Free Private Equity Investment Proposal

Prepared by: [YOUR COMPANY NAME]

Prepared for: Macey Erdman

Date: November 19, 2081

Executive Summary

This investment proposal outlines the opportunity for [YOUR COMPANY NAME] to partner with Macey Erdman in securing a private equity investment in EcoTech Innovations, a rapidly growing company in the clean energy technology sector. The investment will allow for significant business expansion, strategic development, and a path to eventual exit, providing high returns for all stakeholders.

Investment Opportunity

Target Company Name: EcoTech Innovations

Sector: Clean Energy Technology

Investment Type: Equity Investment

Total Investment Amount: $50,000,000

Ownership Offered: 20%

Projected Exit: IPO, with a target exit year of 2086

Company Overview

EcoTech Innovations is a leading developer of renewable energy solutions specializing in solar and wind power technologies. Established in 2025, the company has seen steady growth with a 25% increase in revenues over the past five years. The management team is led by Dr. Jane Stevens, an experienced executive with a proven track record of success in the clean energy sector.

Key Market Insights

Target Market: Global energy market focusing on sustainable, renewable energy solutions.

Market Size: $1.2 trillion (global clean energy market size, expected to reach $2.8 trillion by 2085)

Growth Rate: The clean energy industry is projected to grow at 15% annually over the next 10 years, driven by governmental incentives and increasing demand for sustainable energy solutions.

Competitive Advantage: EcoTech Innovations is differentiated by its patented wind turbine technology and advanced solar panel designs, offering higher efficiency than competitors.

Investment Rationale

High Growth Potential: The global shift towards renewable energy and climate policies that prioritize sustainability present a tremendous opportunity for EcoTech Innovations to capture market share.

Scalable Business Model: The company's business model is easily scalable, with significant expansion potential in emerging markets such as Africa and Southeast Asia.

Experienced Management Team: Led by Dr. Jane Stevens, the team has decades of experience in the energy sector and a proven ability to drive successful commercialization of new technologies.

Strong Financial Performance: Over the last five years, EcoTech Innovations has seen revenue growth of 25% year-over-year, with net profit margins of 12%. The company is on track to achieve $75 million in revenue by 2083.

Financial Projections

EcoTech Innovations projects the following financial performance for the next five years:

Year 1 Revenue: $50,000,000

Year 2 Revenue: $62,000,000

Year 3 Revenue: $80,000,000

Year 4 Revenue: $100,000,000

Year 5 Revenue: $130,000,000

EBITDA Margin: 18%

Net Profit: $15,600,000 in Year 5

IRR (Internal Rate of Return): 22%

ROI (Return on Investment): 250% over the 5-year investment period

Use of Funds

The capital raised through this investment will be used to fund the following key initiatives:

Expansion of Sales and Marketing: $12,000,000 for targeted marketing campaigns in emerging markets and to grow the sales team in North America and Europe.

Product Development: $15,000,000 to fund the next generation of solar panel and wind turbine designs.

Operational Scaling: $10,000,000 to increase manufacturing capacity and upgrade production facilities.

Strategic Acquisitions: $7,000,000 for potential acquisitions of smaller, complementary clean energy companies.

Working Capital: $6,000,000 for liquidity to manage day-to-day operations and fuel further growth.

Exit Strategy

Our proposed exit strategy is an Initial Public Offering (IPO) in 2086, taking EcoTech Innovations public to capitalize on the growing demand for renewable energy stocks. The IPO is expected to yield a return of 250% for investors based on the company's anticipated growth and the rising value of clean energy companies in the market.

Risk Analysis

While this investment presents substantial potential returns, the following risks should be considered:

Market Volatility: Changes in global economic conditions or fluctuations in energy prices could impact demand for EcoTech Innovations’ products.

Competition: The renewable energy sector is highly competitive, with new technologies emerging regularly. Competition from established energy firms and startups could reduce market share.

Regulatory Risks: Changes in government policies or reductions in subsidies for renewable energy could affect the profitability of the company.

Operational Risks: Scaling manufacturing operations quickly may present challenges in maintaining product quality and meeting demand.

Mitigation Strategies:

To mitigate these risks, we plan to:

Focus on international diversification to reduce reliance on any single market.

Continuously invest in R&D to stay ahead of technological advancements.

Engage in ongoing government lobbying to ensure favorable regulations for the renewable energy sector.

Conclusion

This private equity investment proposal presents a highly lucrative opportunity to invest in EcoTech Innovations, a promising company at the forefront of the clean energy revolution. With a strong management team, scalable business model, and a compelling market opportunity, [YOUR COMPANY NAME] is confident that this investment will provide high returns and be mutually beneficial for all involved parties.

For further information, or to discuss this proposal in more detail, please feel free to contact us at [YOUR COMPANY NUMBER].

Signatures

[YOUR NAME]

[YOUR NAME]

Chief Executive Officer

[YOUR COMPANY NAME]

Date: November 19, 2081

Macey Erdman

Macey Erdman

Chief Executive Officer

BrassFox

Date: November 19, 2081

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Attract equity investors with Template.net’s Private Equity Investment Proposal Template. This customizable document is editable in our AI Editor Tool, offering a structured format to detail investment opportunities. Highlight financial data, growth strategies, and ROI projections with ease, creating a persuasive and professional proposal for private equity funding. Donwload it now!

You may also like

- Business Proposal

- Research Proposal

- Proposal Request

- Project Proposal

- Grant Proposal

- Photography Proposal

- Job Proposal

- Budget Proposal

- Marketing Proposal

- Branding Proposal

- Advertising Proposal

- Sales Proposal

- Startup Proposal

- Event Proposal

- Creative Proposal

- Restaurant Proposal

- Blank Proposal

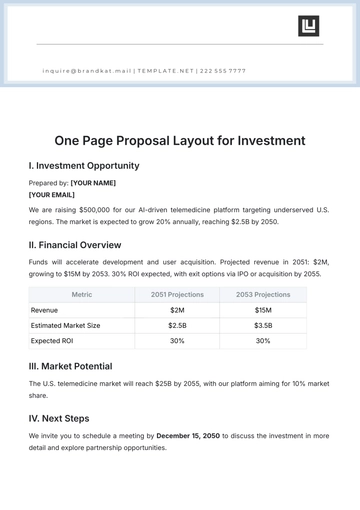

- One Page Proposal

- Proposal Report

- IT Proposal

- Non Profit Proposal

- Training Proposal

- Construction Proposal

- School Proposal

- Cleaning Proposal

- Contract Proposal

- HR Proposal

- Travel Agency Proposal

- Small Business Proposal

- Investment Proposal

- Bid Proposal

- Retail Business Proposal

- Sponsorship Proposal

- Academic Proposal

- Partnership Proposal

- Work Proposal

- Agency Proposal

- University Proposal

- Accounting Proposal

- Real Estate Proposal

- Hotel Proposal

- Product Proposal

- Advertising Agency Proposal

- Development Proposal

- Loan Proposal

- Website Proposal

- Nursing Home Proposal

- Financial Proposal

- Salon Proposal

- Freelancer Proposal

- Funding Proposal

- Work from Home Proposal

- Company Proposal

- Consulting Proposal

- Educational Proposal

- Construction Bid Proposal

- Interior Design Proposal

- New Product Proposal

- Sports Proposal

- Corporate Proposal

- Food Proposal

- Property Proposal

- Maintenance Proposal

- Purchase Proposal

- Rental Proposal

- Recruitment Proposal

- Social Media Proposal

- Travel Proposal

- Trip Proposal

- Software Proposal

- Conference Proposal

- Graphic Design Proposal

- Law Firm Proposal

- Medical Proposal

- Music Proposal

- Pricing Proposal

- SEO Proposal

- Strategy Proposal

- Technical Proposal

- Coaching Proposal

- Ecommerce Proposal

- Fundraising Proposal

- Landscaping Proposal

- Charity Proposal

- Contractor Proposal

- Exhibition Proposal

- Art Proposal

- Mobile Proposal

- Equipment Proposal

- Student Proposal

- Engineering Proposal

- Business Proposal