Financing Arrangement

I. Introduction

This financing arrangement plan of [YOUR COMPANY NAME] aims to outline a structured approach to securing necessary funding for the project. It includes an assessment of different financing options, strategies for negotiation with potential financiers, and a timeline for implementation.

II. Financing Options

Exploring various financing options is crucial for selecting the most viable and cost-effective solution.

A. Equity Financing

Equity financing involves raising capital through the sale of shares. This option does not require repayment but dilutes ownership.

Pros: Access to significant funds, no repayment obligation.

Cons: Ownership dilution, investor expectations.

B. Debt Financing

Debt financing requires borrowing funds which must be repaid with interest. This option retains ownership but incurs debt.

Pros: Ownership retention, tax advantages on interest paid.

Cons: Repayment obligation, interest costs.

C. Hybrid Financing

Hybrid financing involves a combination of equity and debt. This option can balance the pros and cons of both methods.

Pros: Flexible structure, balanced risk.

Cons: Complexity in structuring, potential for confusion.

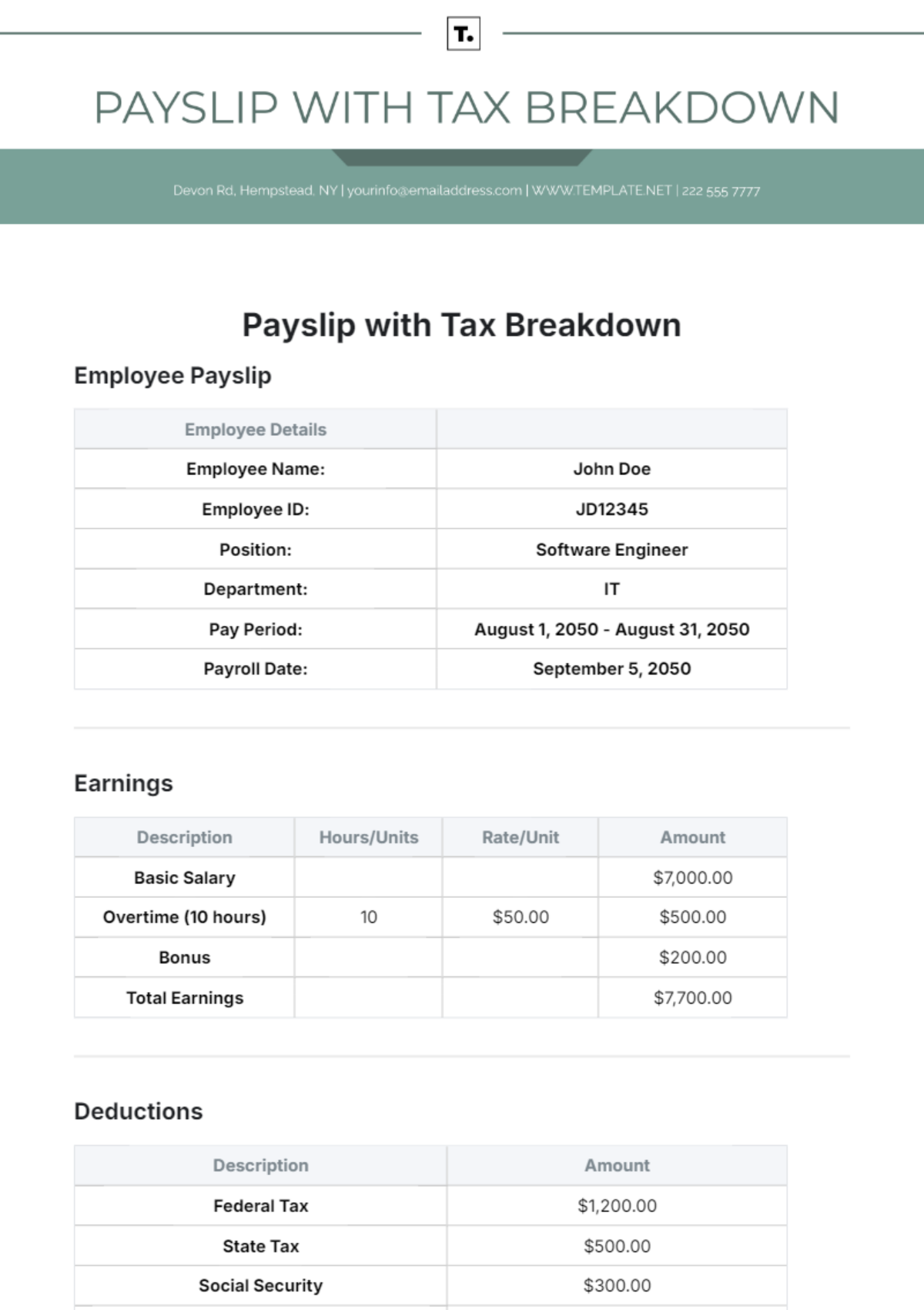

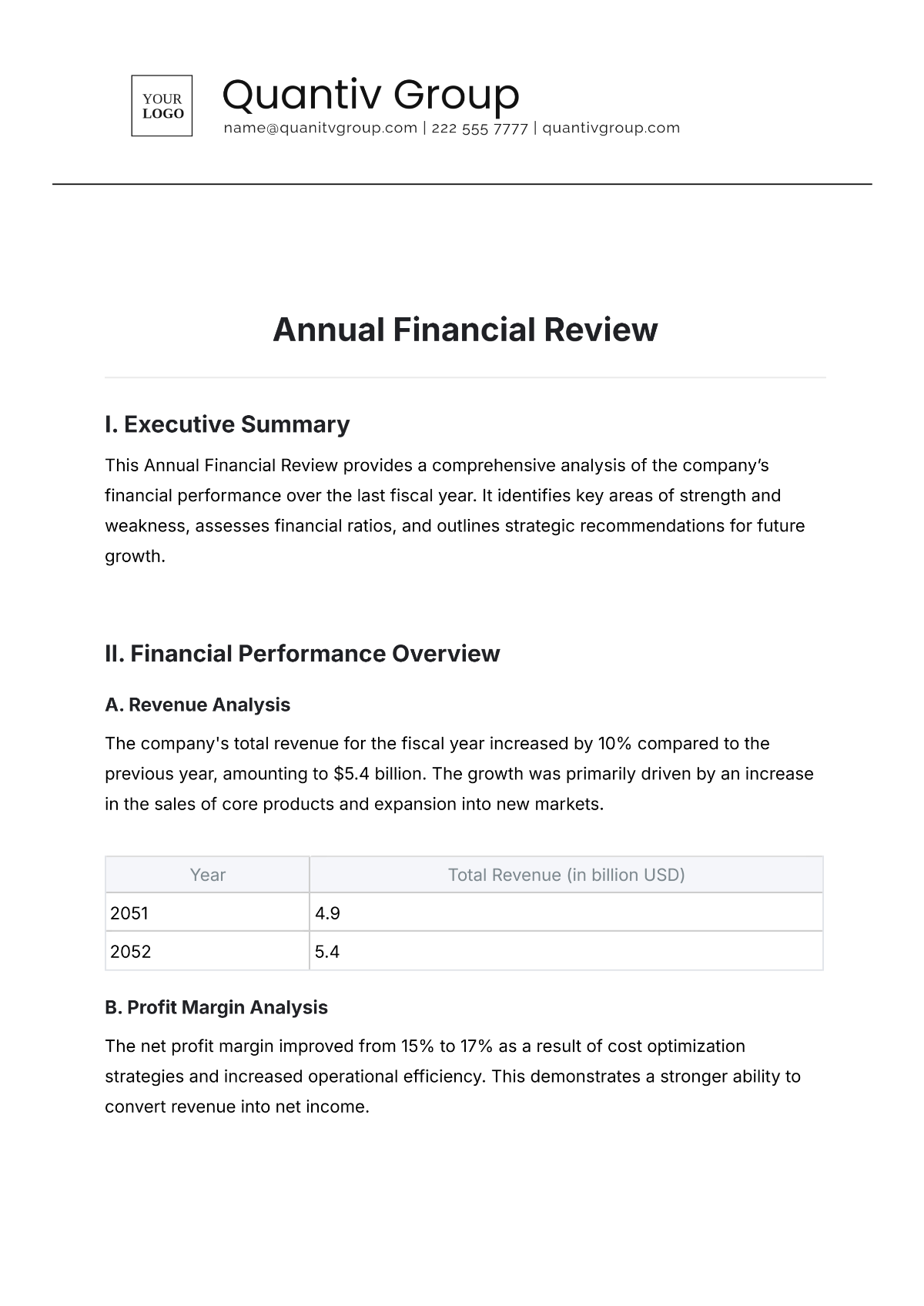

III. Financial Projection and Analysis

Conducting a thorough analysis of the company's financials is crucial to attract potential financiers.

A. Cash Flow Projection

Year | Projected Revenue | Projected Expenses | Net Cash Flow |

|---|---|---|---|

Year 1 | $1,000,000 | $750,000 | $250,000 |

Year 2 | $1,200,000 | $800,000 | $400,000 |

B. Break-even Analysis

Understanding at what point the business will be able to cover all its expenses is critical for decision-making.

Fixed Costs: $500,000

Variable Costs per unit: $20

Selling Price per unit: $50

Break-even Point in Units = Fixed Costs / (Selling Price per unit - Variable Costs per unit)

IV. Strategy for Negotiation with Financiers

An effective strategy must be developed to engage potential financiers productively.

A. Identifying Potential Investors

Compile a list of potential investors who have shown interest or have invested in similar projects.

B. Preparing Pitch Documents

Create comprehensive yet concise pitch documents to present to potential investors.

C. Structuring Terms

Propose terms that are beneficial yet realistic, keeping room for negotiations.

V. Implementation Timeline

A detailed timeline assists in keeping the plan on track and ensures timely progress.

A. Phase 1: Research and Analysis

Duration: 2 months

Activities: Market study, Competitor analysis

B. Phase 2: Proposal and Negotiation

Duration: 3 months

Activities: Prepare documents, Initiate contact with financiers

C. Phase 3: Finalization and Implementation

Duration: 2 months

Activities: Secure funding, Begin project execution

VI. Conclusion

By carefully assessing financing options, conducting thorough financial analysis, and developing a strategic negotiation plan, the financing arrangement can be successfully implemented to ensure the project's success.

References

Due to browse capability limitations, references cannot directly be fetched. Consider consulting resources such as:

Brigham, E. F., & Ehrhardt, M. C. (2052). Financial Management: Theory and Practice. Cengage Learning.

Brealey, R. A., Myers, S. C., & Allen, F. (2051). Principles of Corporate Finance. McGraw-Hill Education.