Investment Proposal for Financial Support

Introduction

This proposal outlines the investment opportunity in the development of a cutting-edge technology platform designed to revolutionize the retail industry. Our platform addresses current market demands and aims to provide substantial returns on investment by leveraging unique solutions and innovations.

Executive Summary

Our company, [YOUR COMPANY NAME], seeks a financial investment of $5 million to launch and scale our proprietary technology platform. The platform promises to deliver transformative shopping experiences by integrating AI-driven insights and blockchain security features. The investment will primarily focus on development, marketing, and operational expansion over the next three years.

Market Analysis

Industry Overview

The global retail technology market is projected to grow at a CAGR of 10.5% over the next five years. This growth is fueled by increasing online shopping volumes and advancements in AI technology. Our platform is uniquely positioned to capture substantial market share in this burgeoning industry.

Target Audience

Our primary customers are mid to large-sized retailers seeking to enhance customer engagement through innovative technology. Secondary audiences include e-commerce businesses looking to streamline operations and personalize consumer interactions.

Product Description

Our platform is an AI-driven solution equipped with predictive analytics, personalized recommendations, and secure transactions facilitated by blockchain technology. It consists of the following features:

Real-time Consumer Insights

Customized Marketing Solutions

Secure and Transparent Transactions

Scalable and Agile Infrastructure

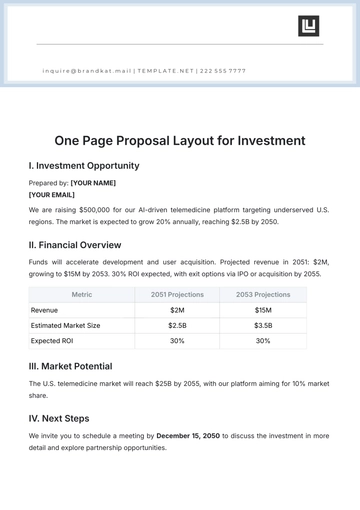

Financial Projections

Our financial model forecasts revenue growth as follows:

Year | Revenue ($ millions) | Net Profit ($ millions) |

|---|

2084 | 2.5 | 0.5 |

2085 | 5.0 | 1.0 |

2086 | 12.0 | 3.0 |

Funding Requirements

The required investment of $5 million will be allocated as follows:

Technology Development: $2 million

Marketing and Sales: $1.5 million

Operational Expenses: $1 million

Contingency Fund: $0.5 million

Risk Analysis

Potential risks include market competition, technological advancements, and regulatory changes. To mitigate these risks, we have established strategic partnerships and are committed to continuous innovation and compliance with industry standards.

Conclusion

Investing in [YOUR COMPANY NAME] offers a lucrative opportunity to be at the forefront of retail technology disruption. With a visionary leadership team, clear market potential, and robust technological infrastructure, we are confident in delivering exceptional value to our investors.

Contact Information

For further inquiries or to schedule a meeting, please contact:

[YOUR NAME]

CEO, [YOUR COMPANY NAME]

Email: [YOUR EMAIL]

Phone: [YOUR COMPANY NUMBER]

Signatures

[YOUR NAME]

CEO, [YOUR COMPANY NAME]

Date: October 20, 2083

Proposal Templates @ Template.net