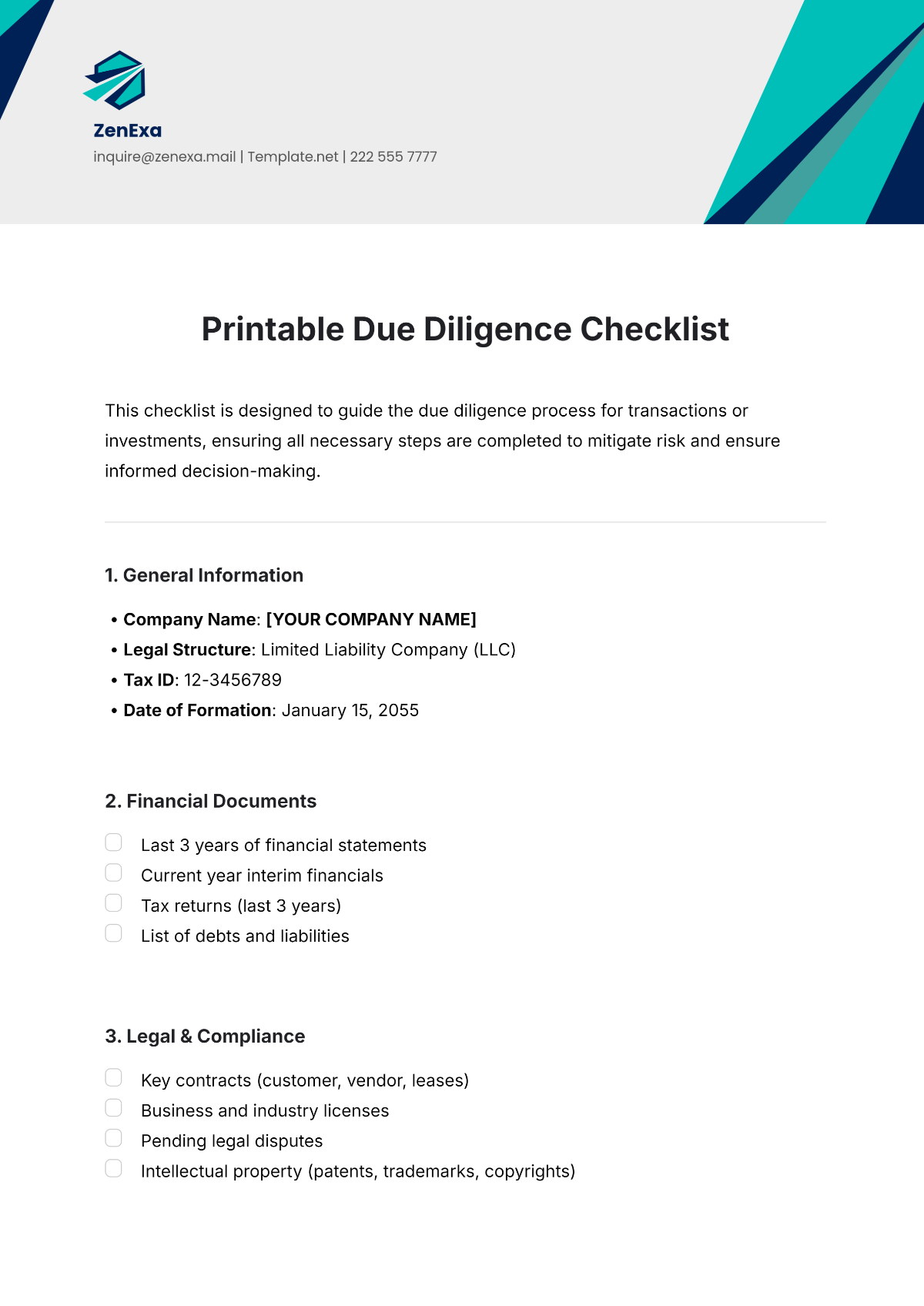

Due Diligence

Prepared by: [YOUR NAME]

For: [YOUR COMPANY NAME]

Date: March 15, 2055

PURPOSE

This report evaluates TechNova Corporation for potential acquisition, assessing its compliance, risks, and overall suitability.

1. EXECUTIVE SUMMARY

Industry: Artificial Intelligence and Robotics

Annual Revenue (2054): $780 Million

Key Strengths: Consistent 18% annual revenue growth, 23 patents, pending patent applications.

Risks: Moderate supply chain dependency, competitive market pressures.

2. FINANCIAL SNAPSHOT

Category | Details |

|---|---|

Total Assets | $2.5 Billion |

Total Liabilities | $1.1 Billion |

Net Worth | $1.4 Billion |

3. KEY FINDINGS

Legal Compliance: No significant disputes, adheres to international AI standards.

Operations: Strong leadership, advanced R&D, reliance on a single chip supplier.

Risks: Supply chain vulnerabilities and high competition.

4. RECOMMENDATIONS

Proceed with acquisition.

Allocate $10 Million to address supply chain risks.

Expedite patent approvals to strengthen market position.

For additional details, contact [YOUR NAME] at [YOUR EMAIL].

This document is confidential and intended solely for [YOUR COMPANY NAME].