Free Financial Planning Gap Analysis

Prepared By: [YOUR NAME]

Date: July 1, 2050

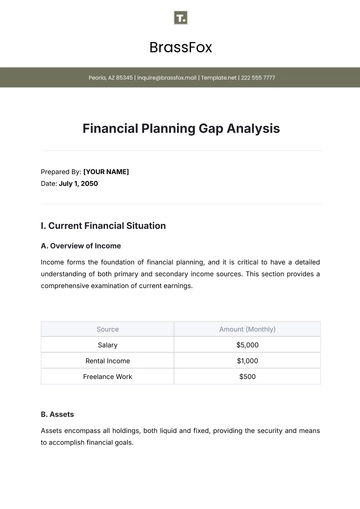

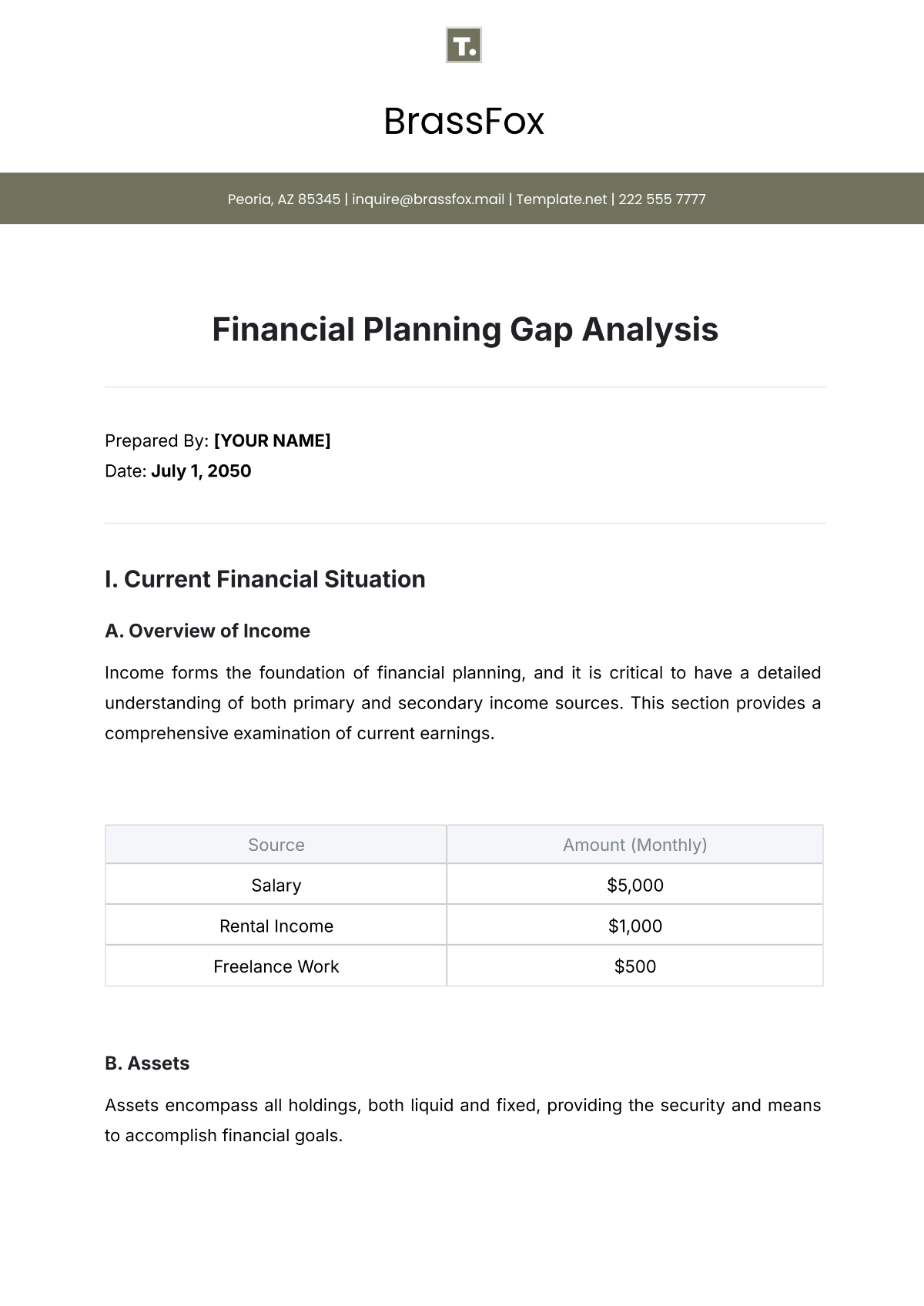

I. Current Financial Situation

A. Overview of Income

Income forms the foundation of financial planning, and it is critical to have a detailed understanding of both primary and secondary income sources. This section provides a comprehensive examination of current earnings.

Source | Amount (Monthly) |

|---|---|

Salary | $5,000 |

Rental Income | $1,000 |

Freelance Work | $500 |

B. Assets

Assets encompass all holdings, both liquid and fixed, providing the security and means to accomplish financial goals.

Category | Amount |

|---|---|

Checking Account | $10,000 |

Savings Account | $25,000 |

Investment Portfolio | $50,000 |

Real Estate | $200,000 |

Liabilities

Understanding liabilities is crucial as they represent existing financial obligations that must be strategically managed.

Liability | Amount |

|---|---|

Mortgage | $150,000 |

Car Loan | $15,000 |

Credit Card Debt | $3,000 |

Student Loan | $20,000 |

Expenses

Expenses are recurring costs that reduce the availability of disposable income. This analysis categorizes expenditures to facilitate effective budgeting.

Expense | Amount (Monthly) |

|---|---|

Housing | $1,500 |

Utilities | $300 |

Groceries | $500 |

Transportation | $200 |

Entertainment | $150 |

Insurance | $250 |

II. Goals and Objectives

Having specific, measurable goals is essential for crafting a financial strategy. The primary objectives include:

Retirement: Accumulate $1 million in retirement savings by age 65.

Savings Targets: Establish an emergency fund covering 6 months of expenses (~$18,000).

Investment Returns: Achieve annual investment growth of at least 7%.

III. Gap Identification

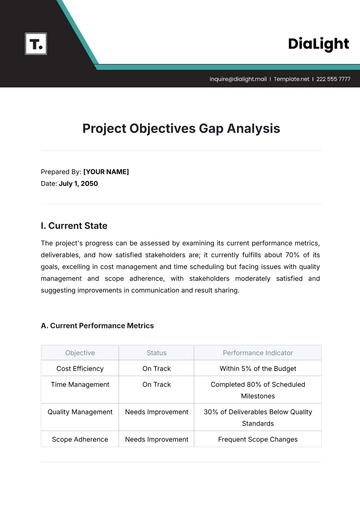

This section identifies the discrepancies between the current financial situation and the targeted goals.

Retirement Savings: Currently, with $50,000 in savings, there remains a shortfall of $950,000.

Emergency Fund: With $10,000 in savings, an additional $8,000 needs to be allocated to the emergency fund.

Investment Returns: The current growth rate falls short of the desired 7% threshold, averaging around 5%.

IV. Action Plan

To address the identified gaps, the following actionable steps are recommended:

Increase Retirement Contributions: Enroll in a higher contribution rate for the retirement plan to accelerate savings.

Build Emergency Savings: Allocate $500 monthly to rapidly build up the emergency fund within 16 months.

Diversify Investments: Consult with a financial advisor to recalibrate the investment portfolio aimed at higher returns through balanced risk exposure.

V. Timeline

The timeline outlines the expected horizon to close the financial planning gaps and achieve set objectives.

Retirement Savings: Aim to close the gap over the next 20 years through structured saving and investment.

Emergency Fund: Projected completion within 16 months by maintaining disciplined contributions.

Investment Returns: Expected to adjust over the next 5 years after strategic reallocation of the portfolio.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Unlock the potential of your financial strategy with the Financial Planning Gap Analysis Template from Template.net. This editable and customizable tool allows you to pinpoint financial gaps and create effective improvement plans. Easily adaptable to suit your unique needs, it’s designed for seamless integration with our Ai Editor Tool, enabling quick adjustments. Whether you're refining budgets or optimizing forecasts,