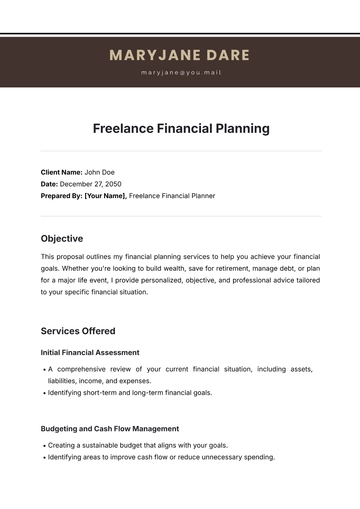

Freelance Financial Planning

Client Name: John Doe

Date: December 27, 2050

Prepared By: [Your Name], Freelance Financial Planner

Objective

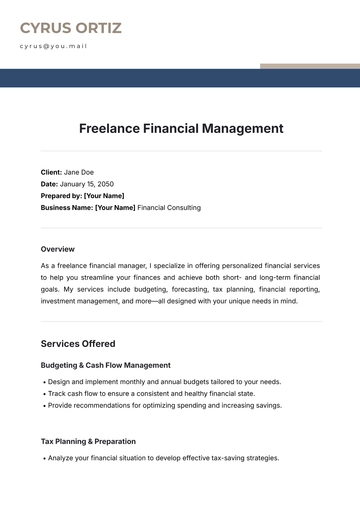

This proposal outlines my financial planning services to help you achieve your financial goals. Whether you're looking to build wealth, save for retirement, manage debt, or plan for a major life event, I provide personalized, objective, and professional advice tailored to your specific financial situation.

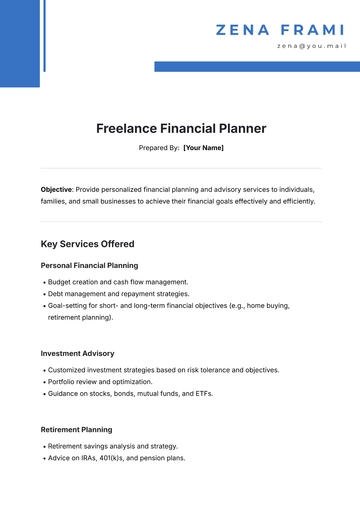

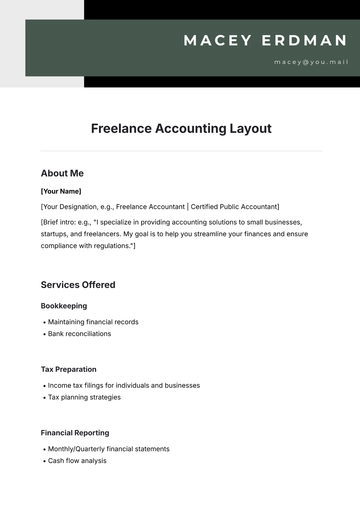

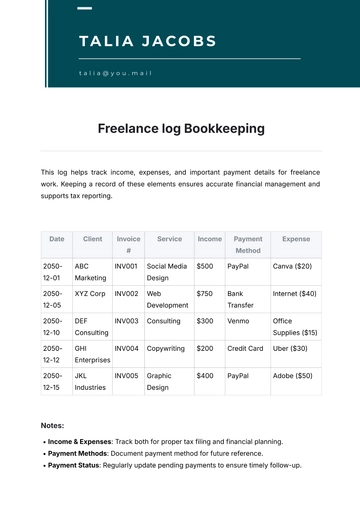

Services Offered

Initial Financial Assessment

A comprehensive review of your current financial situation, including assets, liabilities, income, and expenses.

Identifying short-term and long-term financial goals.

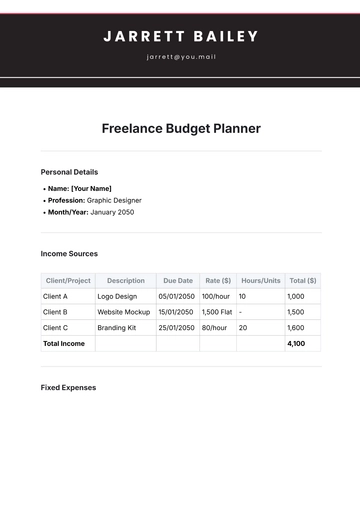

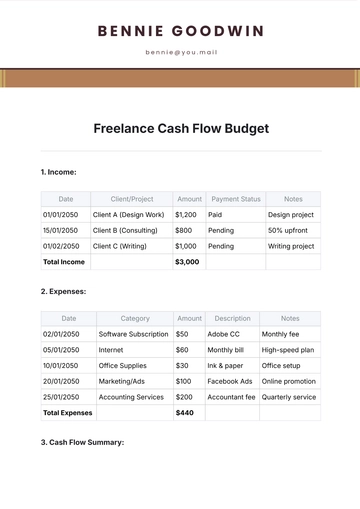

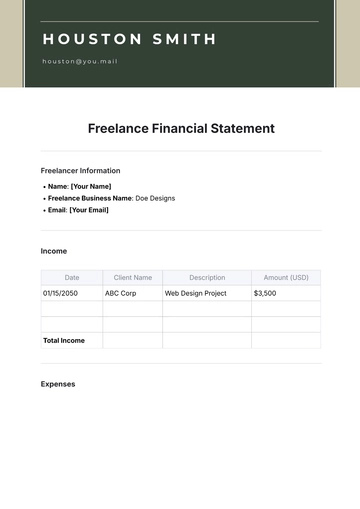

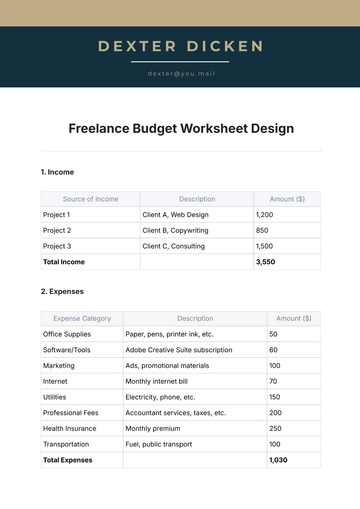

Budgeting and Cash Flow Management

Creating a sustainable budget that aligns with your goals.

Identifying areas to improve cash flow or reduce unnecessary spending.

Investment Planning

Advising on investment strategies based on your risk tolerance and financial goals.

Helping diversify your investment portfolio to balance risk and return.

Retirement Planning

Analyzing your current retirement savings and suggesting ways to improve or optimize your retirement strategy.

Recommending retirement account options (IRA, 401(k), etc.) and contribution strategies.

Debt Management and Reduction

Create strategies to lower high-interest debt and plan loan repayment.

Prioritizing debt payments and creating a roadmap to become debt-free.

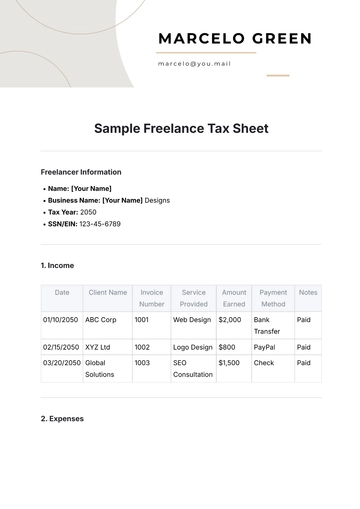

Tax Planning

Offering advice on tax-efficient investment strategies.

Helping minimize your tax liability through deductions, credits, and planning for future tax implications.

Estate Planning

Guiding you in setting up wills, trusts, and other estate-related structures to protect your wealth and ensure your wishes are met.

Periodic Financial Review

Regular follow-up consultations to monitor progress and adjust your plan as life circumstances change.

Process & Timeline

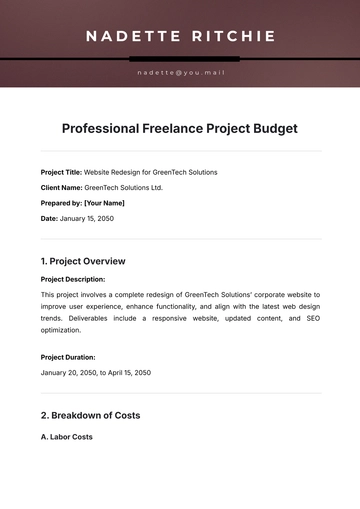

Discovery Meeting (January 5, 2051)

Discuss your goals, current financial situation, and any specific concerns or questions you may have.

Plan Development (January 10–15, 2051)

I will analyze your financial information and develop a comprehensive financial plan tailored to your needs.

Presentation and Discussion (January 20, 2051)

I will present the plan, discuss any questions, and revise it based on your feedback.

Implementation & Follow-Up (Ongoing from February 1, 2051)

Once you approve the plan, we’ll begin implementing the strategies. I will provide ongoing support and conduct periodic reviews every six months.

Pricing Structure

Initial Consultation (1 Hour): $200 (Free with commitment to services)

One-Time Financial Plan Creation: $1,500 (Flat fee)

Ongoing Monthly Retainer: $250 per month for continuous monitoring and advice

Ad Hoc Consultations: $250 per hour for additional support outside the agreed-upon services.

Note: All fees are negotiable based on the scope of services and complexity of your needs.

Why Work With Me?

Personalized Service: I provide a custom approach based on your unique financial situation and goals.

No Conflicts of Interest: As a freelance planner, I don't sell products or receive commissions, ensuring that my advice is unbiased and solely focused on your best interests.

Ongoing Support: I'm available for follow-up questions and advice as your financial situation evolves.

Experience & Expertise: With over 15 years of experience in financial planning, I have helped clients navigate complex financial situations and achieve their financial goals.

Next Steps

If you are interested in moving forward with my services, please reply to this proposal, and we can schedule our initial meeting on January 5, 2051. I look forward to working with you and helping you achieve your financial goals!

Contact Information:

[Your Name]

Email: [Your Email]

Phone: (555) 123-4567

Website: www.myfinance.com

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Plan your freelance finances with Template.net’s Freelance Financial Planning Template. Customizable and editable, it helps you track income, expenses, and set financial goals. Editable in our AI Editor Tool, it can be tailored to your needs. Perfect for freelancers who want a clear financial plan, this template ensures that you stay organized and focused. Download today and start planning your freelance finances.

You may also like

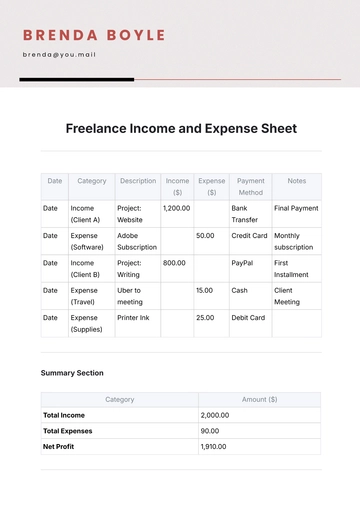

- Budget Sheet

- Personal Budget

- Non Profit Budget

- Monthly Budget

- Project Budget

- HR Budget

- Company Budget

- Home Budget

- Weekly Budget

- College Budget

- Business Budget

- Construction Budget

- Small Business Budget

- Hotel Budget

- Annual Budget

- Home Renovation Budget

- Household Budget

- Student Budget

- Grocery Budget

- Marketing Budget

- Corporate Budget

- Startup Budget

- Manufacturing Budget

- Church Budget

- University Budget

- Annual Budget Plan

- Event Budget

- Operating Budget

- Travel Budget

- Food Budget

- IT and Software Budget

- School Budget

- Real Estate Budget

- Sales Budget

- Conference Budget

- Budget Finance

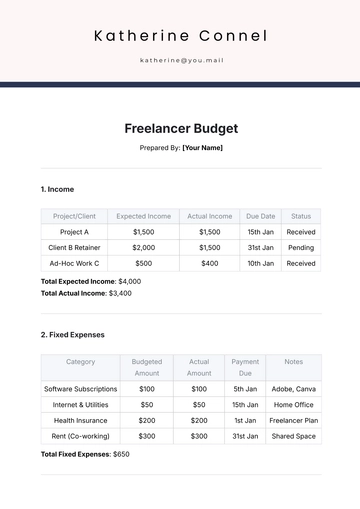

- Freelancer Budget

- Budget Advertising