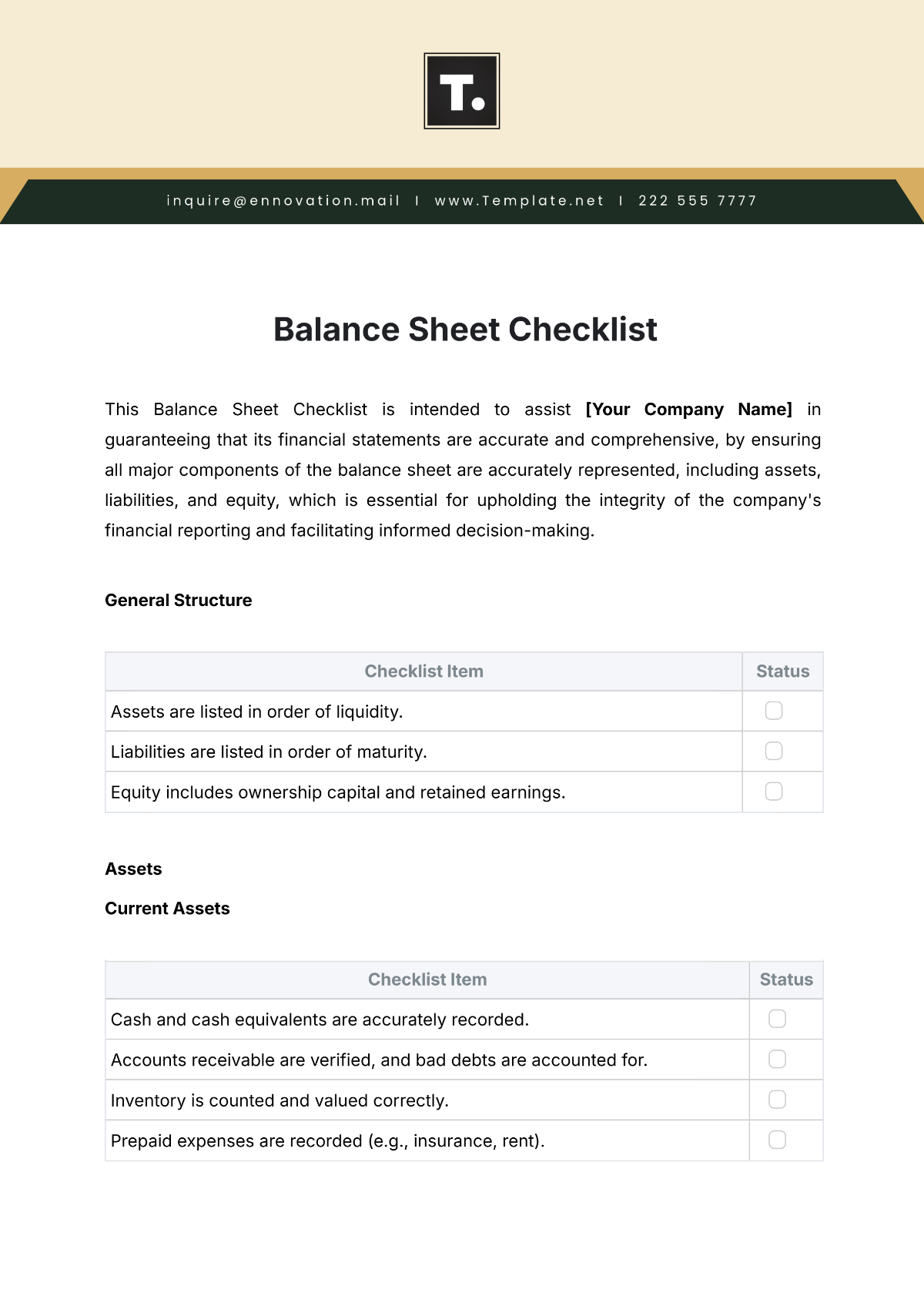

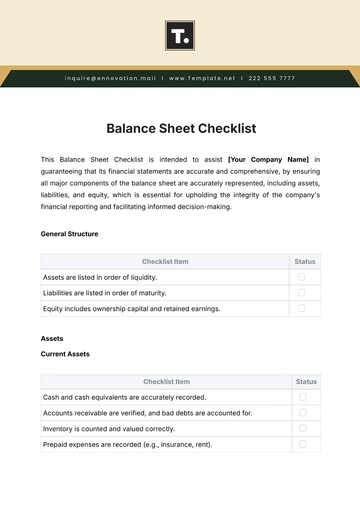

Balance Sheet Checklist

This Balance Sheet Checklist is intended to assist [Your Company Name] in guaranteeing that its financial statements are accurate and comprehensive, by ensuring all major components of the balance sheet are accurately represented, including assets, liabilities, and equity, which is essential for upholding the integrity of the company's financial reporting and facilitating informed decision-making.

General Structure

Checklist Item | Status |

|---|

Assets are listed in order of liquidity. | |

Liabilities are listed in order of maturity. | |

Equity includes ownership capital and retained earnings. | |

Assets

Current Assets

Checklist Item | Status |

|---|

Cash and cash equivalents are accurately recorded. | |

Accounts receivable are verified, and bad debts are accounted for. | |

Inventory is counted and valued correctly. | |

Prepaid expenses are recorded (e.g., insurance, rent). | |

Non-Current Assets

Checklist Item | Status |

|---|

PP&E is recorded at cost, less accumulated depreciation. | |

Intangible assets are accounted for, including amortization. | |

Long-term investments are verified and valued. | |

Other non-current assets, including deferred tax assets, are recorded. | |

Liabilities

Current Liabilities

Checklist Item | Status |

|---|

Accounts payable include all outstanding bills and obligations. | |

Short-term borrowings are included. | |

Accrued liabilities, such as wages and taxes, are recorded. | |

Deferred revenue is recorded accurately. | |

Other current liabilities are identified and included. | |

Non-Current Liabilities

Checklist Item | Status |

|---|

Long-term debt is recorded (e.g., loans, bonds). | |

Deferred tax liabilities are included. | |

Pension liabilities are accurately reflected. | |

Other long-term obligations are included. | |

Equity

Checklist Item | Status |

|---|

Share capital is correctly recorded, including par value. | |

Retained earnings are updated with net income and dividends. | |

Additional paid-in capital is verified. | |

Other equity items, such as treasury stock, are included. | |

Reconciliation

Checklist Item | Status |

|---|

Verify that Assets = Liabilities + Equity. | |

Check for mathematical errors or misclassifications. | |

Compare with prior period balances to identify discrepancies. | |

Ensure compliance with accounting standards (e.g., GAAP, IFRS). | |

Notes and Disclosures

Checklist Item | Status |

|---|

Significant accounting policies are disclosed. | |

Contingent liabilities are identified and disclosed. | |

Related party transactions are disclosed. | |

Subsequent events are disclosed if applicable. | |

Audit and Review

Checklist Item | Status |

|---|

Internal controls for recording and verification are reviewed. | |

Audit adjustments are incorporated. | |

Management has reviewed and approved the balance sheet. | |

Miscellaneous

Checklist Item | Status |

|---|

Currency conversion is accurate for foreign operations. | |

Figures align with the income statement (e.g., retained earnings). | |

Tax provisions, including deferred taxes, are accounted for. | |

Notes:

Ensure that all assets and liabilities are correctly classified as current or non-current.

Verify the balance sheet equation: Assets = Liabilities + Equity.

Keep invoices, bank statements, and loan agreements handy for reference and validation.

Sheet Templates @ Template.net