Free Real Estate Investor Report

Prepared By: [Your Name]

Date: [Date]

Introduction

The real estate market is a vast and dynamic landscape, offering various opportunities for investors seeking to diversify their portfolios. This report aims to provide a comprehensive analysis of the current state of the real estate market, examining trends, opportunities, and risks to help investors make informed decisions. By leveraging data, market insights, and expert opinion, this report delves into various segments of real estate including residential, commercial, and industrial properties.

Market Overview

Current Market Conditions

The real estate market has experienced significant shifts in recent years due to economic fluctuations, changes in consumer preferences, and technological advancements. The demand for residential properties has seen a resurgence amidst low interest rates, while commercial properties have been impacted by the growth of remote work and e-commerce. Industrial real estate, particularly warehousing, has benefited from the increase in online shopping.

Key Market Drivers

Interest Rates: Historically low interest rates have fueled demand for properties, making borrowing more affordable for buyers.

Demographic Shifts: The preferences of millennials and Gen Z are influencing urban development and housing trends.

Technological Advancements: PropTech innovations are transforming property management and real estate transactions.

Economic Policies: Government policies regarding housing loans and taxes continue to shape market dynamics.

Residential Real Estate

Trends and Opportunities

Residential real estate remains a cornerstone of investment portfolios. The sector has seen marked changes, with a noticeable shift toward suburban and rural locations as remote work becomes more prevalent. However, urban centers continue to attract investment due to infrastructure, amenities, and lifestyle offerings.

Market Statistics

Region | Average Price (USD) | Annual Growth Rate |

|---|---|---|

North America | $350,000 | 3.5% |

Europe | $300,000 | 2.8% |

Asia-Pacific | $400,000 | 4.1% |

Commercial Real Estate

Challenges and Adaptations

The commercial sector faces unique challenges as businesses reassess their needs for physical space. Retail properties are adapting to mixed-use models, while office spaces are innovating with flexible, co-working designs. Investors are advised to focus on properties that offer adaptability to changing market conditions.

Investment Strategies

Focus on Mixed-Use Developments: Combining commercial, residential, and recreational facilities to maximize utility.

Flexibility in Leasing Agreements: Offering terms that cater to short-term and hybrid work models.

Technology Integration: Investing in smart buildings and tech-enabled management systems.

Industrial Real Estate

Growth Areas

Industrial real estate has witnessed substantial growth due to increasing demand for storage, logistics, and distribution centers. The rise in e-commerce necessitates expansive warehousing solutions, making this sector a lucrative domain for investment.

Key Metrics

Metric | Value |

|---|---|

Warehouse Vacancy Rate | 5.2% |

Average Lease Rate (per sqft) | $6 |

Year-over-Year Growth | 7.8% |

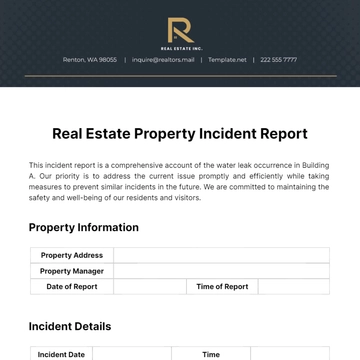

Risk Analysis

Investing in real estate comes with inherent risks that need to be meticulously assessed. Market volatility, changes in regulatory policies, and unforeseen economic disturbances can impact investment outcomes. It's crucial for investors to conduct thorough due diligence and risk assessment before committing capital.

Common Risks

Market Volatility: Rapid changes in real estate values can affect returns.

Regulatory Changes: New laws and regulations may affect property values and rental income.

Economic Downturns: Global economic shifts may lead to decreased demand and higher vacancy rates.

Conclusion

Real estate continues to offer attractive opportunities for investors willing to navigate its complexities. By understanding current trends and strategizing accordingly, investors can capitalize on the potential for growth while mitigating risks. As the landscape evolves, staying informed and adaptable will be key to successful investment in real estate.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Elevate your investment strategies with the Real Estate Investor Report Template offered by Template.net. This customizable, downloadable, and printable template is designed to streamline your reporting needs. Tailored for efficiency, it’s also editable in our AI Editor Tool, ensuring easy adjustments to meet your unique preferences. Optimize your real estate analysis today!

You may also like

- Sales Report

- Daily Report

- Project Report

- Business Report

- Weekly Report

- Incident Report

- Annual Report

- Report Layout

- Report Design

- Progress Report

- Marketing Report

- Company Report

- Monthly Report

- Audit Report

- Status Report

- School Report

- Reports Hr

- Management Report

- Project Status Report

- Handover Report

- Health And Safety Report

- Restaurant Report

- Construction Report

- Research Report

- Evaluation Report

- Investigation Report

- Employee Report

- Advertising Report

- Weekly Status Report

- Project Management Report

- Finance Report

- Service Report

- Technical Report

- Meeting Report

- Quarterly Report

- Inspection Report

- Medical Report

- Test Report

- Summary Report

- Inventory Report

- Valuation Report

- Operations Report

- Payroll Report

- Training Report

- Job Report

- Case Report

- Performance Report

- Board Report

- Internal Audit Report

- Student Report

- Monthly Management Report

- Small Business Report

- Accident Report

- Call Center Report

- Activity Report

- IT and Software Report

- Internship Report

- Visit Report

- Product Report

- Book Report

- Property Report

- Recruitment Report

- University Report

- Event Report

- SEO Report

- Conference Report

- Narrative Report

- Nursing Home Report

- Preschool Report

- Call Report

- Customer Report

- Employee Incident Report

- Accomplishment Report

- Social Media Report

- Work From Home Report

- Security Report

- Damage Report

- Quality Report

- Internal Report

- Nurse Report

- Real Estate Report

- Hotel Report

- Equipment Report

- Credit Report

- Field Report

- Non Profit Report

- Maintenance Report

- News Report

- Survey Report

- Executive Report

- Law Firm Report

- Advertising Agency Report

- Interior Design Report

- Travel Agency Report

- Stock Report

- Salon Report

- Bug Report

- Workplace Report

- Action Report

- Investor Report

- Cleaning Services Report

- Consulting Report

- Freelancer Report

- Site Visit Report

- Trip Report

- Classroom Observation Report

- Vehicle Report

- Final Report

- Software Report