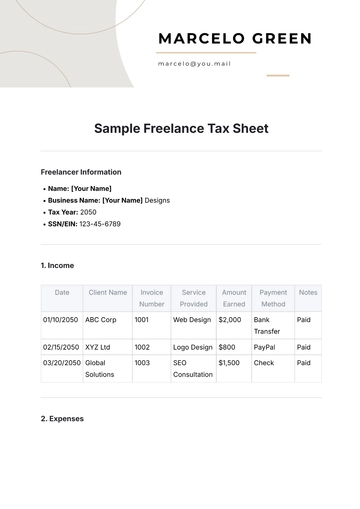

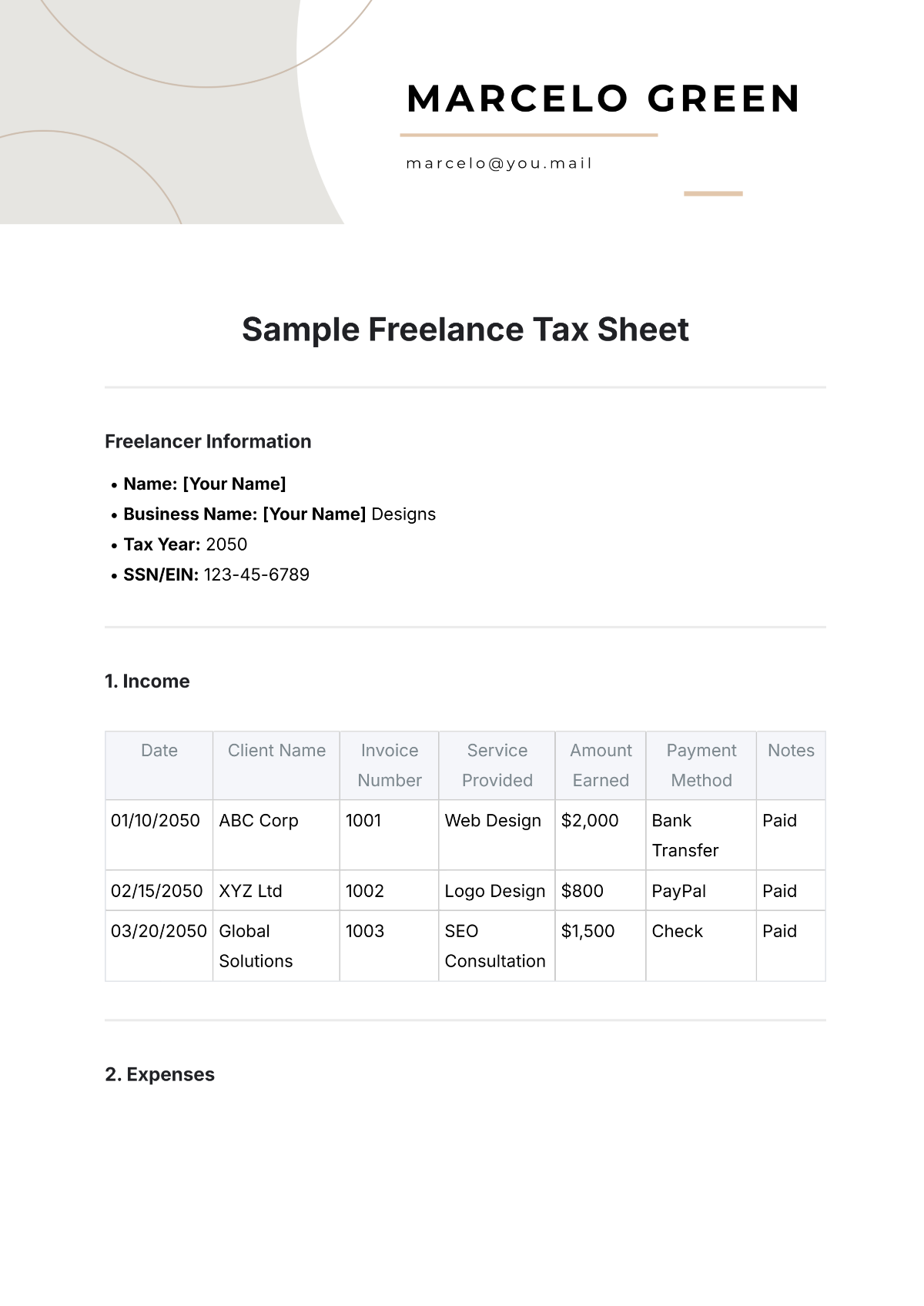

Free Sample Freelance Tax Sheet

Freelancer Information

Name: [Your Name]

Business Name: [Your Name] Designs

Tax Year: 2050

SSN/EIN: 123-45-6789

1. Income

Date | Client Name | Invoice Number | Service Provided | Amount Earned | Payment Method | Notes |

|---|---|---|---|---|---|---|

01/10/2050 | ABC Corp | 1001 | Web Design | $2,000 | Bank Transfer | Paid |

02/15/2050 | XYZ Ltd | 1002 | Logo Design | $800 | PayPal | Paid |

03/20/2050 | Global Solutions | 1003 | SEO Consultation | $1,500 | Check | Paid |

2. Expenses

Date | Vendor Name | Expense Category | Amount Spent | Payment Method | Notes |

|---|---|---|---|---|---|

01/05/2050 | Hosting Co. | Software/Tech | $120 | Credit Card | Annual Hosting |

02/12/2050 | Office Depot | Supplies | $75 | Debit Card | Printer Ink |

03/10/2050 | TaxPro | Professional Fees | $250 | Bank Transfer | Tax Filing |

3. Mileage

Date | Purpose of Travel | Miles Driven | Vehicle Type | Rate per Mile | Total Deduction |

|---|---|---|---|---|---|

01/20/2050 | Client Meeting | 30 miles | Sedan | $0.65 | $19.50 |

03/15/2050 | Conference Travel | 60 miles | SUV | $0.65 | $39.00 |

4. Home Office Deduction

Expense Category | Amount Spent | % of Home Used for Business | Deductible Amount |

|---|---|---|---|

Rent | $1,200/month | 20% | $240 |

Internet | $50/month | 20% | $10 |

5. Self-Employment Taxes

Tax Type | Amount | Notes |

|---|---|---|

Social Security | $5,000 | Based on income |

Medicare | $1,200 | Based on income |

6. Estimated Tax Payments

Date | Payment Made | Amount Paid | Payment Method | Notes |

|---|---|---|---|---|

04/15/2050 | Yes | $1,000 | Check | Q1 Estimated Payment |

06/15/2050 | Yes | $1,000 | Bank Transfer | Q2 Estimated Payment |

09/15/2050 | Yes | $1,000 | PayPal | Q3 Estimated Payment |

7. Total Income and Expenses Summary

Total Income: $4,300

Total Expenses: $745

Net Income (Income - Expenses): $3,555

Self-Employment Tax: $6,200

Estimated Taxes Paid: $3,000

Total Tax Due: $3,200

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Stay organized for tax season with Template.net’s Sample Freelance Tax Sheet Template. Customizable and editable, it helps track tax-related information such as deductions and earnings. Editable in our AI Editor Tool, this template can be easily adjusted to your specific needs. Perfect for freelancers, this tax sheet ensures you’re prepared for tax filing. Download today to manage your freelance tax obligations with ease.

You may also like

- Attendance Sheet

- Work Sheet

- Sheet Cost

- Expense Sheet

- Tracker Sheet

- Student Sheet

- Tracking Sheet

- Blank Sheet

- Information Sheet

- Sales Sheet

- Record Sheet

- Price Sheet

- Plan Sheet

- Score Sheet

- Estimate Sheet

- Evaluation Sheet

- Checklist Sheet

- Bid Sheet

- Call Log Sheet

- Bill Sheet

- Assessment Sheet

- Task Sheet

- School Sheet

- Work From Home Sheet

- Summary Sheet

- Construction Sheet

- Cover Sheet

- Debt Spreadsheet

- Debt Sheet

- Client Information Sheet

- University Sheet

- Freelancer Sheet

- Bookkeeping Sheet

- Itinerary Spreadsheet

- Scorecard Sheet

- Run Sheet

- Monthly Timesheet

- Event Sheet

- Advertising Agency Sheet

- Missing Numbers Worksheet

- Training Sheet

- Production Sheet

- Mortgage Sheet

- Answer Sheet

- Excel Sheet