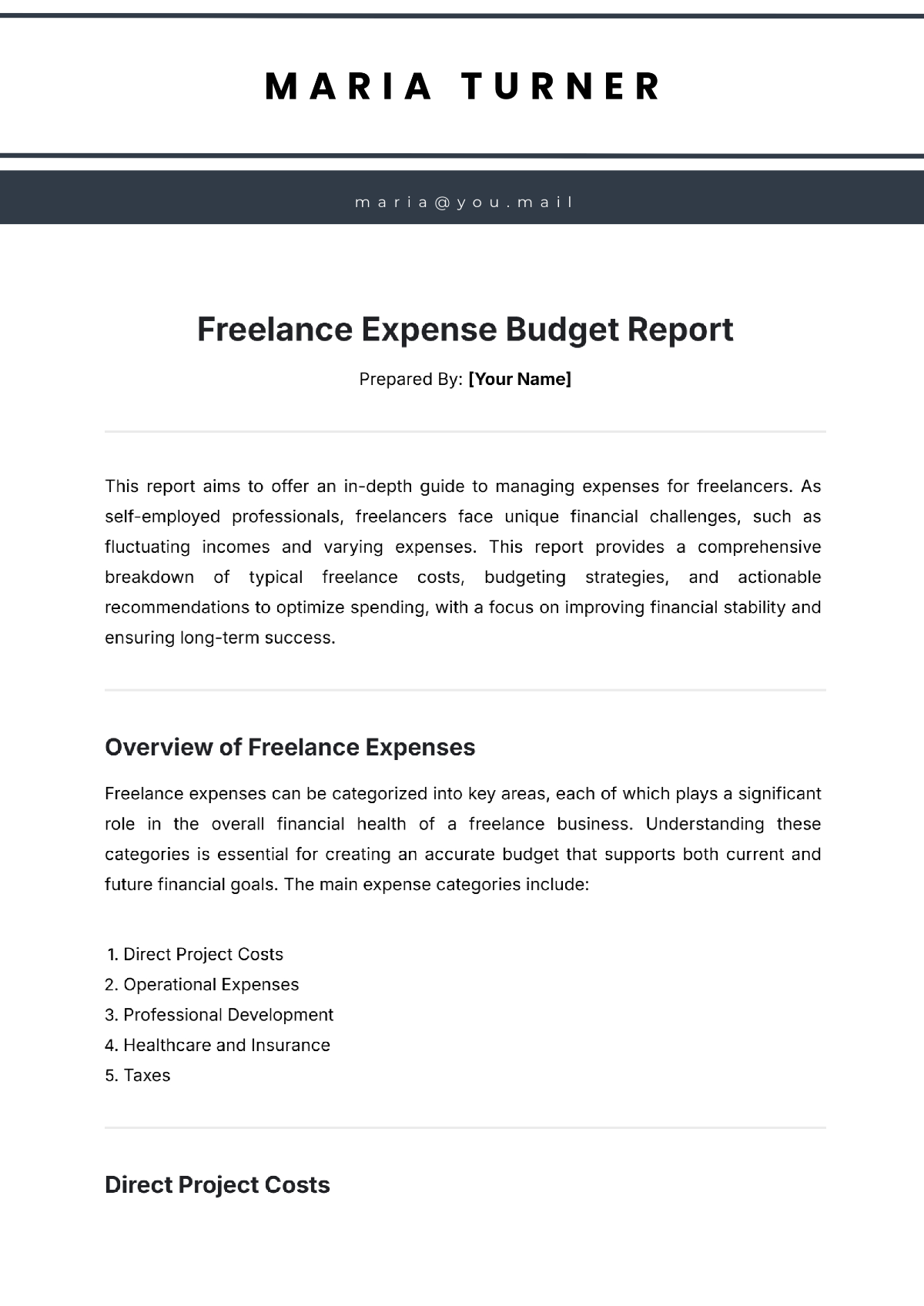

Freelance Expense Budget Report

Prepared By: [Your Name]

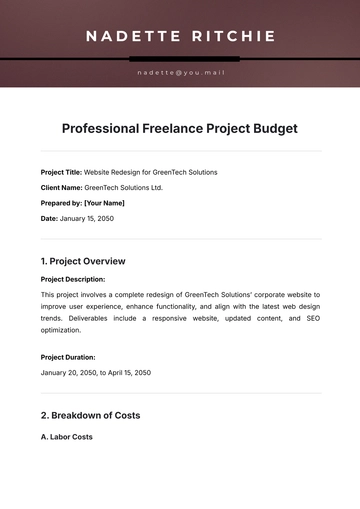

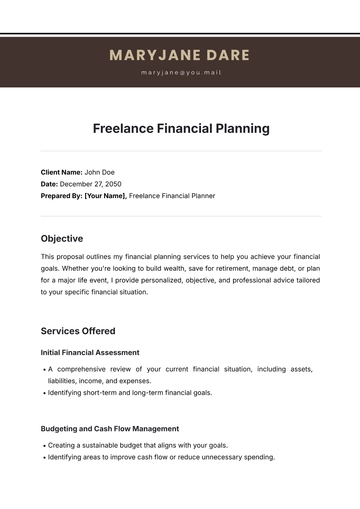

This report aims to offer an in-depth guide to managing expenses for freelancers. As self-employed professionals, freelancers face unique financial challenges, such as fluctuating incomes and varying expenses. This report provides a comprehensive breakdown of typical freelance costs, budgeting strategies, and actionable recommendations to optimize spending, with a focus on improving financial stability and ensuring long-term success.

Overview of Freelance Expenses

Freelance expenses can be categorized into key areas, each of which plays a significant role in the overall financial health of a freelance business. Understanding these categories is essential for creating an accurate budget that supports both current and future financial goals. The main expense categories include:

Direct Project Costs

Operational Expenses

Professional Development

Healthcare and Insurance

Taxes

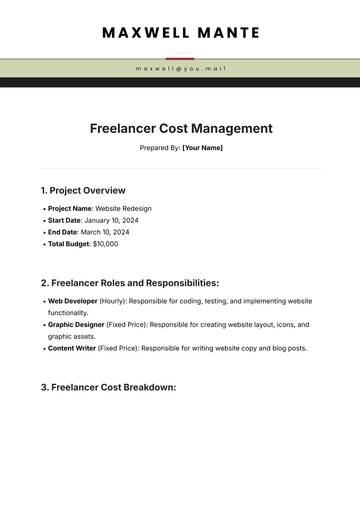

Direct Project Costs

These are the costs directly tied to completing client projects. They include expenses for materials, specialized software, tools, or any subcontracting work needed. By efficiently managing these costs, freelancers can ensure that each project remains profitable.

Common Direct Project Costs:

Software and tools (e.g., design software, coding tools, project management apps)

Necessary equipment or supplies (e.g., cameras, printing materials, hardware)Subcontracting fees for outsourcing tasks like design, writing, or development

Shipping or delivery costs for physical products or prototypes

Operational Expenses

Operational expenses encompass the costs associated with maintaining a freelance business. These are the day-to-day running expenses that are often fixed or recurring. Managing operational expenses effectively ensures that a freelancer's business stays functional without overspending.

Common Operational Expenses:

Home-office rent (or a portion of home rent if working from home)

Utilities (electricity, water, heating, etc.)

Internet and phone service

Office supplies (e.g., paper, ink, printer maintenance)

Equipment maintenance (e.g., computer repairs or upgrades)

Professional Development

To remain competitive in their fields, freelancers must continually invest in skills development. This category includes expenses related to learning new skills, attending workshops, and staying updated on industry trends.

Common Professional Development Expenses:

Online courses, certifications, or workshops

Conferences or networking events

Subscriptions to industry-related magazines, blogs, or tools

Membership fees for professional organizations

Healthcare and Insurance

Unlike traditional employees, freelancers are responsible for their own health insurance and liability coverage. Setting aside funds for these expenses is crucial for ensuring long-term personal and business security.

Common Healthcare and Insurance Expenses:

Health insurance premiums

Dental and vision care insurance

Professional liability insurance

Workers' compensation (if applicable)

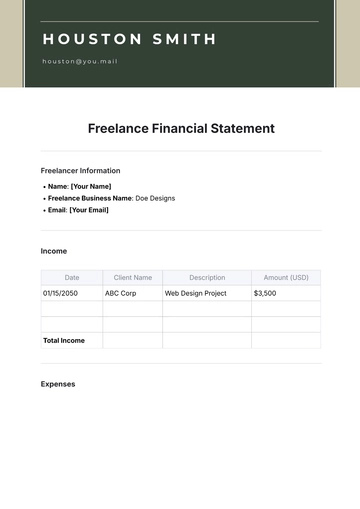

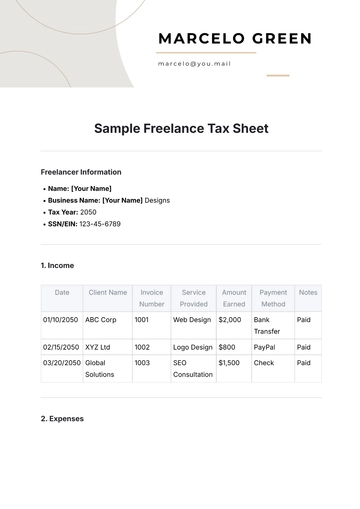

Taxes

Freelancers have a different tax structure than traditional employees. They must account for self-employment taxes, income taxes, and, depending on the region, other state or local taxes. Accurate tax planning is essential to avoid large tax liabilities at the end of the year.

Common Tax-related Expenses:

Estimated quarterly tax payments (income tax, self-employment tax)

State or local business taxes

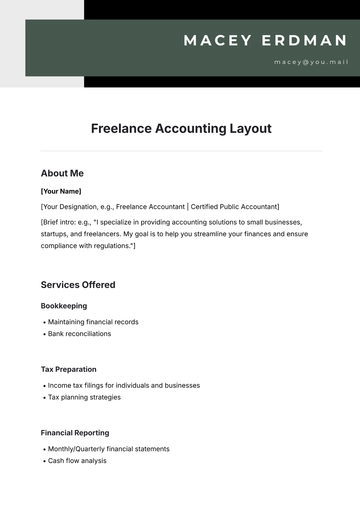

Tax preparation fees or accountant services

Deductions for business-related expenses (e.g., home office, equipment depreciation)

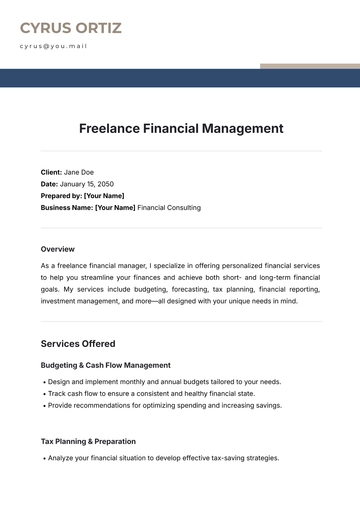

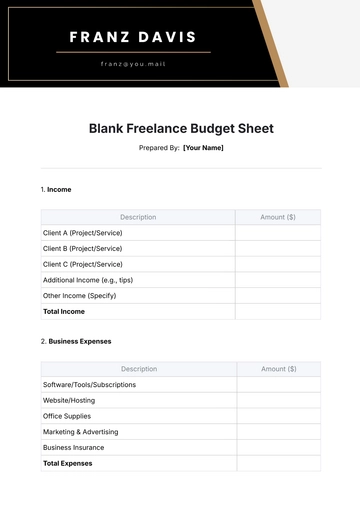

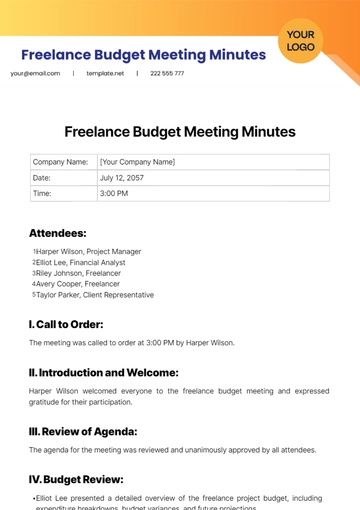

Budgeting Strategies for Freelancers

A structured budget is a cornerstone of successful freelancing. With varying incomes, it’s vital to implement strategies that allow freelancers to balance their finances. The following strategies can help freelancers stay organized and financially secure:

Establish a Separate Business Account

Create an Emergency Fund

Use Budgeting Software

Track and Analyze Expenses Regularly

Establish a Separate Business Account

A separate business bank account helps streamline finances by keeping personal and business expenses distinct. This separation makes it easier to track income and expenses, file taxes, and maintain financial clarity.

Create an Emergency Fund

An emergency fund acts as a financial cushion in the event of a slow month or unexpected costs. Freelancers should aim to save at least 3-6 months' worth of living expenses to maintain stability in times of uncertainty.

Use Budgeting Software

Budgeting software or apps like QuickBooks, Mint, or YNAB (You Need a Budget) can simplify the process of tracking income and expenses. These tools offer insights into spending patterns, help categorize expenses and even forecast potential tax liabilities.

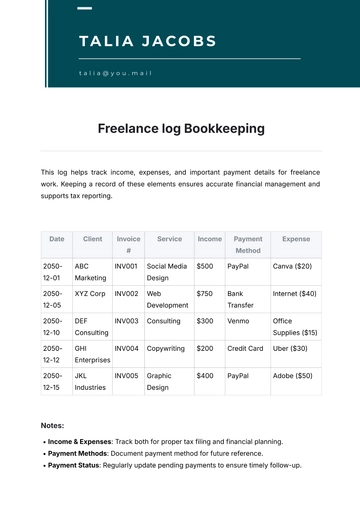

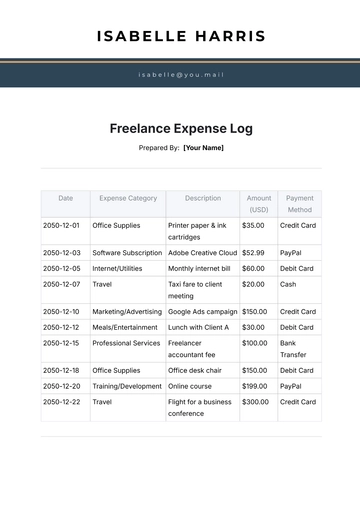

Track and Analyze Expenses Regularly

Freelancers should consistently track their spending to identify areas for cost-cutting or optimization. Regular expense reviews ensure that freelancers stay on top of their finances and can quickly adapt to changes in income or business needs.

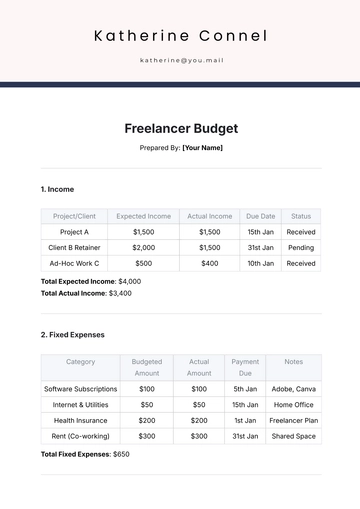

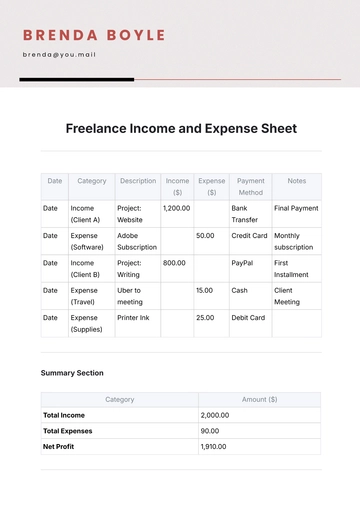

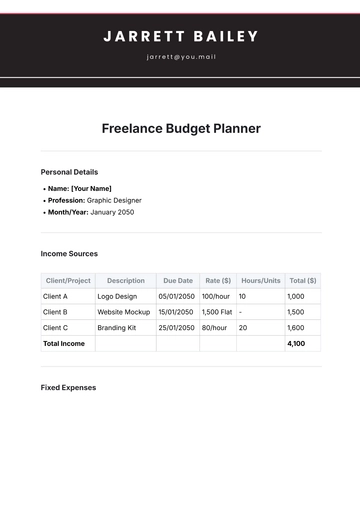

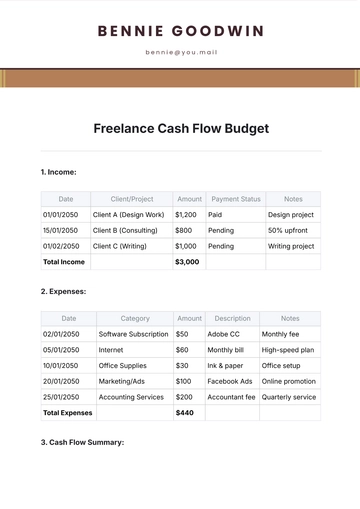

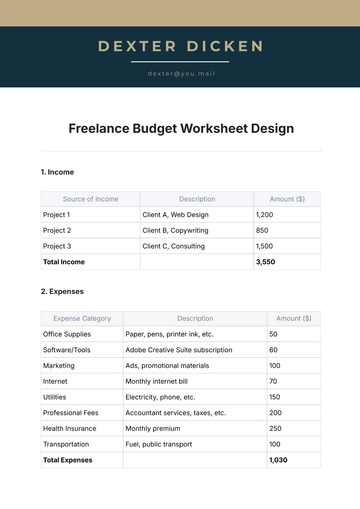

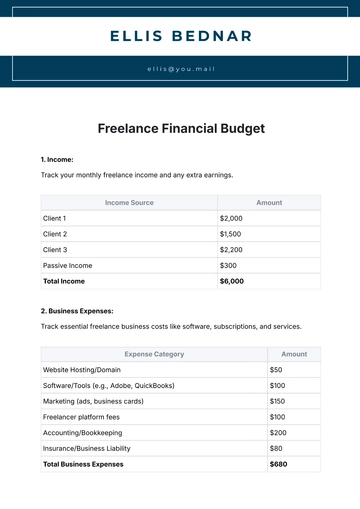

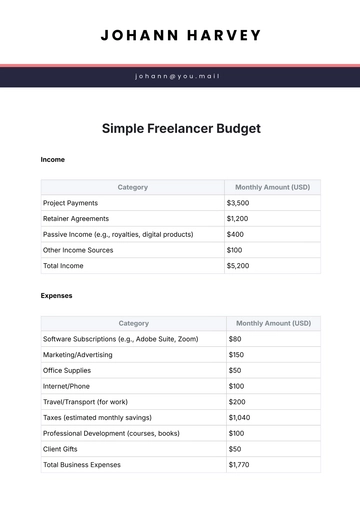

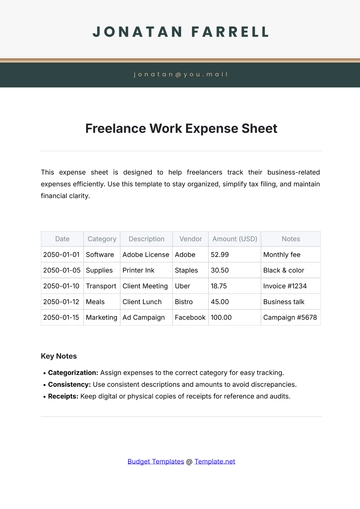

Table of Typical Freelance Expenses

Category | Average Monthly Cost ($) |

|---|---|

Direct Project Costs | 500 |

Operational Expenses | 300 |

Professional Development | 100 |

Healthcare and Insurance | 250 |

Taxes | 400 |

Note: These costs can vary significantly depending on the freelancer's industry, location, and personal circumstances.

Recommendations for Optimizing Freelance Expenses

Optimizing expenses is an ongoing process that can significantly improve profitability and financial well-being. The following strategies will help freelancers reduce costs while maintaining quality and productivity:

Negotiate Prices with Clients and Vendors

Invest in Automation and Productivity Tools

Regularly Review Subscription Services

Consider Tax Strategies

Negotiate Prices with Clients and Vendors

Strong negotiation skills can help freelancers secure better project rates and reduce vendor costs. Negotiating favorable terms with clients ensures that projects are financially viable while negotiating lower prices with vendors can lead to significant savings.

Invest in Automation and Productivity Tools

Automation tools such as time trackers, invoicing software, and project management platforms can save freelancers both time and money. By streamlining repetitive tasks, freelancers can focus on high-value work and reduce administrative overhead.

Regularly Review Subscription Services

Subscriptions to tools, services, or software can accumulate quickly. Freelancers should periodically review these subscriptions to identify underutilized services and cancel or downgrade plans to optimize expenses.

Consider Tax Strategies

Working with a tax professional can help freelancers identify tax deductions or credits they might otherwise overlook. For instance, a home office deduction, equipment depreciation, or business-related travel expenses can reduce overall tax liabilities.

Conclusion

Freelancers operate in a dynamic environment with income and expenses that can vary greatly from month to month. However, by understanding the various categories of expenses and implementing strategic budgeting practices, freelancers can gain better control over their financial health. With regular monitoring, smart negotiation, and investment in productivity, freelancers can build a more stable and prosperous business.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Monitor your freelance expenses with Template.net’s Freelance Expense Budget Report Template. Customizable and editable, it helps freelancers organize and track business-related expenses. Editable in our AI Editor Tool, it adapts to your specific needs. This template simplifies financial reporting and ensures that you stay on top of your expenses. Download today and streamline your freelance expense tracking.

You may also like

- Budget Sheet

- Personal Budget

- Non Profit Budget

- Monthly Budget

- Project Budget

- HR Budget

- Company Budget

- Home Budget

- Weekly Budget

- College Budget

- Business Budget

- Construction Budget

- Small Business Budget

- Hotel Budget

- Annual Budget

- Home Renovation Budget

- Household Budget

- Student Budget

- Grocery Budget

- Marketing Budget

- Corporate Budget

- Startup Budget

- Manufacturing Budget

- Church Budget

- University Budget

- Annual Budget Plan

- Event Budget

- Operating Budget

- Travel Budget

- Food Budget

- IT and Software Budget

- School Budget

- Real Estate Budget

- Sales Budget

- Conference Budget

- Budget Finance

- Freelancer Budget

- Budget Advertising