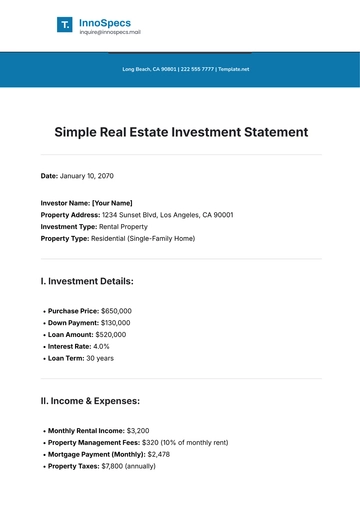

Simple Real Estate Investment Statement

Date: January 10, 2070

Investor Name: [Your Name]

Property Address: 1234 Sunset Blvd, Los Angeles, CA 90001

Investment Type: Rental Property

Property Type: Residential (Single-Family Home)

I. Investment Details:

Purchase Price: $650,000

Down Payment: $130,000

Loan Amount: $520,000

Interest Rate: 4.0%

Loan Term: 30 years

II. Income & Expenses:

Monthly Rental Income: $3,200

Property Management Fees: $320 (10% of monthly rent)

Mortgage Payment (Monthly): $2,478

Property Taxes: $7,800 (annually)

Insurance: $1,200 (annually)

Maintenance/Repairs: $250 (monthly)

Utilities (if applicable): $150 (monthly, tenant pays some utilities)

III. Cash Flow Summary:

Total Monthly Income: $3,200

Total Monthly Expenses: $3,198

Net Monthly Cash Flow: $2

IV. Projected Returns:

Cap Rate: 5.0%

Formula: Net Operating Income / Property Value

NOI: $3,200 (monthly rent) x 12 = $38,400 annually

Cap Rate = $38,400 / $650,000 = 0.059 or 5.0%

Cash-on-Cash Return: 7.0%

Formula: Net Income / Total Investment

Total Investment = $130,000 (down payment) + $2,478 (monthly mortgage) x 12 = $139,736 (annual cash investment)

Cash-on-Cash Return = $2 x 12 / $130,000 = 0.07 or 7.0%

Total ROI (Return on Investment): 9.5%

Formula: Total Profit / Total Investment

Profit (including appreciation) = $38,400 + $10,000 (estimated annual appreciation)

ROI = $48,400 / $650,000 = 0.074 or 9.5%

VI. Appreciation & Equity Build-up:

Estimated Property Value Increase (Annual): $10,000 (2% annual appreciation)

Equity Build-Up (Year 1): $7,072 (based on principal paid down in the first year of the mortgage)

VII. Exit Strategy:

Prepared by:

[Your Name]

[Your Name]

Investor

Real Estate License #: 12345678

Statement Templates @ Template.net

[Your Name]

[Your Name]