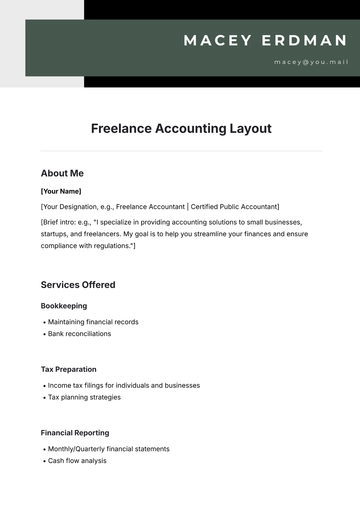

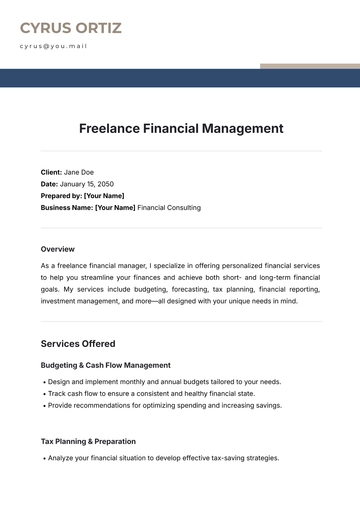

Freelance Financial Management

Client: Jane Doe

Date: January 15, 2050

Prepared by: [Your Name]

Business Name: [Your Name] Financial Consulting

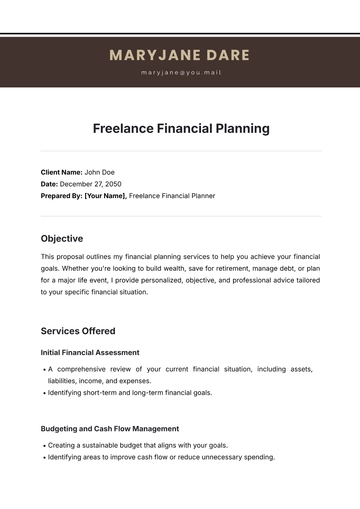

Overview

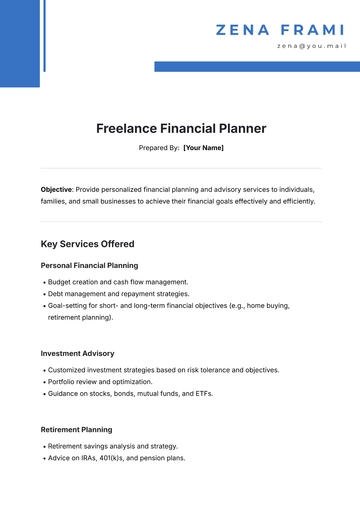

As a freelance financial manager, I specialize in offering personalized financial services to help you streamline your finances and achieve both short- and long-term financial goals. My services include budgeting, forecasting, tax planning, financial reporting, investment management, and more—all designed with your unique needs in mind.

Services Offered

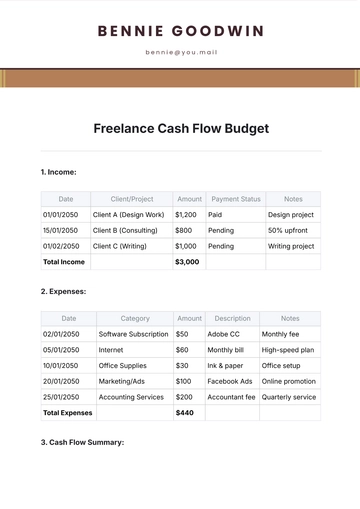

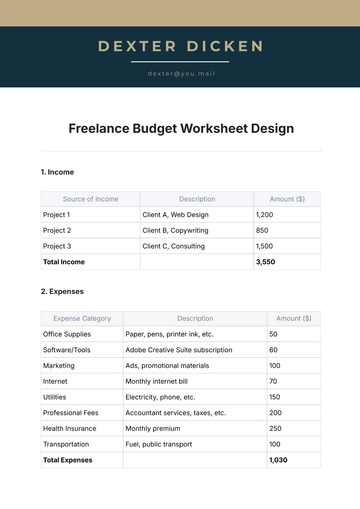

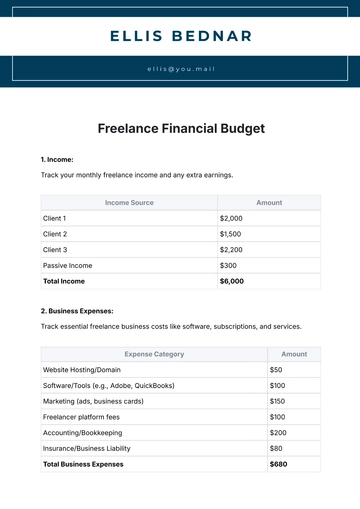

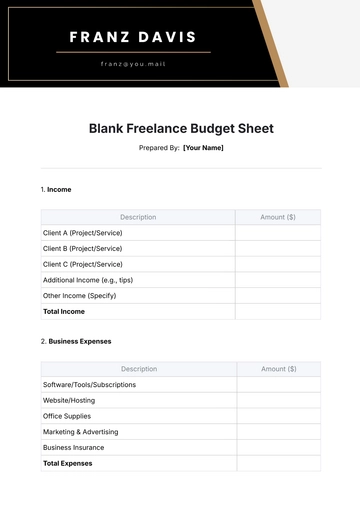

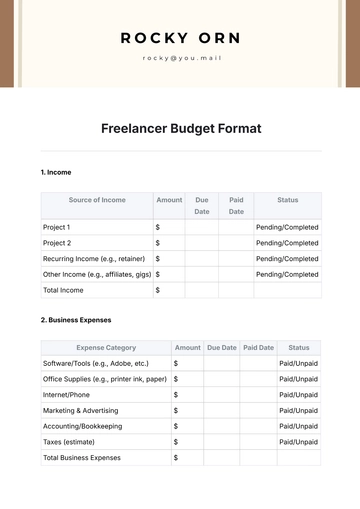

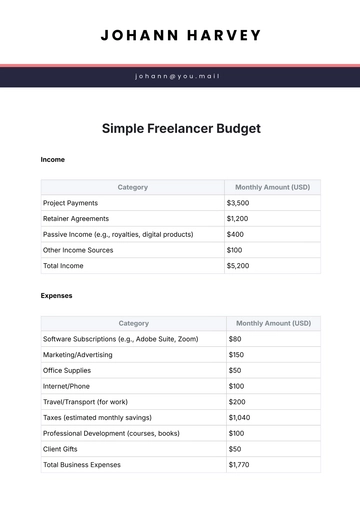

Budgeting & Cash Flow Management

Design and implement monthly and annual budgets tailored to your needs.

Track cash flow to ensure a consistent and healthy financial state.

Provide recommendations for optimizing spending and increasing savings.

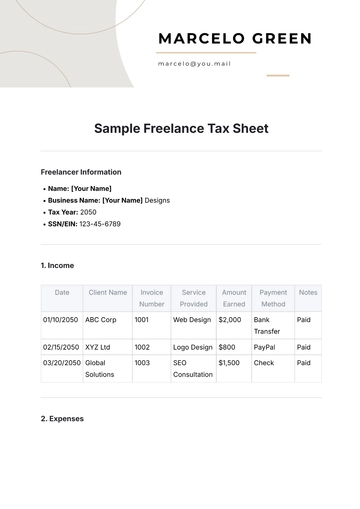

Tax Planning & Preparation

Analyze your financial situation to develop effective tax-saving strategies.

Comply with 2050 tax laws for all returns.

Offer advice on tax-efficient investments, deductions, and credits.

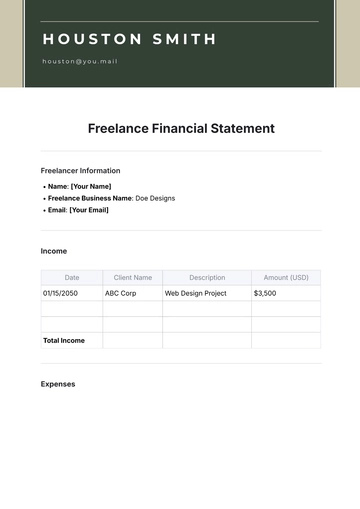

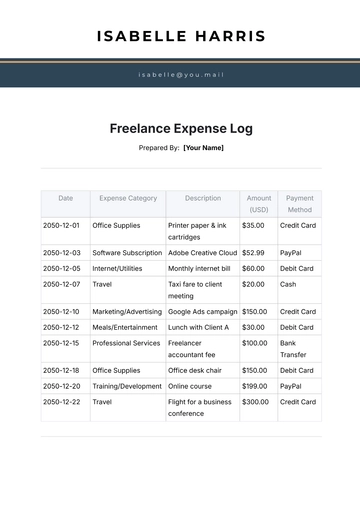

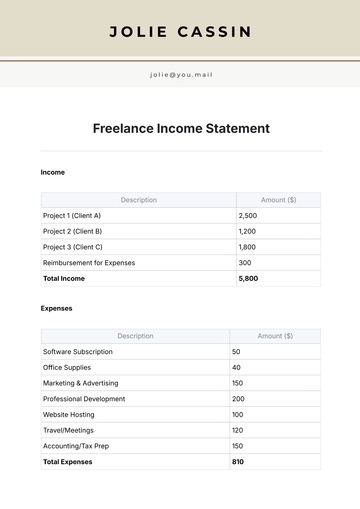

Financial Reporting & Analysis

Provide clear, concise monthly, quarterly, and annual financial statements.

Conduct thorough financial analysis to monitor trends, profitability, and KPIs.

Deliver actionable insights to improve your financial health and performance.

Investment Strategy & Portfolio Management

Design an investment plan aligned with your goals, risk tolerance, and market trends.

Offer ongoing portfolio reviews and adjust investments to ensure optimal returns.

Advise on future market trends and asset allocation strategies to maximize returns.

Debt Management & Credit Counseling

Develop a clear debt management strategy.

Offer strategies to improve your credit score and reduce financial liabilities.

Provide ongoing advice and tools to stay debt-free and financially independent.

Financial Planning & Goal Setting

Establish and prioritize both short-term and long-term financial goals.

Create a financial plan with retirement, estate, and risk management strategies.

Revisit and adjust plans regularly to keep your finances on track.

Project Scope & Timeline

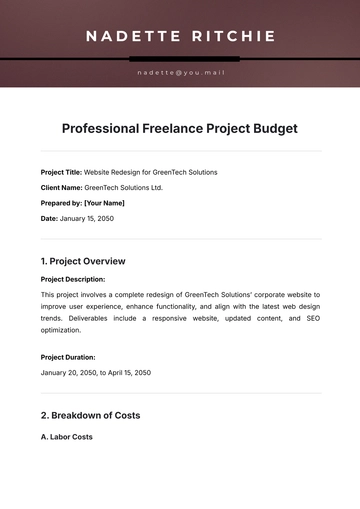

Initial Consultation: A 60-minute discussion to assess your current financial status, outline your goals, and understand your expectations.

Financial Assessment: A detailed review of your financial situation, including income, assets, debts, investments, and tax liabilities.

Ongoing Services: Continuous monthly check-ins to assess progress, provide financial reports, and adjust strategies as needed.

Timeline:

The initial financial assessment will be completed within 1-2 weeks.

Monthly services will begin immediately following the initial consultation and assessment.

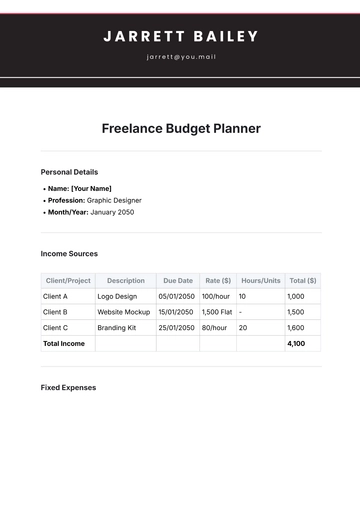

Fee Structure

Hourly Rate: $150 per hour

Flat Rate for Services:

Initial Financial Assessment: $500

Monthly Financial Management: $1,200 per month

Tax Filing Services: $750 per tax year

Additional Services (Investment Management, Reports, etc.): $250 per service

Payment Terms

A 50% deposit is required upon signing the agreement, with the remaining balance due upon completion of each project or at the start of monthly services.

Payment can be made via bank transfer, PayPal, or credit card.

Why Choose Me?

Experience & Expertise: With over 15 years of experience in financial management and consulting, I have helped numerous clients enhance their financial stability and achieve their goals.

Customized Approach: I tailor my services to meet your specific financial needs, ensuring you get the most value out of our collaboration.

Trust & Transparency: I believe in clear, open communication, and will keep you informed every step of the way, ensuring you fully understand your financial position and any decisions made.

Next Steps

Review this proposal and confirm your agreement by January 22, 2050.

Schedule an initial consultation to discuss your financial goals.

Begin working together to create a customized financial management plan.

Contact Information

[Your Name]

Phone: (555) 123-4567

Email: [Your Email]

Website: www.finconsulting.com

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

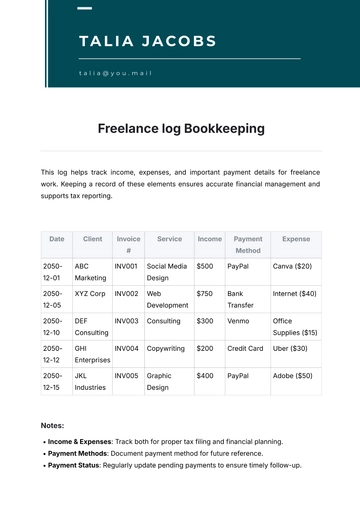

Manage your freelance finances seamlessly with Template.net’s Freelance Financial Management Template. Customizable and editable, it helps track earnings, expenses, and financial goals. Editable in our AI Editor Tool, this template can be personalized to suit your needs. Perfect for freelancers looking to streamline their financial management, it ensures a clear financial overview. Download today and optimize your freelance financial planning.

You may also like

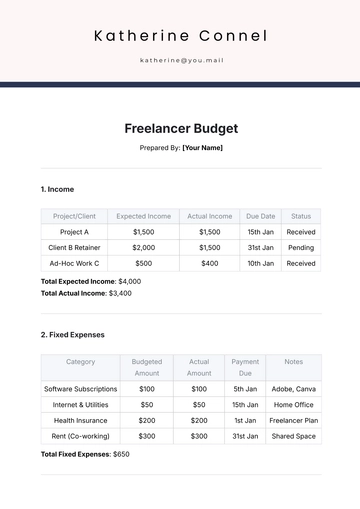

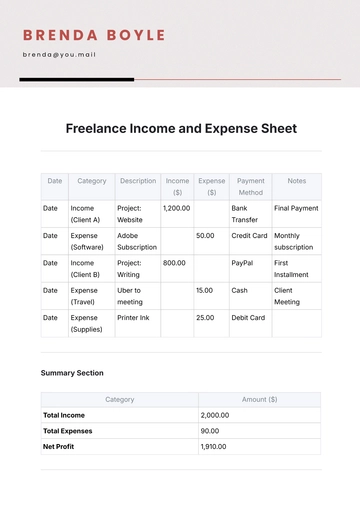

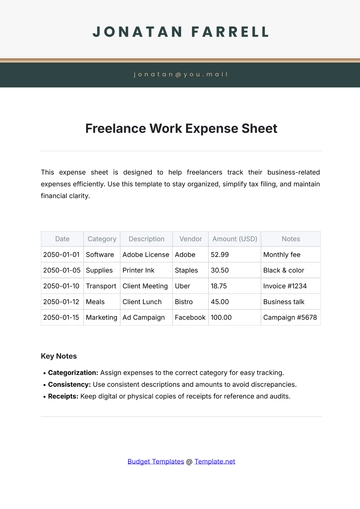

- Budget Sheet

- Personal Budget

- Non Profit Budget

- Monthly Budget

- Project Budget

- HR Budget

- Company Budget

- Home Budget

- Weekly Budget

- College Budget

- Business Budget

- Construction Budget

- Small Business Budget

- Hotel Budget

- Annual Budget

- Home Renovation Budget

- Household Budget

- Student Budget

- Grocery Budget

- Marketing Budget

- Corporate Budget

- Startup Budget

- Manufacturing Budget

- Church Budget

- University Budget

- Annual Budget Plan

- Event Budget

- Operating Budget

- Travel Budget

- Food Budget

- IT and Software Budget

- School Budget

- Real Estate Budget

- Sales Budget

- Conference Budget

- Budget Finance

- Freelancer Budget

- Budget Advertising