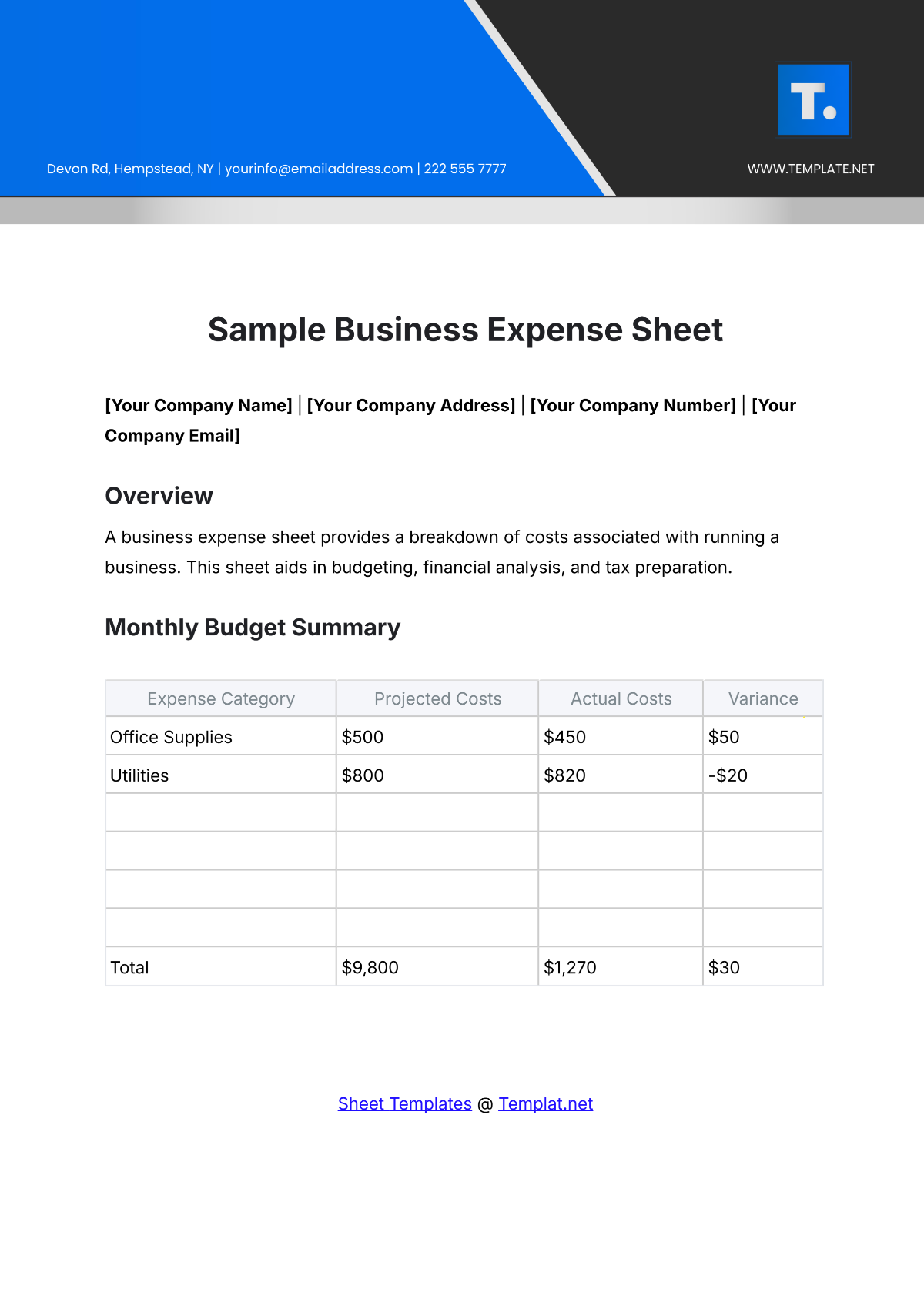

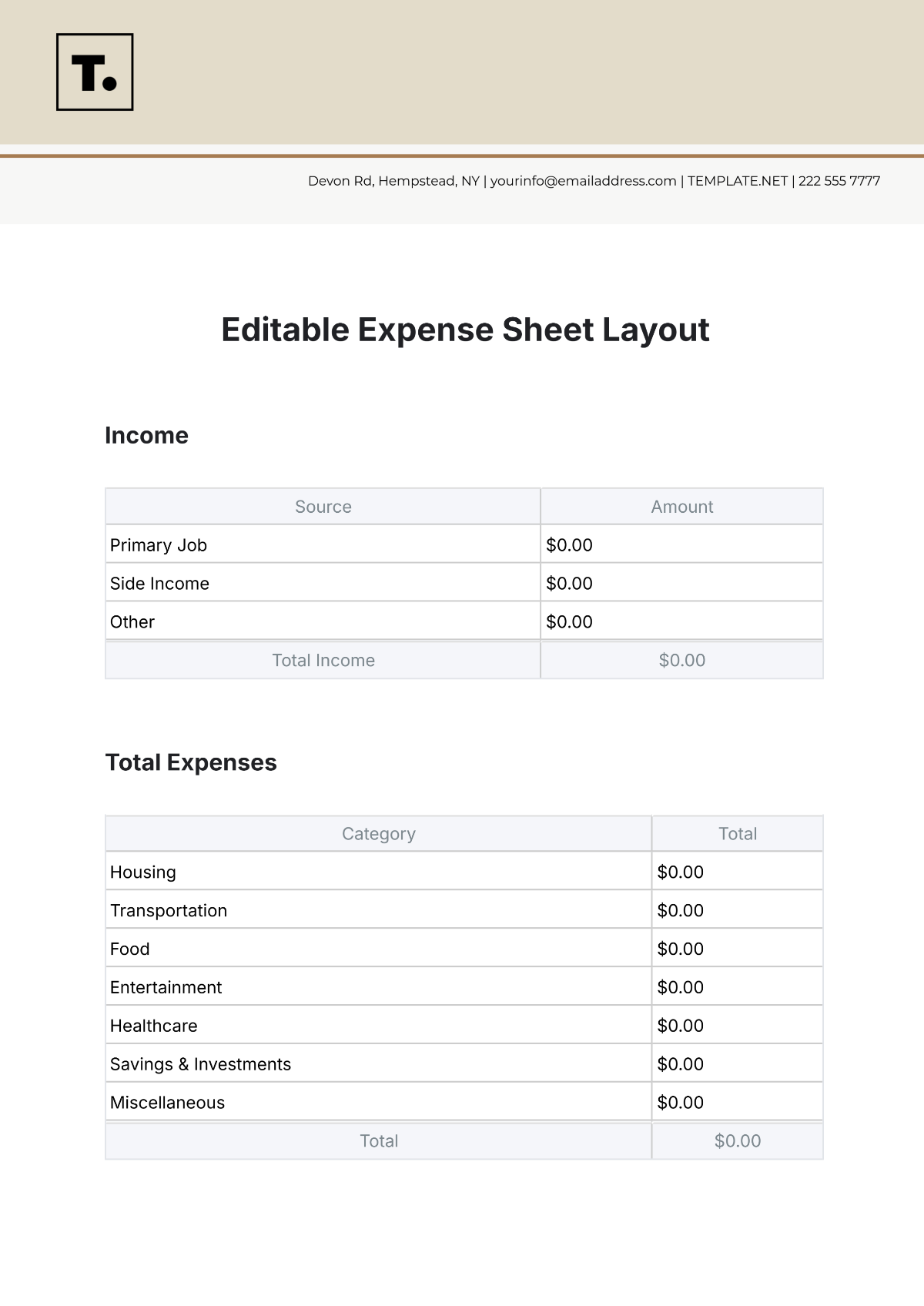

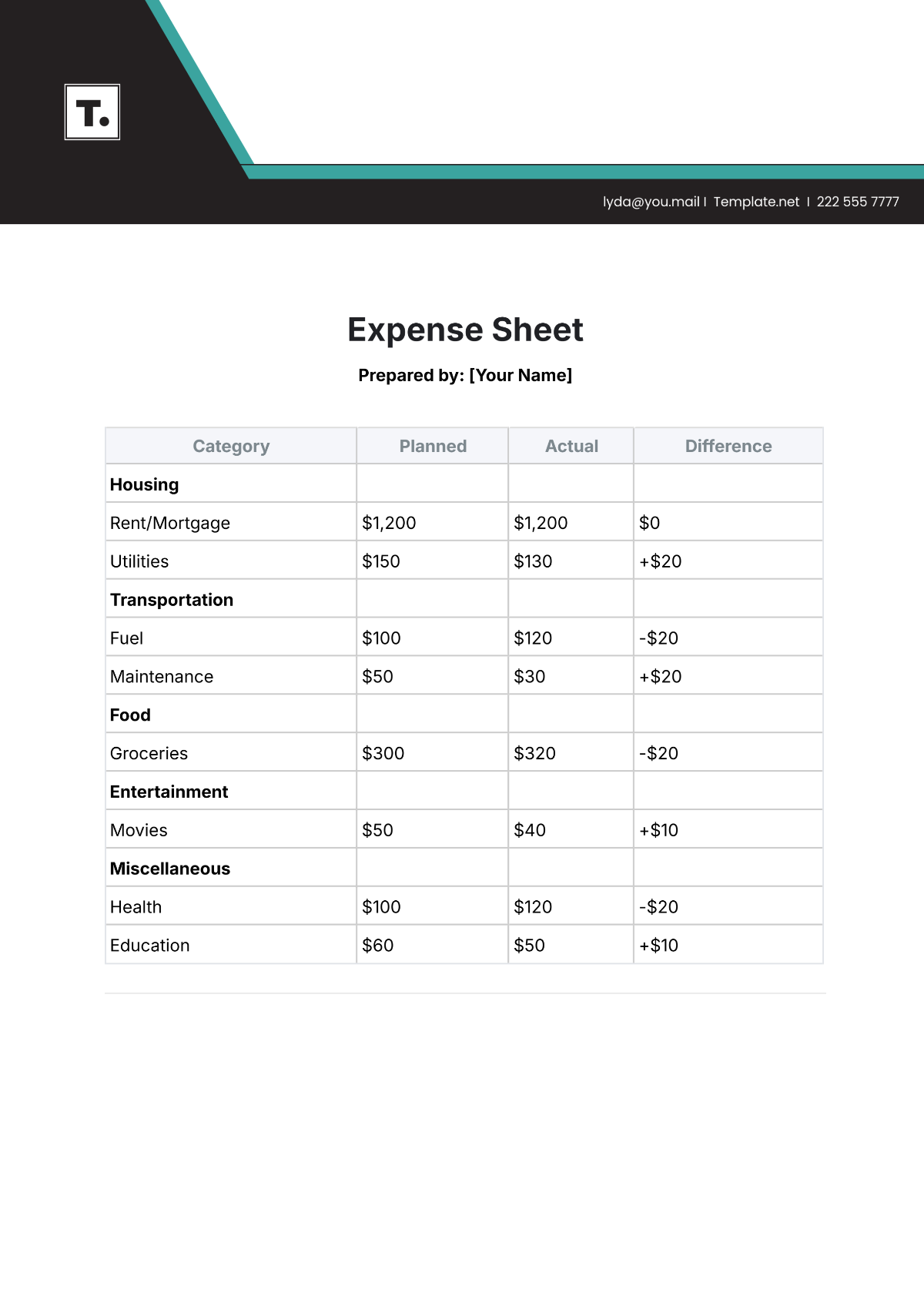

D. Summary of Key Expense Categories

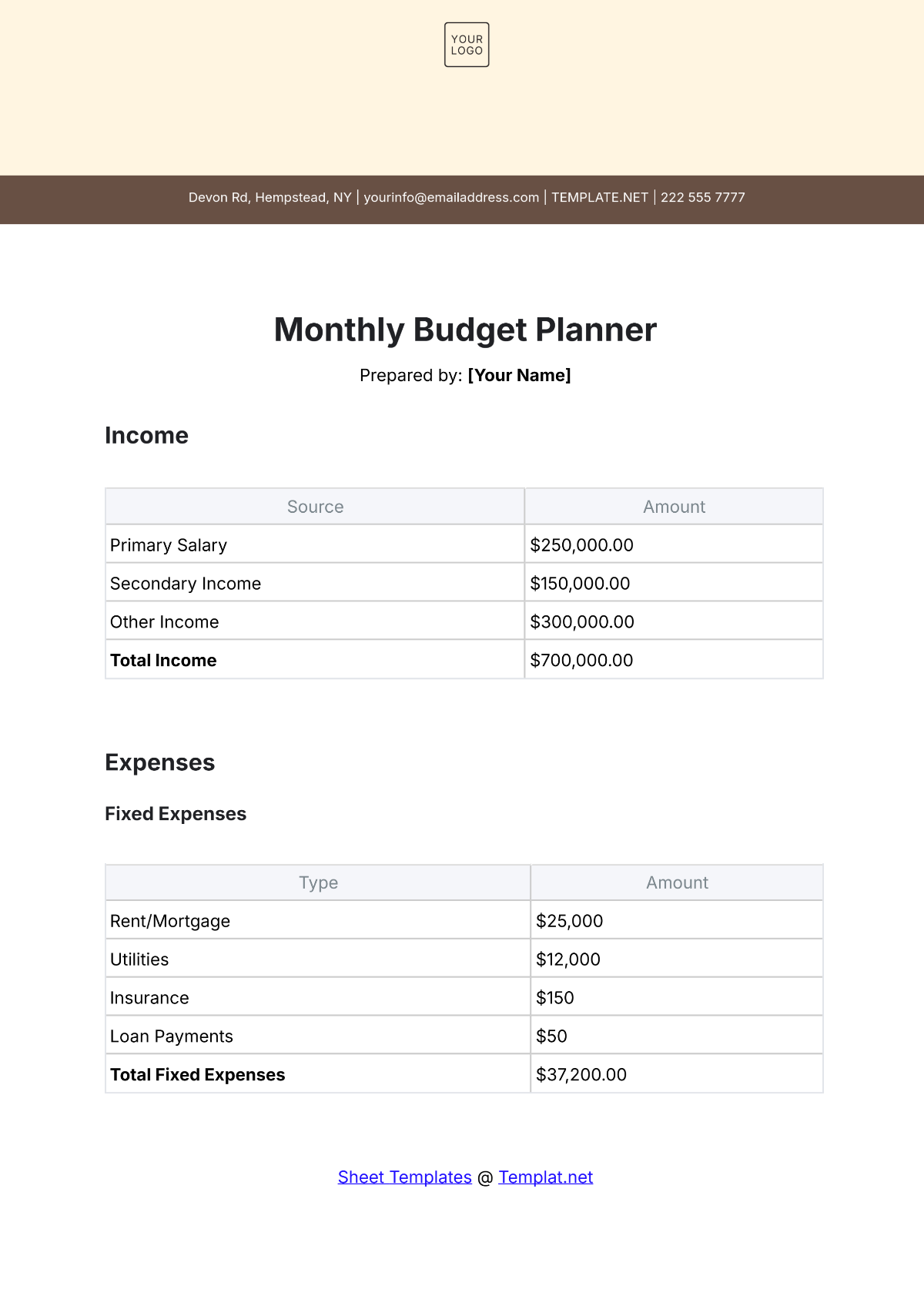

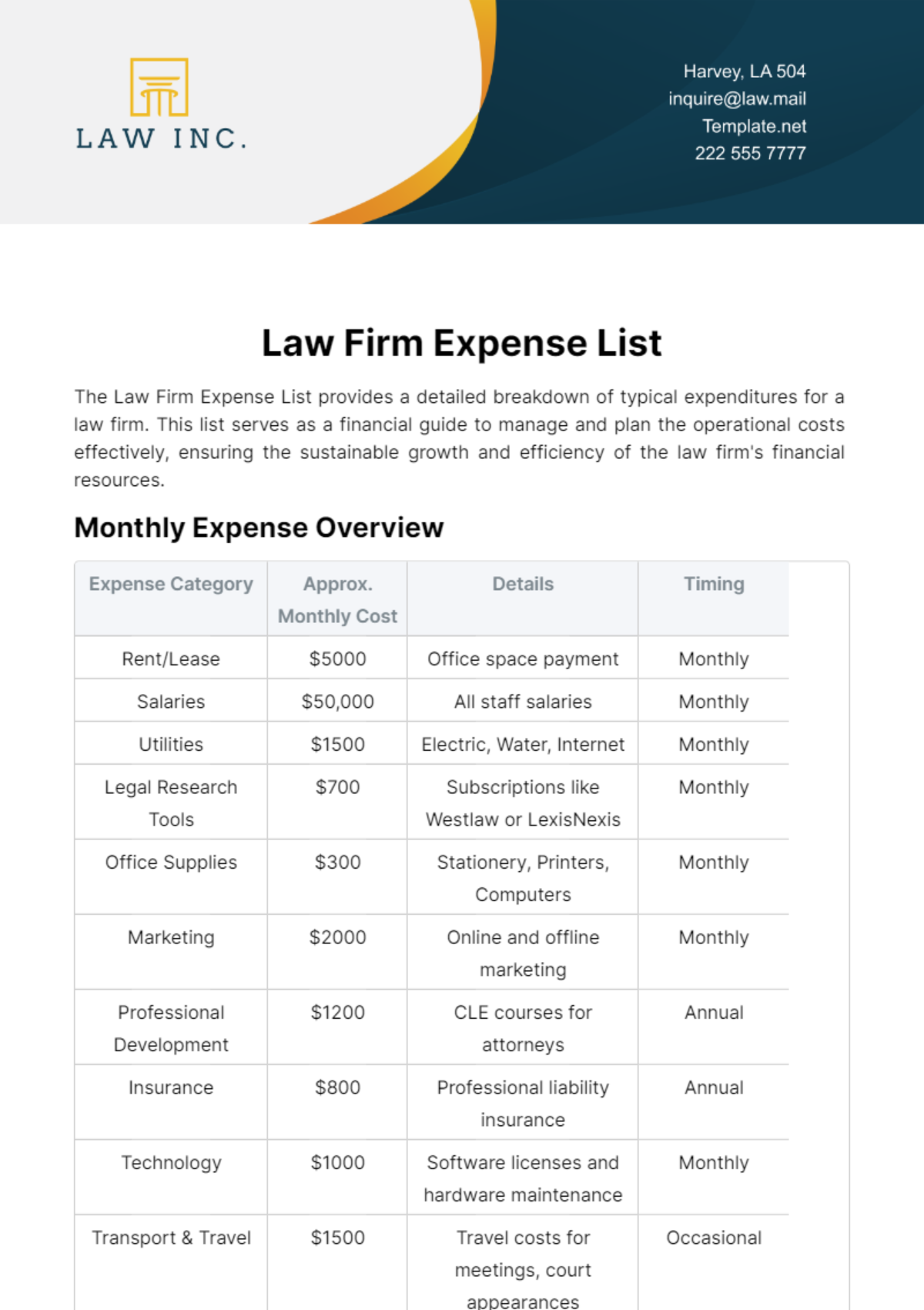

The major categories contributing to the expenses were personnel costs, program supplies, and utilities. Below is a breakdown of the top five categories:

Expense Category | Budgeted Amount | Actual Amount | Variance |

|---|---|---|---|

Personnel Costs | $28,000 | $30,000 | +$2,000 |

Operational Expenses | |||

Program Expenses | |||

Capital Expenditures | |||

Miscellaneous Expenses |

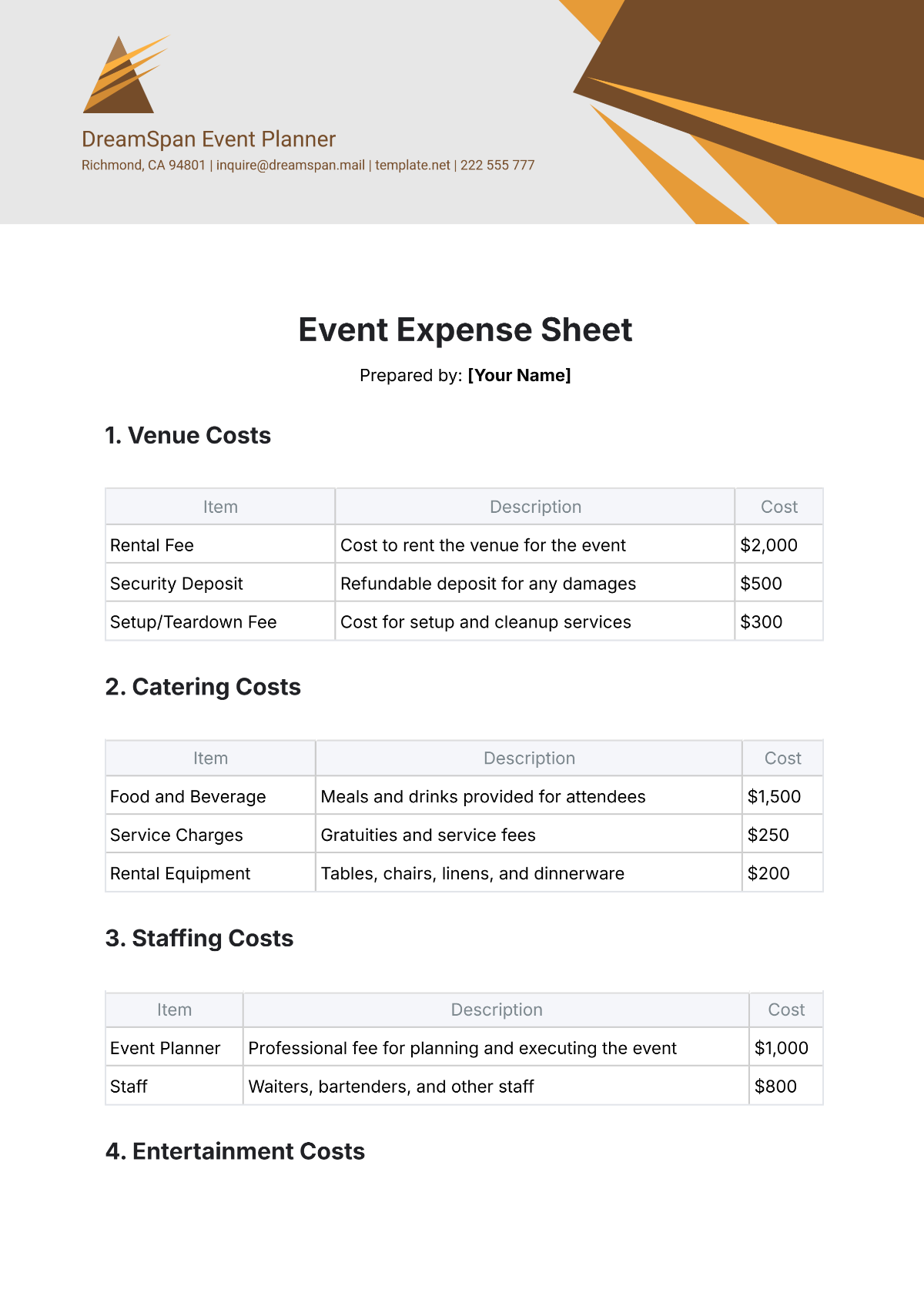

II. Expense Categories

A. Personnel Costs

Personnel costs continue to be the highest category of expense, reflecting the importance of maintaining an experienced workforce. Staff salaries increased slightly due to contractual wage increases and additional overtime hours during community events. Benefits costs have remained steady, although some employees elected higher-cost health insurance plans.

B. Operational Expenses

Rent for the facility remained stable, and utility costs spiked unexpectedly due to harsh winter conditions, raising heating expenses. Regular office supplies like paper and ink were purchased as needed, without significant fluctuations in cost. Maintenance and repair expenses were higher than expected due to the need for immediate plumbing and HVAC repairs.

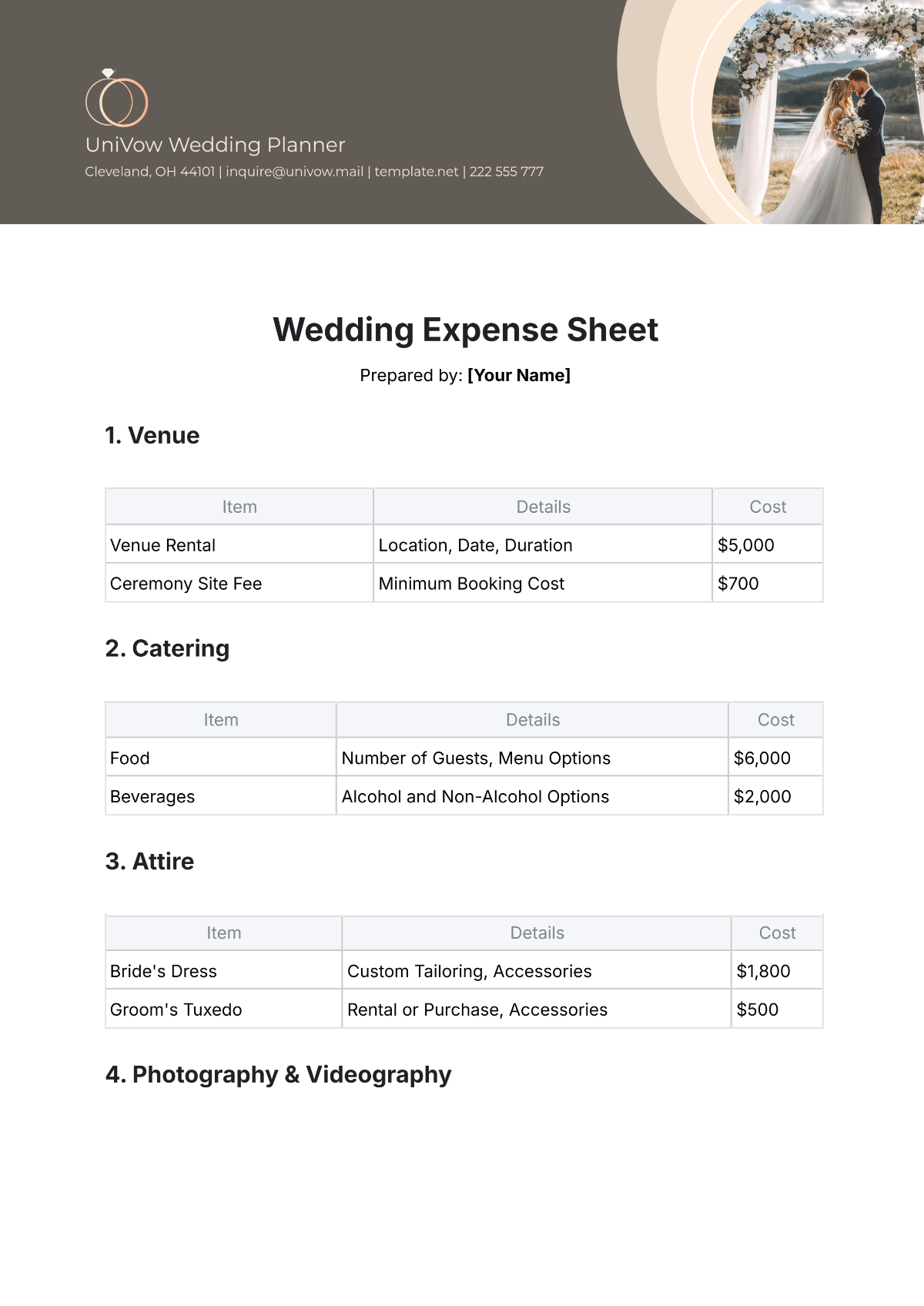

C. Program Expenses

Costs for event supplies, including promotional materials and guest speakers, were essential to the center’s community engagement. The unexpected growth in youth programs required additional supplies, including sports equipment and educational materials. Advertising expenses saw a slight increase as the center invested more in digital marketing to boost program awareness.

D. Capital Expenditures

The community center invested in several essential equipment purchases, including new computers for administrative tasks and upgraded AV equipment for events. Facility improvements were minimal but included parking lot repairs and some landscaping enhancements. The capital expenditure exceeded the planned budget slightly, but these upgrades were necessary for ongoing operations.

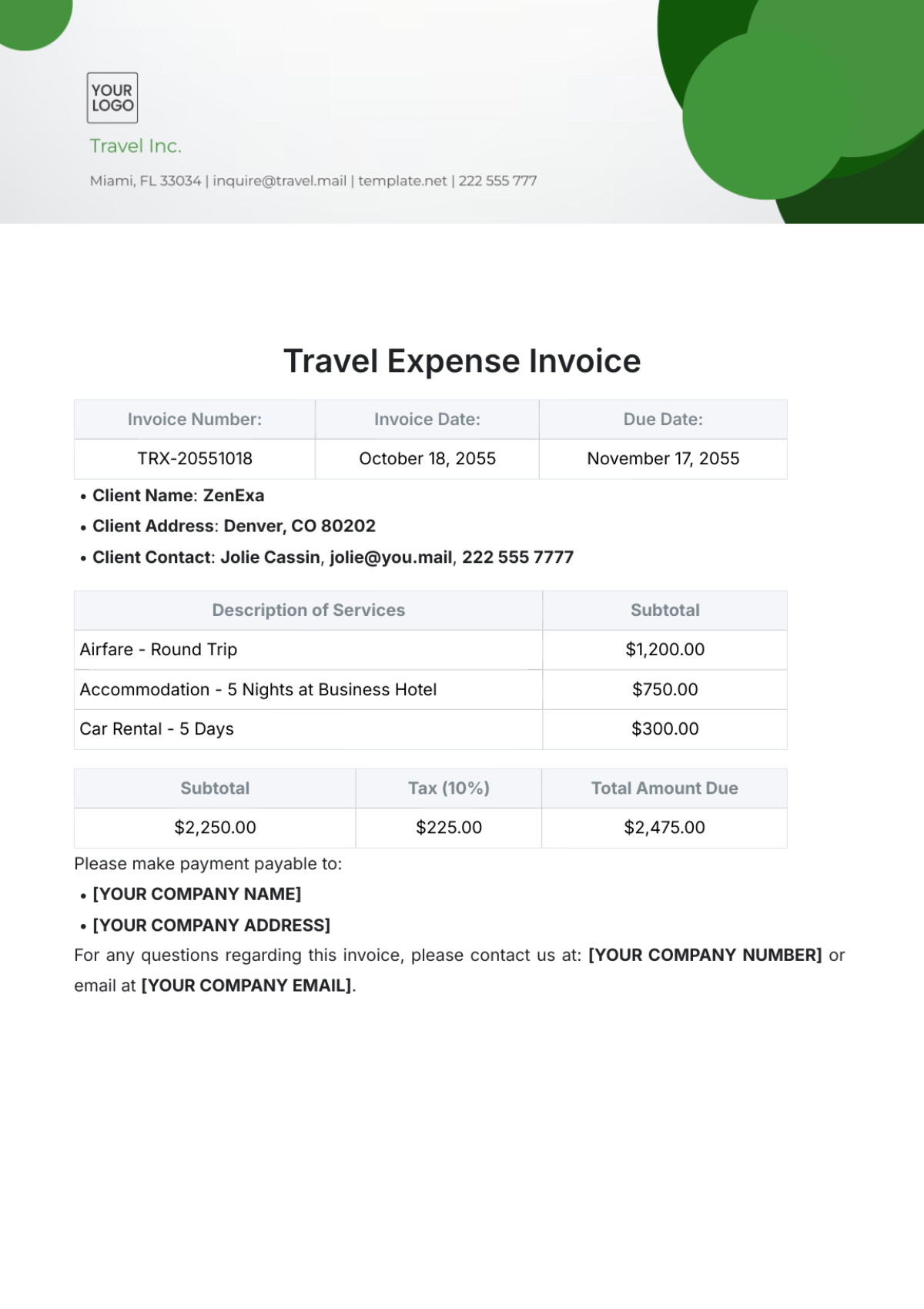

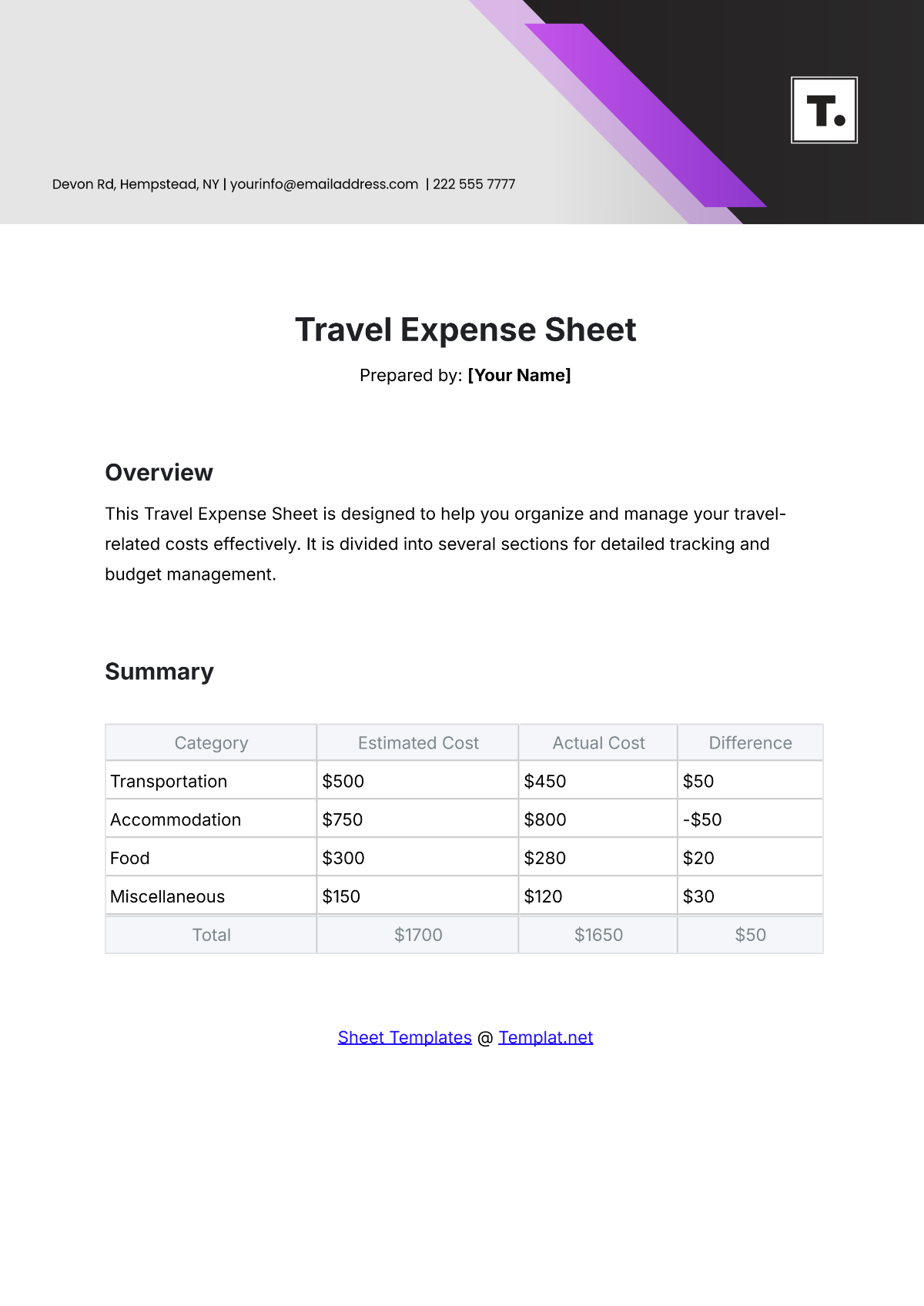

E. Other Expenses

Travel expenses for staff attending a professional development conference added an unplanned cost. Insurance premiums for the center’s property and staff health plans were higher than anticipated due to rising insurance rates. Miscellaneous expenses, such as minor office repairs, also contributed to this category.

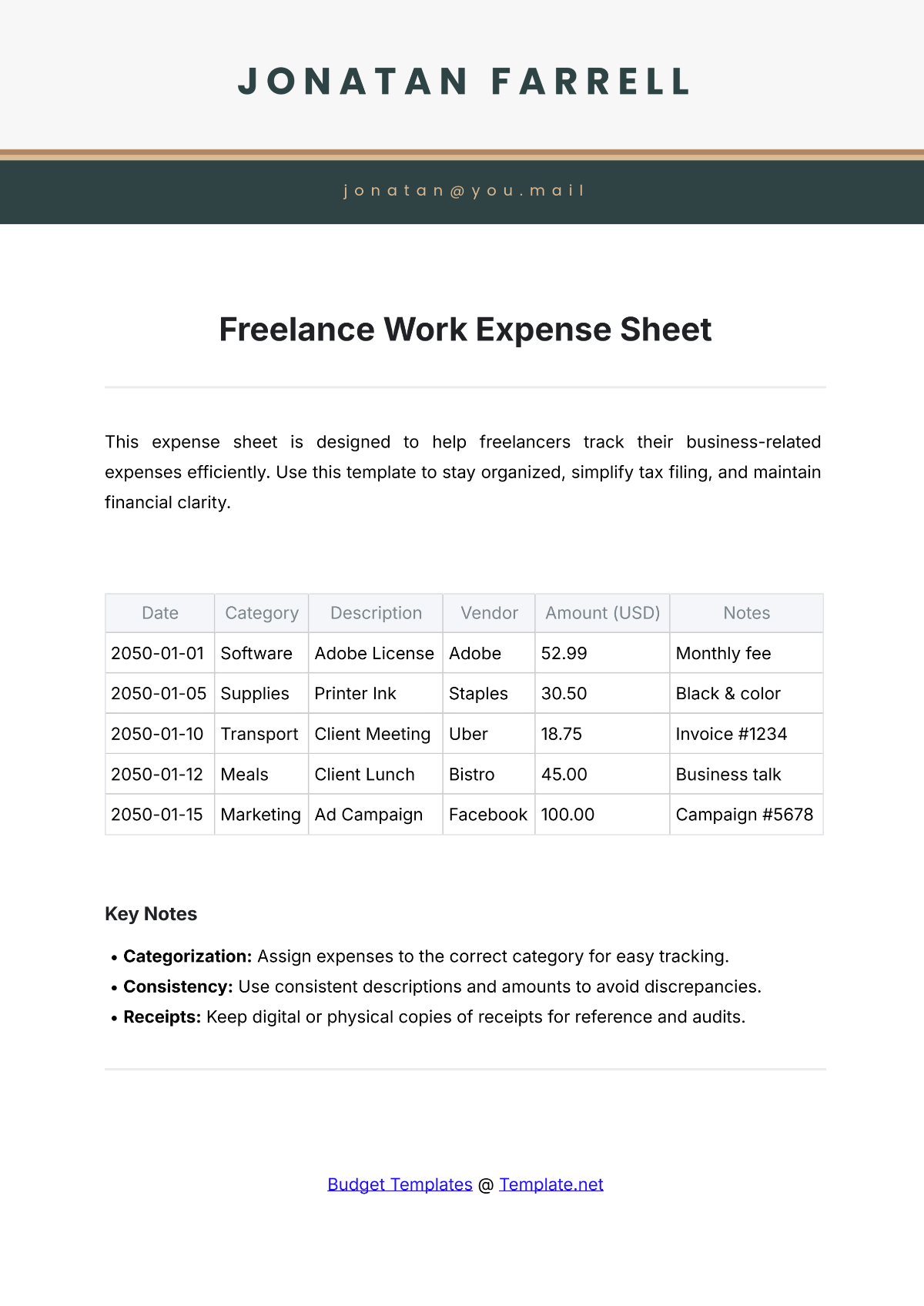

III. Detailed Expense Breakdown

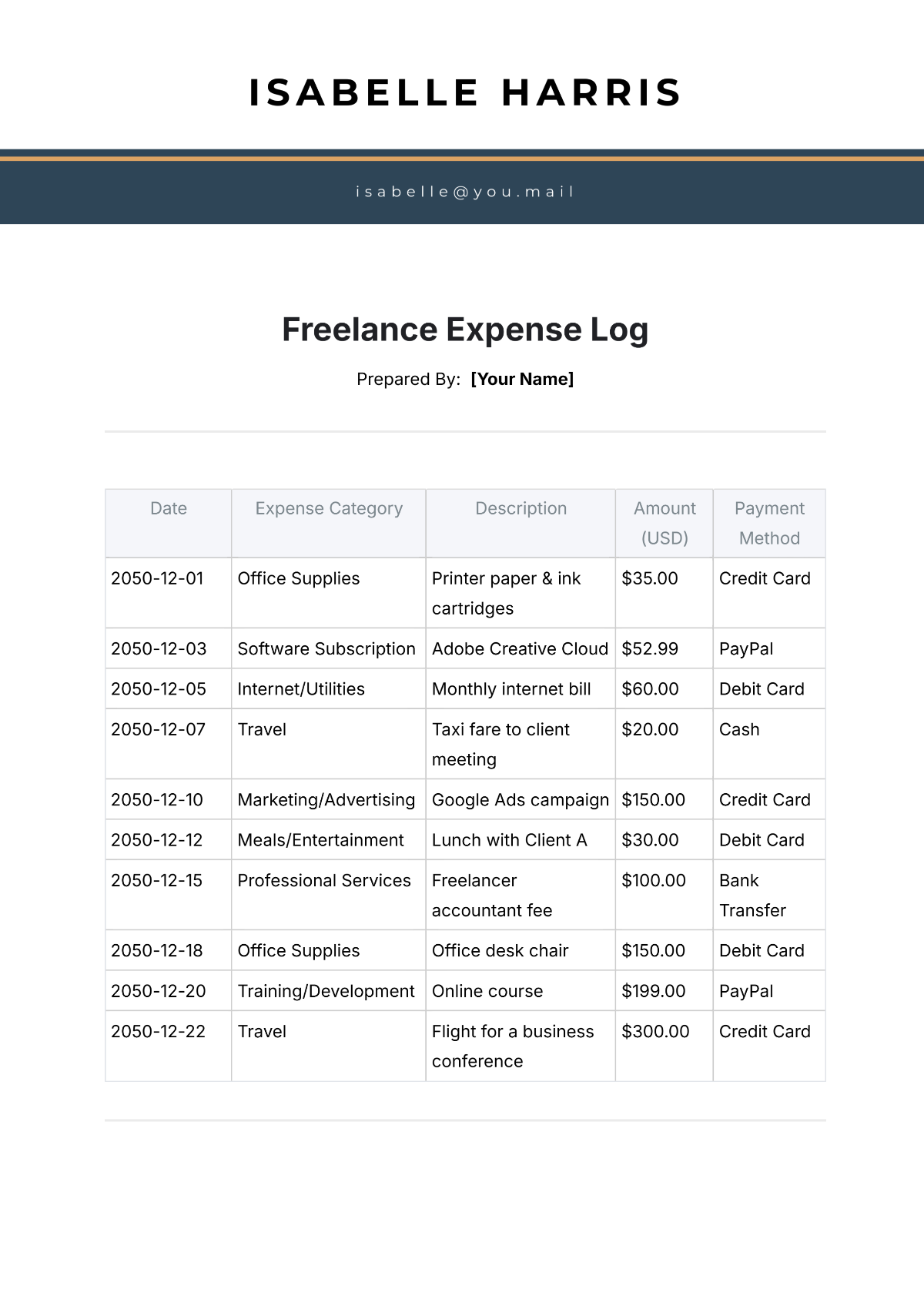

A. Date of Each Expense

The expenses were recorded throughout the quarter, with the following key dates for significant costs:

Date | Expense Description | Amount Spent | Payment Method |

|---|---|---|---|

January 5 | Office Supplies | $2,000 | Credit Card |

B. Description of Each Expense

Office Supplies: Purchase of standard office materials such as paper, ink cartridges, and stationery.

Plumbing Repair: Urgent plumbing issues were addressed after a pipe burst in the facility.

Program Supplies: Purchased new materials for the after-school arts program, including art supplies and craft kits.

C. Amount Spent

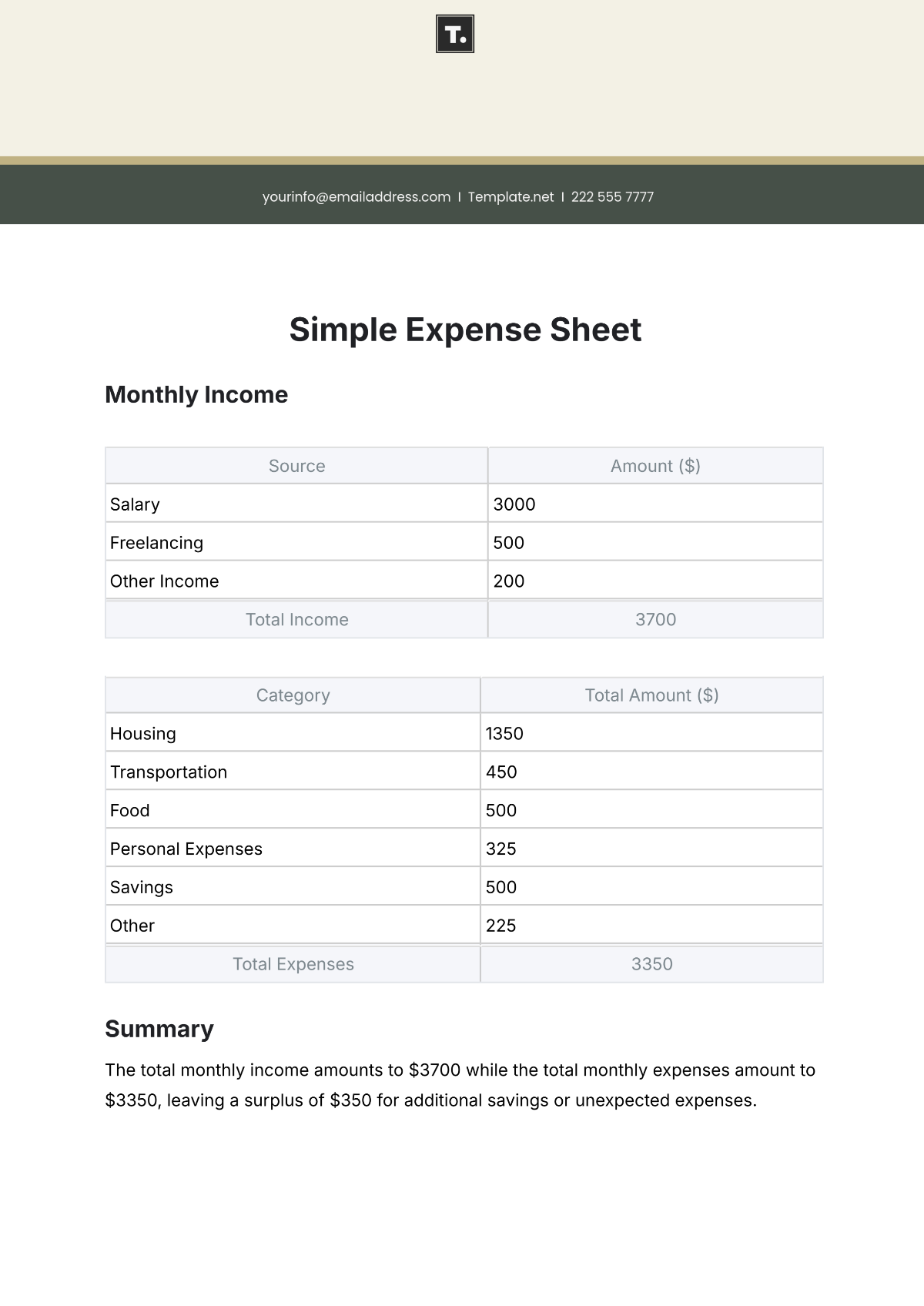

The total amount for these three major expenses is as follows:

Expense Description | Amount Spent |

|---|---|

Office Supplies | $2,000 |

Plumbing Repair | |

Program Supplies |

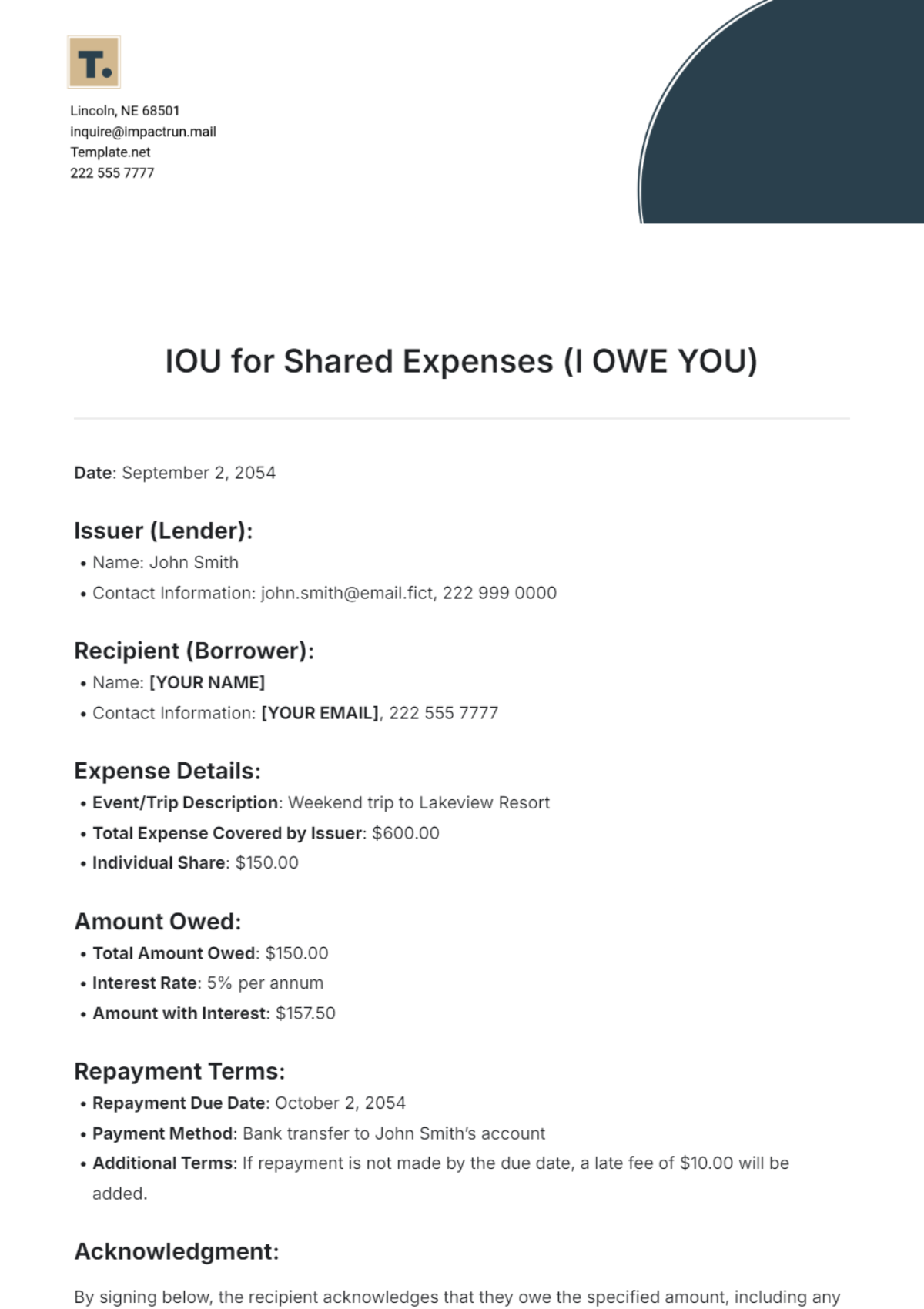

IV. Budget Comparison

A. Budgeted Amounts vs. Actual Spending

Comparing the budgeted amounts to actual expenses reveals the following:

Expense Category | Budgeted Amount | Actual Amount | Variance |

|---|---|---|---|

Personnel Costs | $28,000 | $30,000 | +$2,000 |

Operational Expenses | |||

Program Expenses | |||

Capital Expenditures | |||

Miscellaneous Expenses |

B. Variance Analysis

Personnel Costs: The variance is primarily due to overtime and higher payroll taxes.

Operational Expenses: Utility expenses were overestimated, causing a slight overage.

Program Expenses: The increased program activity resulted in the higher cost of supplies.

Capital Expenditures: Slightly over due to unplanned computer upgrades.

Miscellaneous Expenses: Increased due to additional insurance premiums and emergency repairs.

C. Recommendations for Adjustments

The budget should include a contingency for maintenance repairs and higher-than-expected program growth. For personnel costs, overtime projections should be refined. Additionally, operational cost monitoring should be improved for better forecasting in utility expenses.

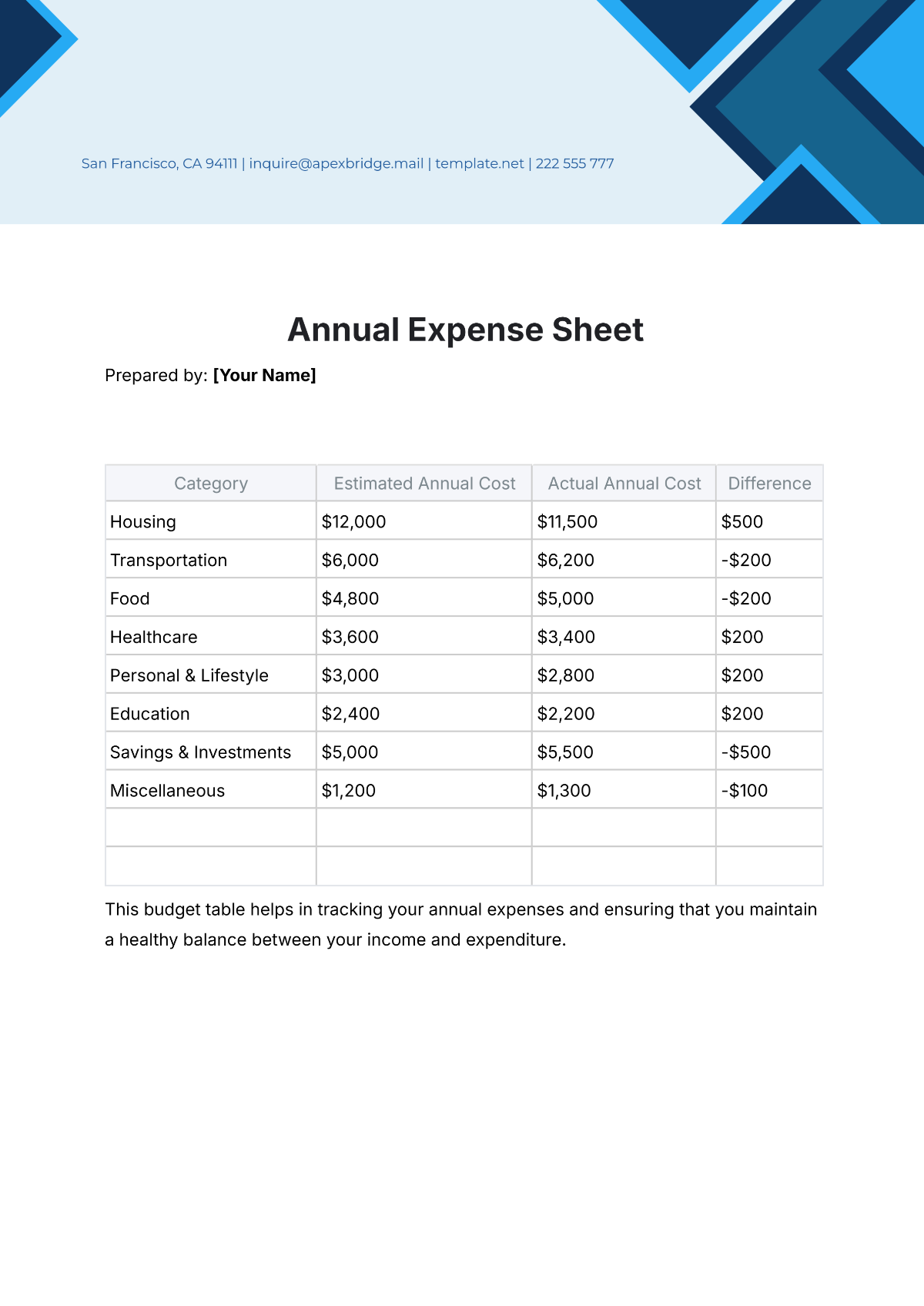

V. Financial Overview

A. Total Revenue for the Reporting Period

Total revenue for Q1 2050 reached $[00], which included program fees, event income, and community donations. The majority of this revenue came from popular programs such as after-school classes, community workshops, and family events, which saw high attendance and strong community engagement. Additionally, a portion of the revenue came from grants and sponsorships secured from local businesses and nonprofit organizations supporting community development.

B. Net Profit or Loss

The center recorded a net profit of $[00] for the quarter, with expenses well-aligned with revenue despite minor budget variances. This net income has been designated for the center’s reserve fund to strengthen financial stability and address future unexpected costs. Continued careful management of both revenue and expenses will be essential to maintaining a positive profit margin across future quarters.

C. Financial Health Assessment

The community center remains in a stable financial position, with adequate reserves and steady revenue streams supporting its activities. However, the overage in program expenses suggests the need for better forecasting as demand for services grows. The center's financial health would benefit from expanding revenue sources, especially to cover future facility upgrades and larger capital expenditures.

VI. Recommendations for Future Budgeting

A. Identifying Cost-Cutting Opportunities

Bulk purchasing of supplies, particularly for recurring needs like program materials and office necessities, could reduce expenses by up to [00]%. Negotiating service contracts for utilities and maintenance services might also offer cost reductions without compromising quality. Additionally, the center could consider optimizing staff schedules and minimizing overtime to further control personnel costs.

B. Suggestions for Increasing Revenue

To supplement the center’s income, hosting additional fundraising events and increasing program fees slightly could be effective. New partnerships with local businesses and grant applications could bring in additional revenue and allow for program expansions. Another strategy could involve introducing new workshops and classes with fees, specifically tailored to community needs, to attract more participants and provide sustainable income.

C. Long-Term Financial Planning

Establishing a five-year financial plan that factors in inflation and future growth would ensure better financial preparedness. Building a reserve fund aimed at capital improvements and emergency repairs will also mitigate financial strain from unexpected costs. Furthermore, the center should project staffing needs and plan for potential expansion or relocation costs as community demand grows, ensuring long-term financial resilience.

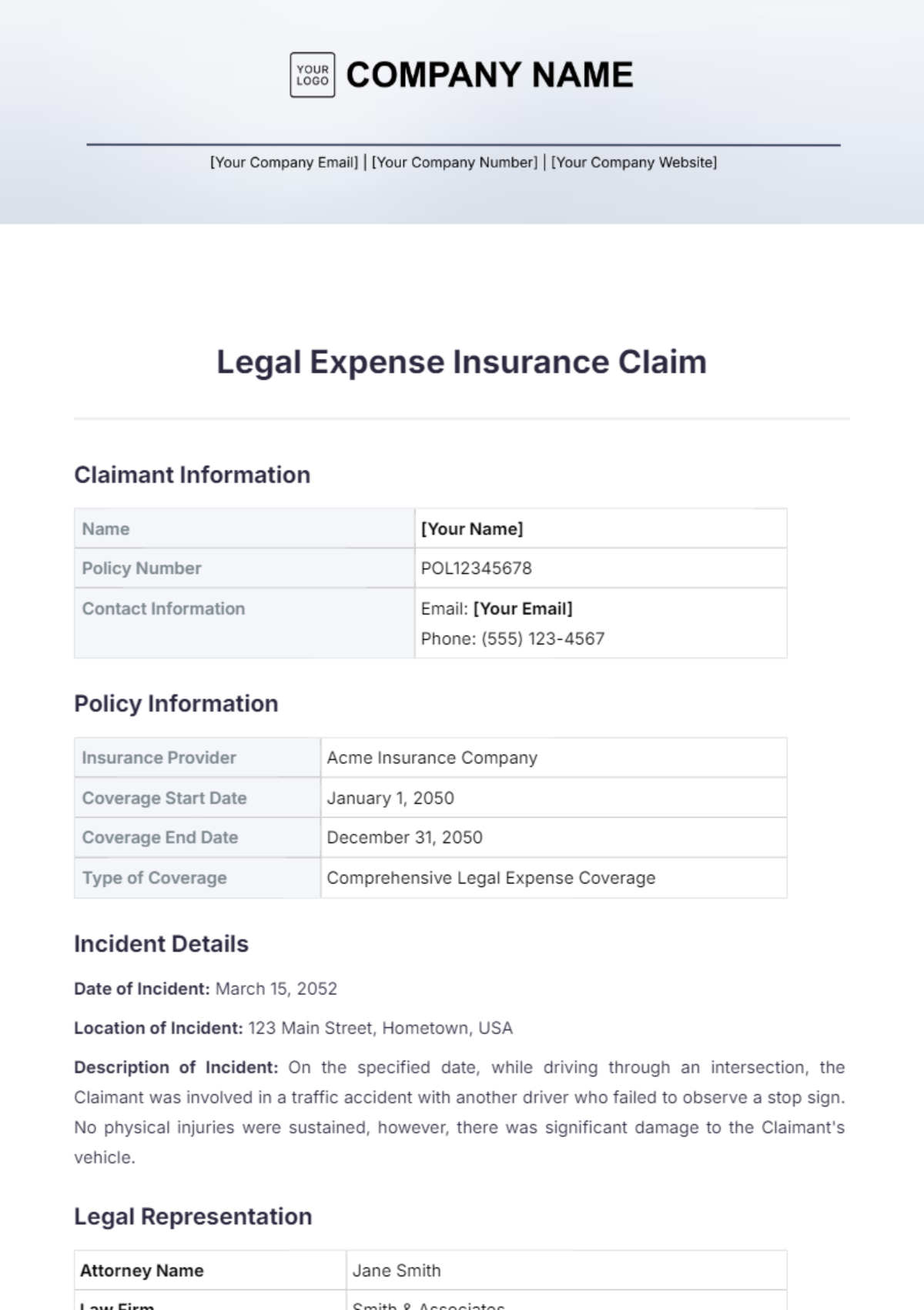

VII. Risk Management and Financial Controls

A. Identifying Financial Risks

Key financial risks include unplanned maintenance expenses, which could disrupt other budget allocations, and over-reliance on program fees that may fluctuate seasonally. Limited funding diversity, with a heavy reliance on donations and sponsorships, could also pose risks if community support decreases. Additionally, the center faces potential risks from program overspending, especially if certain events or services exceed their allocated budgets without offsetting revenue.

B. Mitigation Strategies for Identified Risks

To mitigate these risks, the center should establish an emergency maintenance fund with monthly contributions, ensuring readiness for unexpected repairs. Seeking diverse revenue sources, such as grants and long-term partnerships with local businesses, would help reduce dependence on any single income stream. Implementing stricter budgeting controls for high-cost events or programs can also prevent overspending by ensuring expenses are pre-approved and closely monitored.

C. Internal Controls for Financial Oversight

Monthly financial reviews involving department heads can help identify budget variances early and allow for prompt corrective action. A dual-approval system for large expenses above $[00] ensures accountability and transparency in spending. Additionally, regular audits by an external accountant will reinforce financial integrity, helping to spot and address any discrepancies or areas for improvement in financial management.

VIII. Conclusion

A. Summary of Total Expenditures and Financial Performance

The center’s total expenditures of $[00] for the quarter reflect effective resource allocation, allowing the center to maintain essential services while addressing urgent facility needs. The financial performance was positive overall, with revenues surpassing expenses and resulting in a $[00] surplus. This surplus will support reserve funds, enabling the center to build financial resilience for future needs.

B. Key Takeaways for Financial Improvement

Improved cost forecasting for program expenses and operational maintenance will help minimize future budget overages. Efforts to diversify income streams, such as grant applications and new partnerships, will contribute to sustainable revenue growth. Continued attention to detailed budget tracking and proactive adjustments will further enhance the center's financial performance and support long-term goals.

C. Final Thoughts on Financial Health

The community center’s financial health is strong, though careful planning and risk management are crucial to maintain this stability. Proactive budgeting, combined with an expansion of revenue-generating programs, can ensure the center remains equipped to serve the community. Going forward, reinvesting in infrastructure, personnel development, and program enhancements will solidify the center’s position as a valuable community resource for years to come.