Real Estate Vacancy Report Statement

Date June 12, 2080

[Your Company Name]

1. Overview

The real estate market is undergoing significant transformations, driven by macroeconomic shifts and evolving consumer preferences. This report provides an in-depth analysis of these dynamics, focusing on their impact on vacancy rates across residential, commercial, and industrial sectors. By examining current trends and future projections, this report aims to offer a comprehensive view of the market landscape.

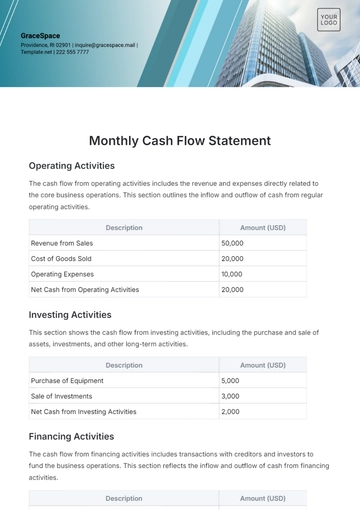

2. Vacancy Rates Analysis

The analysis of vacancy rates plays a crucial role in understanding the health of the market and identifying emerging opportunities. The following is a detailed breakdown of current vacancy rates across key sectors:

Residential

Recent data suggests a moderate uptick in residential vacancies, primarily due to increased construction activity and shifting demographic patterns, such as urban migration and changing household sizes. This trend reflects evolving housing demands, as more people seek affordable living options in both urban and suburban areas.

Commercial

Commercial real estate is experiencing a mixed performance. While retail vacancies have seen an increase, reflecting the ongoing shift towards online shopping and changing consumer habits, office space occupancy has remained relatively stable or even positive in certain markets. This indicates continued demand for flexible workspaces and office environments that cater to post-pandemic hybrid work models.

Industrial

Industrial property vacancies remain notably low, driven by robust demand in the logistics and distribution sectors. E-commerce growth and the ongoing reorganization of global supply chains are key factors in maintaining high occupancy rates in warehouses, fulfillment centers, and manufacturing spaces.

3. Market Trends

Several key trends are influencing the current real estate market:

Migration Trends: Demographic shifts, particularly migration from urban to suburban areas, are directly affecting vacancy rates across both residential and commercial spaces. These trends highlight changing preferences for more space and proximity to nature, especially post-pandemic.

Technological Advancements: Innovations such as smart buildings, automation, and digital real estate tools are reshaping the demand for various property types. Properties that incorporate cutting-edge technology are increasingly in demand, particularly among tenants seeking energy efficiency and enhanced workplace environments.

Changes in Financing Options: The evolving landscape of financing, with greater access to flexible lending options, is impacting purchasing power. Developers and investors are adapting to new financing models, which may influence demand and supply across different property sectors.

4. Future Projections

Looking ahead, we expect further market adjustments as developers, investors, and consumers continue to respond to emerging trends. While residential vacancies may stabilize due to growing housing demands, commercial spaces may face continued challenges in retail, though office spaces could see growth in specific urban markets. Industrial properties will likely continue to see strong demand, particularly in logistics-heavy regions. Overall, market stability will hinge on how well stakeholders can adapt to the ongoing economic shifts and technological advancements.

For further insights and detailed analysis, stakeholders are encouraged to reach out to the report analysts directly.

Statement Templates @ Template.net