Free Zero-Based Budget Tracker Template

Zero-Based Budget Tracker

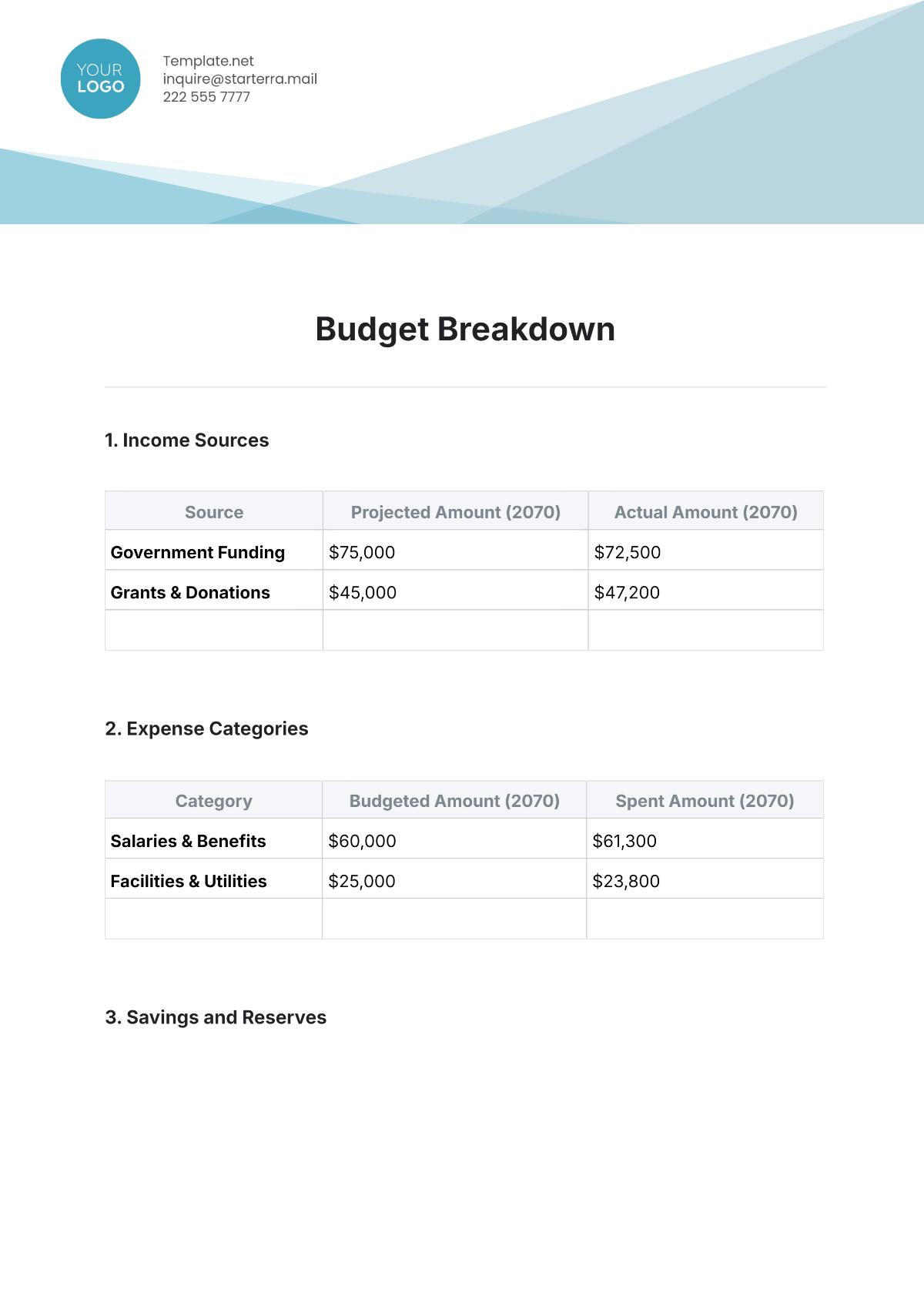

Income

The income section lists all sources of monthly income. This can include salary, rental income, side business earnings, and any other income streams.

Source | Amount ($) |

|---|---|

Salary | 3000 |

Rental Income and Freelance Work | 1400 |

Expenses

This section of the tracker breaks down your monthly expenses. Categorize expenses into fixed and variable to pinpoint where adjustments can be made.

Category | Amount ($) |

|---|---|

Rent | 1000 |

Utilities and Transportation | 350 |

Groceries and Entertainment | 400 |

Savings and Debt Repayment

In this part of the budget tracker, please consider setting aside a portion of your income toward savings and/or debt repayment. Prioritizing savings and implementing a strategy for debt repayments can lead to long-term financial health and stability.

Purpose | Amount ($) |

|---|---|

Emergency Fund and Retirement Savings | 350 |

Credit Card Debt | 250 |

Summary

At the end of each month, use the summary section to compare planned versus actual spending. This practice helps in identifying spending trends and adjusting monthly forecasts accordingly.

Section | Planned ($) | Actual ($) | Difference ($) |

|---|---|---|---|

Income | 4400 | 4400 | 0 |

Expenses | 1750 | 1800 | -50 |

Savings & Debt Repayment | 600 | 700 | -100 |

Prepared by: [YOUR NAME], [YOUR COMPANY NAME]