Investment Proposal for Acquisition

Executive Summary

This investment proposal outlines the strategic acquisition opportunity of [YOUR COMPANY NAME]. The objective is to highlight the synergies, potential returns, and strategic value that this acquisition would bring to our company. [YOUR COMPANY NAME] is a leading player in the industry with innovative products and a robust market presence. The acquisition will not only augment our current capabilities but also expand our market reach and increase our competitive advantage.

Company Overview

About [YOUR COMPANY NAME]

Founded in 2055, [YOUR COMPANY NAME] has rapidly grown to become a leader in its sector. The company specializes in cutting-edge technology solutions with a strong customer base, internationally recognized brand, and consistent revenue growth trend. [YOUR COMPANY NAME]'s mission is to deliver high-quality and innovative solutions that meet the evolving needs of its clients.

Strategic Rationale

The acquisition of [YOUR COMPANY NAME] aligns with our strategic objectives to expand market presence and enhance product offerings. Key strategic benefits of this acquisition include:

Increased Market Share: Access to [YOUR COMPANY NAME]'s customer base provides substantial market share growth.

Diversified Product Line: Introduction of complementary products opens new revenue streams.

Operational Synergies: Cost savings through consolidated operations and shared resources.

Innovation Acceleration: Leveraging [YOUR COMPANY NAME]’s R&D capabilities to fast-track innovation.

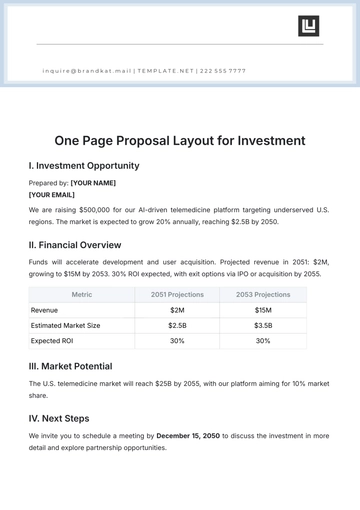

Financial Overview

The financial evaluation of [YOUR COMPANY NAME] indicates a strong financial position with a consistent revenue stream and profitability. The following tables present a snapshot of the financial situation:

Financial Metric | [YOUR COMPANY NAME] | Industry Average |

|---|

Revenue (2072) | $50 million | $45 million |

Net Profit Margin | 12% | 10% |

Return on Equity (ROE) | 15% | 14% |

Valuation and Deal Structure

The proposed acquisition value for [YOUR COMPANY NAME] is based on a comprehensive valuation analysis. The valuation considers an earnings multiple approach and a discounted cash flow methodology. The deal structure will include a combination of cash and equity, optimized to benefit both parties:

Acquisition Price: $80 million

Payment Structure: 60% Cash, 40% Company Stock

Conditional Earn-Out: Additional performance-based incentives

Risk Assessment

We have conducted a thorough risk assessment to identify potential challenges associated with this acquisition. These include but are not limited to:

Integration Risk: Challenges in aligning operational processes and cultures.

Market Risk: Potential changes in market dynamics affecting demand.

Financial Risk: Volatility in financial markets affecting valuations.

Regulatory Risk: Compliance with regulatory approvals and antitrust considerations.

Mitigation strategies have been developed to address each identified risk, ensuring a smooth transition post-acquisition.

Conclusion and Recommendation

This acquisition is a substantial opportunity to enhance our growth trajectory and solidify our competitive standing. We recommend proceeding with the proposed acquisition of [YOUR COMPANY NAME], as the strategic benefits outweigh the inherent risks. This acquisition is anticipated to deliver significant value to shareholders and position our company for sustained success.

Approvals and Signatures

This proposal has been prepared by the Mergers and Acquisitions team. Management's approval is sought to proceed with further negotiations and due diligence.

Prepared by:

[YOUR NAME]

[YOUR NAME]

Mergers and Acquisitions Specialist

Date: 10/22/2072

Approved by:

Tom Walter

Tom Walter

Chief Executive Officer

Date: 10/22/2072

Vetted by:

Emmy Green

Emmy Green

Chief Financial Officer

Date: 10/22/2072

All inquiries and responses related to this proposal should adhere to company confidentiality agreements and compliance guidelines.

Proposal Templates @ Template.net

[YOUR NAME]

[YOUR NAME]