Cost Benefit Analysis for Nonprofits

[YOUR COMPANY NAME] | [YOUR COMPANY ADDRESS]

Introduction to Cost Benefit Analysis

Nonprofits, much like for-profit organizations, face a series of financial decisions that require a systematic approach to discern the best utilization of resources. Conducting a Cost Benefit Analysis (CBA) allows these organizations to compare the anticipated costs and benefits of a project or decision to determine its feasibility. This analysis is particularly crucial for nonprofits due to their reliance on donations and grants, demanding accountability and strategic resource allocation.

Understanding Costs in Nonprofits

Identifying and understanding costs in a nonprofit are essential to any CBA. These can be broadly categorized into direct and indirect costs.

Direct Costs: These include expenses directly tied to a project, such as salaries of project staff, specific materials, and any other resources directly consumed by the project.

Indirect Costs: These are overhead expenses that support the organization's operations but cannot be directly linked to a specific project, such as utilities, administration, and infrastructure expenses.

Nonprofits often need to account not only for tangible financial outlays but also for opportunity costs, which reflect the benefits foregone from not pursuing alternative actions.

Benefits Associated with Nonprofit Projects

Calculating the benefits in a nonprofit context requires identifying the qualitative and quantitative outcomes of the proposed projects. These can include:

Social Impact: Measured by the improved quality of life, education, health, or environmental conditions for the targeted community.

Financial Benefits: Sometimes, cost-saving serves as a direct financial benefit to the organization or affiliated groups.

Reputation and Goodwill: Enhanced public image and increased donor trust and engagement, possibly translating to more donations or support.

Cost Benefit Analysis Methodology

The methodology for conducting a CBA involves several steps, ensuring a comprehensive evaluation of each project or initiative.

Define the project's scope, objectives, and timeline.

Identify all relevant costs and benefits, both direct and indirect.

Quantify costs and benefits using monetary terms where possible.

Consider the time value of money by discounting future cash flows to present value.

Assess non-monetary benefits and costs, possibly using scoring techniques to account for qualitative factors.

Compare total costs with total benefits to determine net benefits or the benefit-cost ratio (BCR).

Discounting Future Values

When determining the present value of future benefits and costs, nonprofits must select an appropriate discount rate. This rate reflects the opportunity cost of capital or prevailing interest rates, adjusted for risk factors associated with the nonprofit's operations. Setting the discount rate is crucial, as it could significantly impact the analysis

Case Study Analysis

To illustrate the process, consider a nonprofit organization planning to implement a health education program in a developing region. The anticipated costs include staff salaries, educational materials, and travel expenses, totaling $100,000. The benefits, though harder to quantify, include improved health outcomes leading to increased productivity and reduced healthcare costs estimated at $150,000 in present value.

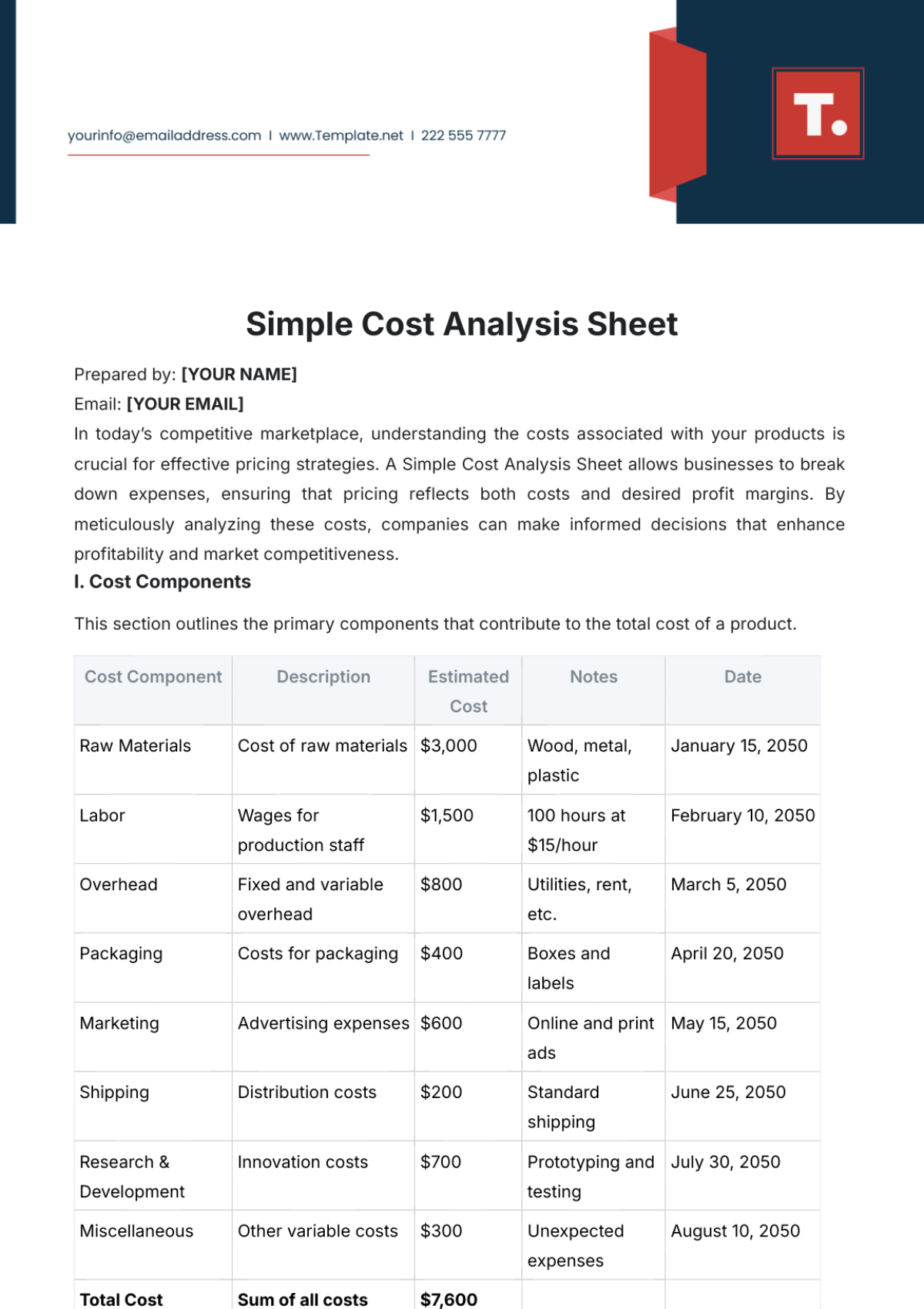

Items | Cost (USD) | Benefit (USD) |

|---|---|---|

Staff Costs | 40,000 | - |

Materials | 30,000 | - |

Travel Expenses | 30,000 | - |

Improved Health Outcomes | - | 150,000 |

The calculated benefit-cost ratio is 1.5, indicating that the benefits outweigh the costs, and the project is viable and strategically advantageous.

Conclusion

Cost Benefit Analysis is an indispensable tool for nonprofits seeking to allocate finite resources efficiently and justify decisions to stakeholders. Through diligent application of CBA, these organizations can ensure that they maximize their social impact per dollar spent, aligning with their mission while fostering donor confidence and supporting sustainable development initiatives.