Board of Director Charter Document

1. Introduction

The Board of Directors (the “Board”) of [Your Company Name] is committed to overseeing the strategic direction, management, and policies that govern the operations of the company. This Charter sets out the responsibilities, governance structure, and expectations of the Board to ensure that [Your Company Name] operates in a manner that aligns with its mission, objectives, and best practices of corporate governance.

The Charter serves as a guiding document that defines the roles, responsibilities, and authority of the Board members. It also establishes the foundation for the Board's operations and ensures alignment with stakeholders, including shareholders, employees, and the broader community. By creating this comprehensive Charter, the Board ensures that there is transparency, accountability, and effective governance in place, which is critical for achieving the company’s long-term success.

1.1 Purpose of the Board Charter

The purpose of this Board of Directors Charter is to:

Provide a clear and concise framework for the Board’s responsibilities, operations, and governance.

Establish policies and guidelines for Board activities to ensure uniformity and fairness in decision-making.

Enhance accountability and transparency in the company’s management, making sure that all stakeholders are treated equitably.

Foster a culture of ethical behavior, respect, and good governance in all aspects of the company’s operations.

This Charter is intended to help the Board fulfill its duty to oversee the management and strategic direction of the company effectively and to protect the long-term interests of shareholders and other stakeholders. By defining the roles and responsibilities clearly, the Board can minimize ambiguity and ensure that the company operates in compliance with legal, ethical, and regulatory standards.

2. Role and Responsibilities of the Board

2.1 Overview

The Board is primarily responsible for ensuring that [Your Company Name] operates effectively, efficiently, and ethically. It provides oversight and strategic direction while delegating the day-to-day management of the company to the executive team. The Board is also responsible for ensuring that the company remains financially viable and resilient in a rapidly changing global market.

The Board’s responsibilities go beyond legal compliance and corporate governance; it also includes protecting the interests of shareholders, guiding executive management, and ensuring the company’s long-term sustainability. The Board is also tasked with fostering innovation, driving growth, and ensuring the alignment of all operations with the company’s values and long-term vision.

2.2 Key Responsibilities

The primary responsibilities of the Board include, but are not limited to:

2.2.1 Strategic Direction

Approving the company’s strategic goals, vision, and mission to ensure the company stays on track for growth and expansion. This may include setting long-term objectives such as entering new markets, increasing revenue by [20%] over the next [5] years, or introducing innovative products that meet market demands.

Providing oversight on the implementation of corporate strategies and initiatives to ensure alignment with the company’s goals. The Board must regularly review strategic plans, market trends, and performance data to make informed decisions.

Ensuring that management aligns operational activities with the long-term goals of the company, including the allocation of capital and resources to support strategic initiatives. The Board must work closely with the CEO and senior management to monitor progress on key initiatives and resolve any barriers to success.

2.2.2 Financial Oversight

Ensuring the integrity of financial statements and reporting, including reviewing financial reports, audit findings, and compliance with accounting standards such as Generally Accepted Accounting Principles (GAAP). The Board must confirm that the company’s financial health is monitored, with annual revenue of at least [$200 million] and a growth rate of [10%] year-over-year.

Overseeing risk management and internal control systems to ensure that financial risks, such as liquidity issues, credit risks, and operational risks, are identified and mitigated. The Board should establish risk tolerance levels, ensuring that the company can manage risks without jeopardizing its long-term strategy.

Approving the annual budget and financial plans, including capital expenditures, and ensuring the company’s financial operations are conducted in compliance with all regulatory requirements.

2.2.3 Corporate Governance

Ensuring compliance with laws, regulations, and corporate governance best practices. The Board is tasked with ensuring that the company operates transparently and ethically, adhering to international standards of corporate governance and legal requirements such as the Sarbanes-Oxley Act in the United States.

Appointing and evaluating the performance of the Chief Executive Officer (CEO). The CEO’s performance will be reviewed annually, with clear metrics based on business outcomes such as revenue growth, market share increase, or improvements in operational efficiency.

Overseeing executive compensation policies and practices to ensure that they align with shareholder interests and are structured to motivate key executives. For example, executive bonuses may be tied to achieving revenue targets of [$500 million] or maintaining a return on equity (ROE) of at least [15%] over a defined period.

Conducting Board performance evaluations and ensuring continuous development of its members. This process will include self-assessments, feedback from management, and identifying opportunities for Board member education to ensure optimal performance.

2.2.4 Risk Management

Identifying and evaluating significant risks, both operational and strategic, that the company may face. This could include market risks, regulatory risks, environmental risks, or cybersecurity threats. The Board should ensure that the company has contingency plans for risk scenarios, such as a significant data breach or supply chain disruption.

Ensuring that appropriate risk management processes are in place and operating effectively. The Board should monitor risk management frameworks and approve major decisions related to risk mitigation strategies, such as allocating [$50 million] to cybersecurity initiatives or forming strategic partnerships with insurance providers.

Overseeing crisis management and mitigation strategies to ensure the company can respond quickly and effectively to unforeseen challenges. For example, in the event of a natural disaster or public relations crisis, the Board should ensure that management has a crisis management plan in place, including the allocation of resources to minimize damage.

2.2.5 Succession Planning

Overseeing the company’s executive succession plan to ensure that key leadership positions are filled in the event of unexpected departures. Succession planning is essential to guarantee business continuity and minimize disruptions. The Board should work with the CEO to identify potential candidates for senior roles and ensure that leadership transitions are managed smoothly.

Ensuring that the company has a robust pipeline for leadership development at all levels, investing in training and mentoring programs to develop future leaders within the organization.

Approving appointments to senior management positions. For instance, if the company is considering hiring a new Chief Financial Officer (CFO), the Board will review the qualifications, experience, and leadership abilities of candidates to ensure that they align with the company’s strategic goals.

2.2.6 Shareholder Relations

Ensuring that the interests of shareholders are prioritized and that the Board is accountable to them. The Board should establish clear communication channels to inform shareholders about major company developments, including earnings reports, mergers and acquisitions, and new product launches.

Maintaining effective communication with shareholders and stakeholders, including annual general meetings, investor briefings, and earnings calls. The Board will be actively involved in managing investor relations, ensuring that shareholders are kept informed and their concerns are addressed promptly.

Approving major capital expenditures, mergers, acquisitions, and other significant investments. The Board will conduct thorough due diligence on potential investments and acquisitions to ensure they align with the company’s long-term goals. For example, if the company is considering acquiring a competitor for [$100 million], the Board will review the financial and strategic benefits of such a move before approval.

3. Composition of the Board

3.1 Board Structure

The Board of [Your Company Name] will consist of a minimum of [5] members and a maximum of [15] members. The composition should include individuals with a diverse range of expertise, skills, and experiences, including but not limited to:

Financial expertise to evaluate complex financial data and make informed decisions on investments, budgeting, and financial strategy.

Legal and regulatory knowledge to ensure compliance with applicable laws and navigate the complex legal landscape in which the company operates.

Industry-specific knowledge to provide valuable insights into market trends, customer demands, and competitor strategies.

Strategic management skills to contribute to long-term planning, operational efficiency, and performance enhancement.

Risk management expertise to guide the company in identifying and mitigating potential risks.

International business experience to ensure that the company can expand into new markets and manage the challenges of global operations.

3.2 Independence of Board Members

The Board will ensure that a majority of its members are independent. Independent directors are those who are free of any relationships that could compromise their ability to exercise independent judgment. The independence of directors is assessed at least annually, and the Board will publicly disclose the results of such assessments.

3.2.1 Independent Director Criteria

To qualify as an independent director, the following criteria must be met:

No direct or indirect material relationship with the company, including any financial interest that could create a conflict of interest.

No financial interest in the company beyond Board compensation and stock ownership. For instance, an independent director may not own more than [5%] of the company’s outstanding shares.

No significant business or personal relationships with senior management. This ensures that decisions are made objectively without undue influence from management.

No recent employment or consulting arrangements with the company. This ensures that the director is free from any biases that might arise from prior working relationships with the company.

3.3 Chairperson and CEO

The Board will elect a Chairperson who is responsible for leading Board meetings, ensuring effective governance, and facilitating the relationship between the Board and management. The roles of Chairperson and CEO may or may not be separate. In the event that the roles are combined, the Board will ensure that appropriate mechanisms are in place to maintain the Board’s independence.

3.3.1 Role of the Chairperson

Lead Board meetings and ensure effective discussions by fostering an environment where all members can contribute openly and freely.

Represent the company to stakeholders, ensuring that the company’s image is accurately portrayed in external communications.

Serve as a liaison between the Board and the executive team to ensure that the Board’s strategic decisions are effectively communicated and implemented.

Foster a culture of accountability, transparency, and collaboration within the Board, ensuring that all members work together in the best interests of the company.

3.3.2 Role of the CEO

The CEO is responsible for the day-to-day management of the company, overseeing operational activities and executing the strategies approved by the Board.

Report to the Board on company performance, strategy, and operations regularly. This includes presenting key financial and operational metrics, such as quarterly revenues exceeding [$50 million], and providing updates on strategic initiatives.

Implement the strategies approved by the Board, ensuring that all departments are aligned with the company’s objectives.

4. Board Meetings and Attendance

4.1 Frequency of Meetings

The Board shall meet at least [4] times a year, with additional meetings scheduled as necessary. Special meetings may be called by the Chairperson, CEO, or any member of the Board with at least [10] days’ notice. This ensures that the Board remains engaged and has the opportunity to address any emerging issues in a timely manner.

4.2 Quorum Requirements

A quorum for Board meetings shall be the presence of a majority of the Board members, in person or via remote participation. Decisions made in Board meetings must be approved by a majority of the Board members present. For example, if the Board consists of [9] members, at least [5] members must be present for decisions to be valid.

4.3 Attendance Expectations

Directors are expected to attend all Board meetings and actively participate in discussions. Directors must notify the Chairperson and the Secretary of the Board if they are unable to attend a meeting. Regular attendance is crucial for ensuring that decisions are made based on diverse perspectives and input.

4.3.1 Absentee Policy

If a director misses more than [two] consecutive meetings without a valid reason, the Board may consider the director’s removal or request a meeting to discuss the absence. This policy helps ensure that the Board remains fully engaged and that directors meet their responsibilities to the company.

4.4 Meeting Agendas and Materials

The CEO, in consultation with the Chairperson, will prepare the agenda for each meeting. Agenda items will be distributed to Board members at least [7] days prior to the scheduled meeting to allow sufficient time for review. This helps directors come to meetings well-prepared and enables focused, productive discussions.

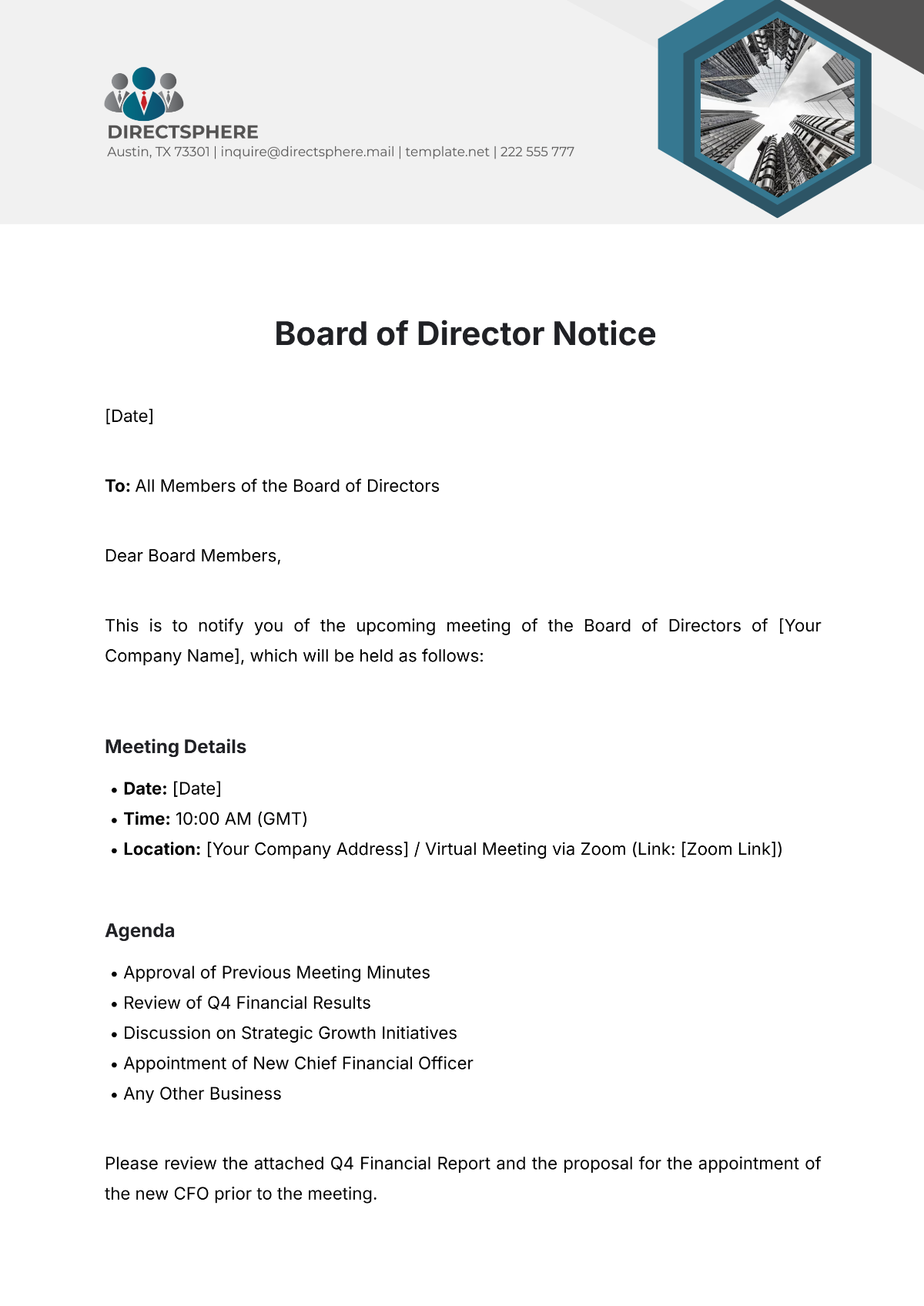

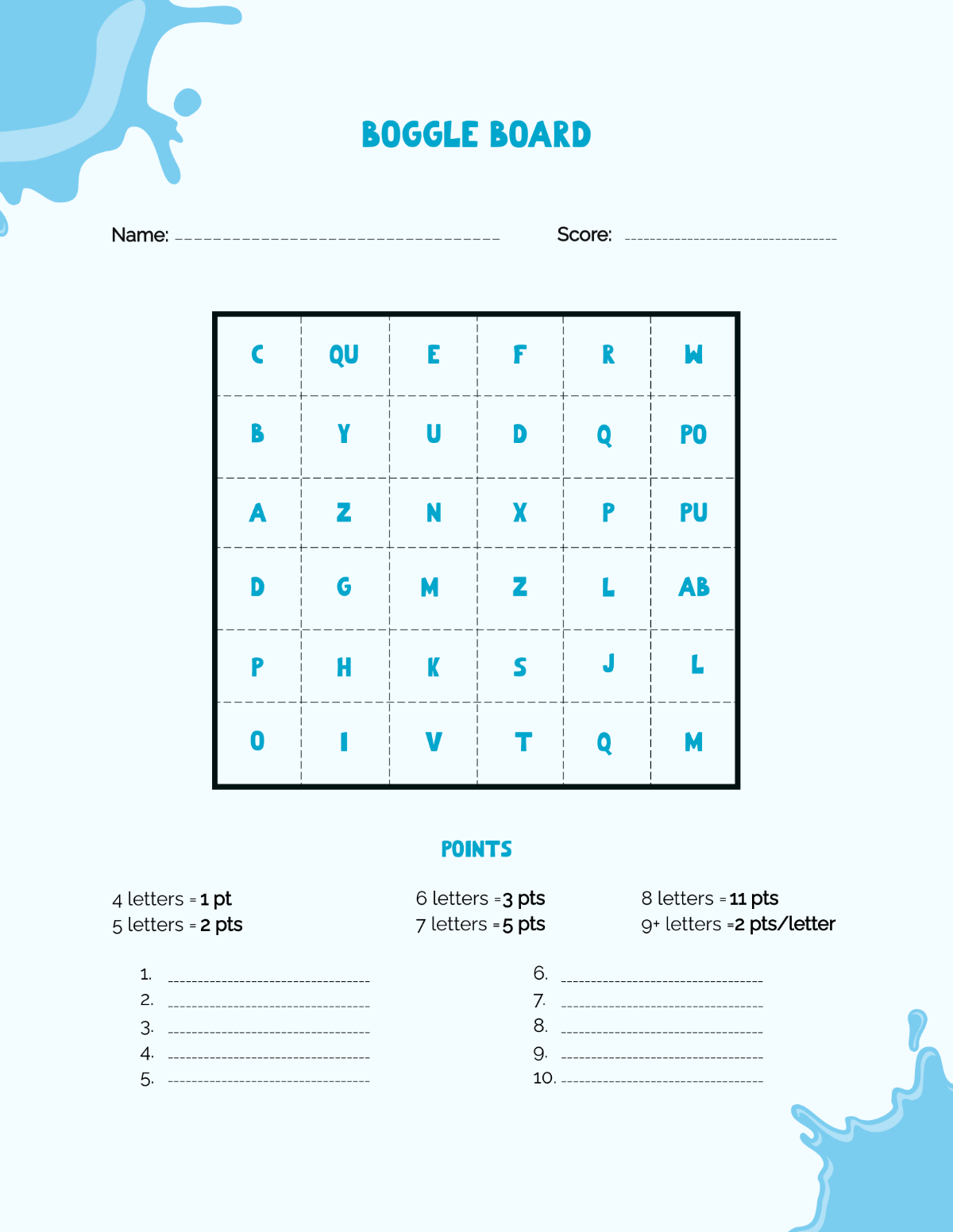

Board Performance Evaluation Metrics

Metric | Rating Scale: 1 = Poor, 5 = Excellent |

|---|---|

Attendance at Meetings | 4 |

Contribution to Discussions | 4.5 |

Committee Participation | 4 |

Leadership and Oversight | 4.5 |

Strategic Guidance and Oversight | 4.8 |

This Board of Director Charter sets the foundation for ensuring effective governance practices at [Your Company Name]. It is designed to guide the Board in fulfilling its responsibilities and uphold the highest standards of corporate oversight for the benefit of the company’s shareholders and stakeholders.

5. Committees of the Board

The Board will establish committees as necessary to fulfill its responsibilities effectively. These committees provide focused oversight in specific areas of the company’s operations, such as audit, compensation, governance, and risk management. Each committee has a clearly defined mandate, and members are appointed based on their expertise and experience relevant to the committee's purpose.

5.1 Audit Committee

The Audit Committee is responsible for overseeing the financial reporting process, the audit of the company’s financial statements, and the internal controls related to financial reporting. The committee’s primary duties include:

Reviewing the company’s financial statements and reports before submission to the Board for approval.

Engaging and overseeing the external auditors, including evaluating their performance and recommending their appointment or removal.

Ensuring that the company’s financial statements comply with all relevant accounting standards, including GAAP or IFRS.

Monitoring internal controls and risk management processes to ensure the integrity of the company’s financial information and its protection from fraud or financial mismanagement.

Reviewing the company’s tax filings and ensuring compliance with tax regulations.

The Audit Committee is composed of at least [3] members, with the majority being independent and having financial expertise. The Chairperson of the Audit Committee must be a financial expert, with in-depth knowledge of accounting practices and financial reporting standards. Meetings of the Audit Committee will occur at least [quarterly], with additional meetings scheduled as needed.

5.1.1 Key Responsibilities of the Audit Committee

Oversee the integrity of the company’s financial reporting process and ensure that financial statements are presented fairly in accordance with accounting standards.

Ensure the independence of the external auditor and review their performance annually.

Discuss the scope and results of audits, including any material findings or recommendations made by the auditors.

Review internal controls and compliance procedures to safeguard the company’s assets and prevent fraud.

5.1.2 Reporting to the Board

The Audit Committee will report to the full Board after each meeting, summarizing key issues discussed and any decisions made. The Audit Committee will also provide a detailed annual report on its activities, including any concerns related to financial reporting or the effectiveness of internal controls.

5.2 Compensation Committee

The Compensation Committee is tasked with establishing and overseeing the compensation policies for senior executives and other key employees of the company. The committee’s key responsibilities include:

Developing and recommending the company’s executive compensation philosophy, including salary structures, bonuses, stock options, and other incentive programs.

Reviewing the performance of the CEO and other senior executives to determine appropriate compensation adjustments or bonuses based on the achievement of performance goals and company performance.

Ensuring that compensation practices align with the long-term interests of shareholders and the company’s overall strategy.

Approving compensation packages for new executives or changes to the compensation of existing executives.

The Compensation Committee is composed of at least [3] members, all of whom must be independent directors. The committee should also have expertise in executive compensation and human resource management to ensure that compensation decisions are fair, competitive, and aligned with the company’s objectives.

5.2.1 Key Responsibilities of the Compensation Committee

Develop and implement executive compensation strategies that motivate and retain top talent, ensuring the company’s ability to compete in its industry.

Review compensation programs regularly to ensure they are aligned with company goals and industry standards.

Approve the compensation packages for key executives, including base salary, performance-based incentives, and stock options.

Monitor the effectiveness of executive compensation programs and make adjustments as necessary to meet evolving market conditions.

5.2.2 Reporting to the Board

The Compensation Committee will report to the Board following each meeting and provide a summary of any decisions made regarding executive compensation. The committee will also provide recommendations for significant changes to the compensation structure, including adjustments to the annual bonus pool or long-term incentive plans.

5.3 Nominating and Governance Committee

The Nominating and Governance Committee is responsible for identifying and recommending candidates for Board membership, as well as overseeing the company’s corporate governance practices. Its primary duties include:

Identifying and recommending candidates for appointment to the Board, ensuring that all Board members possess the necessary skills, experiences, and diversity to contribute effectively to governance.

Reviewing and recommending changes to the company’s corporate governance policies and practices, ensuring they comply with relevant laws and regulations.

Conducting an annual evaluation of the Board’s performance, including individual director evaluations and assessments of Board effectiveness.

Overseeing the company’s succession planning processes for the Board and key management roles.

The Nominating and Governance Committee should consist of at least [3] independent directors. The committee should have a balance of experience in governance, human resources, and strategic management to ensure effective oversight and decision-making.

5.3.1 Key Responsibilities of the Nominating and Governance Committee

Develop and maintain policies related to Board member selection, orientation, and evaluation.

Ensure that the Board is composed of directors who collectively bring a broad range of expertise and diverse perspectives.

Evaluate and recommend the removal of directors who are no longer fulfilling their duties or who have conflicts of interest.

Monitor and report on governance trends and best practices to ensure the company remains aligned with evolving governance standards.

5.3.2 Reporting to the Board

The Nominating and Governance Committee will report to the Board after each meeting, providing updates on Board composition, performance evaluations, and governance matters. The committee will also present an annual report to the Board, summarizing the results of the Board performance evaluation and any recommendations for improvements.

5.4 Risk Management Committee

The Risk Management Committee is responsible for overseeing the identification, assessment, and mitigation of risks that could affect the company’s operations, financial performance, or reputation. Its key responsibilities include:

Identifying and assessing the company’s significant risks, including financial, operational, regulatory, environmental, and cybersecurity risks.

Recommending risk management strategies to the Board and ensuring that appropriate mitigation measures are in place.

Overseeing the company’s crisis management and disaster recovery plans to ensure the company is prepared for unforeseen events.

Reviewing the company’s insurance coverage to ensure it adequately addresses identified risks.

The Risk Management Committee is composed of at least [3] members, with expertise in risk management, operations, and legal compliance. The committee should also work closely with the company’s internal audit and legal teams to ensure all risks are appropriately managed.

5.4.1 Key Responsibilities of the Risk Management Committee

Monitor and assess the company’s risk profile regularly, ensuring that significant risks are identified and addressed in a timely manner.

Review and recommend risk management policies and practices that align with the company’s strategic goals.

Ensure that the company has a robust crisis management and business continuity plan in place, including response plans for issues such as data breaches, natural disasters, or product recalls.

5.4.2 Reporting to the Board

The Risk Management Committee will report to the Board regularly, providing updates on the company’s risk landscape and the effectiveness of mitigation strategies. The committee will also provide an annual report to the Board, including a review of key risks and any changes to risk management strategies.

6. Board Performance Evaluation

To ensure continuous improvement, the Board of Directors of [Your Company Name] will engage in a formal annual evaluation process. This evaluation helps the Board assess its effectiveness, identify areas for improvement, and ensure it is fulfilling its responsibilities. The process will include:

Self-assessments by Board members to evaluate their individual contributions, including attendance, participation in discussions, and the quality of their decision-making.

Evaluation of the Board’s overall performance in areas such as governance, strategic oversight, and financial performance.

A review of Board dynamics, including communication between members and the Chairperson, as well as the level of engagement in decision-making.

Feedback from senior management regarding the effectiveness of the Board in providing oversight, support, and guidance to the executive team.

6.1 Performance Evaluation Criteria

The evaluation will focus on several key performance indicators, including:

Attendance: Board members are expected to attend at least [80%] of all meetings each year.

Contributions to Discussions: Directors should actively participate in Board meetings, offering insights, asking questions, and contributing to decision-making.

Commitment: Board members should demonstrate a commitment to the company’s success by reviewing meeting materials in advance and being prepared for meetings.

Strategic Oversight: Directors should assess the company’s performance against its strategic goals, including financial growth, market share, and innovation.

The results of the evaluation will be reviewed by the Nominating and Governance Committee, which will work with the Board to implement any changes or improvements necessary to enhance Board performance.

7. Summary

This Board of Directors Charter outlines the key responsibilities and governance structure of the Board of [Your Company Name]. By adhering to these guidelines and maintaining a commitment to sound governance practices, the Board ensures the company’s success, protects the interests of its stakeholders, and maintains transparency and accountability.

The Board will continue to evolve and adapt its governance framework to meet the changing needs of the company and the broader business environment. By ensuring the proper balance of oversight, strategic direction, and risk management, the Board will guide [Your Company Name] toward achieving its long-term goals and fostering sustainable growth in the years to come.