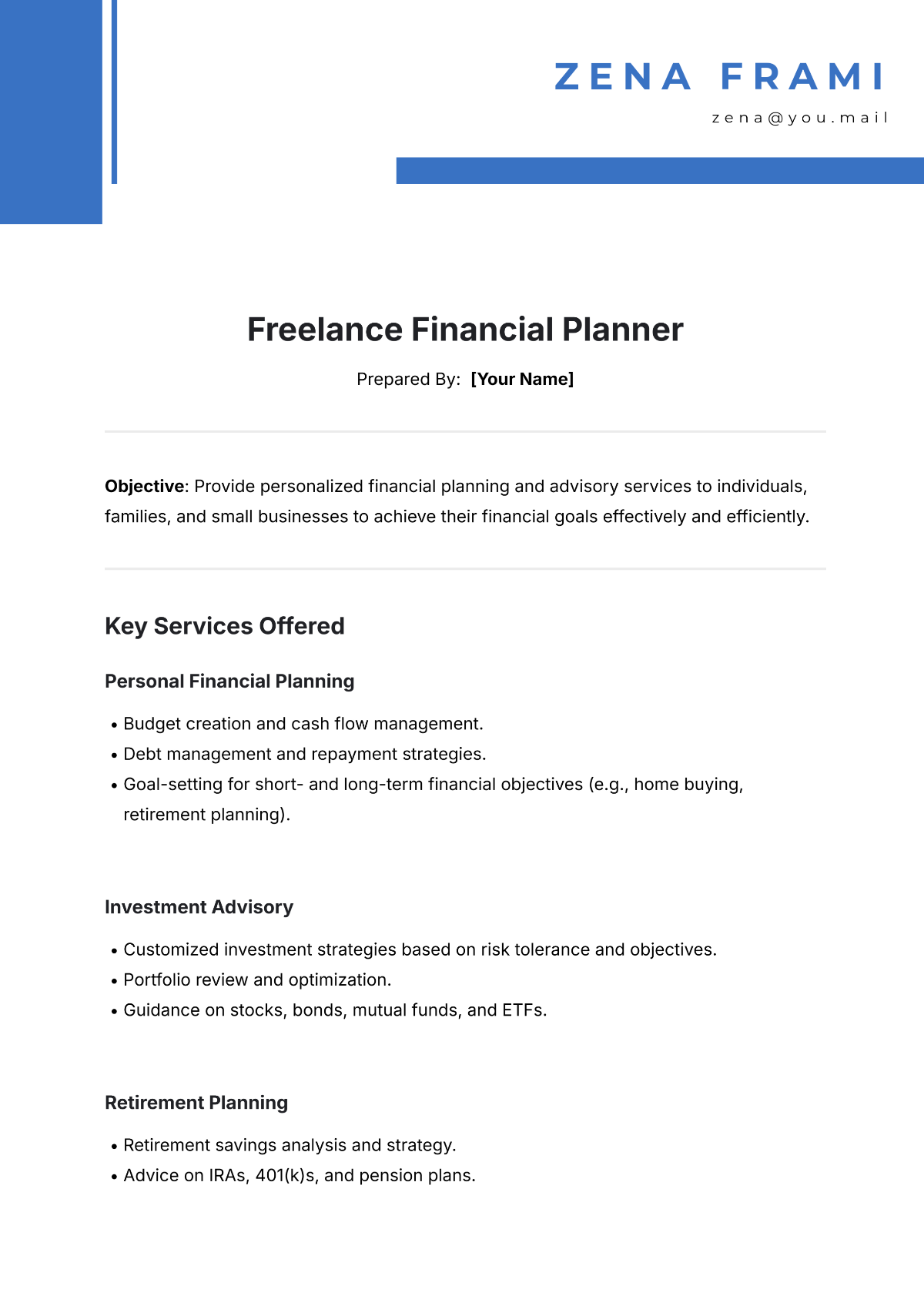

Freelance Financial Planner

Prepared By: [Your Name]

Objective: Provide personalized financial planning and advisory services to individuals, families, and small businesses to achieve their financial goals effectively and efficiently.

Key Services Offered

Personal Financial Planning

Budget creation and cash flow management.

Debt management and repayment strategies.

Goal-setting for short- and long-term financial objectives (e.g., home buying, retirement planning).

Investment Advisory

Customized investment strategies based on risk tolerance and objectives.

Portfolio review and optimization.

Guidance on stocks, bonds, mutual funds, and ETFs.

Retirement Planning

Retirement savings analysis and strategy.

Advice on IRAs, 401(k)s, and pension plans.

Withdrawal planning to minimize taxes and sustain income during retirement.

Tax Optimization Strategies

Advice on tax-advantaged accounts and investments.

Guidance on deductions, credits, and tax-efficient wealth transfer.

Estate and Legacy Planning

Help with wills, trusts, and power of attorney (with legal pros).

Strategies for intergenerational wealth transfer.

Small Business Financial Planning

Cash flow analysis for business operations.

Employee benefits and retirement plan selection.

Tax strategies and succession planning.

Unique Value Proposition

Tailored Solutions: Each client gets a personalized plan for their finances and goals.

Flexibility: Services are available on-demand, with no need for long-term contracts.

Independence: As a freelance planner, I provide unbiased advice without the influence of sales targets or commissions.

Work Process

Initial Consultation: Understand the client's finances, challenges, and goals.

Plan Development: Prepare a detailed financial roadmap.

Implementation Support: Assist in executing the strategies, whether setting up accounts, selecting investments, or collaborating with other professionals.

Ongoing Review: Periodic check-ins to adjust the plan as needed.

Qualifications

Certified Financial Planner (CFP) or equivalent qualification.

[Years] of experience in financial planning and wealth management.

Proficient in financial analysis software and tools.

Excellent communication and interpersonal skills.

Client Engagement Options

Hourly Consultation: For advice on specific financial matters.

Flat-Fee Plans: Comprehensive financial plans for individuals or businesses.

Monthly Retainer: Ongoing advice and portfolio management.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Plan your freelance business finances with ease using Template.net’s Freelance Financial Planner Template. This editable and customizable tool helps freelancers track earnings, plan budgets, and set financial goals. Editable in our AI Editor Tool, it adapts to your specific needs. Stay on top of your financial health and ensure smooth business operations. Download today and take control of your freelance financial planning.

You may also like

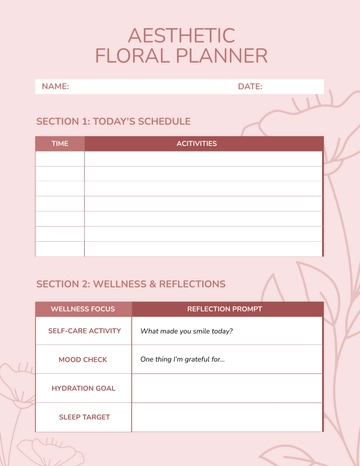

- Aesthetic Planner

- Hourly Planner

- Daily Planner

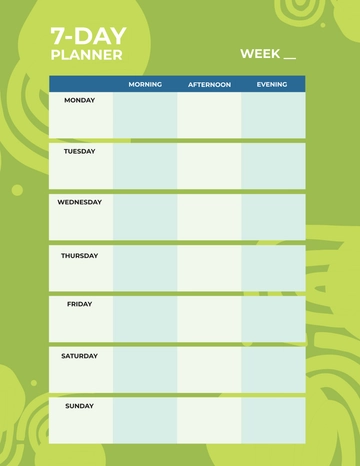

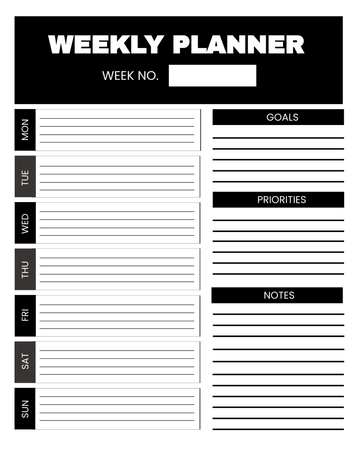

- Weekly Planner

- Monthly Planner

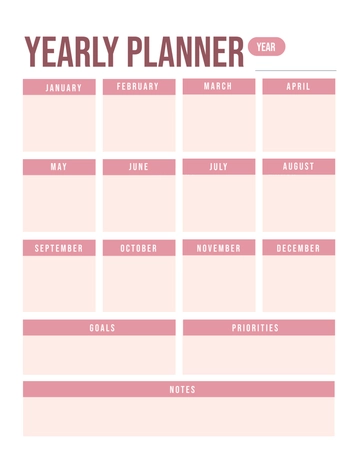

- Planners Yearly

- Event Planner

- Project Planner

- Calendar Planner

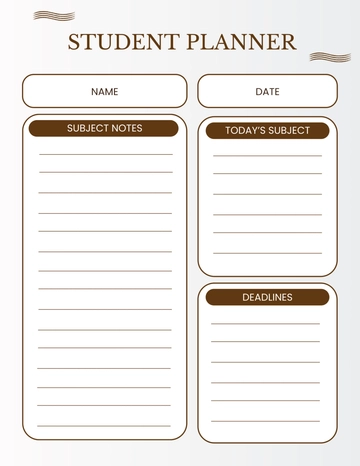

- Student Planner

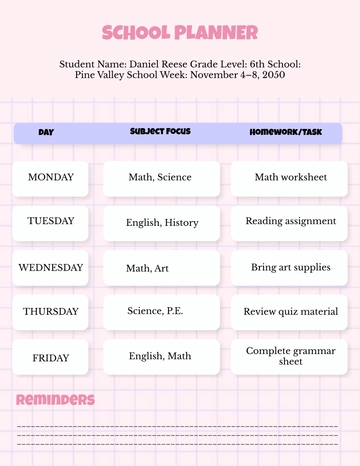

- School Planner

- Teacher Planner

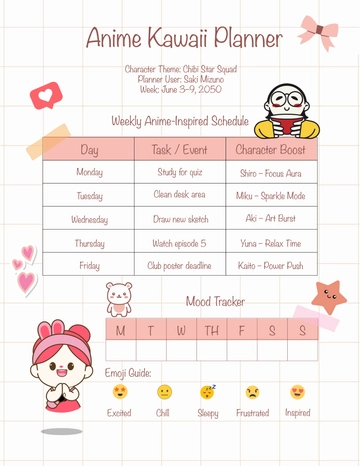

- Kawaii Planner

- Budget Planner

- Life Planner

- Meal Planner

- Study Planner

- Business

- Workout Planner

- Work Schedule Planner

- Party Planner

- Social Media Planner

- Baby Shower Planner

- Book Planner

- Planner Cover

- Debt Planner

- Desk Planner

- Diet Planner

- Family Planner

- Fitness Planner

- Goal Planner

- Health Planner

- Medical Planner

- Holiday Planner

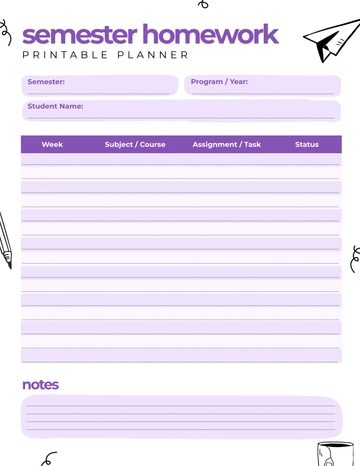

- Homework Planner

- Itinerary Planner

- Journal Planner

- Personal Planner

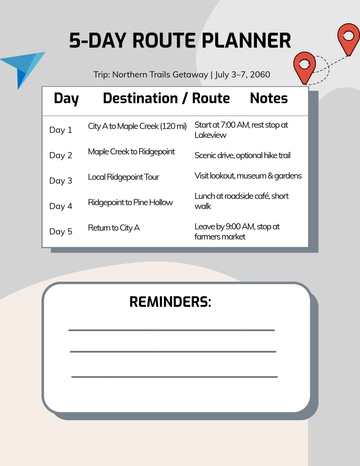

- Route Planner

- Smart Goal Planner

- Travel Planner

- Wedding Planeer